Bitcoin Hyper Explained: Fastest Bitcoin Layer-2 Nears $19M Presale

Yet for all its dominance, the network still struggles with a basic problem: speed. Bitcoin processes around seven transactions per second (TPS), making it slow, expensive, and unsuitable for today’s demands like dApps, DeFi, or even meme coins. During peak periods, fees can spike above $100, pricing out everyday users who simply want to move their $BTC.

The concept has clearly struck a nerve. Its presale has already pulled in close to $19M. If you want to understand why investors are piling in, now’s the time to pay attention.

The Problem Bitcoin Still Hasn’t Solved

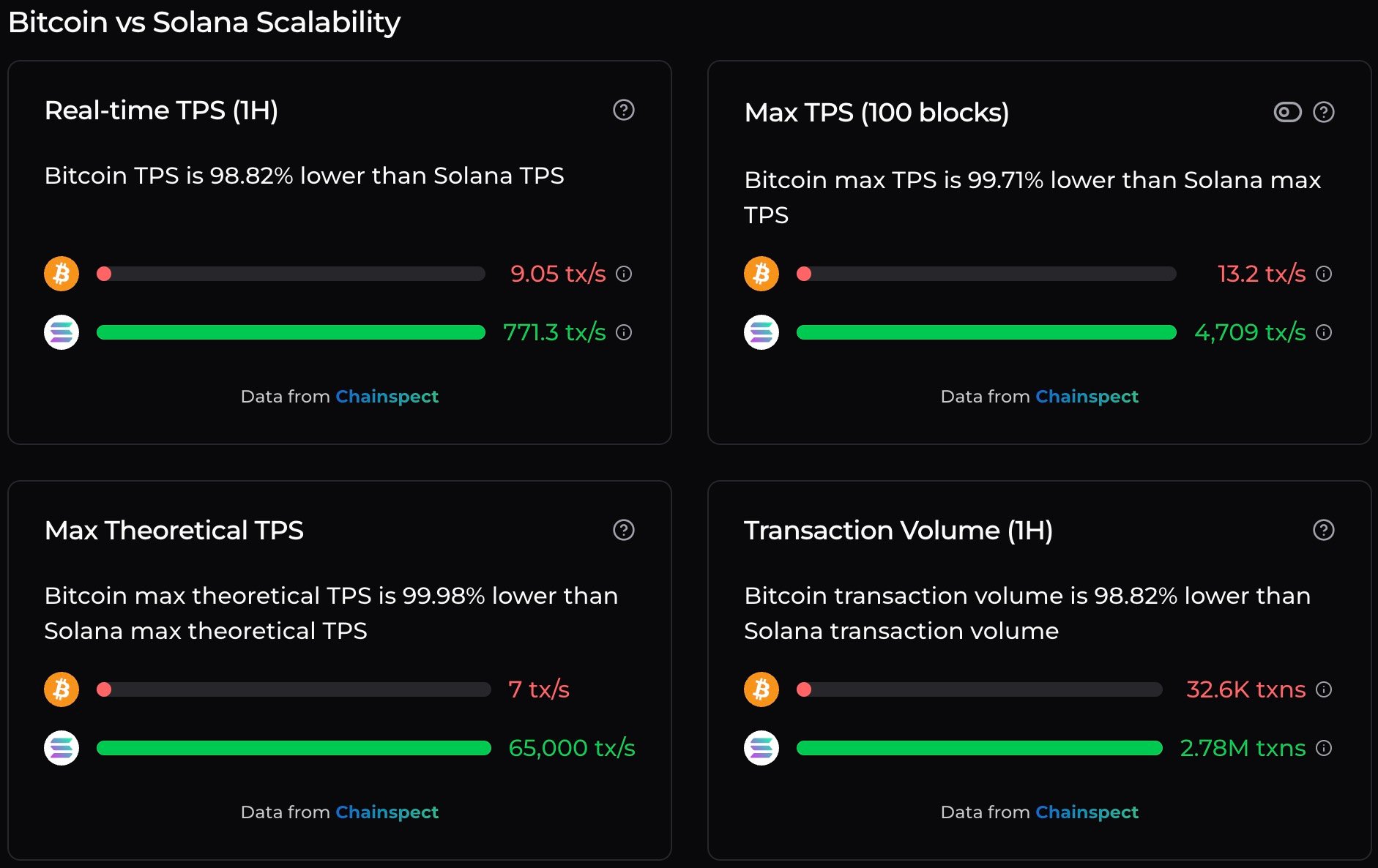

Bitcoin ($BTC) remains surprisingly clunky in 2025. The network averages around nine TPS in real-time, while Solana ($SOL) clears more than 770 TPS – around 85x faster.

At peak, Bitcoin might touch 13 TPS, but Solana’s max throughput has hit 4.7K TPS in recent blocks, with a theoretical ceiling above 65K TPS. That gap shows just how far behind Bitcoin lags in terms of raw scalability.

Source: Chainspect

And block times don’t help. With 10 minutes between confirmations, using Bitcoin for everyday payments feels outdated in a world where people expect instant settlement.

The surge in ordinals and BRC-20 meme coin activity in 2023–2024 filled blockspace, driving fees higher and leaving regular $BTC transactions stuck in the queue.

At the same time, ETFs have made Bitcoin easier to hold, but not easier to use. Bitcoin remains unmatched as a store of value. But as an execution layer, it’s still missing critical components. And that’s exactly where Bitcoin Hyper ($HYPER) aims to change the game.

The Bitcoin Hyper Solution

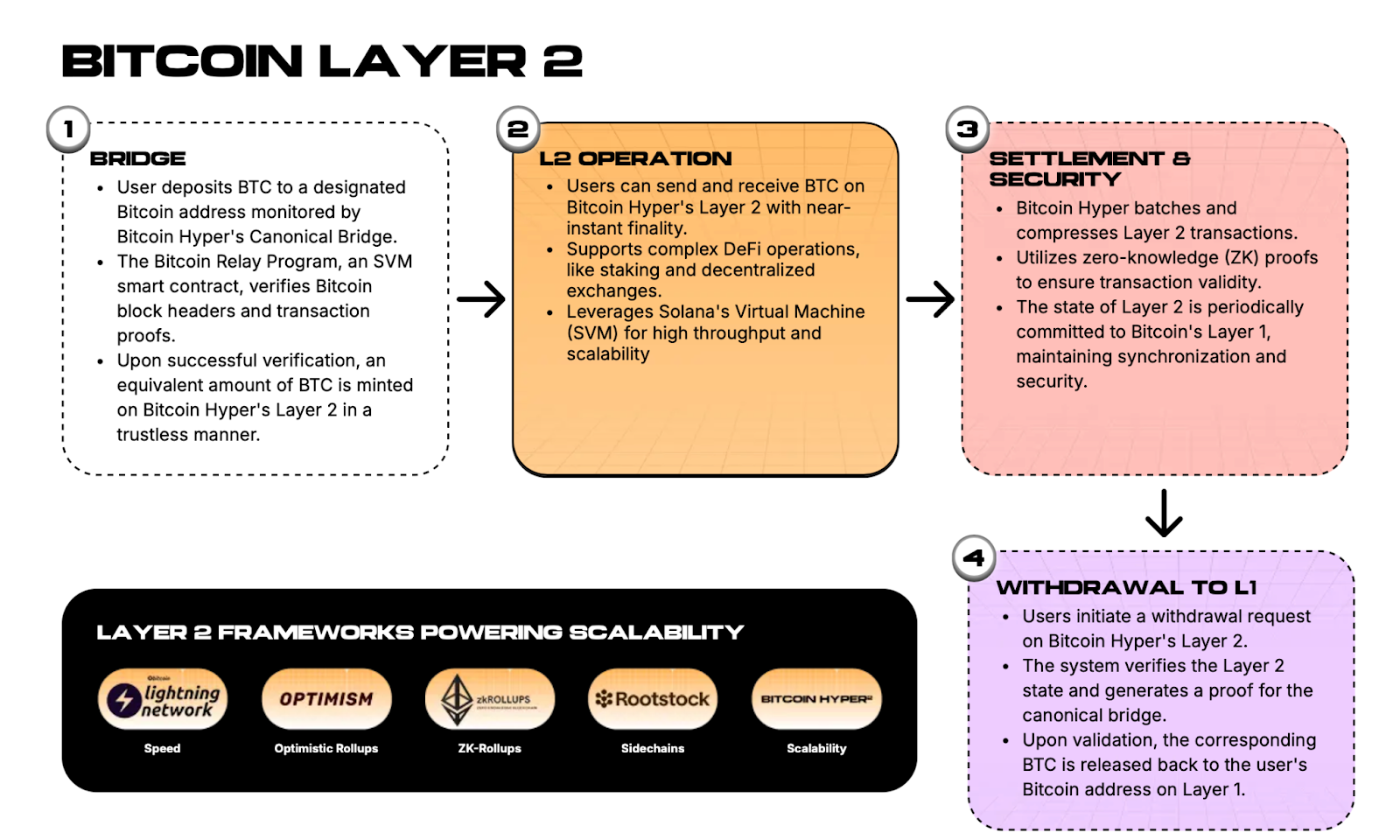

Bitcoin Hyper ($HYPER) brings a unique Layer-2 proposal – built directly on Bitcoin – to the table, using the SVM as its engine. The pitch? Bitcoin remains the monetary base layer, while Hyper acts as its execution layer.

