Poland Debuts First Bitcoin ETF in Eastern Europe – Can Bitcoin Hyper Follow With 10x Gains?

For the first time, Polish investors can tap into $BTC exposure through their brokerage accounts instead of navigating wallets, exchanges, or private keys.

With a population of 38M and a growing fintech sector, Poland’s move could ripple across the region. But if ETFs cement Bitcoin’s role as a regulated asset, what about scaling its utility? That’s where projects like Bitcoin Hyper ($HYPER) come in.

Poland Enters The ETF Arena

Poland’s debut product, the Bitcoin BETA ETF, began trading this week on the Warsaw Stock Exchange (GPW).

Source: X/@BitcoinMagazine

Managed by AgioFunds and greenlit by the Polish Financial Supervision Authority back in June, the fund gives traditional investors regulated access to $BTC without requiring direct custody.

Instead of holding Bitcoin itself, the ETF tracks futures contracts listed on the Chicago Mercantile Exchange (CME). Brokerage firm DM BOŚ serves as market maker, ensuring liquidity on the exchange.

The structure includes a management fee of up to 1% and hedges currency risk through forward contracts, softening the impact of USD/PLN swings on returns. The launch is framed as a response to investor demand.

With 400+ companies worth over $600B listed, GPW remains the heavyweight exchange in Central and Eastern Europe.

Why It Matters for Eastern Europe

Poland has positioned itself as a regional leader in digital finance. The timing of its first Bitcoin ETF is significant: it lands just as the EU rolls out its MiCA framework, giving investors regulatory clarity that has often been missing in Central and Eastern Europe.

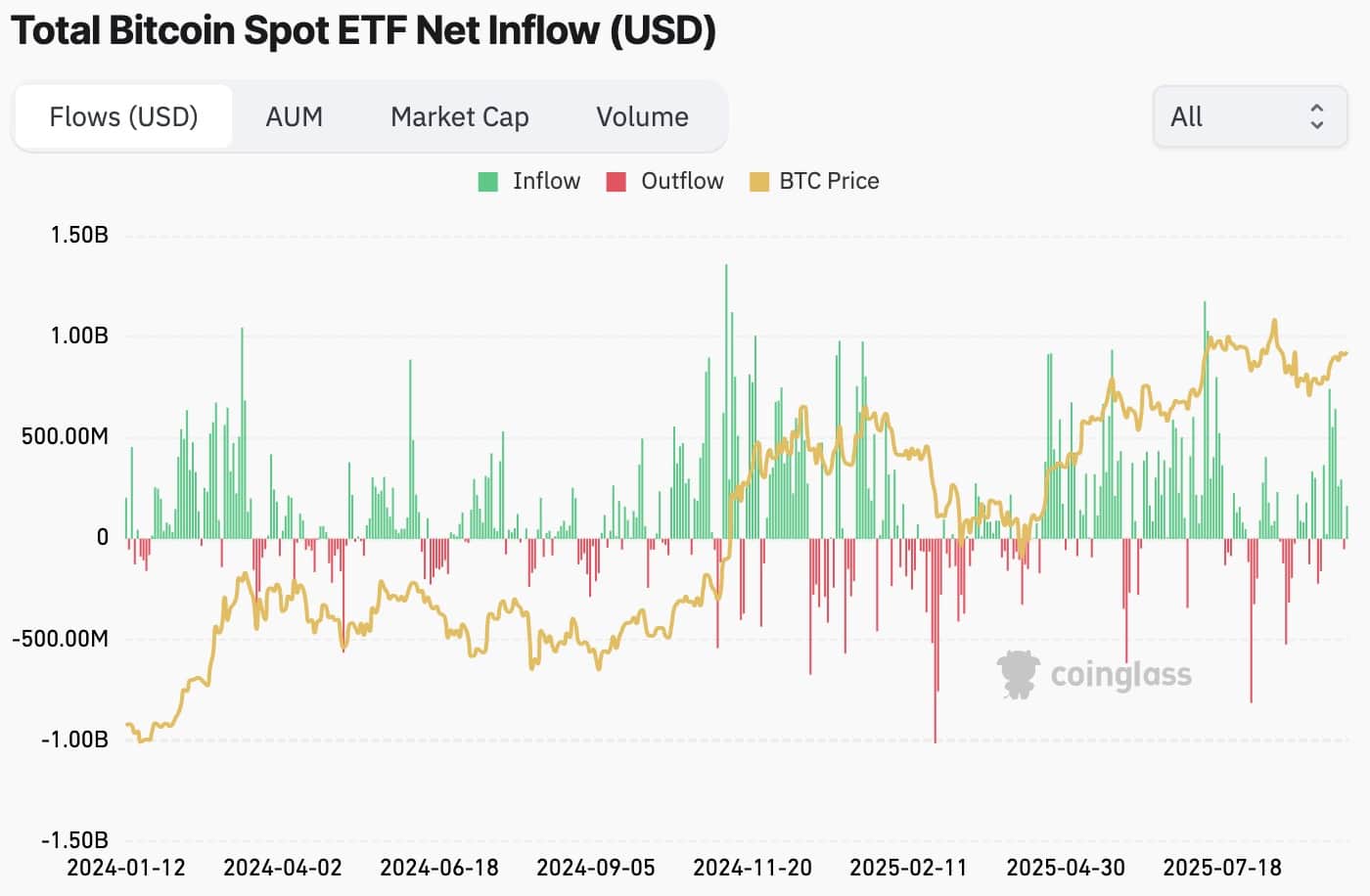

The move also mirrors global flows. In North America, Bitcoin ETFs routinely absorb thousands of $BTC in daily inflows, underscoring how traditional capital prefers regulated channels.

