Adapt chosen as first project on new Sui AI launchpad

Multi-agent protocol Adapt or ANP3 has been selected to be the first project to launch on Sui ecosystem’s AI launchpad Surge. The project is known for facilitating quantitative trading.

- Sui’s new AI launchpad Surge has selected Adapt, a multi-agent quantitative trading protocol, as its first project out of over 70 applicants.

- Adapt’s ANP3 protocol connects AI-powered trading agents to create an interoperable, self-learning DeFi network that enables autonomous market-making and liquidity optimization.

On Oct. 29, Sui’s AI launchpad Surge announced that it has chosen the multi-agent protocol Adapt as the first project that will launch on the ecosystem. The project was the only one selected out of more than 70 AI projects that applied to be on Surge.

“Adapt’s ANP3 protocol links pro trading agents for cutting-edge smart trading that adapts to the user and market dynamics, unlocking advanced DeFi for everyone,” said the AI launchpad platform in a recent post shared on X.

The integration of the multi-agent protocol into Sui’s launchpad could open the door to more on-chain deployment of AI trading agents in the crypto space, making it available to users and developers on the Sui (SUI) blockchain.

Newly launched on Oct. 28, Surge is the first AI Agent Launchpad built natively on the Sui blockchain, designed to incubate and accelerate projects that integrate artificial intelligence into Web3. Its mission is to create a structured ecosystem where AI-driven agents can operate within decentralized applications and DeFi protocols.

Upon its release, many outlets highlighted Surge’s milestone-based funding and token release system which aims to promote long-term project sustainability rather than short-term speculation.

Each project launched through Surge has to undergo a process in which up to 90% of its tokens remain locked until key development milestones are met. The platform also provides integrated liquidity support through the Cetus Protocol, allowing projects to access DeFi liquidity pools immediately after launch.

The decision to launch Adapt on Surge further combines AI and crypto as more developers gravitate towards AI agent-centric projects.

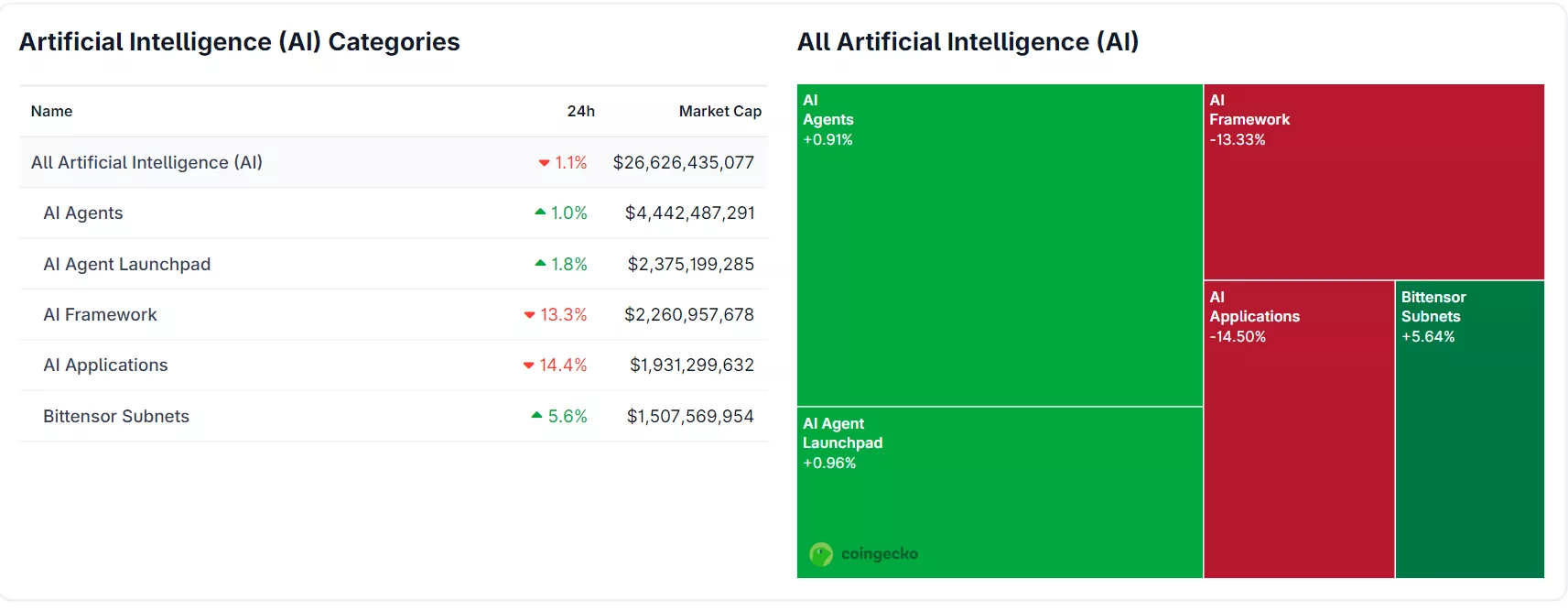

According to data on CoinGecko, AI Agents and AI Agent Launchpads are the chief contributors to the AI and crypto market cap. At press time, AI Agents have generated a market cap of $4.4 billion having seen a 1% growth within the past day.

Meanwhile, AI Agent Launchpads are still behind, contributing at least half of the market cap generated by AI Agents at $2.2 billion. Though, its value has grown by 1.8% compared to the previous day.

How does Adapt work?

Adapt is a web3 protocol that was built around the concept of multi-agent cooperation in quantitative trading. Dubbed the first Agent Interconnection Protocol or ANP3, Adapt aims to create a decentralized network where autonomous agents are powered by AI algorithms.

These AI-powered agents can communicate, collaborate, and execute complex trading strategies across blockchain markets.

The project envisions a future where AI agents operate as DeFi participants, optimizing liquidity provision, arbitrage, and market-making without the need for human intermediaries. By enabling interoperability among these agents, Adapt seeks to establish what it calls an “Agent DeFi Network,” which is an intelligent, self-organizing trading ecosystem that continually evolves through machine learning and decentralized governance.

In a post shared by Adapt, the team stated that it will continue to grow through the support of Surge’s FDV-Milestone vesting model as it prepares to integrate into the Sui blockchain.

“Let’s look forward to Adapt’s fund raising and token performance on Sui Network!” said the protocol in its latest post.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Microsoft Corp. $MSFT blue box area offers a buying opportunity