- Canopy Growth

- Blackberry

- Transat

Stock news for investors: Canopy Growth to acquire MTL Cannabis in $125-million deal

Build your retirement savings with 1.50% interest, tax-deferred contributions and zero fees.

Earn a guaranteed 2.75% in your RRSP when you lock in for 1 year.

See our ranking of the best RRSP accounts and rates available in Canada.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

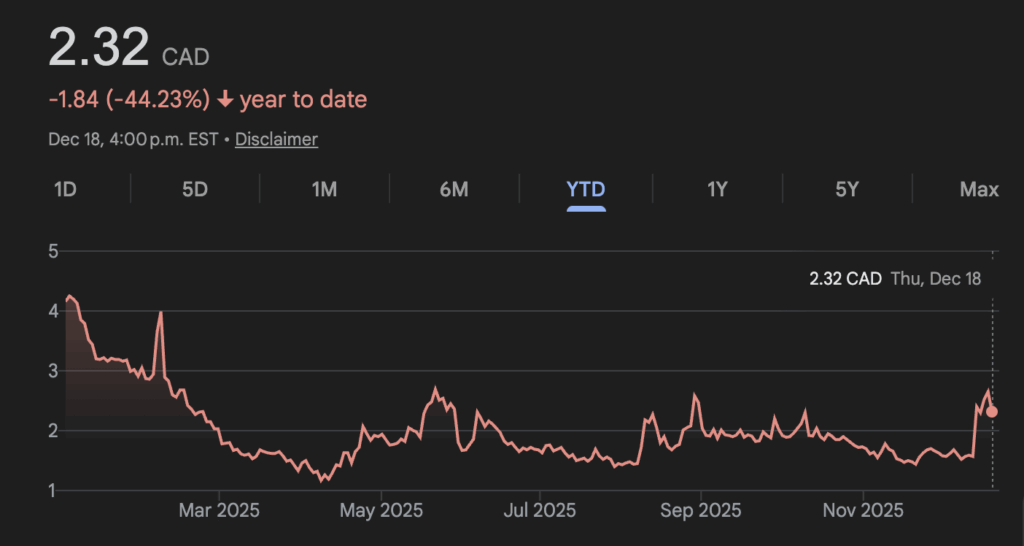

Canopy Growth signs deal to buy MTL Cannabis in agreement valued at $125M

Canopy Growth Corp. has signed a deal to buy Quebec-based MTL Cannabis Corp. in a transaction valued at about $125 million. The deal is expected to help boost Canopy Growth’s position in Canada’s medical cannabis market.

Canopy Growth chief executive Luc Mongeau says MTL’s cultivation expertise, combined with his company’s scale, positions it to improve product quality, expand supply and accelerate its path to profitable growth.

Under the terms of the agreement, MTL shareholders will receive 0.32 of a common share of Canopy Growth and 14.4 cents in cash for each MTL share they hold. Canopy shares closed at $2.40 on the Toronto Stock Exchange on Friday.

The deal requires regulatory and MTL shareholder approval. Closing of the transaction is expected to occur before the end of February.

Source Google

Source Google

BlackBerry reports Q3 profit of US$13.7M, up from a loss a year ago

BlackBerry (TSX:BB)

Numbers for its third quarter of 2025:

- Profit: $13.7 million (up from loss of $10.5 million a year ago)

- Revenue: $141.8 million (down from $143.6 million)

BlackBerry Ltd. reported a third-quarter profit of US$13.7 million, up from a loss of US$10.5 million during the same period a year earlier. The Waterloo-based software company, which keeps its books in U.S. dollars, said Thursday that its earnings per share came in at two cents US, flat compared with the prior year quarter.

BlackBerry says its revenue reached US$141.8 million for the period ended Nov. 30, down from US$143.6 million during the third quarter last year.

John Giamatteo, BlackBerry CEO, says in a press release that the company’s QNX segment reached an all-time high for revenue. QNX segment revenue came in at US$68.7 million, rising 10 per cent from US$62.3 million a year earlier.

Giamatteo says the company’s higher-than-expected overall revenue, coupled with ongoing cost discipline efforts, helped it achieve its strongest profitability in nearly four years during the quarter.

Source Google

Source Google

Transat A.T. reports $12.5M Q4 loss compared with $41.2M profit a year ago

Transat A.T. (TSX:TRZ)

Numbers for its fourth quarter of 2025:

- Loss: $12.5 million (down from profit of $41.2 million a year ago)

- Revenue: $771.6 million (down from $788.8 million)

Travel company Transat A.T. Inc. reported a loss of $12.5 million in its latest quarter compared with a profit of $41.2 million in the same quarter last year. The company says the loss amounted to 52 cents per diluted share for the quarter ended Oct. 31 compared with a profit of $1.05 per diluted share a year earlier.

Revenue in what was Transat’s fourth quarter totalled $771.6 million, down from $788.8 million a year ago when it benefited from compensation related to Pratt & Whitney GTF engine issues. Excluding the impact of this lower compensation, Transat says revenue increased by 1.5 per cent compared with a year ago.

On an adjusted basis, Transat says it lost 42 cents per share in its latest quarter compared with an adjusted profit of 81 cents per share in the same quarter last year.

Last week, Transat narrowly avoided a costly work stoppage when it reached a new tentative contract with its pilots.

Source Google

Source Google

MoneySense’s ETF Screener Tool

Read more news:

- How to tap into AI growth while managing risk

- Here’s how some young Canadians are facing their financial future

- The year in money: notable personal finance changes for 2025

- Dwindling opportunities and soaring costs leave youth adrift

The post Stock news for investors: Canopy Growth to acquire MTL Cannabis in $125-million deal appeared first on MoneySense.

You May Also Like

UK inflation stays high, potentially pausing interest rate hikes

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future