Understanding the price prediction of Sui Network (SUI) gives traders and investors a forward-looking perspective on potential market trends. Price predictions aren't guarantees, but they provide valuable insights by combining historical performance, technical indicators, market sentiment, and broader economic conditions.

Sui Network (SUI) Current Market Overview

Sui Network represents a significant advancement in Layer 1 blockchain technology, designed from the ground up to make digital asset ownership fast, private, secure, and accessible to everyone. As of December 2, 2025, the SUI token continues to establish itself as a key player in the blockchain ecosystem, with its performance reflecting the growing adoption of its innovative infrastructure.

SUI operates as the native cryptocurrency of the Sui blockchain, powering all activities within the ecosystem. The token serves multiple critical functions including transaction fees, staking, and governance participation, which empowers holders to participate in network decisions and security. Recent market movements demonstrate SUI's position as a compelling contender in the Layer 1 blockchain space, with traders actively monitoring its price action across multiple trading pairs, including SUI/USDT on MEXC.

The 24-hour trading activity reflects steady liquidity and renewed demand from both retail and institutional participants interested in Sui's technological innovations. Despite the broader cryptocurrency market's cyclical nature, SUI has maintained resilience through its strong technical foundation and experienced development team from Mysten Labs, composed of five former senior executives and architects from Meta's Novi digital wallet program.

Key Drivers Behind SUI Price Prediction

Price forecasts for SUI depend on multiple interconnected drivers that shape both short-term volatility and long-term trajectory:

Technological Innovation and Performance Metrics

Sui's architecture fundamentally differentiates it from competing Layer 1 blockchains. The platform demonstrates exceptional performance capabilities, with the Sui blockchain showing speeds exceeding 120,000 transactions per second under test conditions, with an average latency of approximately 2 seconds. This technical superiority, combined with the ability to theoretically handle 100,000+ TPS with sub-400ms latency, positions SUI as an attractive option for developers and users seeking high-performance blockchain solutions.

Ecosystem Development and Strategic Partnerships

The expansion of Sui's ecosystem directly influences investor sentiment and token utility. Leading protocols such as Cetus Protocol (emerging as Sui's leading DEX), Scallop (providing lending and borrowing infrastructure), BlueMove, and OriginX demonstrate the growing developer interest in building on Sui. These ecosystem developments strengthen long-term utility and create network effects that support price appreciation.

Investor Sentiment and Community Growth

Social media buzz, institutional adoption announcements, and community expansion significantly shape SUI's demand dynamics. The vision of a blockchain optimized for mass adoption, particularly in gaming, NFTs, and DeFi sectors, resonates with both retail and institutional investors. Backing from prominent venture capital firms including a16z and Coinbase Ventures provides credibility and ongoing support for ecosystem development.

Macro Conditions and Market Cycles

Bitcoin dominance, U.S. dollar strength, regulatory announcements, and broader cryptocurrency market sentiment create ripple effects across altcoins including SUI. The current market cycle, where Sui has taken a leading position, suggests renewed institutional and retail interest in Layer 1 solutions with genuine technological differentiation.

Historical Performance and Sui Network (SUI) Forecast Insights

Sui Network launched its mainnet on May 3, 2023, marking a significant milestone in the project's development trajectory. At mainnet launch, approximately 5% of the total token supply was in circulation, with the remaining supply scheduled for gradual release over an extended period to support the network's long-term health and decentralization.

The tokenomics structure reveals strategic planning for sustainable growth. With a maximum supply capped at 10 billion SUI tokens, the project differs fundamentally from Ethereum's theoretically unlimited supply. During the first year of network operation, 1 billion SUI (10% of maximum supply) was drawn from a subsidy pool to reward validators, supplementing computation fees and storage fund rewards. This approach ensured network security during the critical early phases while establishing sustainable economic incentives.

Examining SUI's trajectory since mainnet launch provides context for understanding its price dynamics. The token's performance reflects growing recognition of Sui's technical advantages and expanding ecosystem adoption. Comparing past price cycles with current trends highlights the importance of accumulation phases preceding significant price movements—a behavior analysts continue monitoring as the network matures.

Short-Term Price Prediction for SUI

In the short term, SUI traders focus on critical support and resistance levels established through recent price action. The token's ability to maintain momentum above key support levels determines whether it can attempt to break through resistance zones.

Short-term price movements for SUI are influenced by several factors:

- Technical Indicators: Moving averages, relative strength index (RSI), and volume analysis provide traders with entry and exit signals

- Ecosystem News: Announcements regarding new protocol integrations, partnerships, or dApp launches can trigger immediate price reactions

- Market Sentiment: Shifts in broader cryptocurrency market sentiment, particularly movements in Bitcoin and Ethereum, create short-term volatility

If SUI maintains positive momentum and ecosystem developments continue at the current pace, traders may observe price consolidation with potential breakout opportunities. The platform's high liquidity on MEXC enables efficient trade execution for both long and short-term traders seeking to capitalize on short-term price movements.

