The crisis hidden in the chart: America’s growing “debt snowball”

By NOAH SMITH

Compiled by: Tim, PANews

I know you all have a lot of concerns about the Trump administration. Trump's tariffs are causing the stock market to plummet and consumer confidence to collapse. Trump has abandoned European allies to curry favor with Putin. Musk's Government Effectiveness Department is recklessly hacking into US government agencies in an attempt to eradicate leftist ideology. And Trump is dramatically expanding presidential power, trying to jail opponents and deport illegal immigrants.

Unfortunately, I have to give you one more thing to worry about, because it is really important. Trump and his Republican Party are planning to borrow a lot more at a time when the current national debt is becoming increasingly unsustainable.

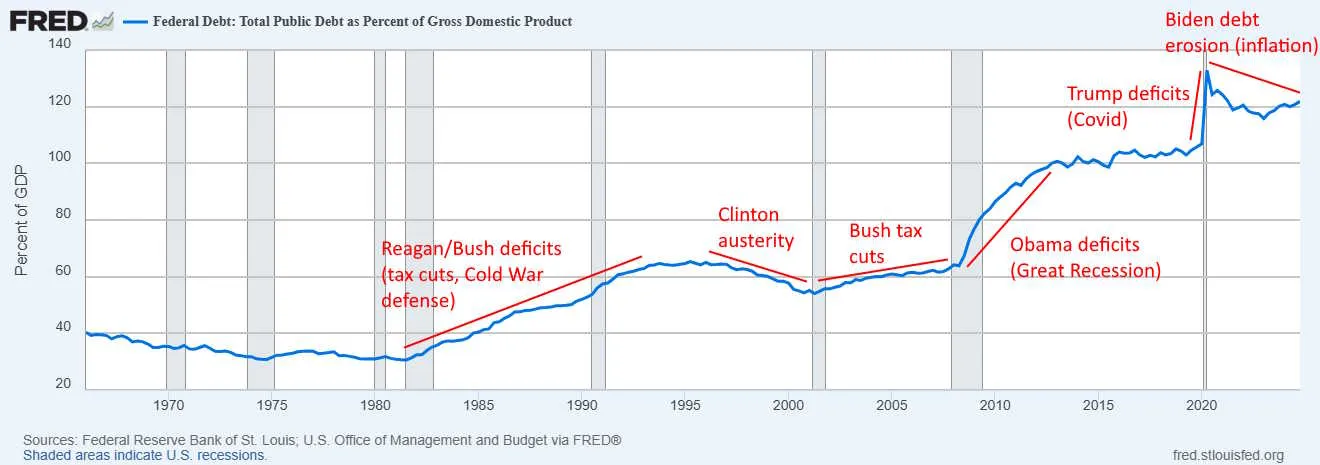

Before I explain why this crisis is so urgent, let me make an important note: Trump does not bear the bulk of the blame for the current debt problem. Democrats and Republicans bear almost equal responsibility for it. Here is a brief history of the rise in the U.S. federal government debt since 1980.

You can see that the growth of the U.S. national debt is mainly concentrated in three major jumps: the first occurred during the Reagan and Bush Sr. administrations in the 1980s and early 1990s, the second during the Obama administration in response to the Great Recession (subprime mortgage crisis), and the third during the COVID-19 pandemic during Trump's first administration. In general, there are two main reasons for the long-term rise in U.S. government debt:

- Major challenges the U.S. government has responded to with debt (Cold War, Great Recession, and COVID-19)

- Republican government cuts taxes but not spending

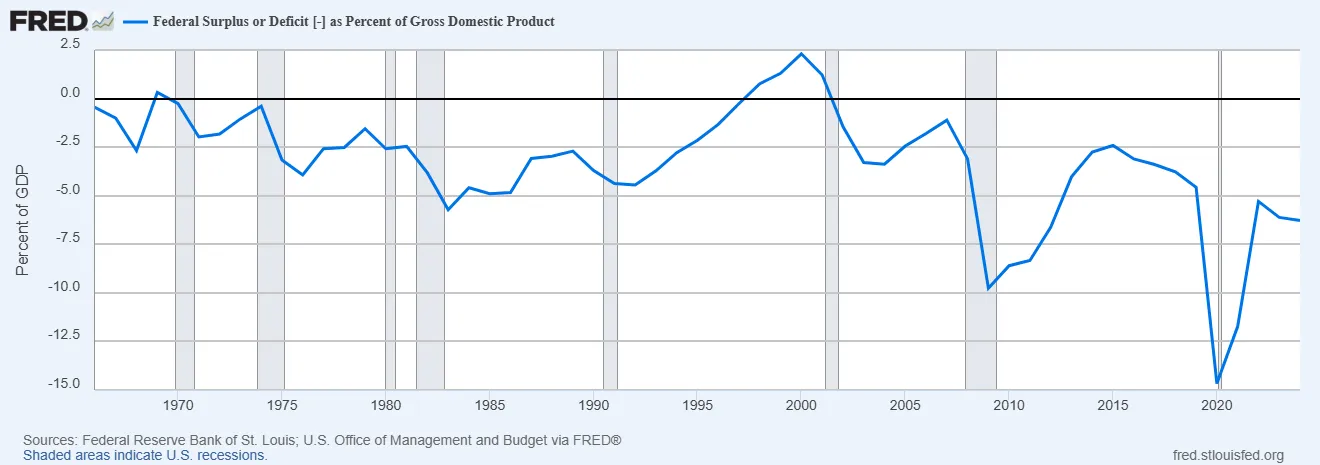

In the 1990s and early 2000s, the Democrats were the more fiscally responsible party, but that pattern has broken down under the Biden administration. The federal debt burden has fallen under Biden, but only because inflation has soared. Biden has spent massively: first on the pandemic relief program, then on student loan forgiveness and health care subsidies. Although the pandemic relief spending has ended, other spending continues, and Biden has not even tried to pay for it with tax increases. The result is that even as the U.S. economy recovers strongly and the threat of the coronavirus recedes, Biden is continuing to borrow at a rate unprecedented in non-pandemic or recessionary times:

This was obviously very unwise. In 2021-2022, I paid insufficient attention to the debt problem for three reasons: A) inflation was eroding the value of the debt B) I expected interest rates to fall C) I thought the government deficit would be under control after the pandemic relief spending ended. Most worryingly, the Democratic Party's core fiscal policy philosophy has undergone a major shift: they have gone from a party that advocates tax increases to a party that promotes unfunded spending plans. Later, I began to realize the seriousness of the problem and began to call for fiscal austerity in the government.

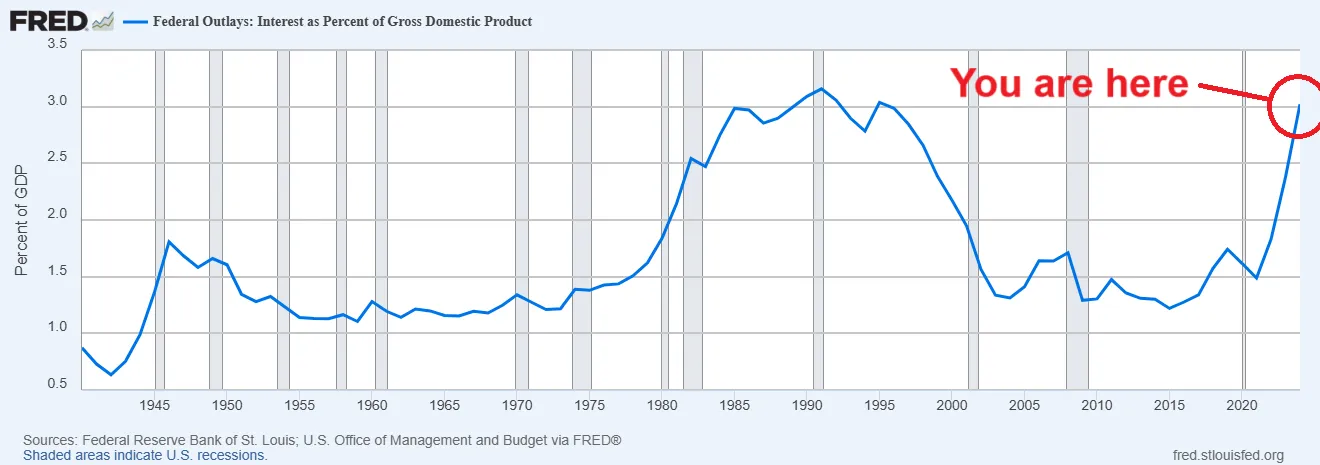

But as the chart at the top of this article shows, rising interest rates are the direct cause of today’s debt problems. As the government’s bond issuance continues to grow, it is forced to refinance that debt at higher rates, causing interest costs as a percentage of GDP to rise sharply. These interest payments are about to break the historical highs set in the early 1990s.

That’s bad enough. But the bigger problem is that the Republicans are preparing massive tax cuts that will make the problem worse—and Musk’s Department of Government Efficiency (DOGE) has done nothing to rein in spending. Democrats have become fiscally irresponsible, and, incredibly, Republicans have become even more profligate rather than implementing fiscal austerity to fix the problem. As a result, the U.S. economy is headed for trouble.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models