Dogecoin Flashes Major Rebound Signal As Exchange Flows Flip, Analyst Warns

Dogecoin’s exchange dynamics have flipped at a key moment, with fresh on-chain data pointing to a shift in short-term market structure. Crypto analyst Ali Martinez (@ali_charts) highlighted a Glassnode chart showing that Dogecoin’s net supply on centralized exchanges has just turned positive, noting on X: “Dogecoin supply on exchanges just turned positive! This shift has marked sharp rebounds before.”

Dogecoin Rebound Loading?

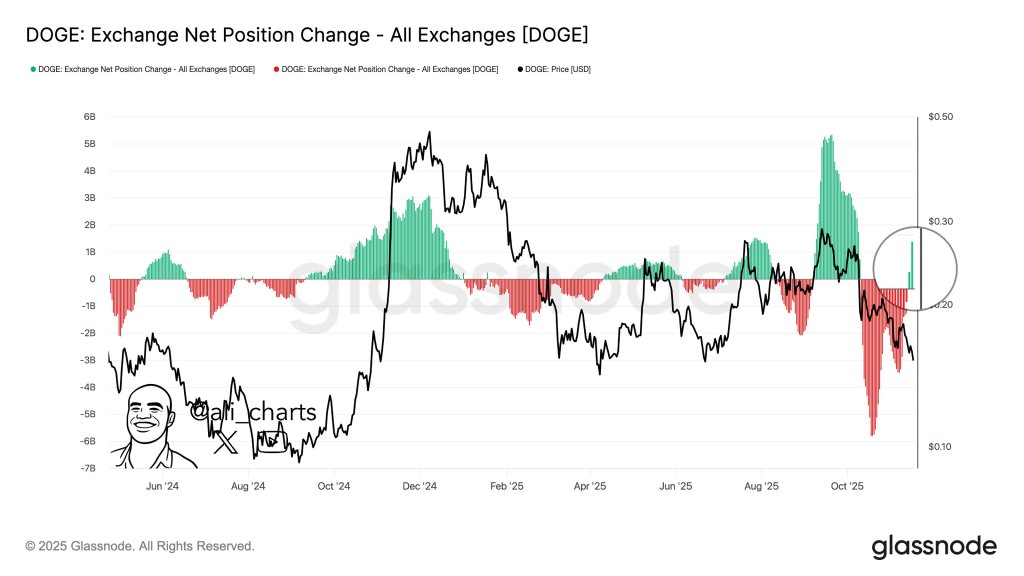

The chart in his post, “DOGE: Exchange Net Position Change – All Exchanges,” tracks monthly exchange inflows and outflows as a histogram, alongside DOGE’s price in US dollars. Green bars indicate net inflows (more DOGE moving to exchanges than leaving), while red bars show net outflows.

From mid-2024 through late 2024, the series alternates between modest red and green periods before a sustained cluster of strong green bars emerges around the fourth quarter of 2024. During that phase, net inflows rise to several billion DOGE per month. At the same time, the price line accelerated from below $0.10 to a local peak to $0.48, illustrating how heavy exchange-side activity accompanied the rally.

After that peak, the structure changes. Through early and mid-2025, the histogram becomes more mixed, with smaller positive and negative reads as price oscillates broadly between roughly $0.12 and $0.30. Heading into late 2025, however, the chart shows a pronounced sequence of red bars, with net outflows extending down toward roughly −5 to −6 billion DOGE while the price trends lower from the mid-$0.20s toward the low-$0.20s and below.

The final data point, emphasized by a circular highlight on the right edge of the chart, marks a clear break in that pattern: a tall green bar crosses back above the zero line, indicating that net flows have turned positive again. At that moment, the price line sits slightly above the $0.15 mark on the vertical scale. Martinez interprets this as a “major rebound signal,” pointing to previous instances where a similar transition from persistent outflows to strong inflows coincided with sharp directional moves.

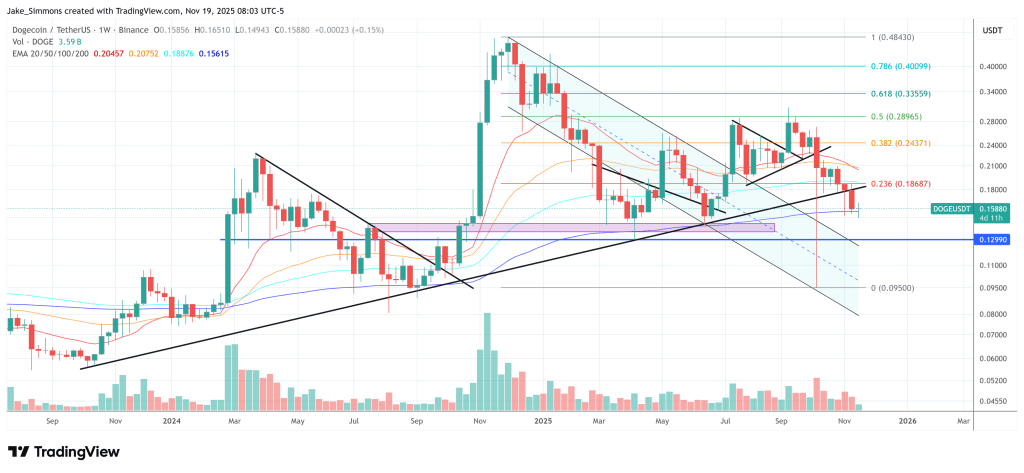

DOGE On Thin Ice Below $0.16

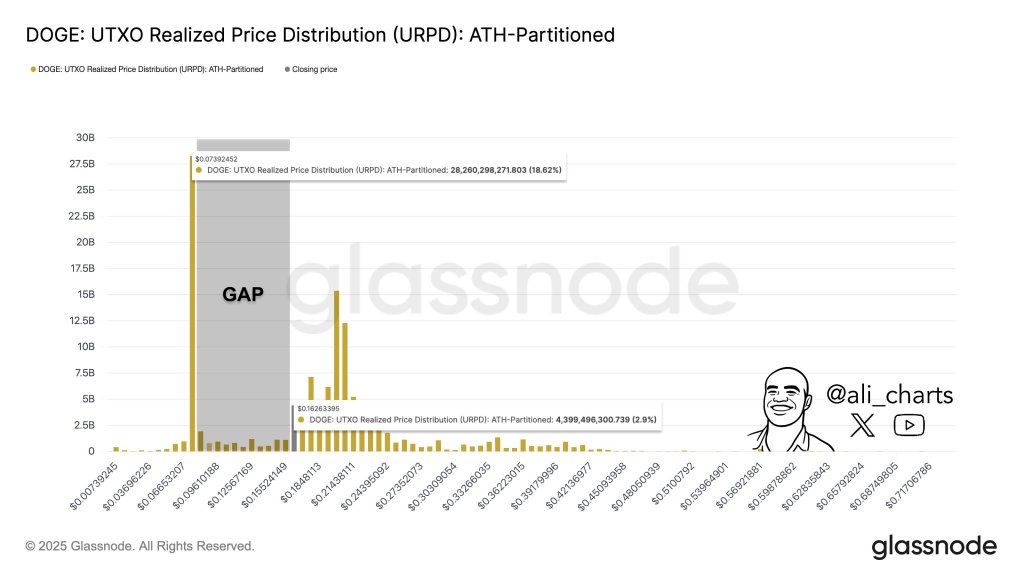

A second chart he shared, an ATH-partitioned UTXO Realized Price Distribution (URPD), sets out where the current DOGE supply last moved on-chain. A single, dominant bar appears around $0.07392452 and accounts for 28,260,298,271.803 DOGE, or 18.62% of the measured supply. Martinez summarizes this by stating that 27.4 billion DOGE have accumulated at roughly $0.08, calling it the “most significant support level.”

Between that $0.07–$0.08 block and approximately $0.16, the URPD shows a shaded “GAP” with only small intermediate bars around levels such as $0.096, $0.125 and $0.155. Above the gap, a smaller but still notable cluster appears at about $0.162633395, containing 4,399,496,300.739 DOGE (2.9% of supply). “Below $0.16, support for Dogecoin $DOGE disappears quickly,” Martinez warns, adding that the “next real demand zone sits at $0.07.”

A third chart, a cost-basis distribution heatmap, tracks DOGE’s price against horizontal bands representing where holders’ cost bases are concentrated. It confirms two core cohorts: a lower band between $0.0812497 and $0.08279775 with 27,397,971,652.123432 DOGE, and an upper band from $0.20103297 to $0.20486326 containing 12,156,333,652.493444 DOGE.

Together with the newly positive exchange flows, these data points define a market caught between a dense realized floor around $0.08 and a substantial holder cluster near $0.20, with the latest flow reversal now in focus for traders tracking DOGE’s next move.

At press time, DOGE traded at $0.158.

You May Also Like

Essential Guide: Binance Pauses RUNE Network Upgrade – What Traders Must Know

Dogecoin’s Strongest Support Zone Revealed—Here’s The Level