Bitcoin stabilizes with triple positive support, while Ethereum volatility surges and takes over market dominance

By: Imran Lakha

Compiled by: Tim, PANews

Bitcoin stabilizes: benefiting from capital flows, policies and macro tailwinds

Bitcoin is once again approaching its all-time high, supported by the return of investor attention and a favorable macro environment.

In April, spot Bitcoin ETFs attracted nearly $3 billion in net inflows, and another $1.6 billion so far in May. Data from the U.S. Commodity Futures Trading Commission (CFTC) showed that leveraged funds did not significantly increase short positions, indicating that most of the capital flows were directional bets rather than arbitrage transactions.

At the policy level, relevant trends are heating up. New Hampshire became the first state in the United States to pass a strategic Bitcoin reserve law, and 19 other states are also preparing similar bills. At the same time, Arizona is simultaneously advancing the legislative process in the field of cryptocurrency custody and strategic reserves.

At the federal level, the Senate blocked the GENIUS Act, a stablecoin regulatory bill, but the crypto market did not take it seriously and market risk appetite remained solid.

Macroeconomic signals are also supportive. Trump's tariff revisions are seen as growth-boosting, boosting stocks and the dollar, while depressing gold, the yen and reducing the odds of a recession. Market volatility has cooled, with the VIX now back to its 12-month average.

In short, Bitcoin is benefiting from three major factors: rising institutional demand, favorable policy environment, and a warming macroeconomic environment. From the perspective of position layout, investors are actively going long.

Bitcoin cedes volatility dominance to Ethereum

Bitcoin's realized volatility rebounded by about 8 percentage points and re-crossed the $100,000 mark. Ethereum was even more eye-catching, with its realized volatility soaring to 90%, and its price jumping 30% in just two days. Bitcoin's short-term implied volatility fell slightly, while Ethereum's implied volatility soared by 20 volatility points due to sharp price fluctuations.

The holding cost of Bitcoin returned to neutral, but the holding cost of Ethereum turned deeply negative, and Gamma sellers suffered heavy losses.

Bitcoin's rally has only broken through the implied high (at the 100,000 mark) once, while Ethereum has achieved multiple upward breakthroughs. It seems that Bitcoin has handed over the momentum to Ethereum, but whether this situation can continue remains to be verified by time.

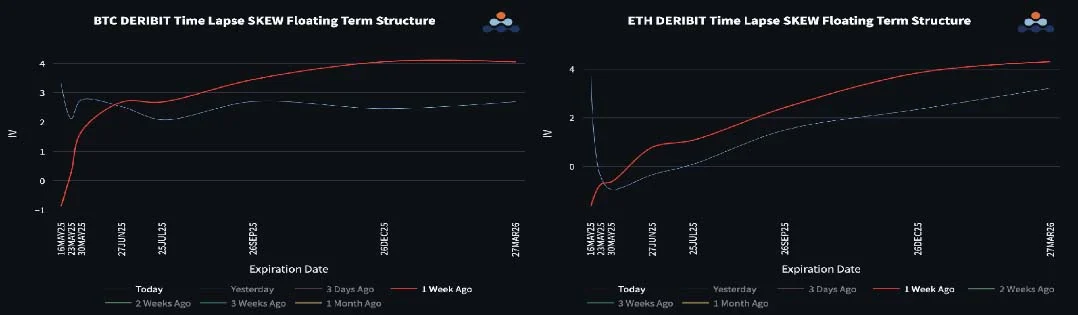

Bitcoin volatility term structure flattens, call option premium reappears

As the market rebounded, the skew curve flattened and call option premiums recovered.

Bitcoin’s volatility skew remains around 2-3 volatility points across the term structure, indicating that there is a bullish flow of funds betting on rising prices, but the implied volatility level remains relatively low.

The volatility skew of Ethereum options has shifted downward, showing a mild bearish trend overall (except for the short-term contract side). If Ethereum can hold on to its recent gains and effectively break through the $2,800 mark, the market may see a resurgence of sustained buying of call options. At this stage, investors remain cautious.

In the long run, Ethereum still has a gap to make up compared to Bitcoin.

Front-end volatility spreads widen dramatically

ETH/BTC has surged 33% over the past week and is now testing the critical downtrend resistance at 0.025. With Ethereum outperforming in realized volatility, its short volatility premium has surged to 35 volatility points.

Meanwhile, its long-end volatility spread remains around 15 volatility points, indicating little reaction, a phenomenon that supports the view that long VEGA (volatility exposure) may be suitable for selling at current levels.

Despite the sharp moves in Ethereum, the volatility skew for short-dated options contracts tilted further toward put premiums, suggesting that the options market has not yet fully recognized the rally.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!