NFT sales plunge 15% to $64.9m, Solana sales jump 44%

According to CryptoSlam data, NFT sales volume has plunged by 15.72% to $64.95 million, down from last week’s $77.10 million.

- Bitcoin recovered to $90K and ETH held $3K, but NFTs continued to underperform.

- NFT sales plunged 16% to $64.95M as buyer and seller participation collapsed.

- NFT buyers fell 68% and sellers dropped 71%.

Market participation has crashed, with NFT buyers plummeting by 68.41% to 154,955 and sellers dropping by 71.48% to 115,051. NFT transactions fell by 13.25% to 940,713.

At the same time, Bitcoin’s (BTC) price has recovered to the $90,000 level following recent volatility. Ethereum (ETH) has maintained the $3,000 level, holding steady above this key threshold.

The global crypto market cap now stands at $3.07 trillion, up from last week’s $3.05 trillion. However, the NFT sector has experienced a sharp downturn with collapsing market participation.

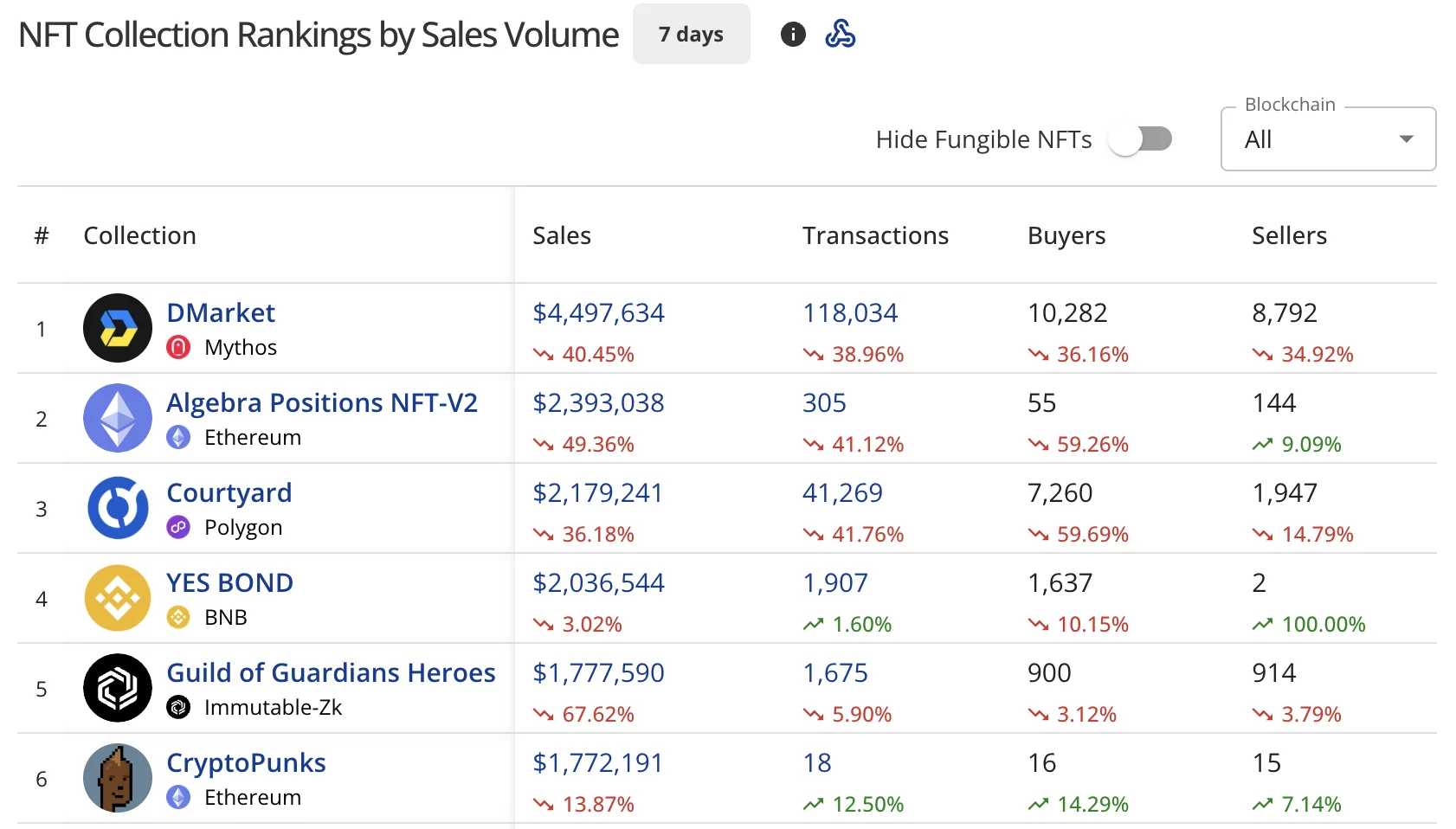

DMarket retains lead as major collections decline

DMarket on the Mythos blockchain maintained first place with $4.50 million in sales, down 40.45% from last week’s $6.73 million. The collection processed 118,034 transactions with 10,282 buyers and 8,792 sellers.

Algebra Positions NFT-V2 on Ethereum held second position at $2.39 million, plummeting 49.36% from last week’s $4.47 million. The collection saw 305 transactions with 55 buyers and 144 sellers.

Courtyard on Polygon secured third place with $2.18 million, down 36.18% from last week’s $3.42 million. The collection processed 41,269 transactions.

YES BOND on BNB posted the most resilience at fourth with $2.04 million, down just 3.02% from last week’s $2.09 million. The collection had 1,907 transactions.

Guild of Guardians Heroes on Immutable-Zk dropped to fifth at $1.78 million, collapsing 67.62% from last week’s $5.46 million. The collection recorded 1,675 transactions.

