Bitcoin Price Outlook: Bulls Target $94,000 Break for Momentum Into New Year

Bitcoin Magazine

Bitcoin Price Outlook: Bulls Target $94,000 Break for Momentum Into New Year

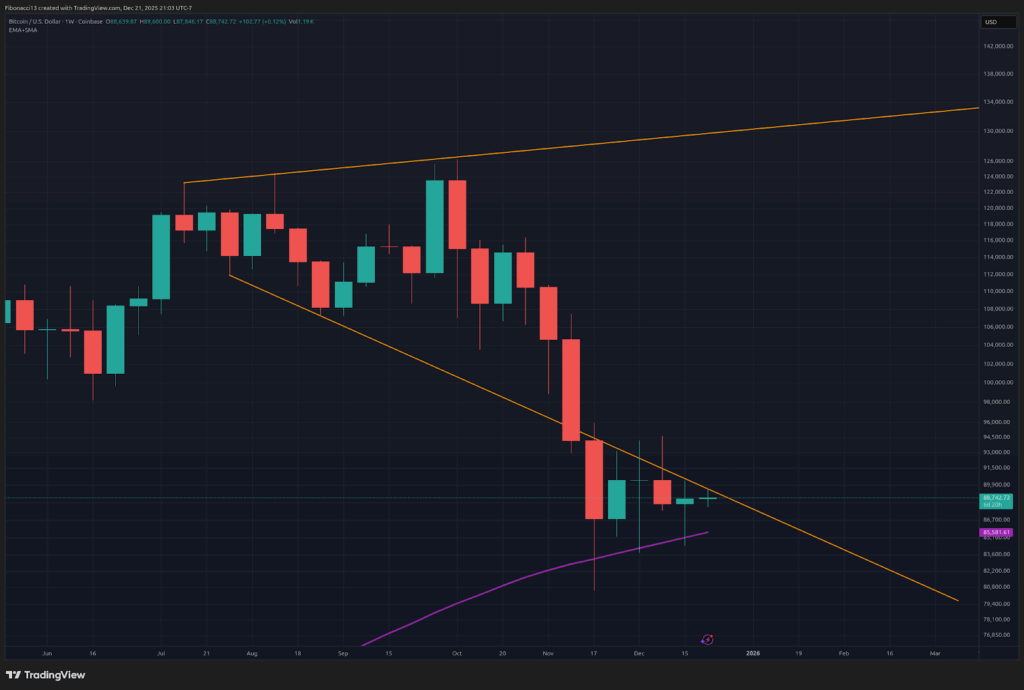

Last week, bulls needed to hold closes above $85,000 to stave off the bears, and they managed to do just that. Bitcoin price dropped to support once again last week, and the bulls defended it well, pushing the price back up to close the week out at $88,656. The price on the weekly chart has been rejecting from the lower trend line of the broadening wedge pattern for several weeks now, but the trend line is so low now that the price should push above it this week. If it fails to do so this week, look for the price to take the next leg down into the low $70,000 range.

Key Support and Resistance Levels Now

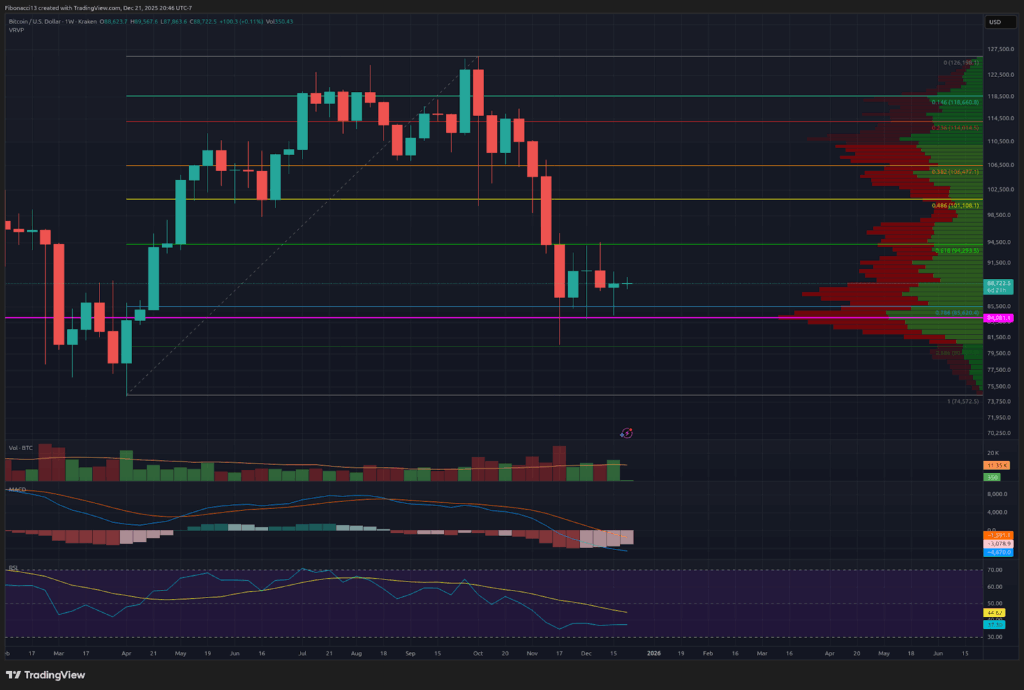

Bulls will want to continue the push this week, level by level if need be. Initial resistance sits at $91,400, with the next level at $94,000. Above here, we should see very strong resistance at $98,000. Then we should see a fairly strong resistance zone from $101,000 all the way up to $108,000. Closing above $108,000 would start to place severe doubts on the long-term top being in place here.

