Ethereum Price Forecast: ETH network growth explodes as GENIUS Bill advances

Ethereum price today: $2,510

- Ethereum network grows steadily adding nearly 1 million new addresses per week since May.

- GENIUS bill, which passed the Senate in a 68-30 vote likely acted as a catalyst.

- ETH could suffer a strong breakdown if it fails to hold the lower boundary of a key channel..

Ethereum (ETH) is trading around $2,500 in the early Asian session on Friday despite a surge in new address growth over the past month. The development follows progress in digital assets regulations after the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) bill passed the Senate.

Ethereum new addresses surge amid progress in stablecoin bill passage

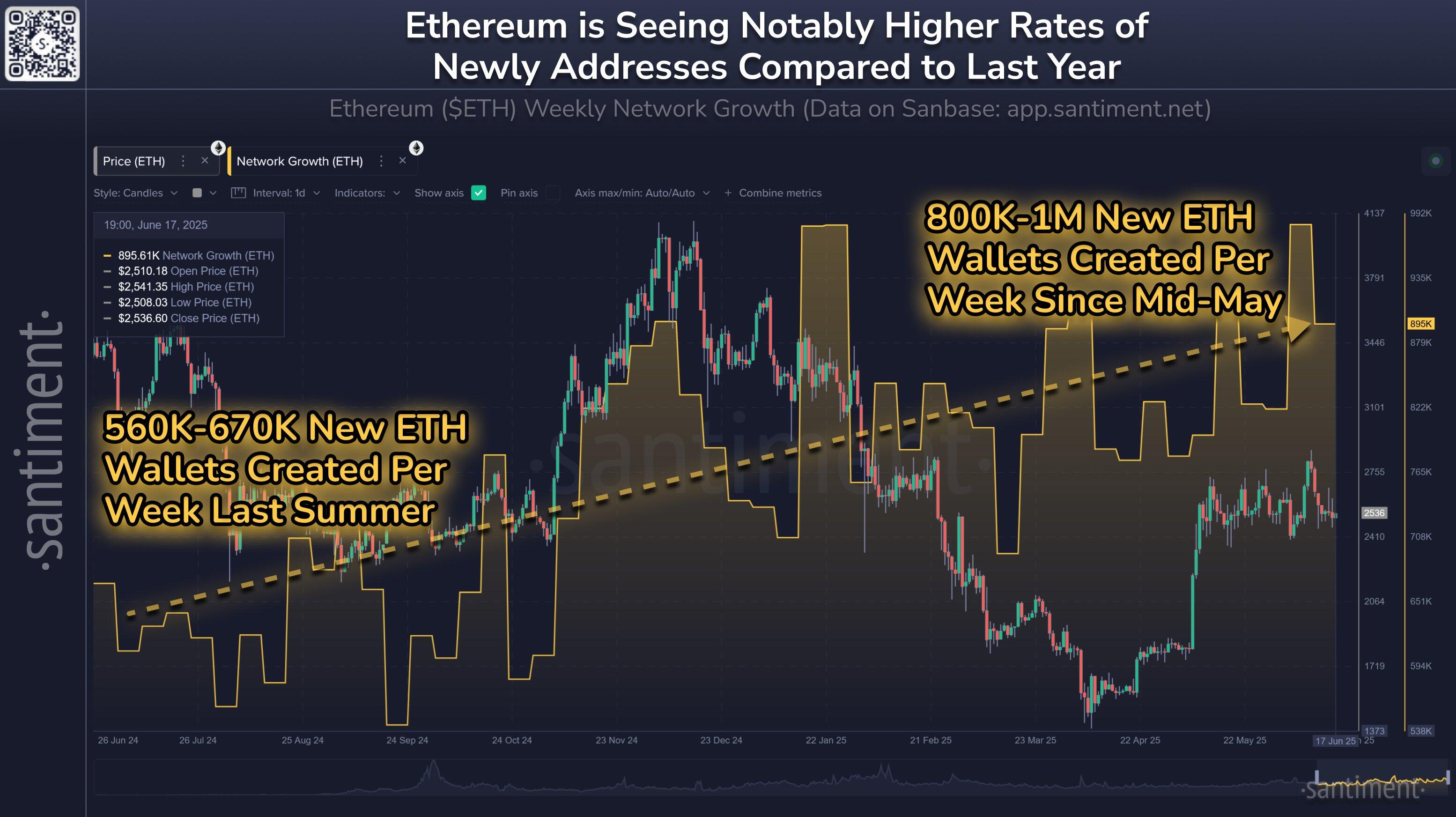

The number of new ETH addresses created in a week has increased in the past month, rising by almost one-third from around the same period last year, according to data from Santiment.

"The amount of new weekly ETH addresses created is ranging around 800K-1M per week, compared to about one-third less at this point last year," wrote Santiment analysts in an X post on Wednesday.

The growth in addresses follows positive developments surrounding the Ethereum ecosystem over the past month, particularly with the stablecoin bill, the GENIUS Act, passing the Senate with strong bipartisan support.

ETH Network Growth. Source: Santiment

President Donald Trump urged House Republicans to act "LIGHTNING FAST" in advancing the Senate-approved GENIUS bill to his desk. He noted that lawmakers should pass the bill "ASAP," with no further delays or adjustments.

"This is American brilliance at its best, and we are going to show the world how to WIN with digital assets like never before," Trump said in a post on social media platform Truth Social on Wednesday.

The Senate passed the GENIUS bill on Tuesday in a 68-30 vote, pushing the stablecoin legislation closer to the finish line. House Republicans are expected to consider the legislation soon, with expectations among market participants that the bill will pass before the August recess. If passed, the GENIUS bill will be the first crypto-related legislature to become law in the United States.

Most companies and banks are already looking to leverage stablecoins in their business operations, with notable examples including Apple, Amazon, JP Morgan, and Morgan Stanley, which are exploring stablecoin solutions.