Source: Coinglass

If that pattern repeats in Warsaw, Bitcoin could see stronger mainstream traction in Eastern Europe than ever before.

From Store of Value to Execution Layer

The arrival of Poland’s first Bitcoin ETF reinforces Bitcoin’s reputation as a store of value; a digital equivalent of gold that institutions can now access through regulated channels.

Yet Bitcoin’s core limitations remain unchanged – slow transaction speeds, high fees, and almost no programmability compared to chains like Ethereum ($ETH) or Solana ($SOL).

One of the first serious attempts to do this is Bitcoin Hyper ($HYPER), a project that aims to give Bitcoin the same flexibility developers enjoy on Solana and Ethereum. And for investors looking beyond ETFs, Bitcoin Hyper represents a chance to capture growth in Bitcoin’s utility layer, not just its store-of-value status.

Bitcoin Hyper ($HYPER) – A Layer-2 Set To Unleash Bitcoin’s Potential

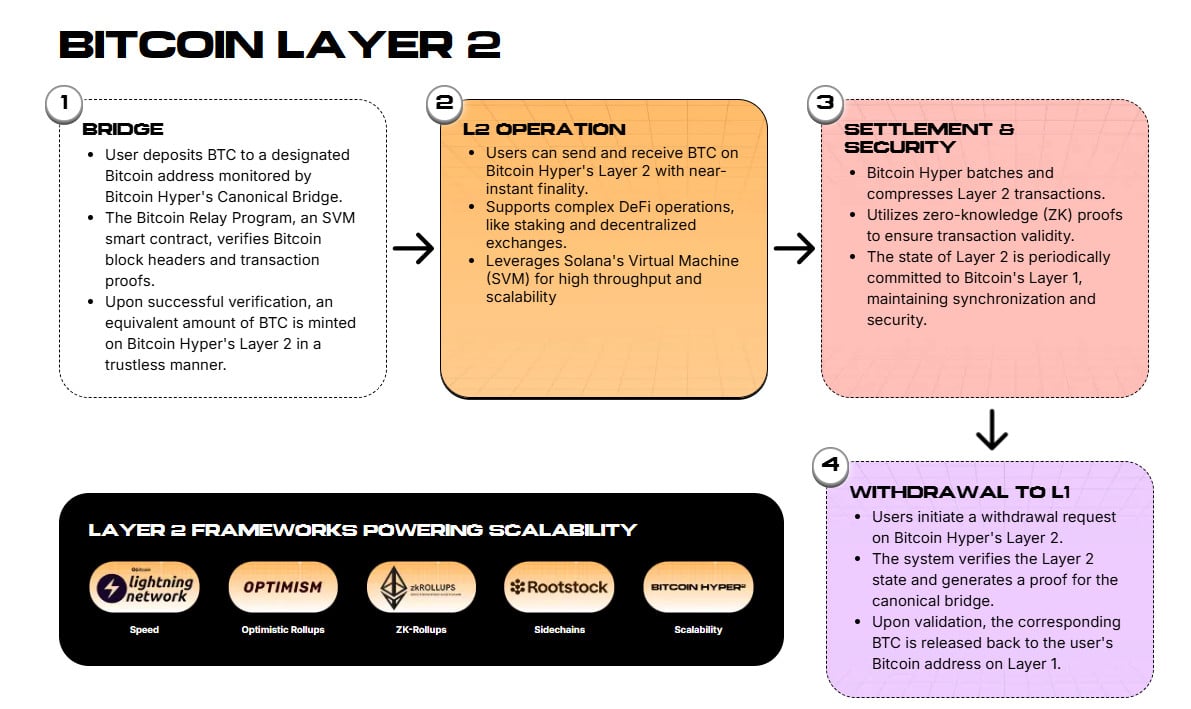

Bitcoin Hyper ($HYPER) positions itself as a true Layer-2 for Bitcoin, one that’s built on Ethereum infrastructure and integrates the Solana Virtual Machine (SVM).

The benefits go beyond speed. Because Bitcoin Hyper integrates the SVM, it integrates seamlessly with existing Solana apps from day one, unlocking a wide range of Bitcoin-native dApps, DeFi platforms, and even meme coin launches that Bitcoin’s main chain could never handle. Everything runs on the $HYPER token, which fuels transactions, staking, and governance.

Thanks to Bitcoin Hyper, investors effectively gain exposure to Bitcoin’s execution layer, while Bitcoin itself remains the monetary base. So, unsurprisingly, the Bitcoin Hyper presale is proving to be a phenomenal success. Just moments ago, it breached the $16.9M milestone. That figure has been helped along by a good few whale buys, including this one for $161.3K.

Poland’s ETF listing helps normalize Bitcoin exposure for institutions, but Bitcoin Hyper stands out as the parallel play that expands $BTC’s use cases and drives real demand.

While ETFs pave the way for regulated inflows, projects like Bitcoin Hyper offer the kind of utility layer that carries 10x potential compared to passive ETF exposure.

Where ETFs make Bitcoin safe to hold, $HYPER makes it powerful to use. So much so, that our Bitcoin Hyper price prediction reckons this new meme coin has the potential to close the year at $0.2. That would mean a 1,445% return on your investment.

Ready to jump in? Join the $HYPER presale before the next price increase.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?