Here’s how it works:

You bridge Bitcoin into the system, and the protocol will mint an equivalent amount on Hyper’s Layer-2. From there, you’ll be able to send, stake, or trade it instantly with near-zero fees. Transactions will be bundled and proven valid using zero-knowledge proofs, and then settled back onto Bitcoin’s Layer-1. That will keep security intact while unlocking speed and scale.

SVM integration is crucial to Hyper’s solution. Solana has proven it can push real throughput into the hundreds of thousands of TPS. By using the same framework, Bitcoin Hyper will inherit this raw performance while adding seamless compatibility with Solana’s existing ecosystem of apps and tools.

This opens doors that Bitcoin alone has never managed to push through. DeFi protocols, lending markets, meme coins, DAOs, and even micro-payments will suddenly become viable on Bitcoin. Cross-chain support from day one will also mean assets can move freely between $BTC, $ETH, and $SOL without friction.

Discover more about this Layer-2 ecosystem in our complete Bitcoin Hyper review.

The Financial Side – Presale & Tokenomics

Momentum around Bitcoin Hyper’s presale has been building quickly. The project has already raised more than $18.8M, with the $HYPER token currently priced at $0.012995. That’s a low entry point for what the dev team positions as the execution layer for Bitcoin. In fact, our Bitcoin Hyper prediction sees the possibility of $HYPER reaching $1.20 by 2030.

Presale buyers aren’t just speculating on price. They can already stake their tokens at a 63% APY, effectively putting their coins to work before exchanges even list $HYPER. If you’re thinking of investing in Bitcoin Hyper, take a look at our step-by-step guide to buying $HYPER.

$HYPER itself plays a central role in the ecosystem. It fuels gas fees, powers staking, underpins governance, and provides access to upcoming token launches on the network. If Bitcoin Hyper develops into the primary playground for Bitcoin-native apps and memes, $HYPER becomes the ticket to entry.

The presale offers $HYPER at its cheapest, with listing prices expected to climb once exchanges open trading. For investors who believe in Bitcoin’s next phase, the incentive is clear: early entry secures first-mover advantage.

Could $HYPER Push Bitcoin Even Higher?

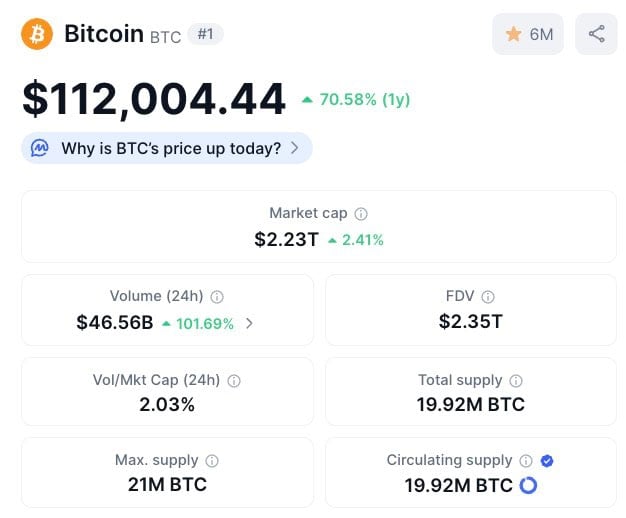

Bitcoin already controls more than 50% of the entire crypto market cap, sitting at around $112K with a market cap of $2.23T – a dominance that has held for years despite waves of competition.

Source: CoinMarketCap

Yet Bitcoin has been largely seen as a vault… The place you store value; not the place you build. Scaling through Bitcoin Hyper changes that equation. Instead of waiting 10 minutes for a transaction, you could send $BTC instantly with negligible fees.

And if Ethereum’s 2017 pivot into dApps turned it from a payments network into a global platform, Bitcoin Hyper could mark a similar inflection point – one that takes Bitcoin beyond ‘digital gold.’

You May Also Like

Momentous Grayscale ETF: GDLC Fund’s Historic Conversion Set to Trade Tomorrow

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident