Bitcoin Miners Post August Haul Near July as Fees Tick Up

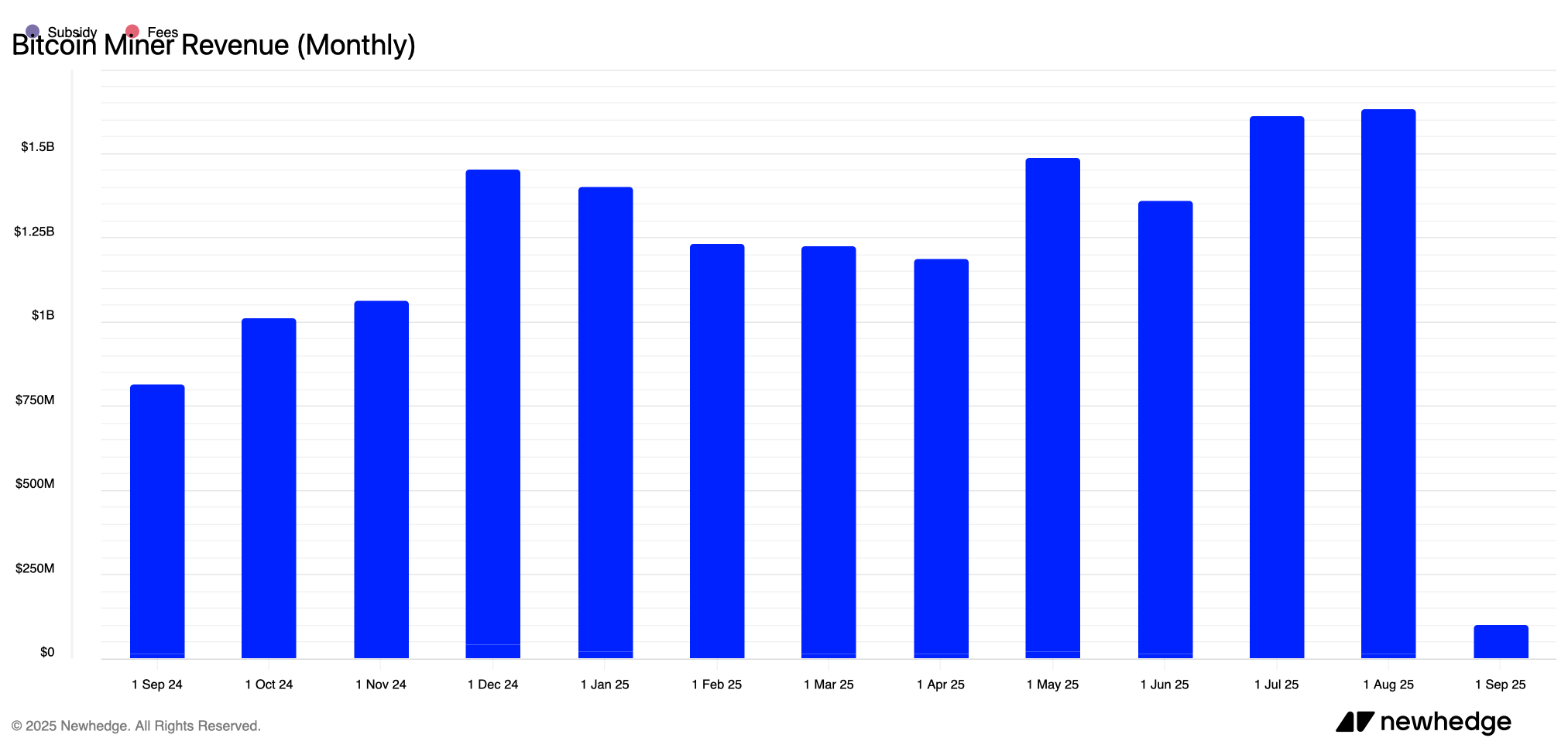

According to recent metrics, bitcoin miners sustained solid earnings results in August, capturing revenue nearly on par with July’s tally, or marginally above, with earnings ranging from $1.633 billion to $1.66 billion.