The $84,000 support level below is proving to be resilient, holding up again this past week. If it is lost, the expected support levels below have not changed. The $72,000 to $68,000 zone should be expected to support the price on a first test at the least. Closing below $68,000 likely leads to a slow grind down to the 0.618 Fibonacci retracement support at $57,000.

Outlook For This Week

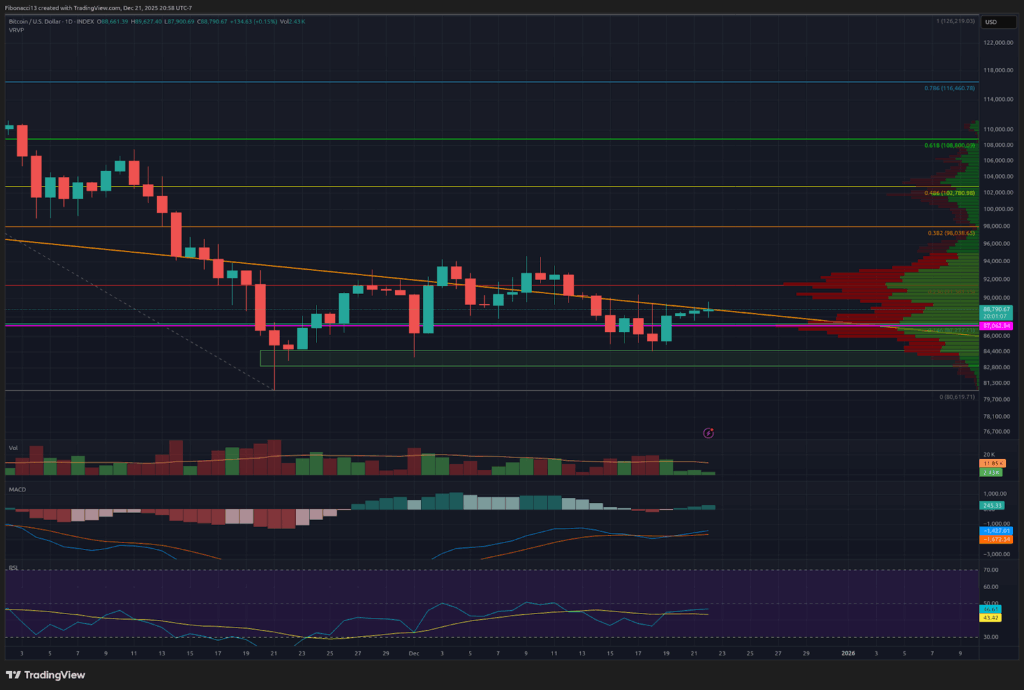

The bears may be getting a little flustered with their recent failure to break support. This week, look for the bulls to push back a bit harder as they gain some confidence after holding support once again. Market liquidity should be low for Christmas week, so price movement may be lacking. There are some very large long-dated bitcoin options expiring on December 26th, however, with a max pain price of $100,000, so look for the price to try to push closer to the $100,000 level this week.

Market mood: Bearish – Bulls are pushing back a little here, but they still need to prove it to the bears with some positive price action.

The next few weeks

Bulls held back the bears from breaking down major support last week. If the bulls can finally manage to take out resistance at $94,000 over the next couple of weeks, they may be able to sustain some upward momentum into the new year as well. So if we see a weekly close above $94,000, look for the price to move towards $101,000. This momentum could continue to $108,000 with a close above $100,000. Resistance becomes extremely thick near this level, though, so a strong rejection near this level should be expected if we can make it there over the coming weeks.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Broadening Wedge: A chart pattern consisting of an upper trend line acting as resistance and a lower trend line acting as support. These trend lines must diverge away from each other in order to validate the pattern. This pattern is a result of expanding price volatility, typically resulting in higher highs and lower lows.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

This post Bitcoin Price Outlook: Bulls Target $94,000 Break for Momentum Into New Year first appeared on Bitcoin Magazine and is written by Ethan Greene - Feral Analysis and Juan Galt.

You May Also Like

The Top 10 Altcoins Most Purchased by Investors in 2025 Have Been Revealed! There’s a Trump Detail Too!

The high premium of silver funds has attracted attention; Guotou Silver LOF will be suspended from trading from the opening of the market on December 26 until 10:30 a.m. on the same day.