Long-Term Price Forecast for Sui Network (SUI)

Long-term price predictions for SUI rely more heavily on fundamental factors than short-term volatility. Several key considerations shape the long-term outlook:

Adoption Trajectory and Real-World Applications

Sui's object-centric model, based on the Move programming language, enables parallel execution and sub-second finality—features particularly valuable for DeFi, NFTs, gaming, and asset tokenization applications. As developers increasingly recognize these advantages and build sophisticated applications on Sui, network utility and token demand should strengthen correspondingly.

Blockchain Scalability and Market Positioning

The platform's horizontally scalable processing and storage architecture addresses fundamental limitations that have hindered mass adoption of blockchain technology. If Sui successfully captures market share in high-throughput applications where competitors struggle, the long-term value proposition strengthens significantly.

Tokenomics and Supply Dynamics

The structured release schedule, with approximately 5.22 billion SUI scheduled for release by May 31, 2030 (representing 141.8% of the circulating supply at that time), indicates the majority of total supply is planned for gradual release over an extended period. This measured approach supports long-term price stability and reduces the risk of sudden supply shocks that could depress valuations.

Macro Cryptocurrency Cycles

Long-term SUI price forecasts must account for broader cryptocurrency market cycles, regulatory developments, and macroeconomic conditions. Periods of institutional capital inflows into Layer 1 solutions with genuine technological differentiation typically support sustained price appreciation.

Risks and Uncertainties in SUI Price Prediction

No forecast is without risk. For SUI, several uncertainties could materially alter price expectations:

Regulatory Developments

Regulatory decisions in key markets, particularly regarding cryptocurrency classification, staking mechanisms, and smart contract platforms, could impact SUI's adoption trajectory and token utility. Regulatory clarity in major jurisdictions would likely support price appreciation, while restrictive policies could create headwinds.

Competition from Rival Projects

The Layer 1 blockchain space remains highly competitive, with established platforms like Solana and Avalanche, as well as emerging competitors, continuously improving their offerings. While Sui's technical advantages are substantial, sustained competitive pressure could limit market share gains and price appreciation potential.

Macroeconomic Shifts

Interest rate hikes, inflation trends, and broader economic uncertainty can reduce risk appetite for speculative assets like cryptocurrency tokens. These macro conditions create cyclical pressure on altcoin valuations independent of project-specific fundamentals.

Ecosystem Execution Risk

While Sui's technical foundation is strong, the long-term success depends on developers building compelling applications and users adopting these applications at scale. Slower-than-expected ecosystem development could disappoint investors and create downward price pressure.

Storage Fund and Economic Model Sustainability

The innovative Storage Fund mechanism, which deposits transaction fees to reward future validators for storing data, represents a novel economic model. If this mechanism fails to function as designed or creates unintended economic consequences, it could undermine network sustainability and investor confidence.

Conclusion

While no one can predict the future with certainty, monitoring price predictions for Sui Network (SUI) gives investors a framework to prepare for different scenarios. The platform's innovative object-centric architecture, exceptional performance metrics, and growing ecosystem position it as a compelling long-term investment opportunity for those believing in Layer 1 blockchain scalability solutions.

MEXC provides up-to-date SUI price forecasts, real-time data, and trading tools to help you navigate SUI price movements with confidence. The exchange's high liquidity for SUI/USDT trading pairs, user-friendly interface, robust security measures, and 24/7 customer support make it an ideal platform for both short-term traders and long-term investors seeking exposure to Sui Network's growth trajectory and price prediction.

As you evaluate SUI as part of your investment strategy, consider both the substantial technological advantages and the inherent risks associated with emerging blockchain platforms. Diversification, risk management, and staying informed about ecosystem developments remain essential principles for navigating the dynamic cryptocurrency market and making informed decisions based on reliable SUI price predictions.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Learn More About SUI

View More

aiSUI: No-Code AI Agents Powered by the SUI Blockchain

What is WAL (Walrus)? An Introduction to Digital Assets

How to Buy WAL on MEXC: A Detailed Guide

Latest Updates on SUI

View More

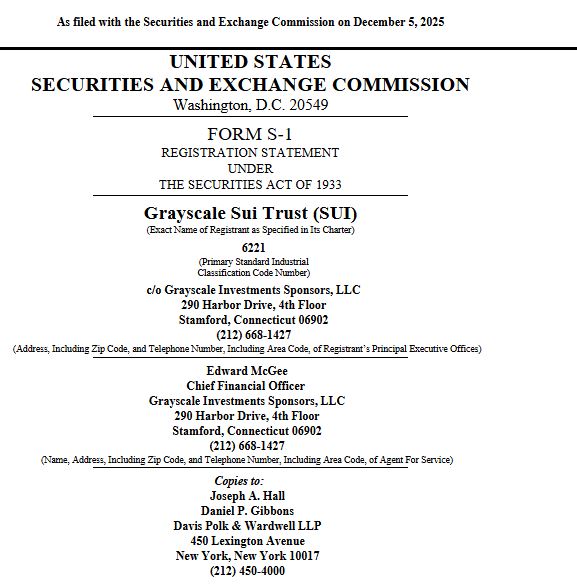

How Grayscale’s S-1 filing marks a new chapter in SUI’s ETF push

Grayscale Sui Trust Filing Follows Momentum From 21Shares’ SUI ETF Debut

Grayscale Files for Sui ETF as Competition with 21Shares Intensifies

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading