BSC Memecoin platform swallows up 90% of the market every day, has Pump.fun completely become a "little brother"?

Author: Mars_DeFi

Compiled by: TechFlow

Pump.fun has long been considered a powerful engine for memecoin.

But that's only part of the story.

PumpFun does dominate the market, but only within the Solana ecosystem.

If you zoom out, you can see that BSC (via @four_meme_ ) is quietly eating up the field.

From the information chart data (taking the market status of the last 24 hours as an example):

-

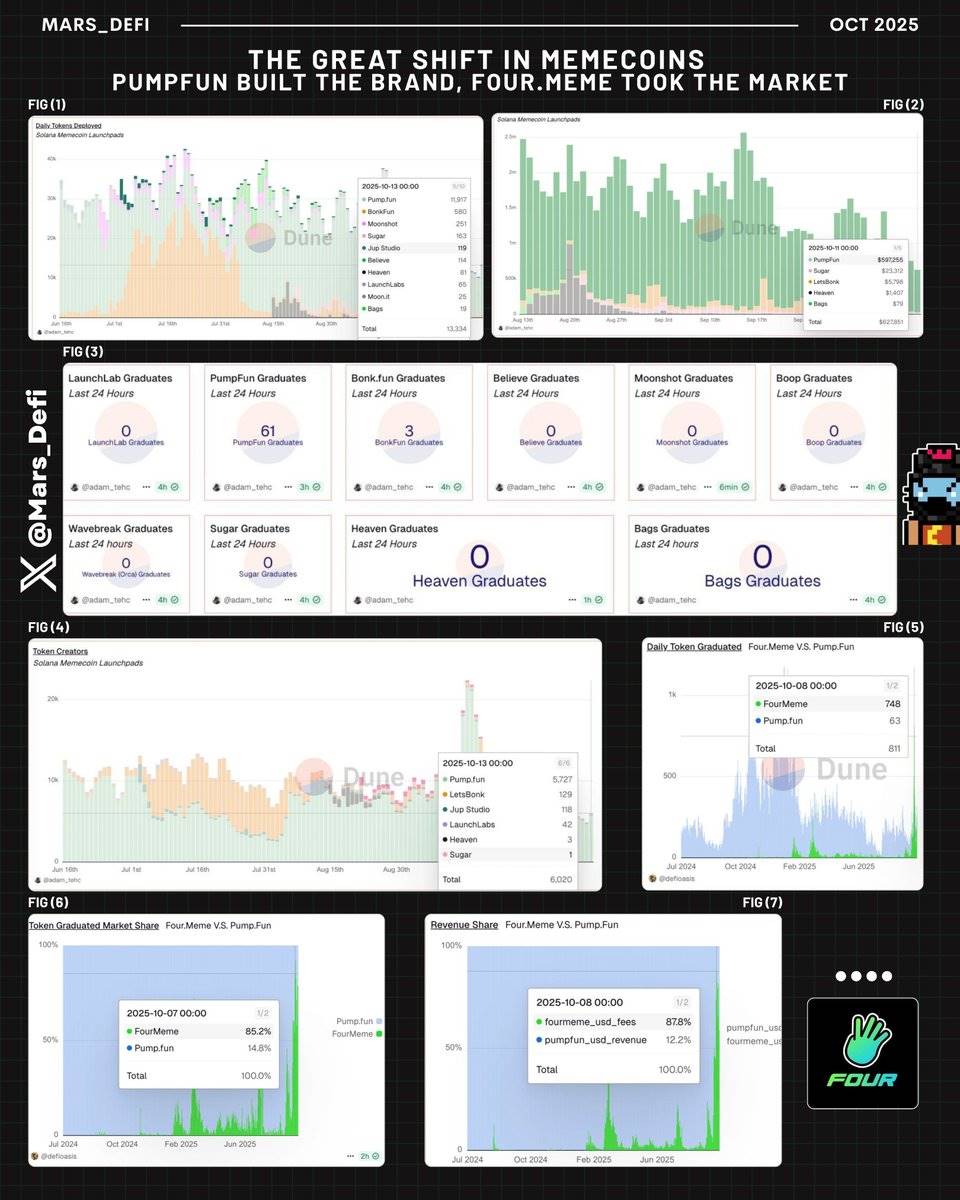

PumpFun drives the issuance of approximately 11,000 tokens per day, a figure that exceeds all other Solana platforms combined. (1)

-

Daily revenue regularly exceeds $500,000 to $600,000, making it the most profitable platform on Solana. (2)

-

Within 24 hours, 61 projects successfully completed the initial issuance phase and were officially launched for trading, while other platforms such as Boop, Bags, Believe, LaunchLabs, Heaven, etc. only had 0-3. (3)

-

Other Solana platforms such as LetsBonk, Sugar, Moonshot, Jup Studio, Launchlabs, etc. have had little luck attracting token creators. (4)

Conclusion : Solana has become a one-man show.

If you’re trading Solana’s memecoin, you’re essentially trading PumpFun’s memecoin, otherwise you’re trading nothing.

However, the real shock came from the cross-chain comparison (Pump.fun for SOL vs @four_meme_ for BSC):

-

Number of tokens graduated (one-day sample) : 63 vs 748 (5)

-

Market share (graduated tokens) : 14.8% vs 85.2% (6)

-

Revenue share (daily cost) : 12.2% vs 87.8% (7)

Some days, @four_meme_ accounts for 85-90% of successful memecoin deployments on both chains.

This clearly shows where liquidity is currently flowing.

The key to being a successful trader is this: liquidity always trumps brand loyalty.

This is where traders need to wake up. Ask yourself:

-

Are you loyal to a chain or to profits?

-

Are you trading tokens, or are you trading liquidity flows?

-

If more than 80% of the current successful memecoins are on BSC, don’t you think you should be there too?

Cruel reality?

If you can’t make the cross-chain transition, you are not a trader, but perhaps a bystander like me.

Action Framework (how to plan for the future)

For Memecoin Hunters:

-

Track where capital flows into, not just where it ends up.

-

@four_meme_ is currently in the main "zero to one" zone.

-

Pump.fun is still available, but it is considered a secondary rotation pool rather than the default choice.

For project parties:

-

If you want organic liquidity, prioritize issuing on @four_meme_ .

For investors/observers:

-

This is a clear sign of a maturing market structure:

-

Solana represents culture and innovation.

-

BSC is the new battlefield for execution and trading volume.

-

Additionally, @four_meme_ recently announced a $45 million Reload airdrop program, launched in conjunction with its ecosystem partners. Here are the details:

-

Over 160,000 users who traded memecoin and incurred losses over the past week will be eligible. $BNB tokens will be randomly airdropped to these addresses.

-

The result is a massive relief effort designed to rebuild community confidence and reward resilience.

-

The first round of distribution will begin this week, and all airdrops will be completed by early November 2025.

This alone should give you an idea of where liquidity will primarily flow in the coming weeks, so adjust accordingly.

You May Also Like

Italy becomes first EU country to pass comprehensive AI law

Metaplanet Forms Bitcoin-Focused Subsidiaries in Japan and the U.S.

![[LIVE] Crypto News Today: Latest Updates for Sept. 18, 2025 – Bitcoin Pushes Towards $118K as Fed Rate Cut Sparks Broad Crypto Rally](https://static.coinstats.app/news/source/1716914275457.png)