Here’s How Much $100, $500, and $1,000 in Little Pepe (LILPEPE) Will Be Worth if the Price Hits $3 in 2026

The post Here’s How Much $100, $500, and $1,000 in Little Pepe (LILPEPE) Will Be Worth if the Price Hits $3 in 2026 appeared first on Coinpedia Fintech News

Currently, the presale is in stage 12, with tokens priced at $0.0021 and almost sold out. Investors who got in during stage 1 have already seen gains of about 110% while those entering stage 12 can still capture around 45% potential upside before launch at $0.0030. The dream scenario that has the community talking is what happens if this meme coin with real tech grows to $3 in 2026. At that point $100 invested today would balloon into roughly $142,857, $500 could climb to $714,285, and $1,000 would soar to $1,428,571. These numbers are speculative, but the story of Little Pepe is not just math. It is about culture, blockchain utility, and investor energy pushing it into mainstream crypto conversations.

Little Pepe (LILPEPE): The Meme Coin with Real Muscles

Unlike many meme coins that rely on hype alone, Little Pepe is built on a Layer 2 EVM-compatible chain that delivers ultra-low fees, fast confirmation, sniper bot protection, and zero transaction tax. The project has also rolled out staking and a meme-focused launchpad, which gives it real infrastructure beyond its community memes. This unique mix suggests it could stand out in a crowded field. At the time of writing, over $25 million has already been raised in the presale. Stage 11 sold out, and stage 12 is now 99% filled at $0.0021 per token. More than 15.5 billion tokens have already been sold.

LILPEPE is also listed on CoinMarketCap and has been audited by Certik, strengthening its credibility in a space where many meme coins struggle to prove trust. The team is also building excitement with a $777k giveaway and an additional Mega Giveaway of more than 15 ETH prizes for top presale buyers between stages 12 and 17. This combination of transparency, rewards, and visible momentum makes Little Pepe worthwhile.

What Makes Little Pepe Different

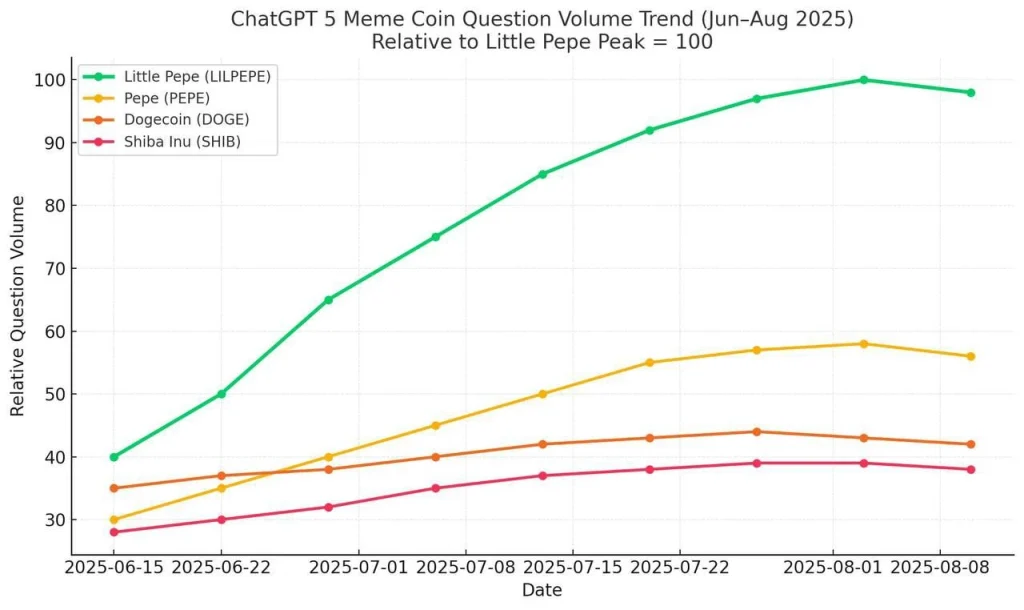

One of the clearest signals of Little Pepe’s potential came between June and August 2025, when ChatGPT data showed LILPEPE peaked at 100 in memecoin question volume, surpassing PEPE, Dogecoin, and Shiba Inu. This is tangible evidence of rising curiosity and community conversation. In crypto, attention is fuel.

With presale nearly finished and only seven stages left before listing, the timing matters. Investors today can still buy at $0.0021, a price that has already increased from $0.0020 in the last stage. Even this small jump highlights how early adopters are rewarded as the stages progress.

A Speculative Glimpse into 2026

The math of $100 turning into $142,857 if LILPEPE hits $3 shows the scale of speculative opportunity. It is not a promise, but it demonstrates how tokenomics and community power can generate substantial returns in crypto. Whether the project hits those heights depends on continued adoption, exchange listings, and real traction for its Layer 2 chain. Even so, the current presale already reflects confidence. Crossing $25 million in raised funds is no small feat. Being listed on CoinMarketCap, audited by Certik, and building visible excitement through giveaways signals that this is not a casual meme play.

Conclusion

If Little Pepe reaches $3 by 2026, a straightforward $100 investment could become $142,859. $500 could turn into $714,285, while $1,000 could increase to $1,428,571. Although these estimates are hypothetical, they show the reasons investors are watching this presale. Compared to Dogecoin, Shiba Inu, and even the growth strength of Solana price action, Little Pepe positions itself as a meme coin with deeper infrastructure and fresh energy. With stage 12 of the presale almost sold out, early buyers are capturing a rare window. The invitation is simple: check out Little Pepe, join the Telegram, follow on Twitter, and see if this next-generation meme coin deserves a spot in your portfolio before the presale closes.

For more information about Little Pepe (LILPEPE) visit the links below:

- Website: https://littlepepe.com

- Whitepaper: https://littlepepe.com/whitepaper.pdf

- Telegram: https://t.me/littlepepetoken

- Twitter/X: https://x.com/littlepepetoken

You May Also Like

Solana Price Prediction from Standard Chartered

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias