Bitcoin Wave 3 Crash: What’s Next As Price Makes A Rebound?

Bitcoin’s price action over the past 24 hours has changed from outright selling pressure to a cautious rebound. After falling into the mid-$75,000 region, the cryptocurrency found support around $75,400. That support has since carried BTC back toward $79,000, with the price now pushing higher, and momentum can rebuild toward the important $80,000 price level.

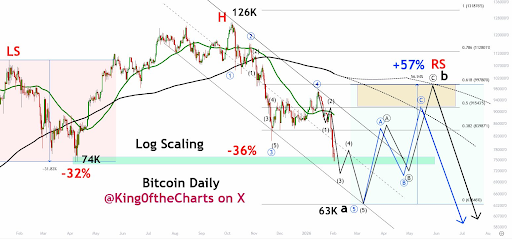

Although the bounce has eased immediate downside pressure, a technical analysis shared on X shows that the move may be occurring within a much larger bearish structure that could still have enough time to develop.

Elliott Wave Structure Points To A Wave 3 Crash

Technical analysis shows that the recent Bitcoin sell-off and crash below $80,000 fit squarely within a larger Elliott Wave structure that still points to additional downside ahead. The Bitcoin technical chart outlines an extended decline that’s been playing out from the $126,000 peak in October 2025.

TheBitcoin Historical Performance Shows How Low The Price Will Go Before A BottomBitcoin kicked off a five-wave downward impulse move after it peaked at $126,000 in October. From the October 2025 high near $126,000, Bitcoin has already fallen roughly 41%, a drawdown the analyst claims aligns closely with prior warnings of a 40% to 50% crash in the early phase of a bear market.

According to the analyst, Bitcoin completed its Primary Wave 4 near the $97,900 region before rolling over into Primary Wave 5. This Primary Wave 5, which is a downward wave, is divided into smaller impulse waves. Within that larger decline, Bitcoin is now said to be deep inside Intermediate Wave 3, which is typically the most aggressive and damaging leg of an Elliott Wave move.

Where The Analyst Sees The Bottom Forming

Bitcoin is expected to transition into Intermediate Wave 4 after Wave 3 is completed, which may offer temporary relief or consolidation. However, that pause is expected to be followed by Intermediate Wave 5, a final leg lower that could push the Bitcoin price to new cycle lows before the entire wave structure reaches completion.

Looking ahead, the analysis outlines a potential bottoming zone between $60,000 and $63,000 for Wave 5. However, the analyst noted that Bitcoin could even briefly probe lower and fall to the 200-week moving average around $58,000, before finally exhausting selling pressure. In this framework, the current rebound from the $75,000 area is viewed as a pause within the downtrend, not confirmation that the lows are in.

Once that low is established, the next outlook is that a sizeable bear-market rally will follow. The chart projects a recovery back toward the 200-day moving average, with upside targets stretching into the $90,000 to low-$100,000 range. That move was described by the analyst as a counter-trend rally before what could be the next major leg lower later in the cycle.

You May Also Like

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds

Why Vitalik Says L2s Aren’t Ethereum Shards Now?