Whales Buy $277K Bitcoin Hyper in Two Days: Next Crypto to Explode?

Quick Facts:

Whales have secured $HYPER tokens worth $277K in just two days, as Bitcoin battles to stay above $100K.

Whales have secured $HYPER tokens worth $277K in just two days, as Bitcoin battles to stay above $100K. Investors are turning to long-term projects with high upside, like Bitcoin Hyper, to offset recent losses.

Investors are turning to long-term projects with high upside, like Bitcoin Hyper, to offset recent losses. The token is available for fixed, discounted prices in its sizzling hot presale, which just broke the $26M milestone.

The token is available for fixed, discounted prices in its sizzling hot presale, which just broke the $26M milestone.

Bitcoin remains trapped in that tricky zone below $110K, raising concerns of steeper crashes.

Now testing the psychological support at $100K, the crypto captain has left investors on edge, giving no hint about where it’s headed – not in the short-term, at least.

The only certain thing is that Bitcoin is set to rebound sooner or later.

JPMorgan recently released a report that suggests significant upside for Bitcoin over the coming months, as it enters a new era of maturity.

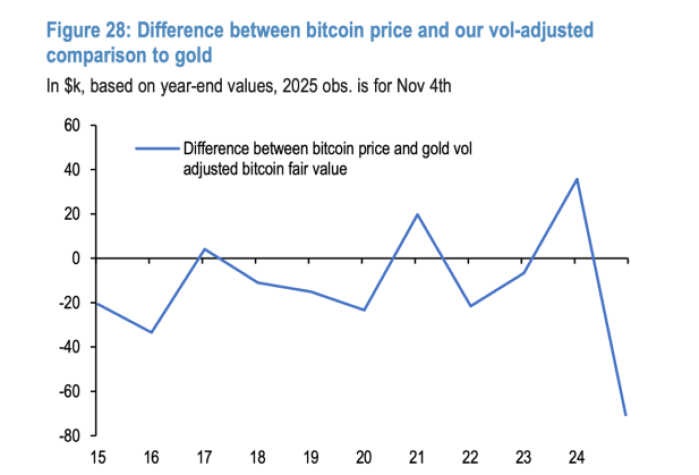

The report notes that Bitcoin is currently trading below its fair value relative to gold, once adjusted for volatility. After setting record highs in October, gold has been prone to high volatility, leading to a drop in the Bitcoin-to-gold volatility ratio, to 1.8.

However, this new phase will be marked by slower gains than previous cycles, due to institutional absorption and passive investment flows.

For example, the growing popularity of Bitcoin ETFs has absorbed liquidity from the market and will likely continue to do so, slightly slowing down price movements. But on the bright side, the trend will give a sturdier anchor for $BTC.

After the historic deleveraging catastrophe of October 10 and the subsequent price corrections, Bitcoin seems more accessible to investors who previously avoided it for fear of high entry barriers and extreme price swings.

Alongside, strategic investors are diversifying into projects focused on building infrastructure for crypto’s next phase of growth, which will be more mature and utility-driven.

A good example of the trend is the steadily progressing Bitcoin Hyper ($HYPER) presale, which recently burst past $26M despite Bitcoin struggling to hold its ground.

A good example of the trend is the steadily progressing Bitcoin Hyper ($HYPER) presale, which recently burst past $26M despite Bitcoin struggling to hold its ground.

What has turned Bitcoin Hyper into a presale sensation this year? Let’s find out.

Bitcoin Hyper is Building a Layer-2 Solution for Bitcoin

Bitcoin Hyper ($HYPER) is a Layer-2 solution that integrates Solana’s Virtual Machine and a non-custodial canonical bridge to bring more speed and programmability to the Bitcoin network.

That sounds complicated, but the infrastructure is cleverly simple, yet sophisticated. Before we unpack that, though, we need to understand why the market needs Bitcoin Hyper in the first place.

The answer lies in Bitcoin’s distinctive pain points as a blockchain. It often comes to light during bull markets, when network congestion and transaction fees peak, frustrating traders.

The answer lies in Bitcoin’s distinctive pain points as a blockchain. It often comes to light during bull markets, when network congestion and transaction fees peak, frustrating traders.

But the speed isn’t impressive during bear markets, either.

Bitcoin is the world’s first blockchain-based asset, and it has made full use of its reputation, with a gigantic 59.8% market share.

While Bitcoin is often referred to as digital gold, the comparison isn’t entirely accurate. Bitcoin isn’t a static reserve of value, unlike gold. Tapping into its reputation, the coin brilliantly generates value from the growth of the broader blockchain market.

It’s projects like Ethereum, Solana, XRP, and BNB that have taken the crypto market to its current heights with smart contract capabilities. They’ve penetrated different industries – from agriculture to gaming and medicine – with a wide range of use cases.

Bitcoin, on the other hand, has failed to even deliver its initial goal of building a digital network of peer-to-peer payments, let alone Web3 use cases. Because of its lack of speed and heavy transaction costs, the asset is unsuitable for micropayments.

How Bitcoin Hyper Upgrades Bitcoin

Bitcoin Hyper ($HYPER) will bring speed and smart contract capabilities to the Bitcoin network, opening it up to a wide range of decentralized applications.

You’ll simply need to deposit your $BTC into the platform’s decentralized canonical bridge to get started. It will verify the deposit and mint an equivalent amount of wrapped $BTC on the Bitcoin Hyper Layer-2 network.

The wrapped version will be much faster than the original, and can be transferred almost instantly at near-zero costs.

To enable parallel smart contract execution within the Bitcoin network, Bitcoin Hyper makes use of Solana’s Virtual Machine. Smart contract developers familiar with Solana will be able to use Bitcoin Hyper to develop dApps, unleashing a new stream of organic demand for $BTC.

However, the framework does raise concerns about security. The original Bitcoin network has largely remained inflexible due to its rigid security features.

Bitcoin Hyper addresses this too, by bundling and validating Layer-2 transactions using zero-knowledge proofs, and then regularly settling them on the base layer.

In other words, Bitcoin Hyper will enable Bitcoin to benefit from Solana-level speed and performance without compromising security.

Take a look at our comprehensive $HYPER review for more on this Layer-2 project.

Take a look at our comprehensive $HYPER review for more on this Layer-2 project.

Unlike many crypto presale projects, Bitcoin Hyper isn’t simply a plan on paper. The team is actively working on development, and it has been sharing regular dev updates via the project’s official website and social media pages. In fact, 30% of the token supply goes toward product development.

A substantial 20% allocation goes to marketing. So there’s a good chance that Bitcoin Hyper won’t simply be another ambitious project that fades into obscurity because it failed to capture early traction from initial investors. It has already raised over $26M in its viral presale.

Is $HYPER the Next Crypto to Explode?

As a token that fuels one of the most interesting projects to enter the market in a long time, it wouldn’t be surprising to see $HYPER outperform $BTC in terms of annual gains. According to our Bitcoin Hyper price prediction, the token could very well be among the next crypto to explode.

By joining the ongoing presale, investors can secure the tokens for a discounted price of $0.013235. And those who stake the tokens can earn attractive passive income at 45% APY.

Check out our guide to buying Bitcoin Hyper for detailed instructions on how to join the presale.

Check out our guide to buying Bitcoin Hyper for detailed instructions on how to join the presale.

As whales continue to snap up $HYPER – amounting to ($20.1K + $10.4K + $140.3K + $68.4K + $38.6K = $277K) in single transactions this week alone – the presale won’t last long.

In addition, the next presale price surge is just one day away.

Jump in while you still can. Join the Bitcoin Hyper ($HYPER) presale today.

Jump in while you still can. Join the Bitcoin Hyper ($HYPER) presale today.

Disclaimer: As always, do your own research before investing in crypto. This is NOT financial advice.

Authored by Bogdan Patru for Bitcoinist – https://bitcoinist.com/whales-buy-277k-bitcoin-hyper-as-traders-bet-on-next-crypto-to-explode

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8