Justin Sun files a lawsuit: Spending $456 million to bail out TUSD and suing First Digital Trust for misappropriation of reserve funds for investment?

Original article: CoinDesk

Compiled by: Weilin, PANews

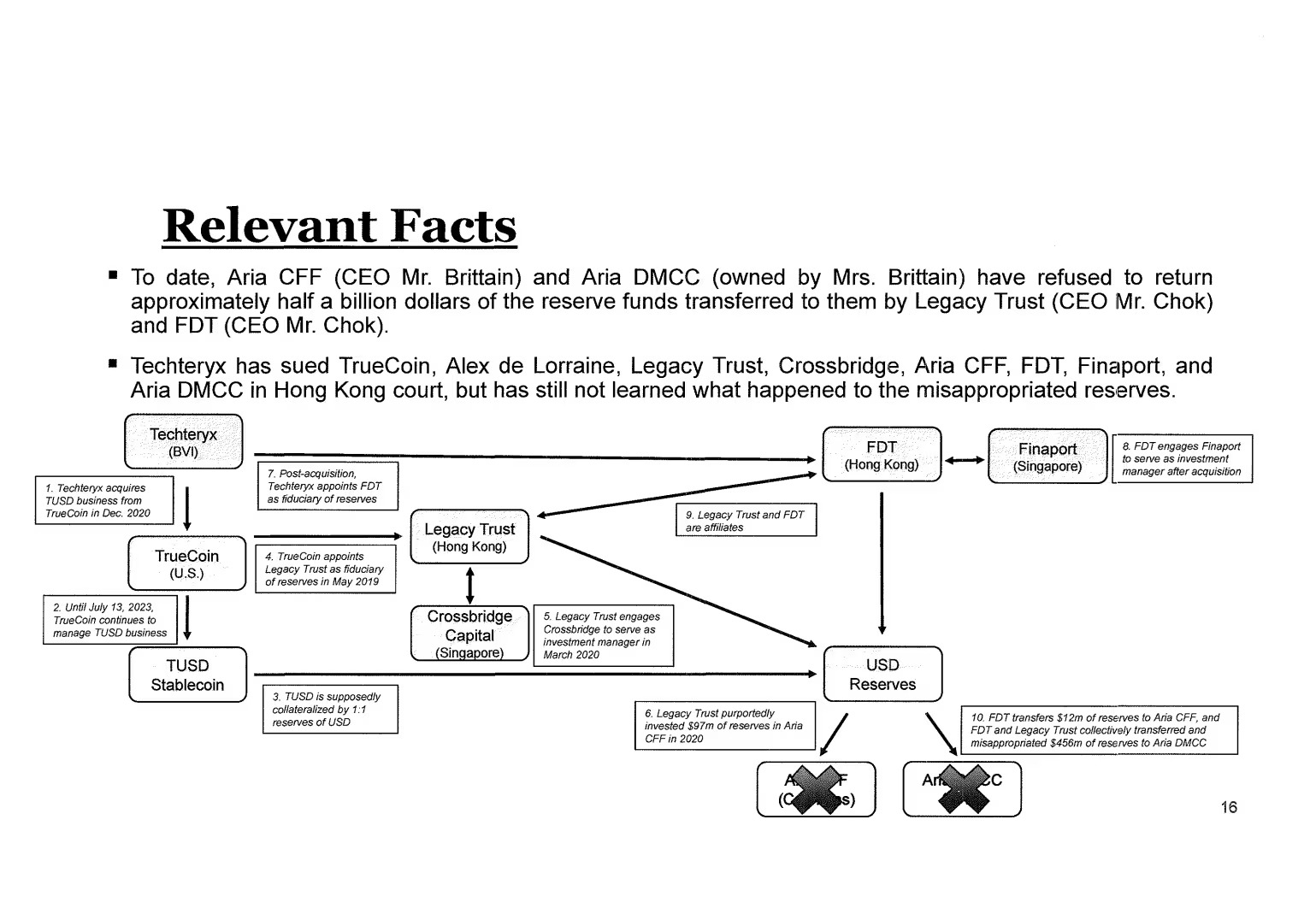

Sun bailed out Techteryx’s TrueUSD stablecoin after nearly $500 million in reserve funds became illiquid, according to court documents filed in Hong Kong by the stablecoin issuer, people familiar with the matter have confirmed.

Following the acquisition of TrueUSD from TrueCoin in December 2020, Techteryx appointed Hong Kong-based trustee First Digital Trust (FDT) to manage its stablecoin reserves.

According to documents prepared by U.S. law firm Cahill Gordon & Reindel, FDT was instructed to invest its stablecoin reserves in the Cayman Islands-registered Aria Commodities Finance Fund (Aria CFF). However, court documents allege that approximately $456 million was improperly diverted to an unauthorized independent entity in Dubai, Aria Commodities DMCC.

Court documents show that Matthew Brittain controls Aria Commodities Finance Fund (Aria CFF) through Aria Capital Management Ltd, while Cecilia Brittain is the sole shareholder of Aria Commodities DMCC, an independently operated entity based in Dubai.

However, Matthew Brittan from Aria's email signature uses an address in Dubai.

Court documents state that Cecilia is Matthew's wife.

ARIA DMCC is engaged in trade finance, asset development and commodity trading, while ARIA CFF provides financing services to commodity traders including ARIA DMCC and other third parties, according to Matthew Brittain in an email to CoinDesk.

An audit report issued by Moore CPA Limited shows that as of November 2024, FDT manages $501 million in TrueUSD reserves.

Hong Kong court documents also state that First Digital CEO Vincent Chok is accused of funneling approximately $15.5 million in undisclosed commissions to an entity called “Glass Door” and of structuring an unauthorized trade finance loan of approximately $15 million from FDT to Aria DMCC that was then retroactively misclassified as a legitimate fund investment. The plaintiffs allege these actions constituted fraudulent misrepresentation and misappropriation of funds.

“The funds wired to Aria DMCC were a blatant act of misappropriation and money laundering,” the complaint reads. “These operations were conducted without the Plaintiff’s knowledge, authorization, or approval.”

As of press time, these statements have not yet been heard in court.

Aria DMCC invests funds in a variety of projects around the world, which it describes as relatively illiquid assets, such as manufacturing plants, mining operations, maritime vessels, port infrastructure and renewable energy projects.

Court documents say Techteryx barely recovered its money when it tried to redeem its investment from Aria CFF between mid-2022 and early 2023, and Aria-related entities are accused of failing to make payments on time and not honoring redemption requests.

Subsequently, Techteryx took over the full operation of TUSD in July 2023, terminating TrueCoin's involvement. As a transitional arrangement after the sale in December 2020, TrueCoin continued to be responsible for the daily operations of TUSD.

According to court documents, Justin Sun stepped in during this period to provide emergency liquidity support for TUSD, which was structured as a loan.

The court document also stated that even though the stablecoin issuer had no funds available, the Techteryx team still isolated 400 million TUSD to ensure that retail users could still redeem them normally and token holders were not affected.

First Digital said it followed Techteryx's instructions

In response to CoinDesk’s request for comment, First Digital CEO Chok categorically denied any wrongdoing or involvement in any fraudulent scheme.

Chok told CoinDesk that First Digital Trust acted solely as a fiduciary intermediary and executed transactions strictly in accordance with instructions provided by Techteryx and its representatives. He stressed that the company was not responsible for independently evaluating or advising on these investment decisions.

“We understand that one of the main obstacles to ARIA’s refusal to redeem the funds early as requested by Techteryx was their concerns about anti-money laundering (AML) and know-your-customer (KYC) issues regarding the transactions between TrueCoin and Techteryx, particularly regarding the true identity of Techteryx’s ultimate beneficial owners,” Chok said in an email to CoinDesk, adding that he does not believe any of the parties involved in the case believe Aria lacks liquidity.

“We have not yet had the opportunity to fully defend ourselves,” Chok said in the email. “We will do our best to clarify these issues as the legal and arbitration proceedings proceed.”

Aria Group’s Matthew Brittain told CoinDesk that he “completely denies the allegations made by Techteryx against ARIA DMCC and any associated entities,” adding that “a number of false allegations have been made during the court proceedings.”

Brittain said Techteryx was fully aware of the relevant investment term commitments, which were set out in the contract agreed by subscribers when investing in ARIA CFF and clearly listed in the offering prospectus.

Brittain also echoed Chok's concerns about Techteryx's beneficial ownership, noting that The Wall Street Journal has reported on the topic.

The Hong Kong court summons lists Li Jinmei as the ultimate beneficial owner of Techteryx. A Techteryx spokesperson confirmed that this person is not Jennifer Yiyang, the former beneficial owner mentioned in the media, despite confusion in some media reports.

“The subscriber has not yet addressed those issues,” Brittain added, referring to concerns about beneficial ownership.

Prime Trust Collapse and SEC Settlement Add to Situation

As this happened, TUSD’s woes continued to intensify, manifested in the collapse of a banking partner and pressure from U.S. regulators to scrutinize it.

In mid-2023, Prime Trust, an independent crypto custodian based in Nevada and not directly related to this case, was taken over by state regulators. TrueUSD used the agency as a fiat currency channel partner.

State regulators accused Prime Trust of improperly using customer funds to meet withdrawal requests, raising serious concerns about its financial stability.

Court documents in Nevada show that Prime Trust owed approximately $85 million in fiat obligations, while having only approximately $3 million in available funds at the time.

This is not the last challenge facing the stablecoin issuer.

In September 2024, TrueCoin and TrustToken (the owners of the stablecoin before Techteryx took over) reached a settlement with the U.S. Securities and Exchange Commission (SEC) after they were accused of falsely advertising TrueUSD as “fully backed by U.S. dollars” while secretly investing reserve funds in high-risk overseas funds.

Although they did not admit any wrongdoing or disclose details of overseas investments by Aria-related companies, TrueCoin and TrustToken agreed to pay civil penalties totaling just over $500,000 and disgorge ill-gotten gains to settle charges of fraud and illegal securities offerings.

Aria’s Brittain said that investing stablecoin reserve funds in Aria was not a suitable decision from the beginning.

“ARIA CFF has never promoted its investment strategy as highly liquid, or suitable for use as a reserve for stablecoins,” he wrote in an email.

Related reading: "Details of the SEC's charges against the former TUSD operator: Sun Yuchen's team holds more than 80% of the shares, and 99% of the reserves are invested in offshore funds"

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models