Launchpad’s Incentive Misalignment: Can Traders Escape the “Suicide Squad” Dilemma?

Author: @0xuberM

Compiled by Saoirse, Foresight News

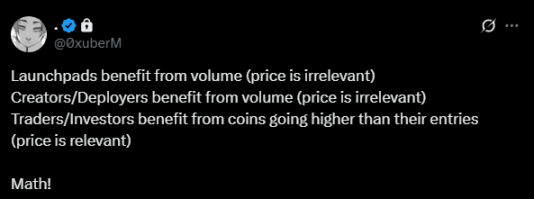

Editor's Note: This article analyzes the current state of Launchpad, creators, and traders through the lens of incentive mechanisms. It argues that Launchpad's focus on transaction volume, the lack of incentive for creators to prop up prices, and the resulting decline of traders into "suicide squads" have created a vicious cycle. Currently, only VCs and insiders have the incentive to drive up token prices, leaving ordinary traders in a difficult position. While this article objectively presents the current market situation and, while not offering solutions, provides important insights into the workings of the crypto market. The following is a compilation of the content:

Incentive Mechanism

Incentives are the core driving force of the world. If you want someone to do something, you simply need to create an environment or scenario where they can be rewarded when they complete it. This is a fundamental law of human nature.

However, currently, on-chain tokens (especially those issued through Launchpad) lack incentive mechanisms to drive price increases, and this issue needs urgent attention.

How Launchpad works

I tweeted about this sarcastically yesterday, and I want to emphasize this point: Launchpads have no incentive to drive up the price of any particular token, except in certain special circumstances (which we’ll get to later).

The operating model of such platforms is essentially similar to that of casinos, and the only important indicator for them is "trading volume".

This is also the core reason why "permissionless issuance" and "binding curve" (a mechanism that adjusts the supply, demand and price relationship of assets through algorithms) have become mainstream today - just like casinos continue to launch lottery games, platforms also hope to provide as many speculative opportunities as possible, by allowing a few people to "win the jackpot" and attract more people to participate.

So, how do token issuance platforms make profits?

The truth is simple: they earn revenue simply by "existing." On the one hand, they provide ordinary people with a permissionless token issuance channel; on the other hand, they provide investors with speculative tools through bonding curves. To further expand, platforms must compete for market share, and there are two common methods:

- Conducting marketing campaigns: either spreading negative news (FUD) about competitors or emphasizing their own “differentiation,” even if their actual business is essentially the same as their competitors’;

- Pushing up the prices of some tokens: This is considered the “best marketing method” and can quickly attract user attention.

I have observed a pattern: token issuance platforms and their teams will only fight for market share in two situations: one is when market share has been taken away by competitors and needs to be regained; the other is when they want to deliberately suppress competitors and damage their reputation.

Interestingly, whenever these two scenarios occur, a small number of tokens on the platform will begin to rise in price, even reaching high valuations. They initially slow down the pace of large-scale token issuance, using "green candlestick patterns" (indicating price increases) and marketing tactics to attract users. Once users are convinced they can make money, they restart large-scale token deployment, significantly increasing trading volume. This is not criticism, but merely objective observation.

Honestly, if I were a member of a token issuance platform team, I would probably adopt the same strategy. After all, the platform is essentially a commercial organization, and the core goal of a business is to make as much profit as possible.

Creators' behavioral tendencies

Like token issuance platforms, creators (such as livestreamers) have no incentive to drive up the price of their tokens. The current revenue mechanism for creators is highly similar to the "permissionless issuance" model—a model that benefits creators just as directly as it benefits frequent token issuers.

You may often hear creators say, "Look, I can make so much money just by turning on the camera!" They use this method to attract more creators to join, and more creators mean more token issuance, which in turn generates more speculative opportunities.

For creators, the profit logic is equally simple: simply exist—turn on your camera, issue a speculative token, and you'll earn income. Of course, if you want to make a lot of money, you do need to persevere for a long time, but even then, there's no guarantee of long-term success.

After all, in the cryptocurrency world, user attention is fleeting, and long-term success is inherently uncertain. In this environment, it's easy for creators to be tempted to "make a quick buck," which is an inevitable consequence of the incentive structure.

Traders: The “Trenches” and “Suicide Squads” of the Crypto Market

What about us traders? What are our incentives? What drives us to do what?

The answer is harsh: we are incentivized to "push each other." After all, the trenches of the crypto market were dug by us (never forget that). And the meaning of the terms "trench" and "suicide squad" is clear: ordinary traders like you and me are essentially "expendable cannon fodder," soldiers on the market's front lines.

Since no one party has the incentive to keep the price of a particular asset class rising over the long term, we can only participate in this "game" in a more brutal way. There is no "player versus environment (PVE)" here, only competition and mutual exploitation.

Because token prices have limited room for growth, we're forced to take aggressive measures to increase our chances of profit, such as pre-locking 10% of a token's supply using multiple wallets (a practice known as "multi-wallet pre-staking"). In this market, timing is crucial—you must enter early enough, otherwise you risk becoming someone else's "exit liquidity" and being ruthlessly harvested.

You might ask: How can traders profit? The answer is: we must put in more effort than others. Unlike token issuance platforms and creators who enjoy "easy profits," we must continuously improve our skills, accumulate industry influence, cultivate judgment, expand our network, and stay abreast of information from multiple fields. Only by doing this can we have a chance of making money in the market.

Even if we encounter a token that experiences a significant short-term surge (such as the recent CCM tokens), we won’t have the motivation to hold on to it long-term, as new “speculative opportunities” (like new lotteries) will soon appear. This market “machine” must continuously produce “lottery tickets” to keep running.

Every time a new opportunity emerges, it's accompanied by a large number of traders' losses, just like the bodies of casualties piled in the trenches of reality. For example: for every account that makes a profit through the Axiom platform, there are hundreds of accounts whose portfolios have been wiped out.

It may sound like I'm complaining, but I'm also a participant in this "game" myself, so to put it in a positive way, I may be a "hypocrite".

Right now, I have three options: Should I adapt to the current market rules? Should I quit the game altogether? (Unfortunately, I'm not one to give up easily.) Or should I explore other areas? (Actually, I'm already doing that.)

Thinking about market cycles and solutions

Will this "game" go on like this forever? I don't think so. History has proven time and again that this vicious cycle will eventually end in one way: winners continue to profit, while losers are continuously eliminated. Until, at some point, there are no more new "losers" in the market, and the former winners become the new losers.

And when everyone is exhausted and chooses to quit, those token issuance platforms will reappear and launch a few "high-end new lotteries" to attract everyone to join again - this is like "a snake swallowing its tail", forming an unbreakable closed loop.

Speaking of this, there is an interesting phenomenon: almost all the tokens that have performed well recently are not issued through the bonding curve. Instead, they are all projects where "a large number of tokens are locked by insiders" - we even jokingly call this situation "illegal operation."

Why is this happening? The core issue lies in incentives. Currently, in the cryptocurrency space, the only ones with the incentive to maintain long-term price increases are venture capital (VC) teams and project insiders. This is because only when prices rise can they sell their tokens at a higher valuation upon unlocking, resulting in massive profits.

What’s even more ironic is that the traders who are currently “winning big” in the market are precisely those who buy “low-quality assets packaged by venture capital” - which is the problem that the bonding curve model originally wanted to solve.

So, what’s the solution? Honestly, I’m not sure. But one thing is clear: if a project team wants their token to succeed, they can’t risk issuing it through a bonding curve—otherwise, there’s a high probability of a “17-year-old using the Axiom multi-wallet grabbing 10% of the token supply.”

As an on-chain trader, I know this better than anyone: the expected return (EV) of participating in this "game" is getting lower and lower. Regardless, the market must change, and the incentives must adjust—otherwise, this cycle will only repeat itself.

I don't have a ready-made solution, only some preliminary ideas, and I'm not sure if they'll actually work. I don't blame anyone for the current situation; it's simply the inevitable result of the existing incentive structure. Unless some institution or model radically disrupts the current dynamic, it's unlikely to see a substantial shift in incentives.

I'm just an active trader and user of a token issuance platform, writing down these thoughts in the hope that the platform team will see them (although my hope gets a little less with each cycle, and I imagine others might feel the same way).

As they say: every man for himself. Until the market truly changes (if it ever does), good luck to all the "suicide squads"—may the more experienced and professional "soldiers" emerge victorious in this game.

You May Also Like

Three Must-Attend Side Events at Korea Blockchain Week 2025

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026