Bitcoin Rally Pauses as The Market See Healthy Reset, XRP And Zcash Gain Ground

Bitcoin (BTC) appeared to be on track to retest the $115,000 level on Oct. 21, marking a solid rebound since bottoming below $105,000 on Oct. 17, still processing the flash crash that occurred in early October.

Meanwhile, digital asset firm Arca argued this pullback is part of a healthy reset and shouldn’t be considered the start of the end of Bitcoin’s bull cycle. This is actually the positioning reset markets needed to form a stronger base to journey to new highs.

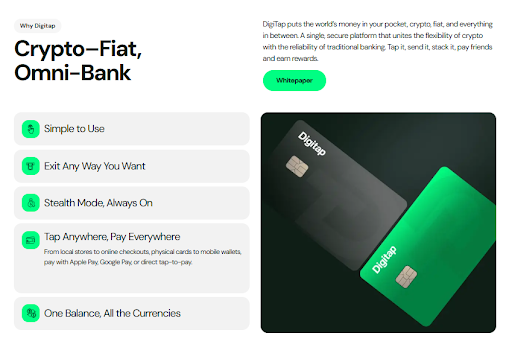

And here’s the token tipped to lead the next leg up: Digitap ($TAP). A crypto upstart in its presale phase offers investors an opportunity to get ground-floor access to the world’s first omni-bank.

Source: Digitap

How A Safe-Haven Selloff Can Fuel An Altcoin Turn

Tuesday was an interesting day for the crypto market. Gold and silver prices plunged hard while some shifted capital into Bitcoin. The world’s largest cryptocurrency rallied in a single day from around $107,500 to about $114,000. But momentum faded, and Bitcoin drifted back to the $107,000 level before bouncing yet again.

While the crypto Fear & Greed Index remains in “deep fear” territory, Arca’s analysts maintain the recent drop was a “structural reset, not a collapse.”

The subsequent rebound is accordingly not “just a dead-cat bounce.” The analysts note improving metrics, like exchange volumes rising 15% week over week, open interest in decentralized futures rising again, and liquidity returning to markets.

XRP Firms As Zcash Leads — Divergence In A Weak Tape

Ripple (XRP) was one of the tokens that sustained momentum while Bitcoin’s price gave up its gains. Traders and analysts appear to be taking a closer look at the hotly debated token. The recent acquisition of GTreasury and partnership with Hidden Road may have been underappreciated by some investors.

While many had viewed the $1 billion purchase of GTreasury as a pivot in its business strategy, some are interpreting the deal as “unlocking idle capital.”

Meanwhile, out of the top 100 cryptos by market cap, only five are trading in the green over the past week. One of those is privacy token Zcash, which is up 3% over the past seven days and up 393% over the past month.

Zcash’s recent run can be directly attributed to Grayscale’s announcement in early October that it was launching a fund to track the coin’s performance. The fund has since launched and amassed $85 million in assets despite a 2.5% expense ratio.

Digitap’s Live App: Hold, Swap, And Spend With Visa

Digitap built the world’s first “omni-bank,” combining traditional banking services with digital assets in a single app. Users can send, receive, save, invest, and spend both crypto and fiat as they wish. This approach has broad mainstream appeal, which explains its recent success.

Digitap’s presale round is about to enter its second round next week, with the price increasing from $0.0194 to $0.0268, meaning investors who purchase today can lock in 38% gains almost instantly. Even better, for investors who haven’t decided whether to trust Arca’s analysis, presales offer a form of safety.

Presales give investors access to staged price increases, which means there is no chance of any immediate loss. Digitap’s first round was priced at $0.0125, which means early investors will soon book a more than 100% paper profit.

Listing Path, Low Cap, And Everyday Pay Case For $TAP

Investors are right to question what would happen after the presale round. In Digitap’s case, it is reasonable to assume the token is destined to trade on multiple CEX and DEX exchanges, and the recent momentum could continue.

Being a low-cap, early-stage project, $TAP has much more room to grow. Many investors who don’t seek out presale opportunities are anxiously waiting for one of the top hidden crypto gems to become accessible on the open market.

These retail investors could quickly recognize Digitap’s investment proposition. It offers a beginner-friendly banking app that simplifies crypto and fiat transactions. Digitap also provides virtual and physical Visa cards that are globally accepted, plus full Apple Pay/Google Pay integration.

Even if $TAP doubles in value from its third-round price to around $0.04 when it hits an exchange, it will still offer the opportunity to vastly outpace any gains a large-cap token like XRP could realistically achieve.

Not A Dead-Cat? What Could Lead The Next Leg Higher

Bitcoin’s rally has paused, but analysts are hopeful the crypto rally is not done, according to Arca. While not everyone is convinced, newcomers like Digitap could lead the next leg up in the market cycle as it ultimately graduates from presale to at least one exchange.

Digitap has a lot working in its favor, including a live product, which is rare for a crypto presale project. This real-world utility is driving interest in the $TAP token, and strong early momentum hints that $TAP may be poised to break out.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Read more: Digitap Price in 2025: Can the Omni-Bank Match XRP & XLM’s Rise?

Disclaimer

Please be advised that all information, including our ratings, advices and reviews, is for educational purposes only. Crypto investing carries high risks, and CryptoNinjas is not responsible for any losses incurred. Always do your own research and determine your risk tolerance level; it will help you make informed trading decisions.

The post Bitcoin Rally Pauses as The Market See Healthy Reset, XRP And Zcash Gain Ground appeared first on CryptoNinjas.

You May Also Like

HitPaw API is Integrated by Comfy for Professional Image and Video Enhancement to Global Creators

Journalist gives brutal review of Melania movie: 'Not a single person in the theater'