Ethereum’s growing pains: From ETF “bleeding” to on-chain weakness, can ETF staking boost the market?

Author: Nancy, PANews

Ethereum is going through a long period of growing pains, with prices under pressure, on-chain activity declining significantly, and spot ETF funds continuously outflowing... These signs are gradually eroding the market's confidence in its growth potential. As the US crypto regulatory environment quietly changes, many ETF issuers have recently submitted Ethereum ETF pledge proposals to the US SEC. For Ethereum, which currently lacks a clear demand catalyst, this change is also seen by the market as a key variable for Ethereum to get out of the trough in the short term.

ETF funds are losing a lot of money. The approval of ETF pledge will be announced as early as this month.

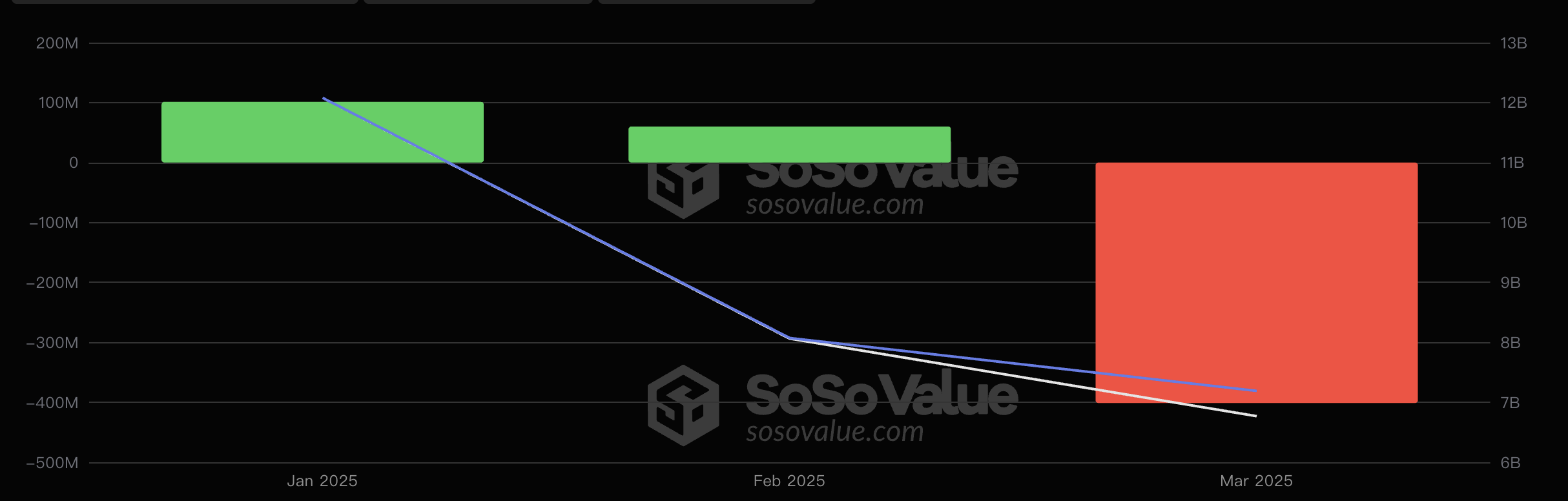

Currently, Ethereum spot ETF funds continue to bleed, further undermining market confidence. According to SoSoValue data, since the beginning of this year, the US Ethereum spot ETF has accumulated a net inflow of about US$160 million in January and February, but has a net outflow of more than US$400 million in March, with a net outflow of nearly US$240 million this year. In contrast, although the Bitcoin spot ETF has also experienced a large outflow in the past two months, the overall net inflow this year is still more than US$790 million, and the scale of net outflow this month has shrunk by 74.9% compared to February.

Ethereum ETF monthly inflows this year

In this regard, Robert Mitchnick, head of BlackRock's digital assets department, believes that approval for pledge may be a "huge leap" for Ethereum ETFs. He recently said that the demand for Ethereum ETFs has been mediocre since its launch in July last year, but if some regulatory issues that hinder its development can be resolved, the situation may change. It is generally believed that the success of Ethereum ETFs is "unremarkable" compared with the explosive growth of funds tracking Bitcoin. Although this is a "misunderstanding", the inability of these funds to obtain pledge income may be a constraint that hinders their development. ETFs are a very attractive tool, but for ETH today, ETFs without pledges are not perfect, and pledge income is an important part of generating investment returns in this field. This is not a particularly easy problem to solve. It's not like... the new government just gives the green light and it's done overnight. There are still many quite complex challenges to overcome. If these problems are solved, there will be a leap forward in seeing the activities around these ETF products.

In fact, since February this year, many issuers including 21Shares, Grayscale, Fidelity, Bitwise and Franklin have successively submitted proposals for staking Ethereum ETFs. Among them, 21Shares was the earliest institution to submit relevant applications, and was officially accepted by the SEC on February 20. According to the SEC approval process, the agency must make a preliminary decision within 45 days after submitting the 19b-4 document, including whether to accept, reject or postpone. Starting from February 12, the preliminary decision time for 21Shares' Ethereum ETF pledge application is March 29. Due to the weekend, it may actually be postponed to the next working day, March 31, and it will take no longer than 240 days, and the final decision is expected to be made on October 9.

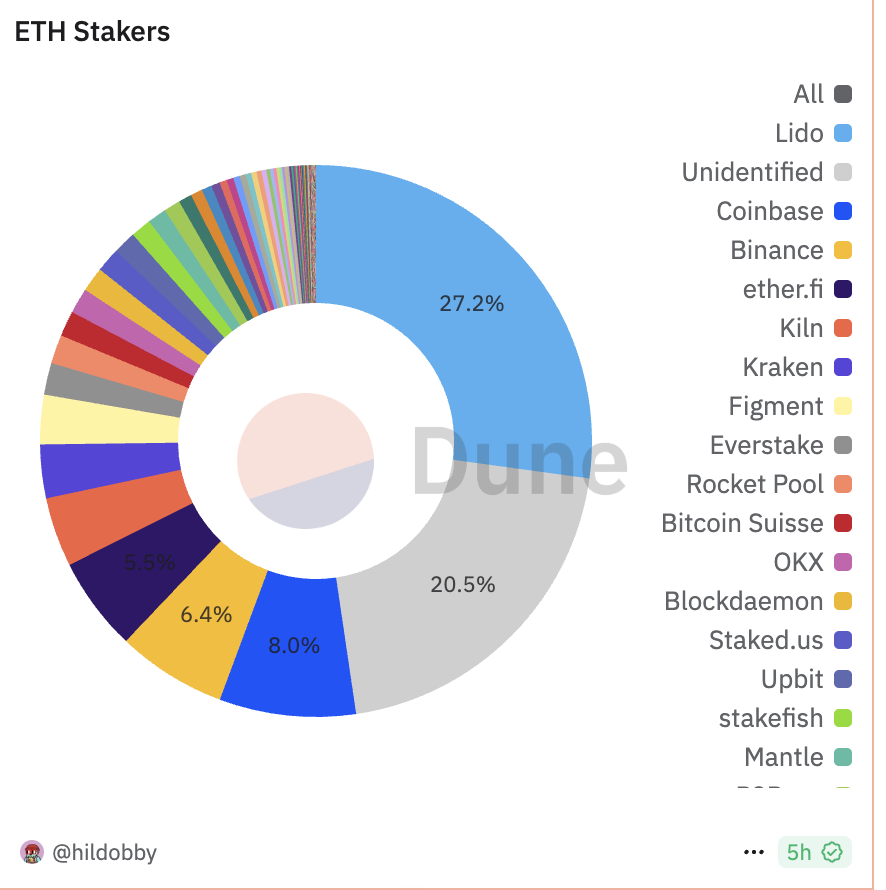

In the market's view, the introduction of the staking function in Ethereum ETF is considered to have multiple potential advantages. In terms of return on investment, the current annualized rate of return on Ethereum staking is about 3.12%. Compared with Bitcoin spot ETFs that rely only on price fluctuations, Ethereum ETFs can bring additional income to the ETH they hold through staking. This feature is particularly attractive to institutional investors and may reverse the current weak demand situation; in terms of price push, staking and locking ETH will reduce market circulation, ease selling pressure, and may push ETH prices up. Dune data shows that as of March 24, the total amount of Ethereum beacon chain staking exceeded 34.199 million ETH, and staking ETH accounted for 27.85% of the total supply. If ETFs join the staking ranks, this proportion will be further expanded; in terms of network security, ETF participation in staking will increase the number of validators on the Ethereum network, improve the degree of decentralization, and alleviate the community's concerns about the centralized risks of liquidity staking protocols such as Lido. Dune data shows that as of March 24, the liquidity staking protocol Lido alone accounted for 27.28% of Ethereum's staking share.

However, for the sake of ease of operation and regulatory compliance, the staking design of Ethereum spot ETFs may weaken their attractiveness to investment institutions. Taking the staking function application documents submitted by 21Shares as an example, the staking process is managed by the custodian Coinbase, which is responsible for the custody of ETH. It adopts the "point-and-click staking" model, that is, directly staking the ETH held by the ETF through a simplified interface without transferring the assets to a third-party protocol (such as Lido or Rocket Pool), thereby reducing the security risks in asset transfer. Not only that, all the income generated by the staking belongs to the ETF trust as the income of the issuer, rather than directly distributed to investors. According to Dune data, compared with centralized exchanges such as Coinbase and Binance, LSD tracks including Lido and ether.fi are still the mainstream choice for ETH staking. According to existing information, the issuers of Ethereum spot ETFs have not explicitly allowed the staking income to be shared directly with investors, but under the relaxation of US regulations and intensified market competition, the possibility of introducing this mechanism is not ruled out.

Not only that, Ethereum spot ETFs also face challenges in staking efficiency. Since the entry and exit mechanisms for Ethereum staking are strictly restricted (each epoch can only allow up to 8 nodes to enter and 16 nodes to exit, and an epoch is generated every 6.4 minutes), this also limits the flexibility of the ETF. Especially when the market fluctuates violently, investors’ inability to exit in time may exacerbate selling sentiment. For example, the current Ethereum spot ETF holds a total of approximately US$6.77 billion worth of ETH, which is approximately 3.28 million ETH based on the ETH price (approximately US$2,064). The staking entry time is approximately 57.69 days, and the exit time is 28.47 days. This queuing mechanism cannot meet the needs of investors, and liquidity staking platforms that bypass these mechanisms are also excluded from ETF staking.

However, the Pectra upgrade (EIP-7251) increases the upper limit of staking for a single verification node from 32 ETH to 2048 ETH, greatly improving staking efficiency. This not only reduces the queuing time for entering and exiting staking, but also reduces technical barriers. However, in the latest 153rd Ethereum Core Developer Consensus (ACDC) conference call, developers have decided to postpone the activation date of the Pectra mainnet, which may be delayed until after May.

From this point of view, compared with the opening time of the staking function, issues such as profit distribution and efficiency are the key factors affecting the demand for Ethereum spot ETFs.

On-chain activities continue to be sluggish, and ETF staking is difficult to solve the ecological dilemma

Even if the Ethereum spot ETF introduces the staking function, its impact on the circulating supply and market sentiment is limited, and it is difficult to fundamentally reverse the competitive pressure and growth bottleneck faced by the Ethereum ecosystem. Currently, the continued sluggish on-chain activities, the intensified L2 diversion effect, and the challenges from other high-performance public chains are all weakening Ethereum's market dominance.

From the perspective of the impact of ETF staking, as of now, the staking rate of Ethereum is about 27.78%, which is 2.84% of the total ETH held by the US Ethereum spot ETF. Even if all these ETFs participate in staking, the staking rate will only increase to about 30.62%, an increase of 2.84%. This slight change has little impact on the circulating supply of ETH and is still not enough to become a decisive force in driving prices up.

In comparison, the pledge rates of other PoS competing chains are much higher than Ethereum, such as Sui's pledge rate of 77.13%, Aptos's 75.83%, Solana's 64.39%, etc. Although Ethereum has room for pledge growth, the scale of funds and pledge potential of ETFs are unlikely to constitute the dominant purchasing power of the market, and the symbolic significance of the pledge function is greater than its actual effect.

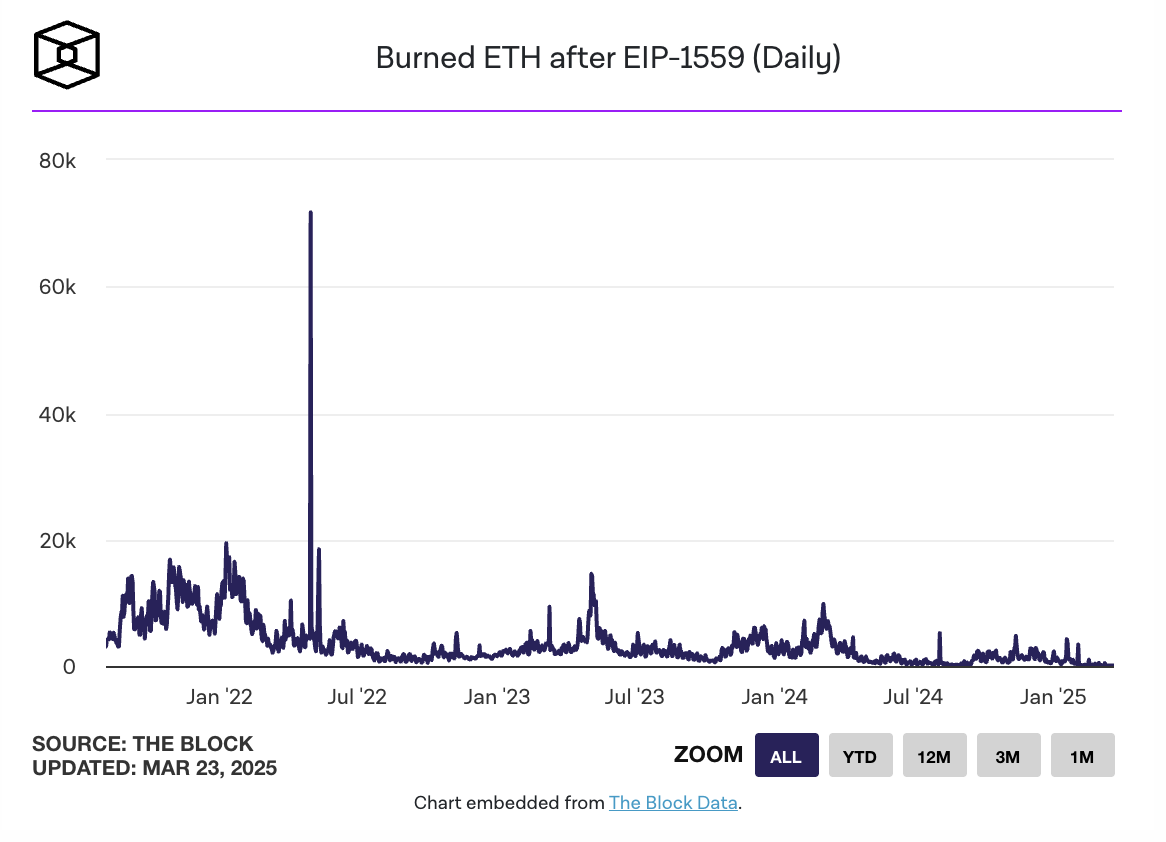

The continued decline in on-chain activity data further highlights the fatigue of the Ethereum ecosystem. According to data from The Block, as of March 22, the number of ETH destroyed by the Ethereum network due to transaction fees fell to 53.07, equivalent to about $106,000, a record low. Ultrasound.money data shows that based on the past 7 days, the annual supply growth rate of ETH is 0.76%. Not only that, the active addresses, transaction volume and number of transactions on the Ethereum chain have declined simultaneously in recent weeks, indicating that the vitality of the Ethereum ecosystem is declining.

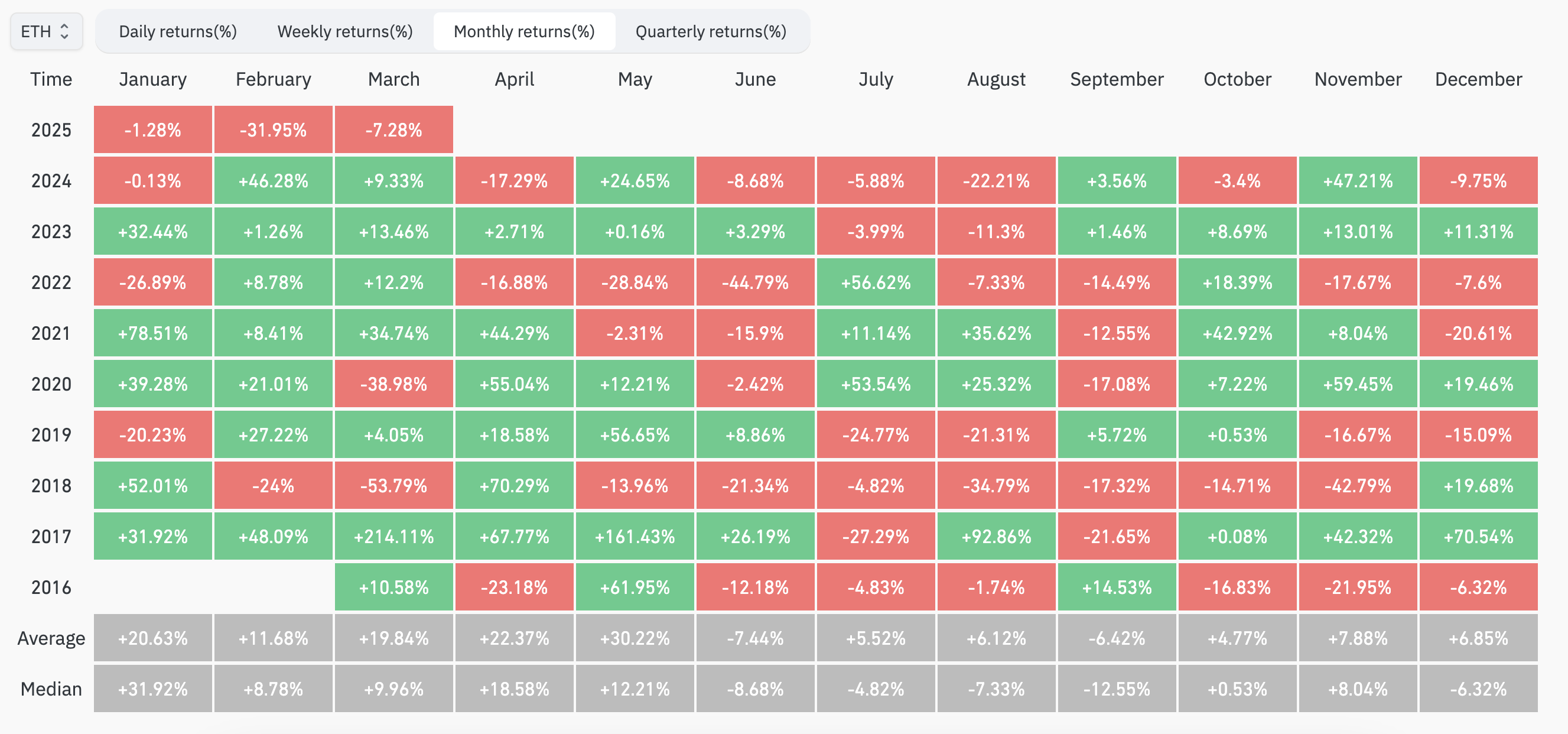

At the same time, Ethereum had its worst performance in history in Q1 this year. Coinglass data shows that Ethereum experienced the worst start in recent years in the first quarter of 2025, with negative returns for the first time in three consecutive months: January: -1.28% (historical average return: +20.63%, median: +31.92%); February: -31.95% (historical average return: +11.68%, median: +8.78%); March: -7.28% (historical average return: +19.55%, median: +9.96%).

The difficulties faced by Ethereum stem from multiple structural problems. For example, although L2 such as Arbitrum and Optimism have significantly reduced transaction costs through Rollup technology, they have also diverted the transaction volume of the main network. The proportion of these L2 transactions has exceeded that of the main network, resulting in a decrease in both the main network gas fee and the amount of ETH destroyed. More importantly, most of the transaction fees generated by L2 remain within its ecosystem (such as Optimism's OP token economy) rather than flowing back to ETH. For another example, Ethereum's market share is being eroded by other public chains such as Solana due to its lack of competitiveness in high-performance application scenarios.

Standard Chartered Bank also lowered its target price for ETH from $10,000 to $4,000 by the end of 2025 in its latest report, and made several key judgments: L2 expansion weakens ETH's market value: L2, which was originally used to improve Ethereum's scalability (such as Coinbase's Base, has caused a market value of $50 billion to evaporate); The ETH/BTC ratio is expected to continue to decline: It is expected to fall to 0.015 by the end of 2027, the lowest level since 2017; Future growth may rely on RWA: If RWA tokenization develops rapidly, ETH may still maintain its 80% security market share, but the Ethereum Foundation needs to adopt a more aggressive business strategy (such as imposing taxes on L2), which is less likely.

In general, although Ethereum ETF staking can affect ETH supply and holder returns to a certain extent, it cannot directly solve core challenges such as ecological competition, L2 diversion or low market sentiment. Ethereum still needs to seek a deeper breakthrough in technology and narrative.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models