Introduction to SUI Short-Term Price Predictions

In the fast-paced world of cryptocurrency, short-term predictions can help traders identify opportunities in daily, weekly, and monthly timeframes. Short-term price predictions for Sui Network (SUI) combine technical indicators, trading patterns, and current market sentiment to provide insights into where SUI might be heading next. As a Layer 1 blockchain platform designed for high-speed transactions and scalability, SUI has garnered significant attention from traders and developers alike, making it an important asset to monitor for near-term price movements and potential SUI price forecasts.

Current Sui Network Market Conditions

As of December 2, 2025, the SUI token represents a significant player in the Layer 1 blockchain ecosystem. SUI is a Layer 1 blockchain and smart contract platform designed from the bottom up to make digital asset ownership fast, private, secure, and accessible to everyone. The token's market position reflects growing interest in platforms that address scalability challenges inherent in earlier blockchain generations, influencing both current SUI price analysis and future SUI network predictions.

SUI's current market conditions are shaped by its fundamental technological advantages and ecosystem development. With a fixed maximum supply of 10 billion SUI tokens, the project maintains a controlled tokenomics structure that differs from platforms with unlimited supplies. The token serves multiple critical functions within the network, including securing the network through staking, paying transaction fees, and participating in governance decisions.

Technical Indicators Shaping SUI Short-Term Price

Short-term movements in SUI are often driven by technical patterns such as support and resistance levels, moving averages, and momentum indicators. Understanding these technical factors is essential for traders seeking to capitalize on near-term price movements and developing accurate Sui Network price predictions.

Network Performance and Adoption Metrics

SUI's technical foundation directly influences investor sentiment and short-term price action. The network demonstrates exceptional performance capabilities, with the Sui blockchain showing speeds of over 120,000 transactions per second under test conditions with an average latency of approximately 2 seconds. This technical superiority creates a compelling narrative for traders and investors evaluating the platform's long-term viability and near-term growth potential for SUI price forecasts.

Ecosystem Development Signals

The expansion of SUI's decentralized finance (DeFi) ecosystem serves as a technical indicator of network health. Cetus Protocol has emerged as Sui's leading decentralized exchange, while Scallop provides lending and borrowing infrastructure. These ecosystem developments signal growing utility and adoption, factors that typically drive positive short-term price momentum and influence SUI price analysis.

Transaction Processing Efficiency

SUI's innovative parallel transaction processing capability represents a key technical differentiator. Transactions involving single-owner objects, which include coin transfers, NFT issuance, and voting, are processed using a streamlined Fast Pay procedure based on the Byzantine Consistent Broadcast mechanism. This efficiency advantage can translate into increased network usage and positive price sentiment in the short term, affecting Sui Network price predictions.

Sui Network Short-Term Price Prediction (24 Hours)

Within the next 24 hours, SUI could react sharply to trading volume spikes, market news, or sudden shifts in sentiment. These rapid changes create opportunities for day traders monitoring the asset closely with SUI price forecasts.

Short-term daily movements for SUI are typically influenced by:

- Intraday trading volume patterns on platforms like MEXC, which offers high liquidity for fast trade execution and multiple trading pairs including SUI/USDT

- Cryptocurrency market-wide sentiment shifts affecting Layer 1 blockchain assets

- Technical support and resistance levels established through recent price action

- Regulatory announcements or macroeconomic news affecting the broader crypto market

Day traders should monitor MEXC's real-time price feeds and order book depth to identify potential entry and exit points within the 24-hour window for accurate SUI price analysis.

SUI Short-Term Price Prediction (7 Days)

A weekly outlook for SUI provides a broader perspective, accounting for potential events like project announcements, ecosystem developments, or market-wide catalysts affecting Sui Network price predictions.

Over a seven-day period, SUI's price trajectory may be influenced by:

- Ecosystem milestone announcements from Mysten Labs or partner projects within the Sui ecosystem

- DeFi protocol developments such as new liquidity pools or governance proposals on platforms like Cetus Protocol

- NFT and gaming activity on platforms like BlueMove and OriginX, which demonstrate the platform's real-world utility

- Broader Layer 1 blockchain competition and comparative performance metrics

- Staking reward distributions and validator participation changes that affect token circulation

The weekly timeframe allows traders to identify emerging trends while remaining responsive to rapid market changes characteristic of cryptocurrency markets and developing more reliable SUI price forecasts.

Sui Network Short-Term Price Prediction (30 Days)

Over the next month, SUI's price will likely be influenced by broader crypto sentiment, upcoming token-specific developments, and macroeconomic news that factor into Sui Network price predictions.

Tokenomics and Supply Dynamics

SUI's 30-day price outlook must account for the token's release schedule. At Mainnet launch on May 3, 2023, approximately 5% of total tokens were in circulation. The network's first year included 1 billion SUI (10% of maximum supply) drawn from a subsidy pool to reward validators, supplementing computation fees and storage fund rewards. Understanding these supply dynamics helps traders anticipate potential price pressure or support from token unlocks and validator rewards for their SUI price analysis.

Ecosystem Expansion Catalysts

The monthly outlook should consider potential announcements regarding new DeFi protocols, gaming partnerships, or enterprise adoption initiatives. SUI's positioning in gaming, NFTs, and DeFi markets creates multiple catalysts for positive price momentum over 30-day periods, affecting SUI price forecasts.

