Is This $100K Million Presale Quietly Engineering the Biggest Supply Shock in Crypto History?

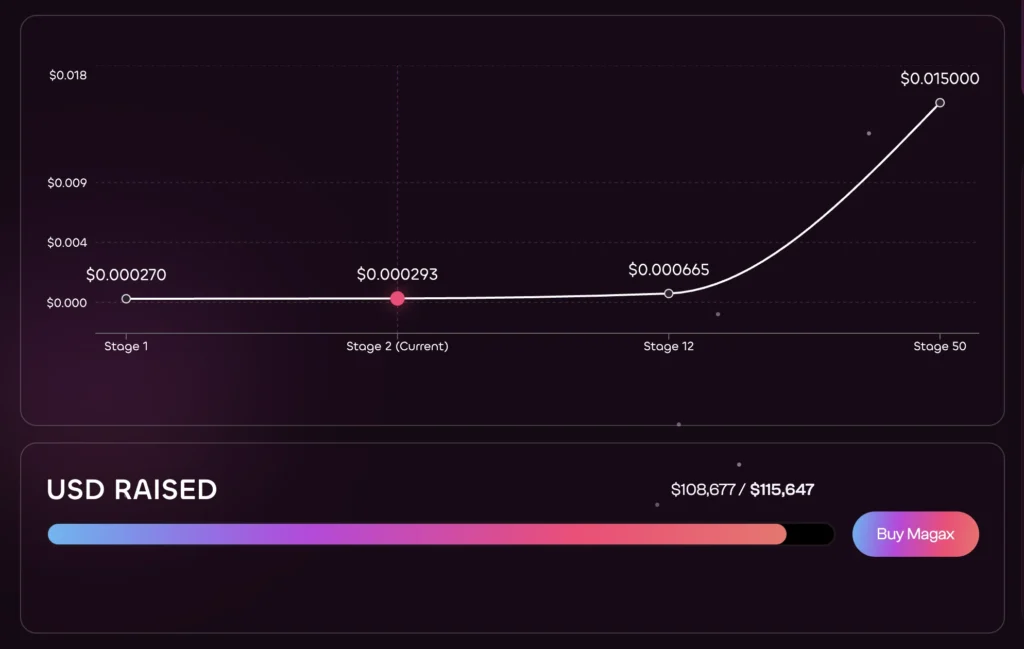

The crypto markets have always thrived on sudden jolts, the kind of shocks that ripple through supply, squeeze demand, and send prices soaring. But every so often, one project engineers a storm before anyone realizes what’s happening. Currently, in a presale that is quietly raising just over $108,000 of its $115,647 target, Moonshot MAGAX (MAGAX) is setting up what could be the most calculated supply shock in meme coin history.

The Anatomy of a Brewing Supply Shock

Most meme tokens ride hype cycles and community buzz until they burn out. MAGAX takes a different route. Built as an AI-powered meme-to-earn token, it utilizes a 50-stage presale model, where each stage increases the price and narrows the entry window. Today, MAGAX trades at $0.000293 in Stage 2.

The next step is $0.00031, small enough to appear harmless but significant enough to snowball into a major valuation jump once momentum accelerates.

This is the math behind the looming supply crunch: a fixed allocation of 100 billion tokens (10% of supply) is being sold in stages. Once these tokens are gone, they’re gone. The engineered scarcity makes each incremental buy-in more expensive, rewarding those who step in early and punishing hesitation.

Not Just a Meme Coin — A Meme Economy

To understand why MAGAX feels different, you need to contrast it with memecoins like DOGE, SHIB, and PEPE, coins that rode pure virality into billion-dollar valuations. Their rise was explosive, but unsustainable, hinging largely on community memes and trading momentum.

MAGAX has engineered an economy around virality itself. Through its partnership with Loomint, MAGAX utilizes AI to scan platforms such as Twitter and TikTok for viral memes. Once detected, the ecosystem automatically rewards both the creator and the promoter with tokens. This isn’t guesswork; it’s a measured, algorithmic reward system.

Layered on top are features you’d expect from a serious DeFi contender: staking for passive yield, DAO governance, deflationary mechanics through burns, and referral pools capped to prevent abuse. Add in the fact that MAGAX’s smart contract is CertiK-audited with zero critical issues, and suddenly the meme coin market doesn’t feel like a casino; it feels like infrastructure.

Scarcity Meets Utility

The supply shock is more than a presale gimmick. It’s baked into the tokenomics. MAGAX’s deflationary design locks or burns tokens during specific functions, creating constant downward pressure on the circulating supply. Meanwhile, governance participation gives holders a stake in how rewards, airdrops, and platform incentives are structured.

In other words, this isn’t a coin that evaporates after a hype cycle. It’s engineered for stickiness, long-term engagement, and ecosystem demand, all of which add layers to the presale’s scarcity narrative.

How MAGAX Stacks Against the Meme Legends

When Shiba Inu launched, most investors initially shrugged, but it soon minted overnight millionaires. PEPE did the same, thriving on memes without a roadmap. MAGAX, in contrast, is laying out both: it feeds on the same viral energy but backs it with real economic mechanics and AI-driven transparency.

If SHIB and PEPE were accidents of culture, MAGAX is culture by design, and that’s why the presale numbers matter. The jump from $0.000293 to $0.015 at Stage 50 implies an ROI north of 150x for early believers. The gap between meme speculation and engineered meme economics has never been this clear.

A Simple Guide: How To Buy MAGAX Presale

Getting into the MAGAX presale doesn’t require technical wizardry; just a wallet and a few clicks. Here’s how it works:

Connect Your Wallet

Start by linking your cryptocurrency wallet to the MAGAX presale portal. This ensures secure transactions and lets you instantly track your contribution.

Choose Payment Method

MAGAX supports over 50 popular cryptocurrencies, including ETH, BNB, and USDT. Select the one that best suits you; the system is designed for flexibility.

Confirm the Payment

Once you’ve chosen your crypto, confirm the transaction directly in your wallet. Always double-check the address and payment details before hitting send.

Receive Coins

After confirmation, your MAGAX balance updates on the presale dashboard. These tokens are locked and ready to claim once the Token Generation Event (TGE) goes live.

The Window Is Narrow

What makes the meme-to-earn crypto token stand out is how quietly it’s moving. The presale has raised just over $108K without the flashy marketing blitz that often inflates meme projects. Instead, it’s leaning into organic scarcity, AI credibility, and a structured rollout.

If history has taught us anything, it’s that supply shocks don’t announce themselves; they happen suddenly, catching latecomers off guard. With MAGAX’s staged pricing model already pushing the cost of entry higher, the shock might be closer than most expect.

The window for early entry is narrow. Secure your MAGAX before Stage 2 closes and the price moves higher.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

HitPaw API is Integrated by Comfy for Professional Image and Video Enhancement to Global Creators

Journalist gives brutal review of Melania movie: 'Not a single person in the theater'