Cardano vs Ethereum Price Prediction — Which Layer-1 Hits $5 First While DOT Pushes Stablecoin Vote?

Cardano and Ethereum are back in the spotlight as Q4 opens with firmer technicals and a wave of headlines from top crypto desks. Fresh price notes key ADA levels to flip for a sustained rebound, while technicians keep ETH on a glide path toward fresh highs.

Polkadot is also moving a native, DOT-collateralized stablecoin proposal through an on-chain vote—an upgrade that could reshape its DeFi liquidity stack and at the same time, MAGACOIN FINANCE is steadily gaining traction to become the outsider favourite amid shifting sentiment and growing attention on next-gen altcoins.

Cardano (ADA) — Price Prediction & Q4 Catalysts

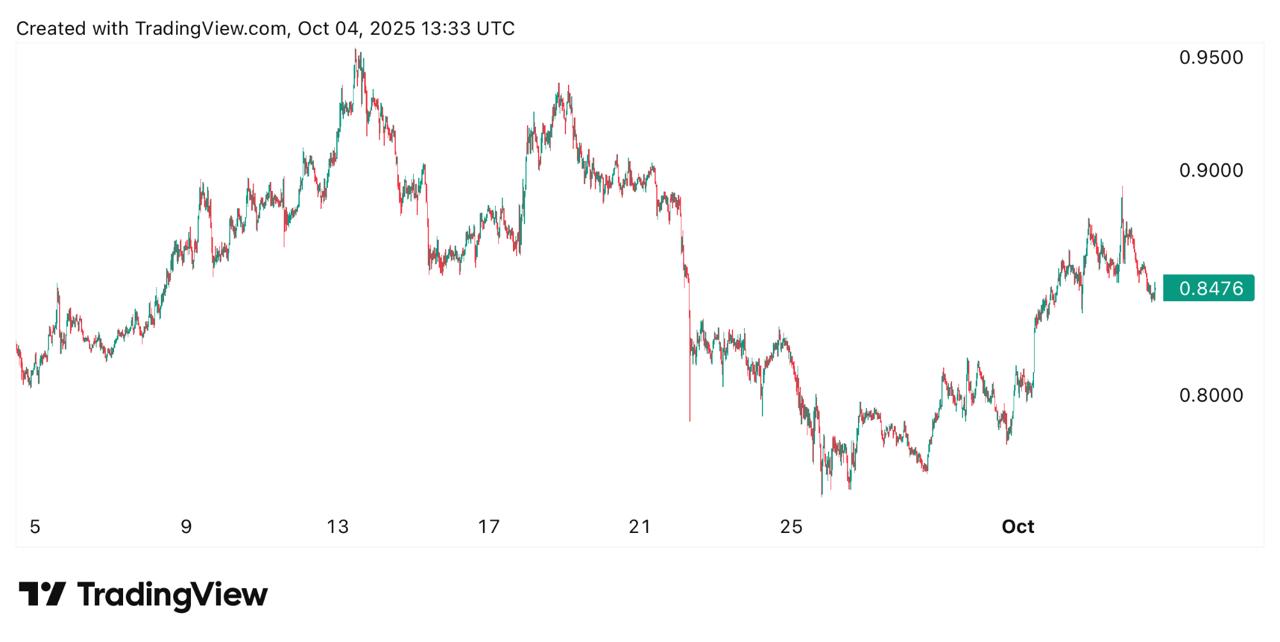

Cardano has been grinding in the $0.80–$0.85 bracket, with short-term sentiment hinging on whether bulls can reclaim nearby resistance. Today’s desk notes point to $0.94–$1.02 as a decision zone; failure to hold the 20-day EMA (~$0.84) risks a slide toward $0.75, while a clean break higher opens room for a multi-week recovery.

ADA TradingView

Intraday trackers show ADA roughly $0.85–$0.87, consistent with its recent consolidation band as traders wait for a catalyst. A near-term push above resistance would validate momentum plays into the $1 handle; lose $0.75 and the market could retest deeper supports before attempting another leg up.

Structurally, the bull case leans on Cardano’s methodical scaling roadmap (e.g., Hydra) and improving participation across its dApp stack.

Ethereum (ETH) — Price Prediction & Narrative

ETH continues to range in the low-to-mid $4K area with robust dev activity and steady DeFi volumes. Fundstrat’s Mark Newton recently reiterated a $5,500 objective on favorable momentum and buy-the-dip zones near $4,418–$4,375, framing ETH as the leading large-cap into mid-October if flows persist.

ETH TradingView

Across research desks, Ethereum’s rollup-first roadmap plus the drumbeat of ETF chatter keep it top of mind for allocators, with several market wraps through September emphasizing ETH as the higher-conviction L1 relative to peers.

In practical terms, it shows ETH is still the favorite to tap $5K before ADA reaches $5, even if ADA’s percentage upside could be larger from current levels.

Polkadot (DOT) — Stablecoin Vote & DeFi Innovation

Polkadot’s headline driver: a community proposal for pUSD, a native DOT-backed algorithmic stablecoin designed to deepen on-chain liquidity and reduce reliance on third-party stables.

Early support has been strong, with the measure framed as a pivotal step for Polkadot DeFi if it clears final checks and goes live across key parachains. Price watchers say a confirmed greenlight could reinforce DOT’s improving structure into the $4+ zone.

MAGACOIN FINANCE Gains Ground as the outsider favourite

Alongside the big caps, MAGACOIN FINANCE continues to show up in watchlists as a secured, externally-audited asset riding broader market flows rather than hype cycles.

For investors, the emerging strategy pairs ETH’s institutional track with ADA’s asymmetry—and sprinkles measured exposure to a smaller-cap project that’s building steadily, increasing wallet activity on X/Telegram, and tracking liquidity conditions without overextending.

Smart investors now have access to a milestone celebration offer: a 50% EXTRA bonus, available for a limited time only when redeeming the code PATRIOT100X.

Bottom Line

ETH remains the statistical favorite to cross its big round figure first, powered by stronger volume expansion and institutional participation. ADA retains a credible pathway to higher prices if the market cooperates and technicals flip cleanly. DOT could rewrite its DeFi story if the pUSD vote finalizes as expected—an underappreciated catalyst for Q4.

Within that mix, MAGACOIN FINANCE has been gaining quiet traction as the outsider favourite in diversified baskets: smaller allocation, clear audits, security top-of-mind, and disciplined communication—designed to complement, not compete with, the L1 heavyweights.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Cardano vs Ethereum Price Prediction — Which Layer-1 Hits $5 First While DOT Pushes Stablecoin Vote? appeared first on Coindoo.

You May Also Like

Once Upon a Farm Announces Pricing of Initial Public Offering

Forward Industries Bets Big on Solana With $4B Capital Plan