👨🏿🚀TechCabal Daily – Locked out of Eden

TGWSAVO.

If you guessed what today’s acronym stands for, it means you couldn’t wait for Saturday to be over so you could get back with your true love: TC Daily.

We reciprocate the love, comrade.  Now, go oppress your Valentine’s Day oppressors with the same gusto by sharing today’s newsletter with them.

Now, go oppress your Valentine’s Day oppressors with the same gusto by sharing today’s newsletter with them.

We published the latest edition of Headlines by TechCabal on February 14, so you wouldn’t feel lonely on that day (yes, you’re welcome). If you haven’t watched it yet, we might consider reviewing the terms and conditions of our friendship.

We break down all the headlines in African tech, and as usual, we do so with humour, clarity, and depth.

Go check it out here.

- Eden Life pauses consumer operations

- Eskom gets vote to split

- Airtel’s Smartcash targets Nigeria’s mobile market

- Cell C is profitable again, but at what cost?

- World Wide Web 3

- Job Openings

Startups

Eden Life hits pause on consumer-facing operations

Image Source: TechCabal

Image Source: TechCabal

Eden Life, a Nigerian startup that offers managed home services, including house cleaning, laundry, and food delivery, is pausing consumer operations to focus on corporate clients, TechCabal exclusively reported.

The company’s decision to pause its consumer business is less a retreat and more an admission: managed home subscriptions are brutally hard to scale in Nigeria’s current economy.

What worked? Timing and taste. Launched in 2019 by Andela alumni, Eden Life rode the COVID-era surge in demand for convenience. It bundled meals, cleaning, and laundry into a premium subscription and abstracted away the chaos of managing informal labour. For a moment, affluent Lagos households paid for peace of mind.

What didn’t? Unit economics. Inflation, foreign exchange volatility, and logistics costs eroded margins. But the deeper issue was structural. Managed marketplaces in emerging markets fight two battles: thin consumer purchasing power and labour disintermediation.

If a cleaner or cook can be hired directly over WhatsApp for less, the platform’s take rates become fragile. Eden Life’s defence should have been lock-in; long-term contracts, embedded credit, workplace delivery hubs, or loyalty layers that made off-platform switching costly. That’s hard to execute when customers themselves are under macro pressure.

Refocusing on corporate catering makes strategic sense. B2B offers larger ticket sizes, predictable demand, centralised billing, and lower churn (if Eden layers on other essential services that make lock-in possible). Enterprises value compliance, food safety, and reliability—areas where informal alternatives struggle. In tough economies, companies still need to feed staff; households can cut subscriptions.

But B2B is not a silver bullet. Margins hinge on procurement discipline, operational efficiency, and tight cost control. Payment cycles can stretch, and competition shifts from informal workers to established corporate catering and managed service contractors.

Eden Life can win if it becomes an operations company, not a lifestyle brand—optimising kitchens, standardising supply chains, and treating B2C as an optional layer atop profitable infrastructure.

The reset isn’t glamorous; it’s like Chowdeck, the food delivery platform, deciding to focus exclusively on enterprises—though it doesn’t play in the same market as Eden Life. But in this macro climate, boring might be beautiful.

FINCRA X ATS Nairobi 2026

As Headline Sponsor of ATS 2026, Fincra is building the financial rails that connect Africa to the global financial ecosystem through resilient infrastructure that delivers. Get started with Fincra.

Companies

Eskom, South Africa’s electricity company, is splitting up

Image Source: MyBroadBand

Image Source: MyBroadBand

South Africa is moving forward with breaking up Eskom, the state-owned national electricity utility, to create a fully independent state-owned company to manage the national transmission grid.

Was Eskom not split before? Not really. In 2019, the government announced a plan to unbundle Eskom into three separate businesses: generation, transmission, and distribution. In 2024, Eskom established the National Transmission Company of South Africa (NTCSA) as a subsidiary, carving out the transmission aspect operationally while retaining ownership by Eskom.

South Africa’s President Cyril Ramaphosa says the government will move ahead with creating a fully independent state-owned transmission company.

Why break the company up? Eskom’s debt burden is enormous, and it cannot fund the R390 billion ($24.5 billion) estimated by the Department of Electricity and Energy as the amount needed over the next decade to modernise transmission infrastructure alone. Separating transmission is meant to attract private investment and reform the electricity sector.

What happens next? A task team now has three months to map out the implementation for the split, including mapping out assets to be transferred and deciding how debt is to be allocated. The team would also set up market rules for electricity trading.

The Smarter Way to Save

Earn up to 20% interest on your savings with PalmPay. Join over 40 million users building smarter saving habits with simple, automated tools designed for everyday life. Learn more.

Mobile money

Airtel’s Smartcash is taking another crack at Nigeria’s mobile money market

Image source: Zikoko Memes

Image source: Zikoko Memes

Airtel Nigeria, the subsidiary of the Africa-focused telecom firm, is rejigging its strategy to crack the mobile money market. Free transfers. Cashback on everything. A flat 15% interest rate. Nearly 60,000 point of sale (PoS) terminals. On paper, it’s aggressive.

But incentives rarely solve structural disadvantages.

What does that mean? SmartCash operates under the Payment Service Bank framework—no lending, tighter regulatory limits, slower product iteration. Meanwhile, fintechs like OPay and PalmPay built their dominance on velocity: fast merchant onboarding, agent density, consumer loans, and relentless distribution.

There are over 6 million active PoS terminals nationwide, meaning it is already an entrenched payment method for many Nigerians. Airtel’s edge should be distribution and trust. It has over 60 million telecom subscribers.

If Airtel tightly integrates SmartCash into its telecom ecosystem—airtime, data bundles, device financing, SME merchant services—it could build closed-loop value. Not just a wallet, but infrastructure embedded in everyday telecom usage.

While its telecom scale doesn’t automatically convert to wallet usage, it could habituate customers who might be incentivised to apply for unsecured loans or receive yields. OPay did the same with OKash; the entry phase was a payments app, and credit and savings became add-ons.

Yet, there’s a sticky situation: If deposit growth is driven primarily by yield-seeking customers, stickiness will fade once incentives taper. Cashback wars compress margins for everyone, and without lending—often the highest-margin product in Nigerian fintech—monetisation pathways are narrow.

Incentives may spark trials. But relevance in Nigeria’s mobile money market is earned through ubiquity, not promotions.

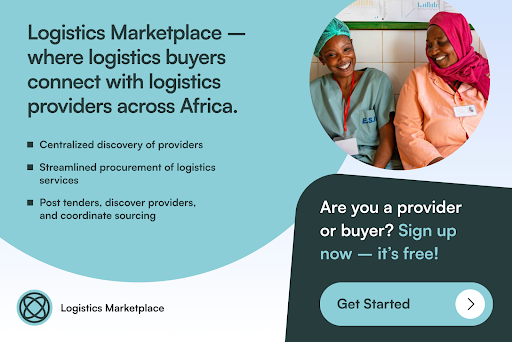

Discover providers and manage logistics in one secure platform.

The Logistics Marketplace connects health buyers – governments, partners, humanitarian organizations & manufacturers with logistics providers across Africa. Backed by Global Fund & Gates Foundation Join for free today.

Telecoms

Cell C posts profitable half-year after JSE listing, thanks to debt-for-equity conversions

Image Source: TechCentral

Image Source: TechCentral

Cell C, a South African mobile network operator and telecommunications company, posted a R3.4 billion ($213 million) profit in its six-month results ending November 2025; its first as a newly-listed company on the Johannesburg Stock Exchange (JSE).

This sounds grand until you realise that most of it came from once-off restructuring gains rather than operations.

What this means is the operator didn’t make that money from selling more airtime or data; it came from changing how debt was recorded.

Here’s a breakdown: Before listing, Cell C owed a lot of money and had negative equity of R8.3 billion ($520 million), more than the company was worth. Instead of demanding repayment, lenders agreed to become part-owners by converting R4.1 billion ($257 million) in debt into company shares, which cancelled the debt and is recorded as a gain. So, Cell C’s recorded profit is not operational performance.

Does this make it fake? No, it’s legit, but it is not recurring as it won’t repeat itself next year. When you strip out the restructuring effects, the company’s revenue grew just 1.8%; prepaid service grew its subscriber numbers, but average revenue per user (ARPU) declined, meaning that more people are using Cell C’s service but spending less.

So, is this a turnaround? Not so much as it is a financial reset. The restructuring cleaned up the books and gave Cell C—a telecom operator that has been burning cash in search of profitability and saw an underwhelming IPO in 2025—breathing room, but its operational turnaround is yet to arrive. The telecom company will now be tested on whether it can grow its revenue, improve subscriber count, and make a space for itself against bigger, publicly listed rivals like MTN and Telkom.

Get the Nimbus Aid Foundation’s 2025 Impact Report

Nimbus Aid Foundation’s 2025 Impact Report shows how ₦50M in DOOH advertising transformed 33 women-led businesses, driving 65% traffic growth and moving beneficiaries from pre-revenue to post-revenue. Download here.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $68,836 |

– 1.77% |

– 27.84% |

| Ether | $1,971 |

– 4.93% |

– 40.07% |

| Initia | $0.1025 |

+ 34.05% |

– 1.97% |

| Solana | $85.42 |

– 3.59% |

– 40.65% |

* Data as of 06.00 AM WAT, February 16, 2026.

JOB OPENINGS

- Big Cabal Media — Associate Videographer/Video Editor (full-time); Senior Financial Analyst (full-time); Zikoko Citizen Reporter (full-time); Content Creator (contract); Journalist (contract); Project Associate (contract); Senior Editor (contract); Senior Writer; Business Development Executive — Lagos, Nigeria

- Piggyvest — Senior Accounting Associate, Customer Success Intern — Lagos, Nigeria

- Miden — Junior Brand Designer — Lagos, Nigeria

- Buffer — Senior Engineer, Growth Marketing — Remote

- Moniepoint — Several roles — Remote (Nigeria)

- Palmpay— Senior Graphics Designer — Lagos, Nigeria

- Wave — Machine Learning Scientist — Nairobi, Kenya

- Pavago — Customer Success Manager — Remote (Kenya)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

- Digital Nomads: Africa enters the golden passport market as the world tightens rules

- “I had no assumptions. I was just building:” Day 1-1000 of Selar Can prediction markets fix a multi-billion-dollar information gap for African startups?

Written by: Opeyemi Kareem and Emmanuel Nwosu

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

What SBI Really Owns in Ripple May Surprise XRP Investors

![[Just Saying] ICC arrest warrant does not need local court imprimatur](https://www.rappler.com/tachyon/2026/02/icc-co-perpetrators.jpg?resize=75%2C75&crop=480px%2C0px%2C1080px%2C1080px)

[Just Saying] ICC arrest warrant does not need local court imprimatur