Storage Fund Innovation Impact

SUI's innovative Storage Fund mechanism represents a unique economic model. This fund is used to reward future validators for storing data created by today's transactions, with tokens held in the Storage Fund accruing rewards from their proportionate amount of total staked supply. As this mechanism matures and demonstrates value, it could drive sustained investor interest and positive price pressure over monthly timeframes.

Macroeconomic Considerations

Broader cryptocurrency market conditions, Federal Reserve policy signals, and traditional finance market movements typically influence Layer 1 blockchain asset prices over 30-day periods. Traders should monitor macroeconomic calendars and crypto market sentiment indicators alongside SUI-specific developments for comprehensive Sui Network price predictions.

Market Sentiment and News Impact on SUI Short-Term Price

Crypto prices react strongly to news, whether it's regulatory updates, exchange listings, or project milestones. Short-term predictions must always factor in this external influence on SUI price analysis.

Positive Sentiment Drivers

SUI benefits from strong technical fundamentals and experienced leadership. The platform was developed by Mysten Labs, led by five former senior executives and architects for Meta's Novi digital wallet program. This pedigree attracts institutional interest and positive media coverage, supporting short-term price appreciation and favorable SUI price forecasts.

The platform's focus on addressing key web3 issues by reducing latency in smart contract execution and improving blockchain speed and security resonates with developers and enterprises seeking scalable solutions. Announcements regarding new enterprise partnerships or developer adoption typically drive positive short-term price movements.

Potential Headwinds

Regulatory developments affecting Layer 1 blockchains or cryptocurrency markets generally could create short-term selling pressure. Additionally, competitive developments from other Layer 1 platforms or shifts in developer preference could negatively impact SUI's near-term price action and Sui Network price predictions.

Exchange Listing and Liquidity Events

MEXC's support for SUI trading, including the SUI/USDT trading pair with high liquidity and competitive fees, provides traders with reliable execution for both long and short positions. Announcements regarding new exchange listings or increased trading pair availability typically generate positive short-term price momentum for SUI price analysis.

Expert Opinions on Sui Network Short-Term Outlook

Industry analysts recognize SUI's significant technological advantages and market positioning. The platform's object-centric model, based on the Move programming language, enables parallel execution, sub-second finality, and rich on-chain assets. This architectural innovation positions SUI favorably compared to earlier-generation Layer 1 blockchains, influencing expert SUI price forecasts.

Experts highlight SUI's potential to theoretically handle 100,000+ transactions per second with latency under 400 milliseconds, substantially outperforming Ethereum's 15 transactions per second. This performance advantage creates a compelling narrative for traders evaluating the platform's long-term viability and near-term growth potential for Sui Network price predictions.

The platform's focus on mass adoption, particularly in gaming, NFTs, and DeFi sectors, aligns with broader cryptocurrency market trends toward real-world utility and user-friendly experiences. This positioning suggests sustained investor interest and potential for positive short-term price movements as ecosystem developments materialize.

Conclusion

Short-term price predictions for Sui Network (SUI) are particularly useful for traders navigating fast-changing crypto markets. While volatility makes exact forecasts difficult, tools such as technical indicators, sentiment analysis, and expert insights provide a strong framework for decision-making and creating reliable SUI price forecasts.

SUI's innovative architecture, experienced development team, and growing ecosystem position it as a compelling Layer 1 blockchain platform. The token's fixed maximum supply of 10 billion, combined with its utility functions in staking, transaction fees, and governance, creates a balanced tokenomics structure supporting long-term value proposition.

For the most up-to-date forecasts and market outlook, check the short-term price predictions for SUI on MEXC and stay ahead of upcoming market moves. MEXC's user-friendly interface, high liquidity, multiple trading pairs, robust security measures, and 24/7 customer support make it an ideal platform for traders seeking to capitalize on SUI's short-term price movements and implement effective SUI price analysis strategies.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Learn More About SUI

View More

aiSUI: No-Code AI Agents Powered by the SUI Blockchain

What is WAL (Walrus)? An Introduction to Digital Assets

How to Buy WAL on MEXC: A Detailed Guide

Latest Updates on SUI

View More

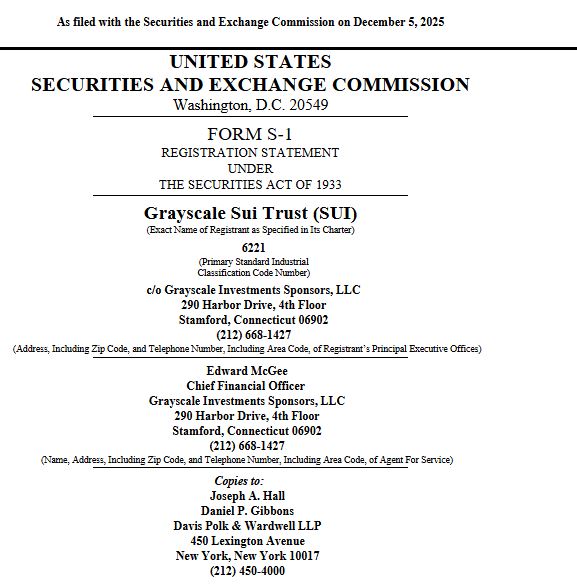

How Grayscale’s S-1 filing marks a new chapter in SUI’s ETF push

Grayscale Sui Trust Filing Follows Momentum From 21Shares’ SUI ETF Debut

Grayscale Files for Sui ETF as Competition with 21Shares Intensifies

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading