The Gold Price Question

The global gold market has experienced unprecedented momentum throughout 2025, with prices climbing over 50% year-to-date and establishing multiple record highs that reflect fundamental shifts in investor sentiment and macroeconomic conditions. As of November 13, 2025, gold has reached approximately $4,238 per troy ounce, representing a 65% increase compared to the same period last year. This remarkable rally has been underpinned by several converging factors that extend beyond traditional safe-haven demand. Central banks worldwide have maintained consistently elevated purchase levels, with forecasts indicating approximately 900 tonnes of central bank gold acquisitions in 2025 alone, demonstrating sustained institutional confidence in the precious metal's strategic value. The structural trend of higher central bank buying has further to run in 2025 and 2026, according to major financial institutions, suggesting that official-sector demand will continue supporting prices at elevated levels.

Beyond central bank accumulation, the gold price surge reflects mounting expectations of monetary easing by major central banks, rising global geopolitical uncertainty, and the continued reallocation of investor portfolios toward assets perceived as offering superior risk-hedging characteristics. Major gold exchange-traded funds have returned to net inflows in recent weeks, indicating renewed institutional interest in traditional precious metal vehicles. The concurrent decline in real yields and the U.S. dollar index has provided substantial valuation support, creating an environment where gold's opportunity cost has diminished relative to alternative investments. Additionally, the expansion of the stablecoin ecosystem backed by precious metals has introduced novel channels for retail investor participation in gold markets, with particular momentum observed during August 2025 as investor interest in metal-backed digital instruments surged. These multifaceted drivers collectively position gold as a compelling allocation for investors navigating an increasingly complex macroeconomic landscape characterized by policy uncertainty and geopolitical tensions.

Gold Meets the Digital Revolution

The emergence of Bitcoin and other digital currencies has fundamentally altered the competitive dynamics within alternative asset markets, creating a compelling parallel narrative to traditional gold investment theses. Bitcoin, frequently characterized as "digital gold," has demonstrated distinct performance characteristics throughout 2025, appreciating approximately 23% year-to-date compared to gold's 54% gain, yet maintaining significant strategic positioning within institutional and retail portfolios seeking inflation protection and portfolio diversification. This performance divergence underscores the distinct market drivers influencing each asset class, with Bitcoin exhibiting greater sensitivity to broader equity market sentiment and cryptocurrency-specific developments, while gold benefits from its established role as a traditional safe-haven asset and central bank reserve instrument.

The "digital gold" narrative has evolved considerably as institutional capital has increasingly recognized Bitcoin's potential to capture a substantial portion of conventional gold's valuation. J.P. Morgan Private Bank has projected that gold could surpass $5,000 per ounce in the coming year, largely supported by central bank buying in emerging markets, yet simultaneously acknowledges Bitcoin's structural advantages in terms of portability, divisibility, and programmability. The Bitcoin-to-gold ratio, a key metric tracked by market analysts, has recently shown improvement but still indicates potential for Bitcoin to achieve greater parity with gold's market valuation, particularly if market fear indicators decline and investor confidence in digital asset infrastructure strengthens. However, this competitive dynamic should not be interpreted as a zero-sum relationship; rather, both assets serve complementary functions within sophisticated investment portfolios, with gold maintaining advantages in terms of established institutional acceptance and regulatory clarity, while Bitcoin offers technological innovation and enhanced accessibility for digital-native investors.

Critical Drivers of Gold and Cryptocurrency Valuations

The valuation dynamics governing both gold and digital assets reflect complex interactions among institutional investment behaviors, macroeconomic policy trajectories, geopolitical developments, and evolving technological infrastructure. Institutional capital flows represent perhaps the most significant driver of contemporary gold prices, with major financial institutions recognizing the precious metal's strategic allocation value amid slowing economic growth and overlapping policy easing cycles across major central banks. The World Gold Council's data on central bank purchasing patterns demonstrates that official-sector demand has remained remarkably resilient despite elevated price levels, suggesting that institutional investors perceive gold as undervalued relative to its fundamental risk-hedging attributes. This institutional demand contrasts sharply with speculative positioning, where the recent increase in speculative net-long positioning in gold futures indicates that retail and leveraged investors have also embraced bullish price expectations, potentially creating crowded positions vulnerable to mean-reversion dynamics.