Bitcoin Fees Inch Higher While Miners’ Locked in $1.63B–$1.66B Last Month

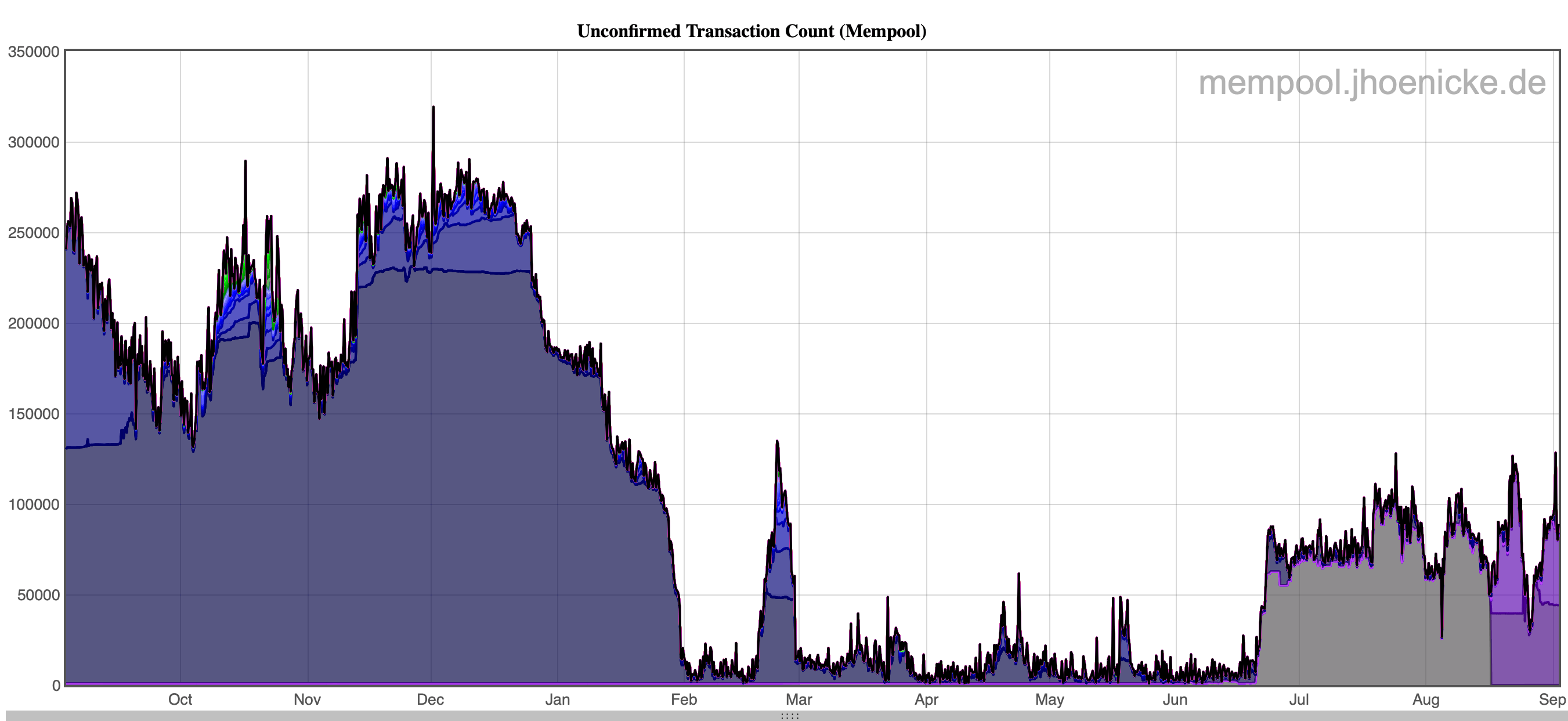

At the time of writing, data from mempool.space and Johoe’s mempool tracker indicate a queue of approximately 85,000 to 93,000 unconfirmed transactions. This points to a spurt of heightened onchain activity alongside increased fees. On Sept. 1, the average cost of a BTC transaction reached 0.000016 BTC, or 8.7 satoshis per byte, equivalent to $1.75 per transfer.

Johoe’s mempool tracker shows a bump in pending transfers since the end of June.

Johoe’s mempool tracker shows a bump in pending transfers since the end of June.

Not long ago, transaction fees made up less than 1% of the overall block reward. Archived data from Sept. 2 shows that during the past day, fees represented 1.89% of the total reward. Since the end of June, a steady buildup of unconfirmed transfers has persisted, with daily backlogs ranging from 50,000 to 139,000. This stands in contrast to earlier periods of record-low onchain activity, when blocks were at times not fully utilized.

Despite the steady transfer activity, fees have remained relatively stable, averaging $1.30–$1.40 per transaction over the past three months. Most values fall between a $1.00 and $1.50 average, with only occasional spikes into the $2.00–$3.00 range, which remain outliers. By late August, the average slipped closer to $0.80–$1.00, followed by a slight uptick at the start of September.

Miners fared well in August, securing revenue nearly identical to the prior month’s earnings, which marked the strongest haul since the April 2024 halving. Data from theblock.co records miner rewards at exactly $1.65 billion from the subsidy alone, rising to $1.66 billion when fees are included. Same as July. Figures compiled by newhedge.io offer a more granular view, placing the subsidy at $1.62 billion and the combined total at $1.633 billion, and above July’s $1.61 billion aggregate.

Bitcoin miner monthly revenue from newhedge.io.

Bitcoin miner monthly revenue from newhedge.io.

Taken together, steady queues, modestly firmer fees, and earnings holding near July levels suggest miners enter September with resilient cash flow. Subsidy remains the backbone, while onchain demand offers a small but growing tailwind. If activity persists, revenue should stay supported; if congestion eases, efficiency and energy costs will decide margins until the next catalyst reshapes block economics once more.

You May Also Like

The Channel Factories We’ve Been Waiting For

Shanghai residents flock to sell gold as its price hit record highs