Zcash (ZEC) Rips While Bitcoin Dips — Can This Privacy Coin Run 49% Higher

Zcash has seen a strong surge in recent weeks as demand for privacy coins grows across the market. ZEC’s rise stands out due to its limited correlation with Bitcoin, allowing it to perform independently during periods of volatility.

This unique behavior has fueled renewed interest and helped strengthen ZEC’s upward momentum.

Zcash Is Independent

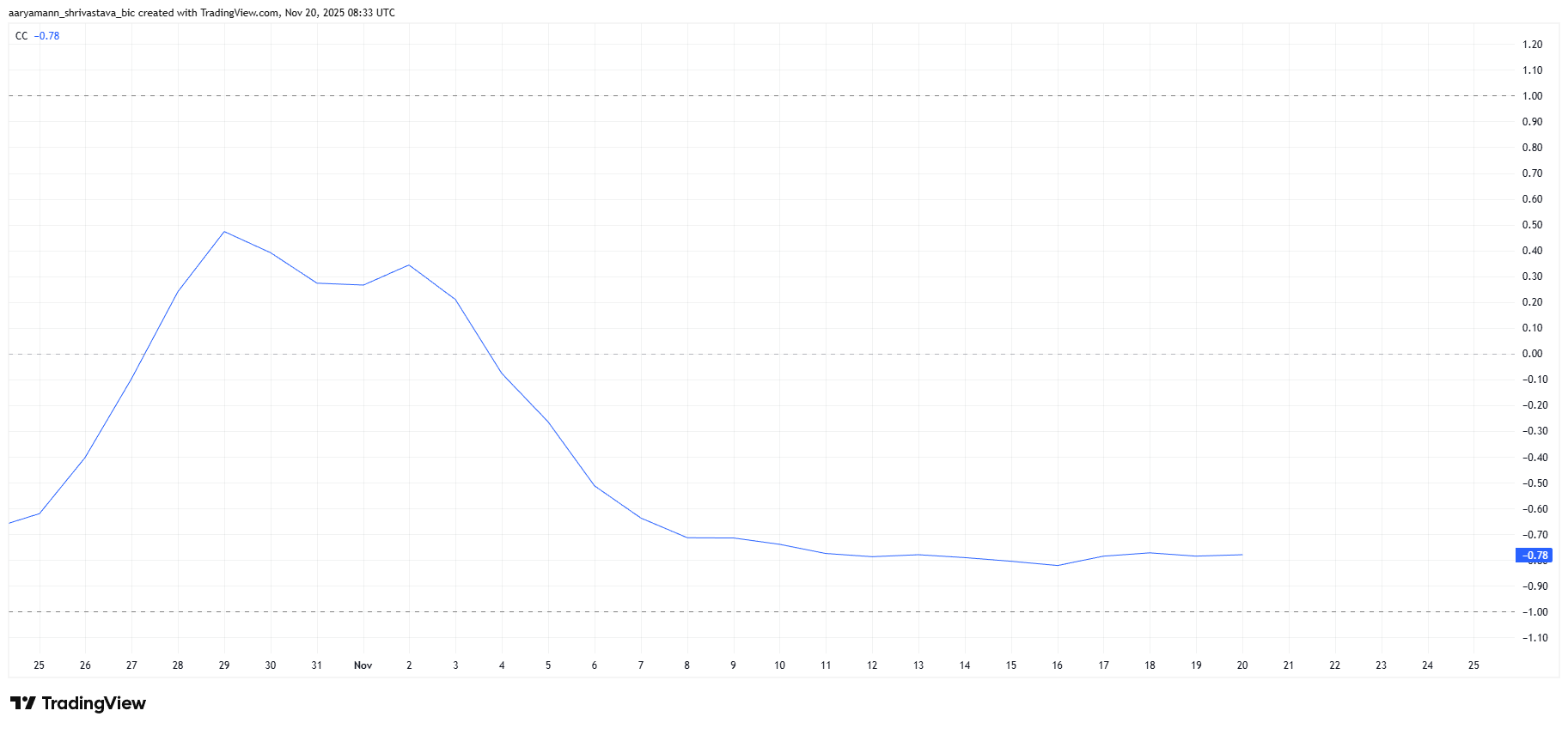

Zcash’s correlation with Bitcoin currently sits at -0.78, signaling a strong negative relationship. This means ZEC is moving in the opposite direction of BTC, which is highly beneficial at a time when Bitcoin is trading near $90,000 after several days of decline. ZEC’s ability to decouple from BTC enables it to avoid broader market pullbacks.

This negative correlation has remained intact since early November, reinforcing ZEC’s resilience. As long as the correlation stays below zero, Zcash will be less vulnerable to Bitcoin-driven sell-offs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC Correlation With Bitcoin. Source: TradingView

ZEC Correlation With Bitcoin. Source: TradingView

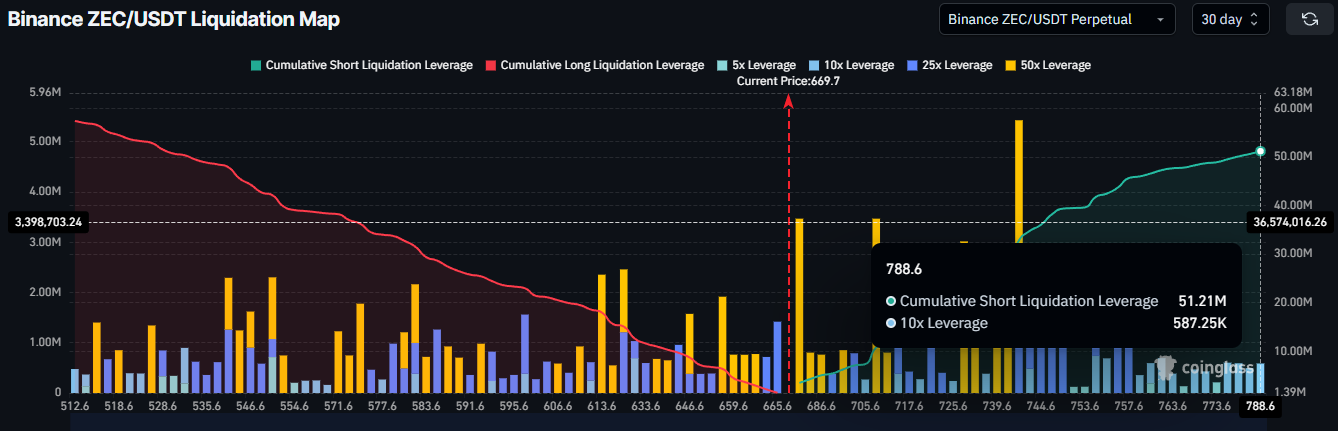

Macro indicators also suggest favorable conditions. Zcash’s liquidation map reveals that short sellers should approach the market with caution. If ZEC climbs to $788, roughly $51 million worth of short positions could be liquidated. This creates an additional incentive for traders to avoid bearish strategies.

Large liquidation clusters often discourage short positions and can fuel further upside as forced liquidations amplify price movement. For ZEC, reaching these levels would disrupt bearish sentiment and provide additional support for continued appreciation.

Zcash Liquidation Map. Source: Coinglass

Zcash Liquidation Map. Source: Coinglass

ZEC Price Has A Lot Of Room To Grow

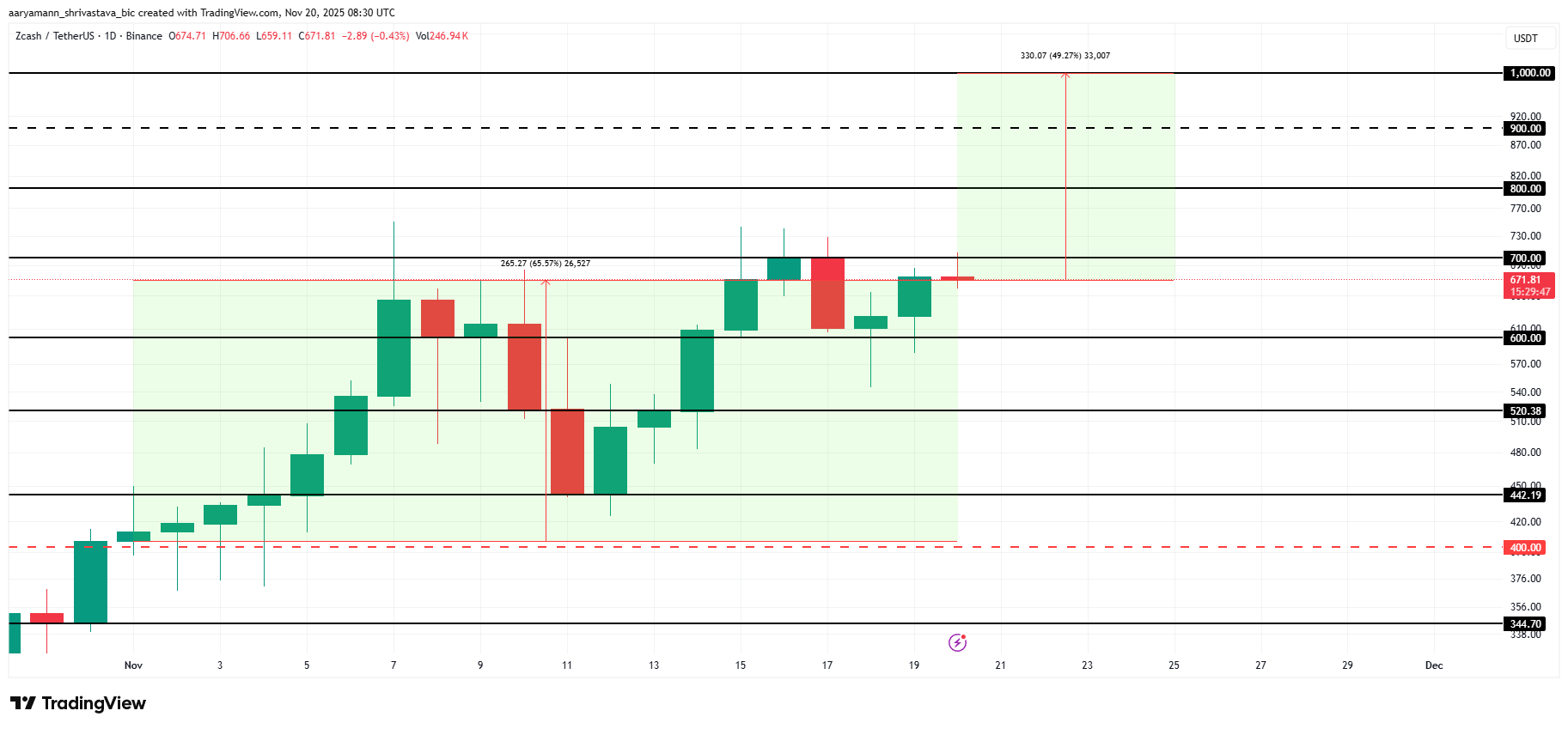

Zcash trades at $671, sitting just below the $700 resistance level. The altcoin has gained 65.5% since the start of the month. This reflects strong market participation and growing interest from both retail and institutional traders.

If momentum continues, ZEC could rise toward $1,000, which sits 49% above current levels. Achieving this target within 10 days is possible if investor support remains consistent. To reach $1,000, ZEC must first break through and convert the $700, $800, and $900 levels into support.

ZEC Price Analysis. Source: TradingView

ZEC Price Analysis. Source: TradingView

However, if selling pressure increases, ZEC could lose momentum and fall to $600. A deeper correction may push the price toward $520, invalidating the current bullish thesis, leaving the altcoin vulnerable to a crash.

You May Also Like

Polymarket, Kalshi bet big on web3—and global expansion

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council