Debates among lawmakers regarding the crypto market structure bill, the CLARITY Act, which aims to establish a broader regulatory framework for digital assets, have also contributed to rising interest in Ethereum, which hosts the majority of crypto market activity outside of Bitcoin transactions. According to DefiLlama's data, the stablecoin market cap on the Ethereum Layer 1 is above $126 billion, marking a steady increase over the past weeks and a 50.2% dominance over other blockchains.

"This is going to start playing, turning blockchains into infrastructure. And once blockchains become infrastructure that the whole world's powered on, financial infrastructure and a variety of other applications — social, logistics, supply chain, etc. — then ETH becomes like the internet," said Ethrealize co-founder Vivek Raman in an exclusive interview with FXStreet.

"ETH has underperformed for a long time mostly because we have been under regulatory purgatory. Now that all that is lifting, there's going to be a repricing at some point from 'tech play,' which is very limiting to store of value, global infrastructure like oil," he added.

Ethereum Price Forecast: ETH needs to hold a key channel's lower boundary to prevent a strong breakdown

Ethereum futures experienced $16.59 million in liquidations over the past 24 hours, with long and short liquidations totaling $7.77 million and $8.82 million, respectively, according to Coinglass data.

With the 200-day Simple Moving Average (SMA) proving difficult to overcome, ETH continued holding the $2,450 support at the 38.2% Fibonacci Retracement. The level is strengthened by the convergence of the 50-day SMA and Exponential Moving Average (EMA) just above the lower boundary of a key channel.

ETH/USDT daily chart

As volume continues to decline, ETH has to hold the lower boundary of the key channel to prevent a strong breakdown. If it holds this level and sustains a move above its 200-day SMA, it could retest the channel's upper boundary resistance. However, a breakdown below the lower boundary could send ETH toward the $2,260-$2,110 range, which is strengthened by the 100-day SMA.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are moving sideways below their neutral levels, indicating a slightly dominant bearish momentum.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures