Ethereum Sees 570,000 ETH Buy Yet Faces Market Shakeout

- Ethereum derivatives market reset triggered mass long liquidations and a sharp drop in open interest across exchanges.

- Nearly 570,000 ETH were accumulated in one week, yet market leverage dynamics overshadowed strong underlying demand.

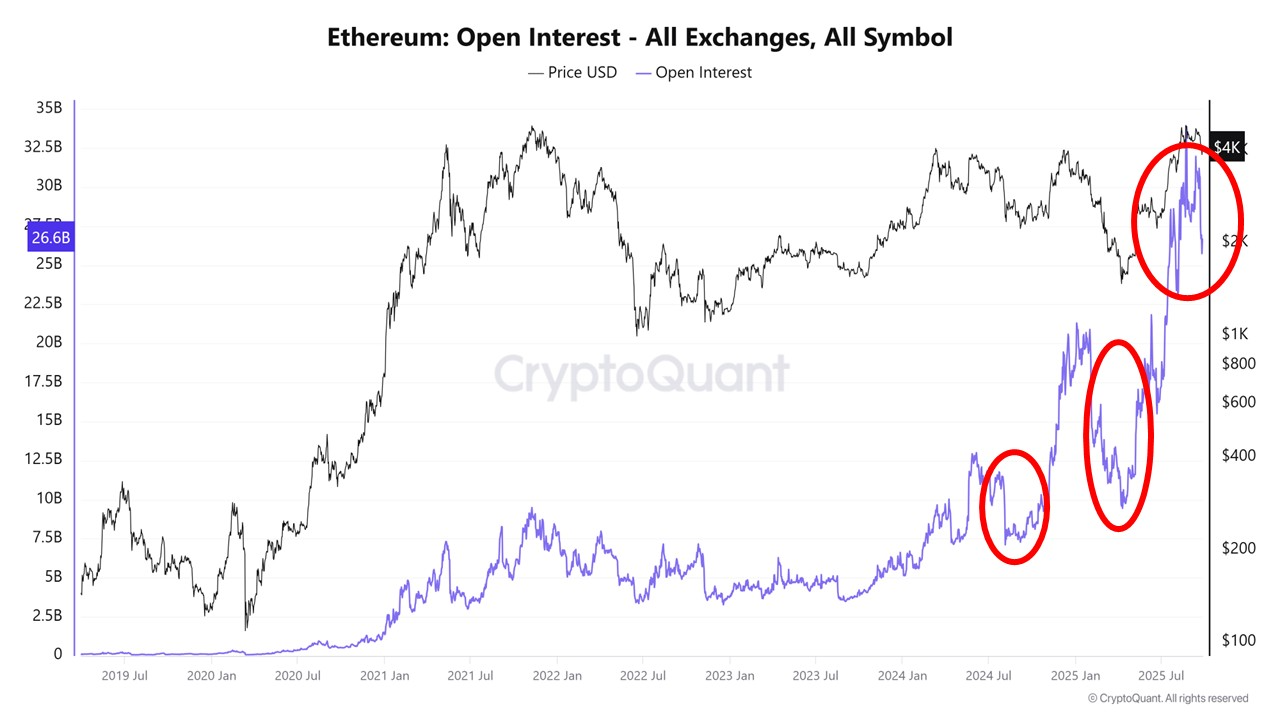

The Ethereum (ETH) derivatives market is experiencing a major upheaval. According to analysis by XWIN Research Japan on CryptoQuant, ETH has just experienced one of its biggest resets since 2024.

Data shows open interest on exchanges plummeting, followed by hundreds of millions of dollars in long positions being forcibly liquidated.

Ironically, amid this pressure, investors accumulated nearly 570,000 ETH in just one week. However, the price of ETH still fall.

Amid this correction, ETH is now trading at about $4,022. Short-term movement is indeed slightly positive, with a 0.16% increase in the last 4 hours and a 3.25% increase in 24 hours. However, looking at the weekly trend, ETH is still down 10.05%.

Long Liquidations Reveal the Hidden Weakness in ETH’s Rally

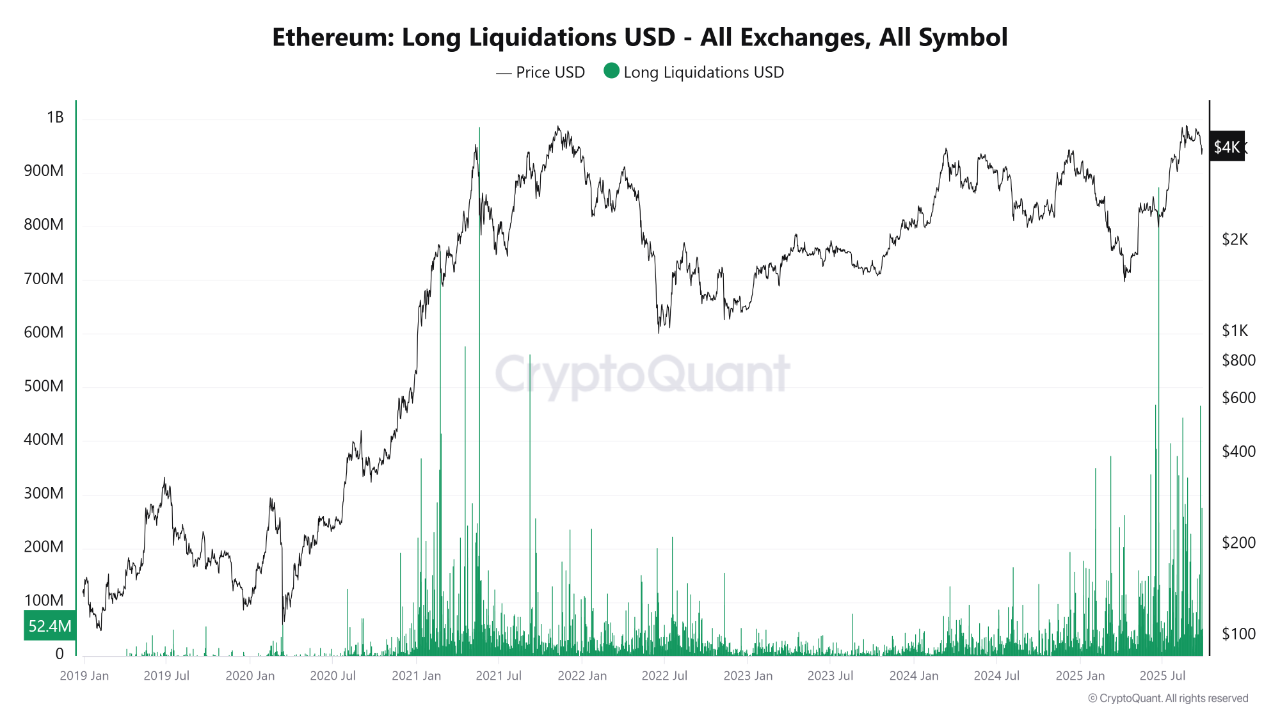

The question arises: why did the price fall when investors were buying in large quantities? The answer, according to XWIN Research Japan, lies in the structure of the derivatives market.

When long positions accumulate too high, the market becomes fragile. At the slightest trigger, forced liquidations spread rapidly like dominoes. Selling pressure floods the market, while market makers accelerate the downward trend. As a result, prices fall despite strong underlying demand.

Source: CryptoQuant

Source: CryptoQuant

On-chain charts show that spikes in long liquidations always accompany sudden price declines. The plummeting OI indicates that excessive leverage is being “cleaned out.”

Interestingly, this reset pattern is not new. Similar situations occurred in 2021, 2023, and early 2025. Each time leverage exploded and was then reduced, the market found a new foundation for recovery. So, while seemingly weak, this process often paves the way for healthier movement going forward.

Source: CryptoQuant

Source: CryptoQuant

Whales and ETFs Signal a Stronger Phase for Ethereum

On the other hand, previous CNF reports have shown a strengthening trend in fundamentals. ETH balances on exchanges fell to 14.8 million ETH after more than 2.7 million ETH (equivalent to $11.3 billion) left in the past month.

The reduction in supply on exchanges typically reflects increased interest in holding coins in private wallets, a sign of maintained long-term confidence.

Furthermore, ETH ETFs in the United States also continue to see inflows. Currently, total ETF holdings have reached 6.75 million ETH, valued at nearly $28 billion.

This surge adds to evidence that large institutions are not afraid of volatility. In fact, they appear to be taking advantage of the correction phase to strengthen their exposure.

We previously highlighted that institutional funds, futures contracts, and options are showing increasingly solid signals of confidence. Whales have been observed accumulating extraordinary amounts of ETH, a pattern rarely seen before. When spot accumulation, derivatives activity, and whale holdings move in the same direction, the market is typically entering a more robust phase.

This correction, according to XWIN Research Japan, should not be considered an anomaly. The crypto market does have a typical cycle: leverage builds up, a reset occurs, and then a recovery phase begins.

In the short term, prices can appear fragile and easily depressed. However, in the long term, risk clearing actually provides the foundation for the next rally.

]]>You May Also Like

CME Group to Launch Solana and XRP Futures Options

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise