Trading Moment: Markets Enter a Key Week Ending the Year, Bitcoin Holds Key Level at $86,000

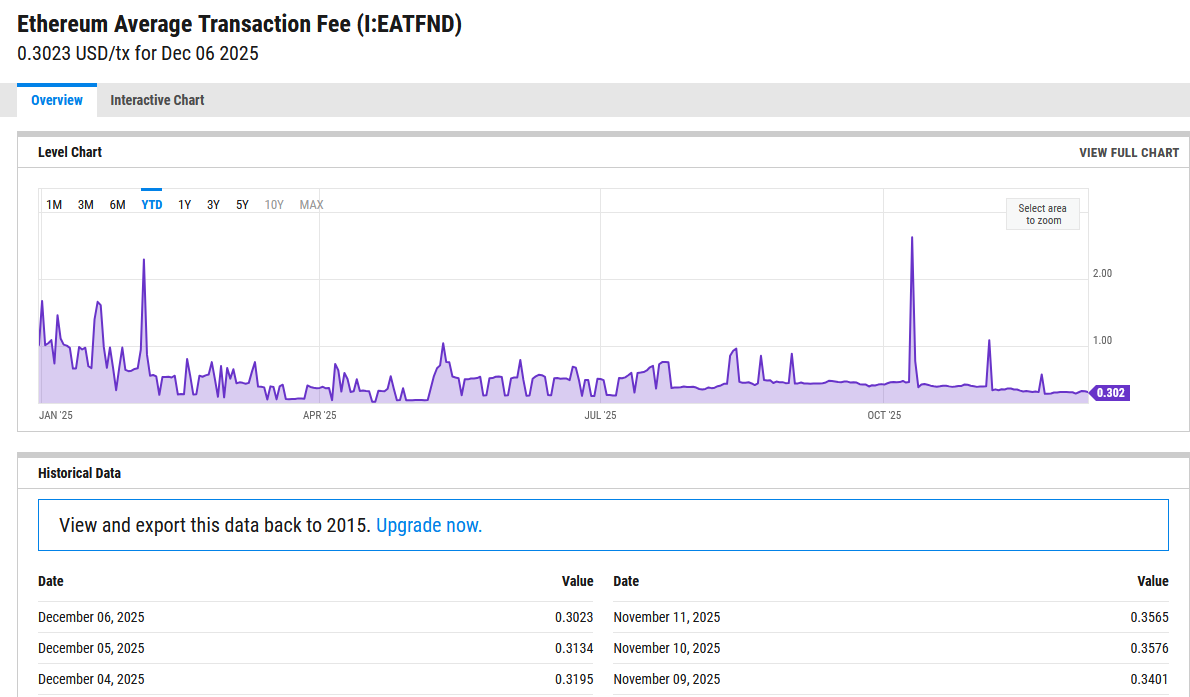

Daily market data review and trend analysis, produced by PANews. 1. Market Observation Markets are holding their breath for this week's Federal Reserve meeting, with a 25-basis-point rate cut widely expected. However, contrary to conventional wisdom, since the rate-cutting cycle began in September, the yield on long-term US Treasury bonds, the anchor for global asset pricing, has risen instead of falling, triggering intense debate about the future economic path. Optimists see this as a signal of a "soft landing," while pessimists worry it's a vote of no confidence from the "bond vigilantes" regarding the high national debt and inflation risks in the US. Against this backdrop, Wall Street veteran strategists like Mark Cabana of Bank of America predict that, in addition to rate cuts, the Fed may announce a major balance sheet expansion plan of up to $45 billion per month to address potential liquidity shortages. Meanwhile, China will also usher in a super week of policy announcements, with important meetings and the release of key economic data such as inflation and social financing providing new guidance for the market. Furthermore, competition in the field of artificial intelligence is becoming increasingly fierce, with OpenAI planning to release GPT-5.2 ahead of schedule to address this competition. The financial reports of Broadcom, a chip designer and Oracle, both core players in the AI industry chain, as well as the visit of Microsoft's CEO to India, will all serve as key indicators for assessing the investment climate in AI infrastructure and the future direction of the industry. In the Bitcoin market, short-term sentiment is cautious, but long-term indicators remain resilient. Analyst Murphy, based on the MVRV indicator, predicts that Bitcoin's price may reach $85,000 to $94,000 by December 31st, and then touch the $71,000 to $104,000 range in early 2026, considering $104,000 as a key bull-bear dividing line. Several analysts consider the $86,000 to $88,000 area as key support. For example, Daan Crypto Trades points out that a break below this key Fibonacci level could lead to a price pullback to a low of $76,000, while Michaël van de Poppe believes that holding $86,000 is a prerequisite for his bullish scenario (i.e., a price break above $92,000 and head towards $100,000). On-chain data presents a mixed picture: on the one hand, Glassnode points out that ETF demand continues to weaken, and market risk appetite is declining; on the other hand, analyst @TXMCtrades emphasizes the continued rise in the "activity" indicator, and CryptoQuant data also shows that selling pressure from long-term holders has been "completely reset," which may indicate potential spot demand and the formation of a market bottom. Bloomberg ETF expert Eric Balchunas, however, offers a more macro-level reassurance to the market, believing that Bitcoin's correction this year is merely a normal cooling down of last year's extreme 122% surge. Its resilience in reaching new highs after multiple significant pullbacks makes it no longer suitable for comparison to the "tulip bubble." Regarding Ethereum, short-term market sentiment leans towards pessimism, but long-term technical patterns are showing optimistic signals. According to Nansen data, "smart money" traders are still adding to their short positions in Ethereum on the derivatives platform Hyperliquid, with net short positions accumulating to over $21 million. However, analyst Sykodelic sees a positive side in the technical charts, pointing out that Ethereum's 5-day MACD and RSI indicators, after a thorough reset, are exhibiting patterns that have historically led to significant rallies, suggesting that a market bottom is forming. In the altcoin market, the AI project Bittensor (TAO) became the focus of attention. The project will undergo its first halving on December 14th, reducing the daily token issuance by half. Grayscale analyst Will Ogden Moore commented positively, believing it marks a significant milestone in the network's maturation. He pointed out that its strong adoption momentum, rising institutional interest, and the success of the dTAO mechanism could all be catalysts for price increases. TAO rose nearly 10% intraday. The weekend saw numerous market developments, with several events and figures attracting widespread attention. Terraform Labs co-founder Do Kwon's legal case saw new developments. US prosecutors recommended a 12-year prison sentence for his "massive" fraudulent activities, and US District Judge Paul Engelmayer will deliver sentencing on December 11th. This news initially caused USTC and LUNA tokens to surge by over 100% over the weekend before falling sharply, down nearly 20% in the past 24 hours. Additionally, Binance founder CZ's joke about executive He Yi's misspelling of "DOYR" in a tweet unexpectedly spawned a meme coin with the same name. Meanwhile, Binance responded directly to community concerns, stating that it is conducting an internal review of potential corruption related to token listings. Another noteworthy piece of news comes from the intersection of the tech and cryptocurrency worlds: Moore Threads, the "first domestically produced GPU stock," saw its share price surge after listing on the STAR Market. The controversial past of its co-founder, Li Feng, has also resurfaced, including his involvement in the "Mallego Coin" project with Li Xiaolai and others, and a long-standing debt dispute with OKX founder Star involving 1,500 bitcoins (currently worth approximately $135 million). In response, Star recently stated on social media that the debt issue has been handed over to legal action and that the focus should be on the future. 2. Key Data (as of 13:00 HKT, December 8) (Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap) Bitcoin: $91,596 (down 2.11% year-to-date), daily spot trading volume $40.49 billion. Ethereum: $3,134 (down 6.17% year-to-date), daily spot trading volume $25.27 billion. Fear of Greed Index: 20 (Extreme Fear) Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei Market share: BTC 58.7%, ETH 12.2% Upbit 24-hour trading volume rankings: XRP, ETH, BTC, MOODENG, SOL 24-hour BTC long/short ratio: 50.54% / 49.46% Sector Performance: Meme and DeFi sectors saw a slight pullback, while SocialFi and AI rose by over 2%. 24-hour liquidation data: A total of 112,699 people worldwide were liquidated, with a total liquidation amount of $416 million. This included $105 million in BTC liquidations, $169 million in ETH liquidations, and $21.92 million in SOL liquidations. 3. ETF Flows (as of December 5) Bitcoin ETFs saw a net outflow of $87.77 million last week, with ARKB experiencing the largest net outflow at $77.86 million. Ethereum ETFs saw net outflows of $65.59 million last week, with BlackRock's ETHA experiencing the largest net outflow at $55.87 million. Solana ETF: Net inflow of $20.3 million last week XRP ETF: Net inflows of $231 million last week, marking the fourth consecutive week of net inflows. 4. Today's Outlook HumidiFi: New token public sale will begin on December 8th at 23:00. The Stable mainnet will launch on December 8th at 21:00. The company formed by the merger of Twenty One Capital and CEP is expected to list on the NYSE on December 9. BounceBit (BB) will unlock approximately 29.93 million tokens at 8:00 AM Beijing time on December 9th, representing 3.42% of the circulating supply, worth approximately $2.7 million. The top 100 cryptocurrencies by market capitalization with the largest gains today are: Ultima up 7%, SPX6900 up 5.8%, Canton Network up 5.5%, Ethena up 5.1%, and Zcash up 4.5%. 5. Hot News Data: APT, LINEA, CHEEL and other tokens will see large-scale unlocking, with APT unlocking value estimated at approximately $19.3 million. This Week's Preview | The Federal Reserve FOMC announces its interest rate decision; the Stable blockchain mainnet will officially launch on December 8th. The largest short position in BTC on Hyperliquid currently has a floating profit of approximately $17 million, having reduced its position by about 20 BTC in 26 minutes. The BEAT team's linked wallet sent $1.2 million worth of tokens to a CEX, seemingly indicating a planned sell-off for profit. Twenty One Capital transferred 43,122 BTC to a new wallet. The U.S. SEC's Cryptocurrency Working Group will hold a roundtable meeting on financial regulation and privacy on December 15. Bittensor will undergo its first halving on December 14th, at which time the daily supply of TAO will decrease to 3600 tokens. ZKsync plans to abandon its early network, ZKsync Lite, in 2026. The long positions held by the "whale that opened short positions after the 1011 flash crash" have reached $164 million, and are currently showing a floating loss of $950,000. A wallet suspected to be Windemute has accumulated approximately $5.2 million worth of SYRUP tokens over the past two weeks. South Korea is considering legislation requiring virtual asset operators to bear "no-fault liability" for hacker attacks, with fines potentially increased to 3% of sales revenue. The average cash cost for public miners mining Bitcoin has reached $74,600, with a total cost of $137,800. Caixin: Last year, 3,032 people were prosecuted for money laundering related to cryptocurrencies; establishing a firewall against virtual currencies is necessary to protect normal economic and trade activities. Farcaster announces strategic shift: from a social-first approach to wallet-driven growth.