LiquidChain ($LIQUID) Crypto Presale Ranks as a Must-Watch Altcoin – Here’s Why

The LiquidChain ($LIQUID) is a new crypto presale that crossed $40,000 in commitments from early participants. Over 3.3 million tokens now sit in staking contracts at $0.0122 per token.

These numbers look more than solid. Participants are locking capital into infrastructure designed to solve blockchain’s biggest structural problem.

The presale window remains open ahead of mainnet deployment and Q3 2026 centralized exchange listings. For investors evaluating which crypto to buy during this cycle, infrastructure with established growth and clear utility presents a different profile.

3.3M Tokens Staked Signal Strong Early Conviction

Crossing the $40,000 threshold during presale shows serious participant commitment. This isn’t airdrop farming or quick-flip positioning. Stakers can lock tokens to earn rewards and support network security.

The 3.3 million tokens staked show real capital allocation decisions. Participants evaluated the cross-chain liquidity thesis and committed funds.

The ratio of staked to purchased tokens shows participants view this as infrastructure, not trading inventory.

Annual staking rewards exceeding 17,000% create immediate value during the presale phase. Most projects offer no utility until mainnet launch.

The $0.0122 entry price precedes all major catalysts. Mainnet launch activates cross-chain swaps and liquidity pools.

Developer partnerships begin deploying applications. Exchange listings in Q3 2026 bring institutional liquidity.

Why Previous Cross-Chain Solutions Failed Where LiquidChain Succeeds

Security vulnerabilities in bridges have cost users billions. A single compromised signature can drain entire liquidity pools. Wrapped assets trade at premiums or discounts based on redemption confidence.

Synthetic tokens create additional counterparty risk. Users must trust that collateral backing synthetic positions remains solvent. Smart contract exploits in wrapping protocols have resulted in permanent capital loss.

LiquidChain removes these trust assumptions through verifiable on-chain proofs. Bitcoin UTXOs, Ethereum account states, and Solana balances get verified directly. No intermediary custodians, no wrapped token schemes.

The trust-minimized protocol verifies everything atomically. Transactions either settle across all chains or fail completely. No partial executions, no stuck assets in bridge contracts.

Previous solutions asked users to accept additional risk for cross-chain access. LiquidChain’s architecture removes that tradeoff entirely. The difference matters when billions in liquidity move between chains.

Staking Rewards at 17,000%+ Annually Create Immediate Presale Value

Most crypto presales offer tokens with zero utility until mainnet launch. Participants wait months or years for network activation. Capital sits idle with no returns.

The staking mechanism also reduces circulating supply during network growth. Locked tokens can’t hit markets during early price discovery. Reduced float creates different supply dynamics as demand increases.

Participants choosing the Buy and Stake option during presale maximize their position. Rewards accumulate while mainnet development continues. By launch, stakers hold larger positions than initial purchase amounts.

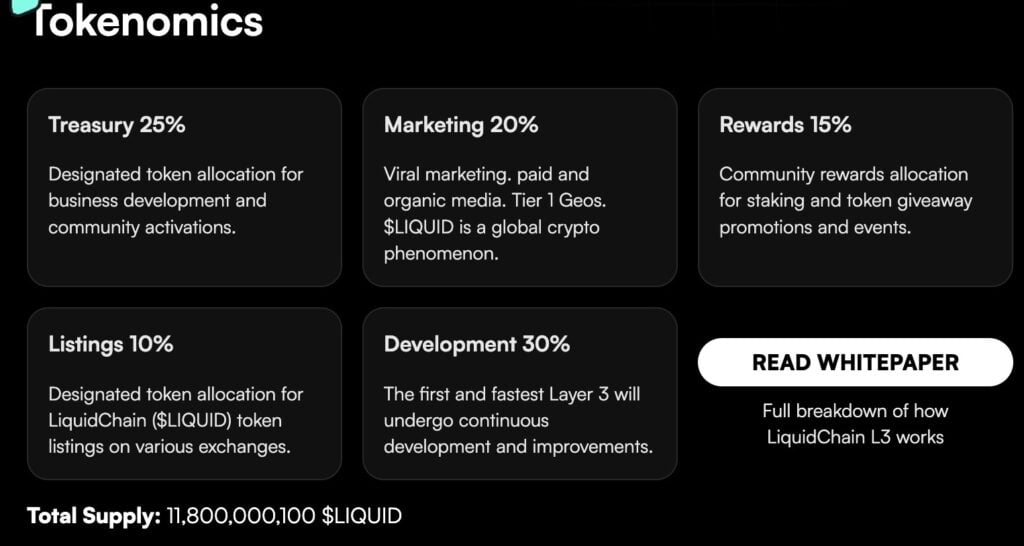

The 15% token allocation to rewards supports long-term staking incentives. Community rewards for staking and token giveaway promotions ensure ongoing participation.

Immediate staking rewards differentiate this crypto presale from delayed-utility projects. Capital earns returns from day one. The presale phase becomes productive, not just speculative.

Token holders provide network security and liquidity in exchange for rewards. The relationship creates sustainable economics rather than ponzi-style emissions with no underlying value.

Real-World Applications Post-Mainnet Make $LIQUID a Crypto to Buy

Mainnet launch activates practical cross-chain functionality that doesn’t exist today. Unified trading lets users swap Bitcoin for Solana memecoins in one transaction. Order books combine liquidity from all three ecosystems.

Cross-chain lending becomes possible without wrapped collateral. A Bitcoin holder can borrow against their position to access Ethereum DeFi yields.

Institutional liquidity access bridges traditional capital into multi-chain markets. Funds can deploy across Bitcoin, Ethereum, and Solana ecosystems through one interface. This removes technical barriers keeping institutional capital on sidelines.

The roadmap through Phase 3 and Phase 4 expands these applications. Cross-chain derivatives let traders take leveraged positions spanning multiple chains. Layer 2 integrations bring additional liquidity sources into unified pools.

Token utility grows with each application launched. $LIQUID pays network fees for all cross-chain transactions. Liquidity providers earn $LIQUID proportional to pool contributions. Developers stake $LIQUID to receive ecosystem grants.

Post-mainnet applications create real demand for the token beyond speculation. Users need $LIQUID to access cross-chain functionality. This demand comes from actual utility, not marketing narratives.

Step-by-Step Guide to Buying $LIQUID Before Exchange Listings

Participating in the LiquidChain presale requires basic crypto infrastructure. Start with a compatible wallet like Best Wallet or MetaMask. Load the wallet with crypto from any major exchange.

Head to the official LiquidChain presale website. Connect the wallet using the interface buttons. The system will prompt for wallet approval.

Select the purchase amount in $LIQUID tokens at the current $0.0122 price. Review the transaction details before confirming. Gas fees vary based on network congestion.

Activate the Buy and Stake option to begin earning rewards immediately. Staked tokens start accumulating the 17,000% annual rewards right away. This maximizes position growth during the presale period.

Alternative payment methods include credit or debit cards. Choose Buy With Card and connect a mobile wallet or browser extension. Follow the prompts to complete card payment processing.

Discover the future of cross-chain liquidity with LiquidChain:

Presale: https://liquidchain.com/

Social: https://x.com/getliquidchain

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Where to Buy BFS Crypto? Arkham Abandons the CEX Model, North Korean Malware Targets Traders, and DeepSnitch AI’s Moonshot Launch Is About to Come and Go in Early 2026