Market volatility patterns have assumed heightened importance in shaping investment decisions across both asset classes, with the cryptocurrency market exhibiting substantially greater price oscillations compared to traditional precious metals. Bitcoin's recovery to approximately $115,000 following earlier October volatility demonstrates the digital asset's sensitivity to geopolitical developments and policy announcements, particularly those affecting U.S.-China trade relations and tariff frameworks. The expanding stablecoin ecosystem, particularly instruments backed by precious metals, has created novel mechanisms for retail investor participation in gold markets while simultaneously introducing digital asset characteristics such as programmability and real-time settlement into traditional commodity markets. Regulatory frameworks continue evolving across jurisdictions, with implications for both asset classes; cryptocurrency regulations increasingly influence Bitcoin's institutional adoption potential, while gold faces potential policy changes affecting central bank reserve adequacy requirements and precious metal taxation treatment.

Retail investor participation trends have accelerated throughout 2025, driven by democratized access to trading platforms, enhanced financial education resources, and growing recognition of portfolio diversification benefits offered by alternative assets. MEXC's comprehensive platform infrastructure has facilitated expanded retail participation in digital asset markets, providing sophisticated trading tools and market data resources that enable informed investment decisions across cryptocurrency and tokenized commodity markets. The correlation between gold and Bitcoin has demonstrated variability throughout 2025, with periods of positive correlation reflecting shared safe-haven demand during geopolitical uncertainty, and periods of negative correlation highlighting the distinct fundamental drivers influencing each asset class's valuation trajectory.

Market Intelligence and Expert Forecasts

Leading financial institutions have articulated divergent perspectives regarding precious metal and digital asset valuations, reflecting genuine uncertainty regarding macroeconomic trajectories and technological adoption rates. J.P. Morgan Research projects that gold prices will average $3,675 per ounce during the fourth quarter of 2025, with prices rising toward $4,000 per ounce by the second quarter of 2026, representing a more conservative outlook than current spot prices but acknowledging continued upside potential driven by central bank purchasing and geopolitical risk premiums. The same institution's projection that gold could surpass $5,000 per ounce in the coming year, supported primarily by emerging market central bank accumulation, suggests substantial institutional conviction regarding gold's intermediate-term appreciation potential, though this forecast remains subject to policy and geopolitical contingencies.

Market analysts have identified key watchpoints for monitoring gold price trajectories, including U.S. core inflation data, employment statistics, central bank policy guidance, official-sector purchase trends, exchange-traded fund holdings patterns, and geopolitical developments affecting safe-haven demand. The Federal Reserve's policy trajectory represents a critical variable, with traders currently pricing approximately a 64% probability of a 25-basis-point rate reduction in December 2025, though some Fed officials have advocated for larger half-point reductions amid declining inflation metrics and rising unemployment indicators. These policy expectations directly influence gold's valuation, as declining real yields reduce the opportunity cost of holding non-yielding precious metals.

Regarding Bitcoin's valuation prospects, institutional research has highlighted the importance of the Bitcoin-to-gold ratio as a key indicator of market sentiment and fear dynamics, with ratios exceeding 30 potentially signaling meaningful reductions in market uncertainty and enhanced potential for Bitcoin appreciation relative to gold. Market intelligence suggests that successful resolution of U.S.-China trade tensions could substantially alter Bitcoin's competitive positioning relative to gold, potentially reducing safe-haven demand for precious metals while simultaneously bolstering investor confidence in risk assets including digital currencies. These contrasting institutional perspectives underscore the genuine complexity characterizing contemporary asset valuation dynamics, with reasonable analysts reaching divergent conclusions regarding future price trajectories based on differing assumptions regarding monetary policy, geopolitical developments, and technological adoption rates.

Understanding Asset Class Distinctions and Risks

Gold and Bitcoin occupy fundamentally distinct positions within investment portfolios, despite superficial similarities in their safe-haven positioning and inflation-hedging characteristics. Gold functions as a traditional store of value with millennia of institutional acceptance, serving as a central bank reserve asset, a hedge against currency debasement, and an insurance instrument against extreme events including hyperinflation and potentially catastrophic systemic crises. The precious metal's physical characteristics—durability, divisibility, and universal recognition—have established gold as a reliable medium of exchange and store of value across diverse cultural and economic contexts. However, gold exhibits imperfect hedging characteristics against standard inflation, with historical analysis demonstrating that gold's real returns vary substantially across different inflationary regimes and economic cycles.

Bitcoin represents a fundamentally novel asset class, offering superior portability, divisibility, and programmability compared to physical precious metals, while introducing distinct risk profiles associated with technological infrastructure, regulatory uncertainty, and market maturity considerations. The cryptocurrency's distributed ledger technology enables instantaneous settlement and transparent transaction verification, characteristics unavailable in traditional precious metal markets. However, Bitcoin's valuation remains substantially influenced by sentiment dynamics and speculative positioning, with the asset exhibiting greater volatility compared to gold and demonstrating higher sensitivity to macroeconomic policy announcements and geopolitical developments. The risk profile distinction reflects Bitcoin's relatively nascent market development compared to gold's centuries-long institutional integration.

