FOMO Kicks In as Bitcoin Hyper Defies Tate’s BTC Crash Warning: Next 100x Crypto

A recent remark from Andrew Tate stirred waves across the crypto scene after he suggested that Bitcoin might drop to $26,000.

The statement instantly divided the community; some viewed it as a cautionary signal, others as pure clickbait.

Yet volatility and headlines have always gone hand in hand in crypto; what truly endures is conviction. The market has heard every prediction imaginable, from “Bitcoin to zero” to “Bitcoin to the moon.”

The reality remains the same: cycles test patience, not technology. Still, Tate’s outburst served one useful purpose; it reminded investors that volatility creates opportunity.

And one project quietly capitalizing on that opportunity is already catching the eye of crypto whales: Bitcoin Hyper.

Source – 99Bitcoins YouTube Channel

Bitcoin Hyper – A Layer-2 Revolution Built on Bitcoin’s Backbone

While Bitcoin’s price dominates headlines, Bitcoin Hyper is busy building the technology that could define the next wave of blockchain adoption.

The project aims to bring speed, scalability, and DeFi utility to the world’s oldest cryptocurrency.

The numbers speak volumes: over $24 million raised in presale, a multi-million-dollar marketing budget, and a strong treasury designed to sustain long-term growth.

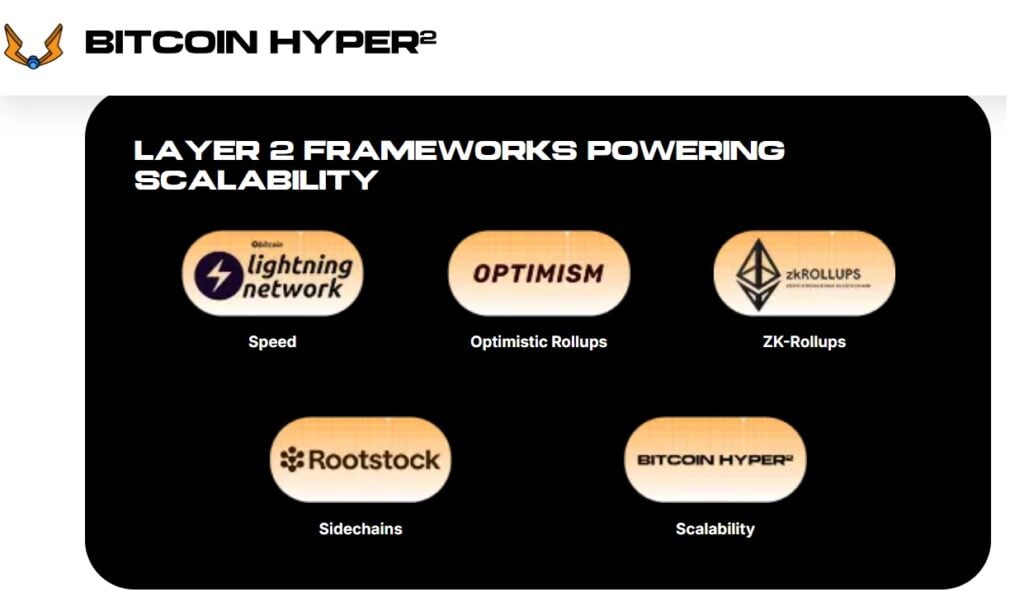

At its core, Bitcoin Hyper functions as a Bitcoin Layer-2 chain, combining scaling tools like zk-rollups, Optimism roll-ups, Lightning Network integration, and Rootstock sidechains to deliver faster, cheaper Bitcoin transactions without compromising security.

This allows users to bridge their BTC into the Hyper Layer-2, stake it, earn rewards, and interact with dApps and meme coins, then withdraw back to Layer-1 at any time. In essence, Bitcoin Hyper transforms Bitcoin from a passive store of value into a fully functional ecosystem.

Whales Are Rushing Into Bitcoin Hyper as Marketing Push Heats Up

Bitcoin Hyper’s presale is gaining traction fast. Tokens remain priced near $0.01, but a price hike is expected within hours, creating urgency among early participants.

Unlike many short-lived presales, Bitcoin Hyper’s roadmap suggests lasting growth. The team is preparing a complete Bitcoin ecosystem that includes:

- A dedicated wallet, bridge, and explorer

- Seamless staking integration

- Support for meme coins and NFTs

- Developer tools for Layer-2 projects on Bitcoin

Reports indicate that many whales are already investing, viewing Bitcoin Hyper as a project designed to endure beyond launch. With daily funding inflows between $100K and $200K, the presale continues to build momentum.

To complement this growth, Bitcoin Hyper has also allocated a multi-million-dollar marketing reserve alongside its main treasury, ensuring sustained visibility through partnerships, media coverage, and community outreach.

The results show that the project is trending across Telegram channels and social media discussions, gaining new wallet holders every day. Visibility fuels liquidity, and liquidity drives the market.

By combining real technology with aggressive marketing, Bitcoin Hyper is positioning itself for powerful momentum just as the next Bitcoin halving draws near, a period when investors typically refocus on BTC-linked assets poised for renewed demand.

Turning Market Panic Into Profit

Ironically, Tate’s bearish prediction highlights why projects like Bitcoin Hyper often thrive. When fear dominates the market, innovators build quietly in the background.

And when sentiment shifts, those builders become the biggest beneficiaries. The timing could not be better.

With Bitcoin’s next rally approaching and Layer-2 technology driving massive developer interest, Bitcoin Hyper sits at the intersection of two explosive trends: Bitcoin’s resurgence and blockchain scalability.

That combination is why many analysts and communities are calling it the best crypto presale to buy right now, especially for investors seeking Bitcoin-based projects with real-world utility and long-term potential.

Conclusion

Andrew Tate’s crash prediction may have stirred short-term anxiety, yet projects like Bitcoin Hyper prove that innovation continues even amid volatility.

As the next bull cycle approaches, Bitcoin Layer-2 solutions are expected to take the spotlight, and Bitcoin Hyper appears well-positioned to lead that trend.

For those tracking the best crypto presales to buy, now could be the ideal time to explore Bitcoin Hyper ahead of its exchange debut.

With its focus on building real utility during uncertain market conditions, Bitcoin Hyper stands out as one of the most promising projects emerging from Bitcoin’s foundation.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

The Channel Factories We’ve Been Waiting For

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets