Ledger Exposes Tangem Wallet Security Flaw: What Crypto Wallet To Use

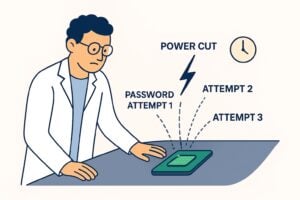

Ledger Wallet’s security research team, Donjon, recently published a report highlighting a potential flaw in Tangem hardware wallets. The exploit described a method to brute-force access codes using what is known as a “tearing attack.” This technique involves interrupting the chip’s power to bypass time delays between guesses. In theory, it could allow an attacker to speed up code-breaking attempts.

Tangem responded quickly. The company clarified that it does not use short PIN codes but rather long, customizable access codes that can include letters, numbers, and symbols. According to Tangem, the hardware would likely fail long before an attacker could guess a strong code, making the exploit impractical outside of a laboratory setting.

What Crypto Wallet Users Need to Know

On paper, the vulnerability looks concerning. In reality, it is far from a real-world threat. The exploit requires physical access to the wallet, expensive equipment, and advanced technical skills. Even then, brute-forcing a long access code would take longer than the device could survive.

This means that only weak, short codes could be at risk. For ordinary users who create strong, unique access codes, the chance of losing funds to such an attack is effectively zero.

Why the Security Debate Matters

Ledger and Tangem are both respected hardware wallet providers. Their public exchange is less about exposing real danger and more about demonstrating rigorous security practices. Donjon has built a reputation by stress-testing wallets from Ledger, Trezor, Coldcard, and others. For Tangem, this report was notable because it was the only flaw Donjon claimed to find. Some users even saw that as a sign of strength.

Ultimately, the back-and-forth highlights how competitive the wallet market has become. Security is a selling point, and companies will continue to emphasize their resilience against extreme scenarios.

Practical Protection for Everyday Users

The Tangem–Ledger wallet debate is a reminder that some vulnerabilities only exist in highly controlled lab conditions. For everyday users, the real dangers come from exchange hacks, phishing attempts, and weak passwords. That is where Best Wallet puts its focus, protecting users against the threats they are most likely to face, while keeping self-custody simple and secure.

It provides users with a way to safeguard their crypto against the most common risks in the space today.

Protecting Your Crypto from Real-World Risks – Which Wallet To Use

It’s pretty clear that the increasing wallet-targeted scams plaguing the crypto space have prompted a broader shift among investors toward self-custody. Instead of relying on centralized platforms to safeguard assets, self-custodial tools empower investors to hold their own private keys and maintain direct control of their crypto without sacrificing their privacy.

That alone eliminates the risk of losing funds to exchange exploits and data leaks that continue to spread across the industry. Among the few reliable options that excel in this aspect is Best Wallet.

Its no-KYC, self-custodial architecture ensures that investors remain fully in charge of both their money and privacy – no email-based attack vectors, no identity verification hurdles, and no middlemen.

This security-first design, when paired with best practices such as Fireblocks integration, strong unique passwords, biometric fingerprints, scam filters, two-factor authentication, and regular safety updates, help protect against the phishing, malware, and drainer exploits that continue to spread across the crypto landscape.

Therefore, for investors who want exposure to digital assets through a wallet solution that’s built with security at its core, Best Wallet represents a smart way forward. Its WalletConnect’s certification further attests to this, presenting it as a highly secure wallet with quality assurance that users can trust.

But beyond security, Best Wallet stands out in other crucial areas as well, especially when it comes to trading features. It’s a multichain wallet, with plans to support up to 60 major blockchains, giving users the opportunity to access as many cryptocurrencies and staking facilities as possible.

The next key attraction is its integration with over 300 decentralized protocols and more than 30 cross-chain bridges, ensuring that users always find the best rates for their trades.

Other key features that have been driving Best Wallet’s growing popularity include fiat payments, iGaming perks, and advanced gas controls amongst others.

For investors who want to stay in control while accessing the best trading features, Best Wallet provides everything needed to trade securely in 2025. That’s why it is recommended by well-known crypto publications, including YouTube channels like 99Bitcoins.

Download Best Wallet

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!