Institutional investors increasingly recognize that gold and Bitcoin serve complementary rather than competitive functions within sophisticated portfolios, with gold providing stable value storage and regulatory certainty, while Bitcoin offers technological innovation and enhanced accessibility for digital-native participants. MEXC's platform infrastructure supports effective portfolio management across both asset classes, providing real-time market data, advanced trading tools, and secure custody solutions that enable investors to construct diversified allocations aligned with their specific risk tolerance and investment objectives. Understanding these asset class distinctions remains essential for informed investment decision-making, as conflating gold and Bitcoin characteristics may result in suboptimal portfolio construction and misaligned risk management approaches.

Strategic Investment Approaches

Effective navigation of contemporary gold and cryptocurrency markets requires comprehensive understanding of macroeconomic fundamentals, geopolitical risk factors, and technological developments influencing asset valuations. Investors should maintain systematic monitoring of Federal Reserve policy communications, employment data releases, and inflation statistics, as these variables directly influence real yields and consequently affect gold's opportunity cost relative to alternative investments. Geopolitical developments, particularly those affecting U.S.-China relations and global trade frameworks, warrant continuous attention given their demonstrated capacity to rapidly shift investor sentiment and safe-haven demand dynamics. MEXC's comprehensive market intelligence resources, including real-time price data, technical analysis tools, and institutional research summaries, provide essential information infrastructure supporting informed investment decisions.

Position sizing and volatility management assume heightened importance when constructing portfolios incorporating both traditional precious metals and digital assets, particularly given the elevated volatility characterizing cryptocurrency markets. Analysts recommend avoiding the temptation to chase strength in high-volatility conditions, instead emphasizing disciplined portfolio rebalancing and systematic accumulation strategies aligned with long-term investment objectives. Retail investors should establish clear entry and exit criteria prior to initiating positions, utilizing technical analysis frameworks and fundamental valuation metrics to identify attractive risk-reward opportunities while simultaneously implementing protective measures limiting downside exposure. MEXC's platform infrastructure facilitates implementation of sophisticated trading strategies, including limit orders, stop-loss mechanisms, and automated rebalancing protocols that enable systematic portfolio management across digital asset markets.

Diversification across asset classes remains essential for constructing resilient portfolios capable of withstanding diverse macroeconomic scenarios and market dislocations. Investors should consider allocating portions of their portfolios to gold for its traditional safe-haven characteristics and central bank reserve status, while simultaneously maintaining Bitcoin exposure for its technological innovation potential and enhanced accessibility characteristics. MEXC's comprehensive service ecosystem, encompassing spot trading, derivatives markets, and staking opportunities, enables investors to implement nuanced portfolio strategies capturing value across multiple market segments. By combining disciplined fundamental analysis, systematic position management, and access to sophisticated trading infrastructure, investors can effectively navigate the evolving landscape of traditional precious metals and digital assets throughout 2025 and beyond.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Learn More About Humanity

View More

Is USDT Safe? A Complete Guide to Tether's Reserves, Audits & Regulatory Compliance in 2026

BONE & LEASH Tokens Explained: Your Complete Guide to the Shiba Inu Ecosystem

Pi Network KYC Deadline March 14, 2025: Complete Guide to Verification

Latest Updates on Humanity

View More

Medicus Healthcare Solutions Releases a Data-Driven Look at the Breast Imaging Radiologist Shortage

$H Shows Real Technical Strength Beyond Social Hype

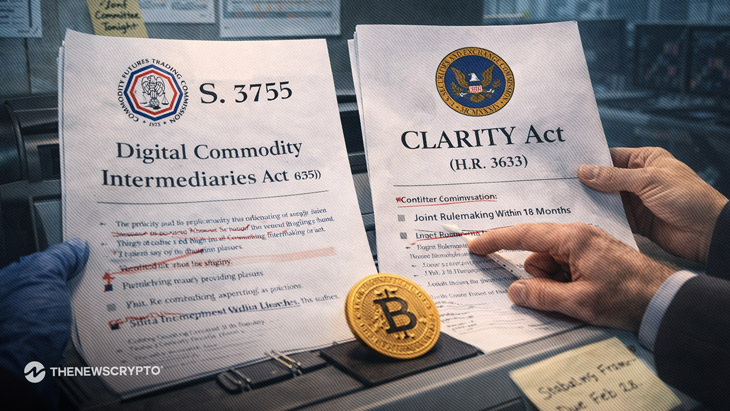

Trump Signals Crypto Bill to Give CFTC Control Over Bitcoin and Ethereum Markets

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading