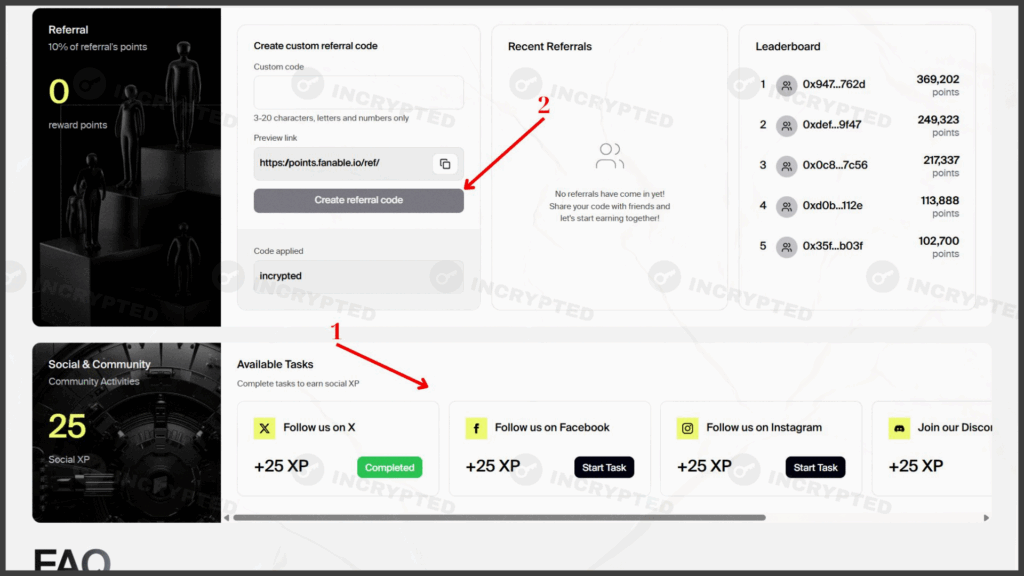

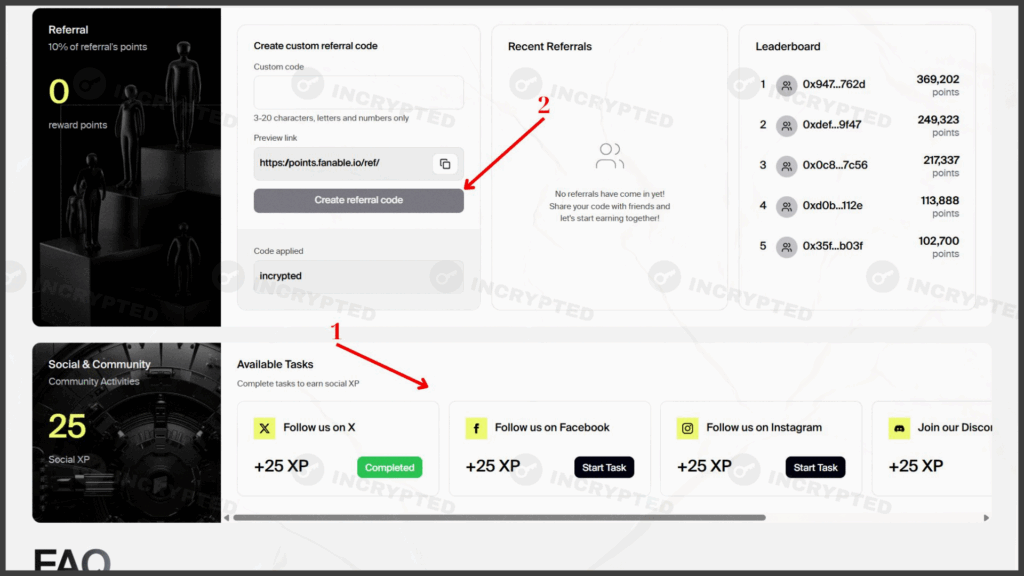

- Go to the website and connect your wallet. Complete all available social tasks and invite your friends:

Complete tasks. Data: Fanable

Complete tasks. Data: Fanable

- Join the project’s Discord, stay active, and earn roles.

1. Guide to completing the activities

2. Conclusion

Fanable is a platform that connects physical collectible items with digital ownership through tokenization.

The project has raised $11.5 million in funding from Ripple, Morningstar Ventures, Polygon, and other venture funds.

In this guide, we’ll cover which activities are worth completing in the project, with a focus on a potential future airdrop.

Complete tasks. Data: Fanable

Complete tasks. Data: Fanable

The project is in its early stage. At the time of writing, a point farming system is active, which involves completing social tasks. The activities themselves are simple and require no expenses. Follow the project’s social media channels to stay updated on important announcements.

Highlights:

If you have any questions while completing activities, you can ask them in our Telegram chat.

Useful links: Website | X | Discord