rust-lld: How It Can Give You Faster Linking Times

TL;DR: rustc will use rust-lld by default on x86_64-unknown-linux-gnu on nightly to significantly reduce linking times.

Some context

Linking time is often a big part of compilation time. When rustc needs to build a binary or a shared library, it will usually call the default linker installed on the system to do that (this can be changed on the command-line or by the target for which the code is compiled).

\ The linkers do an important job, with concerns about stability, backwards-compatibility and so on. For these and other reasons, on the most popular operating systems they usually are older programs, designed when computers only had a single core. So, they usually tend to be slow on a modern machine. For example, when building ripgrep 13 in debug mode on Linux, roughly half of the time is actually spent in the linker.

\ There are different linkers, however, and the usual advice to improve linking times is to use one of these newer and faster linkers, like LLVM's lld or Rui Ueyama's mold.

\ Some of Rust's wasm and aarch64 targets already use lld by default. When using rustup, rustc ships with a version of lld for this purpose. When CI builds LLVM to use in the compiler, it also builds the linker and packages it. It's referred to as rust-lld to avoid colliding with any lld already installed on the user's machine.

\ Since improvements to linking times are substantial, it would be a good default to use in the most popular targets. This has been discussed for a long time, for example in issues #39915 and #71515, and rustc already offers nightly flags to use rust-lld.

\ By now, we believe we've done all the internal testing that we could, on CI, crater, and our benchmarking infrastructure. We would now like to expand testing and gather real-world feedback and use-cases. Therefore, we will enable rust-lld to be the linker used by default on x86_64-unknown-linux-gnu for nightly builds.

Benefits

While this also enables the compiler to use more linker features in the future, the most immediate benefit is much improved linking times.

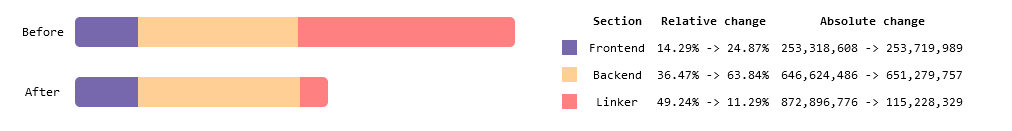

\ Here are more details from the ripgrep example mentioned above: linking is reduced 7x, resulting in a 40% reduction in end-to-end compilation times.

Most binaries should see some improvements here, but it's especially significant with e.g. bigger binaries, or when involving debuginfo. These usually see bottlenecks in the linker.

\ Here's a link to the complete results from our benchmarks.

\ If testing goes well, we can then stabilize using this faster linker by default for x86_64-unknown-linux-gnu users, before maybe looking at other targets.

Possible drawbacks

From our prior testing, we don't really expect issues to happen in practice. It is a drop-in replacement for the vast majority of cases, but lld is not bug-for-bug compatible with GNU ld.

\ In any case, using rust-lld can be disabled if any problem occurs: use the -Z linker-features=-lld flag to revert to using the system's default linker.

\ Some crates somehow relying on these differences could need additional link args. For example, we saw <20 crates in the crater run failing to link because of a different default about encapsulation symbols: these could require -Clink-arg=-Wl,-z,nostart-stop-gc to match the legacy GNU ld behavior.

\ Some of the big gains in performance come from parallelism, which could be undesirable in resource-constrained environments.

Summary

rustc will use rust-lld on x86_64-unknown-linux-gnu nightlies, for much improved linking times, starting in tomorrow's rustup nightly (nightly-2024-05-18). Let us know if you encounter problems, by opening an issue on GitHub.

\ If that happens, you can revert to the default linker with the -Z linker-features=-lld flag. Either by adding it to the usual RUSTFLAGS environment variable, or to a project's .cargo/config.toml configuration file, like so:

[target.x86_64-unknown-linux-gnu] rustflags = ["-Zlinker-features=-lld"] Rémy Rakic on behalf of the compiler performance working group

\ Also published here

\ Photo by Antoine Gravier on Unsplash

You May Also Like

Unlocking Opportunities: Coinbase Derivative Blends Crypto ETFs and Tech Giants

Crossmint Partners with MoneyGram for USDC Remittances in Colombia