CryptoPunks placed sixth with $1.77 million, down 13.87% from last week’s $2.06 million. The Ethereum collection had 18 transactions with 16 buyers and 15 sellers.

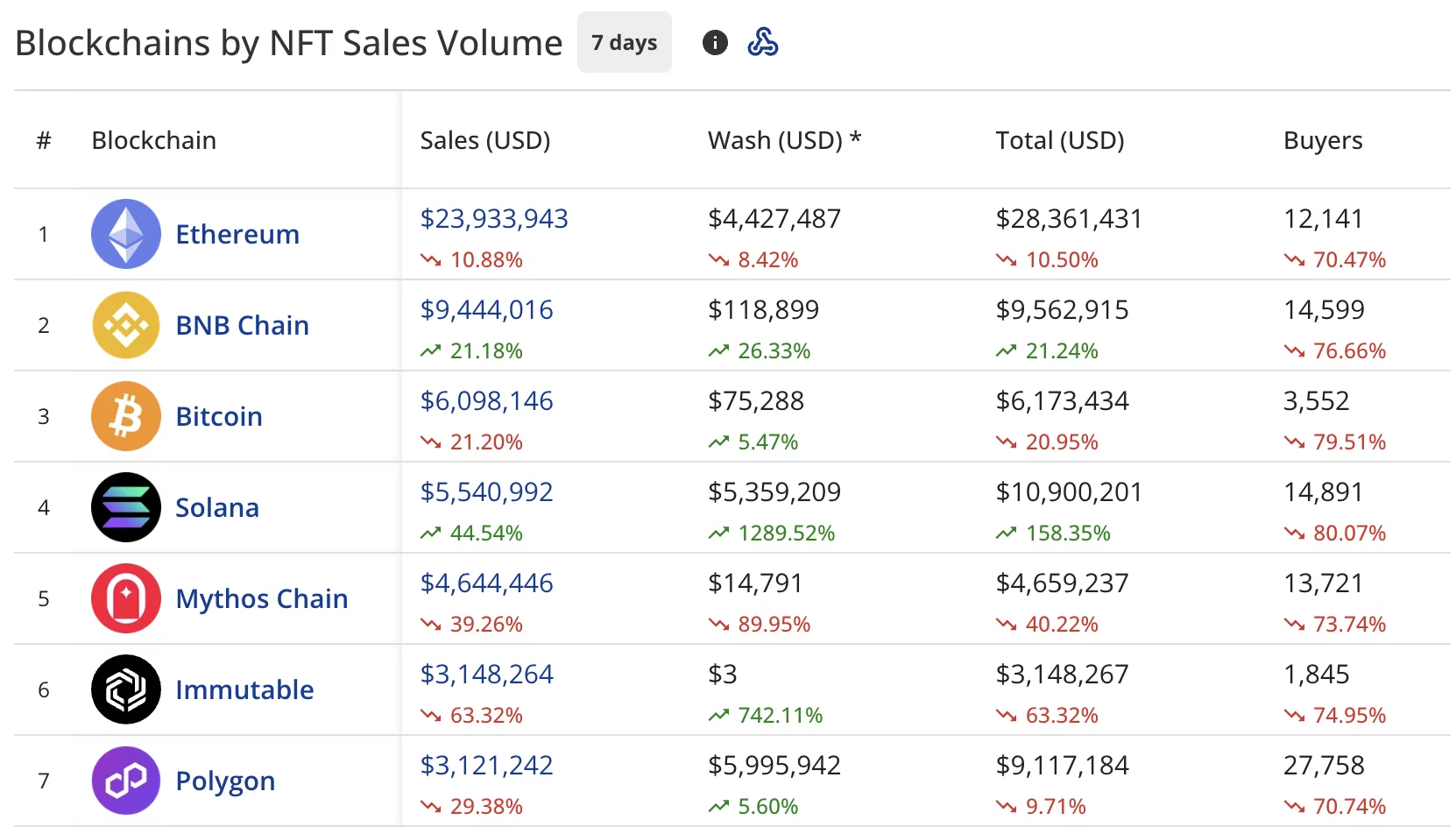

Solana surges as Ethereum and Immutable decline

Ethereum maintained first position with $23.93 million in sales, down 10.88% from last week’s $27.30 million.

The network recorded $4.43 million in wash trading, bringing its total to $28.36 million. Buyers collapsed by 70.47% to 12,141.

BNB Chain (BNB) climbed to second place with $9.44 million, up 21.18% from last week’s $7.73 million.

The blockchain recorded $118,899 in wash trading, with buyers dropping 76.66% to 14,599.

Bitcoin held third position at $6.10 million, down 21.20% from last week’s $7.19 million. The network saw 3,552 buyers, down 79.51%.

Solana (SOL) secured fourth place with $5.54 million, surging 44.54% from last week’s $4.03 million.

The blockchain recorded $5.36 million in wash trading, bringing its total to $10.90 million. Buyers fell 80.07% to 14,891 despite the sales increase.

Mythos Chain dropped to fifth at $4.64 million, down 39.26% from last week’s $6.88 million. The blockchain attracted 13,721 buyers, down 73.74%.

Immutable (IMX) tumbled to sixth with $3.15 million, plunging 63.32% from last week’s $8.51 million. The blockchain had 1,845 buyers, down 74.95%.

Polygon (POL) landed in seventh at $3.12 million, down 29.38% from last week’s $4.38 million. The blockchain recorded $5.99 million in wash trading, with buyers falling 70.74% to 27,758.

Bitcoin BRC-20 NFT maintains top position

The $X@AI BRC-20 NFT held the top individual sales spot at $809,337.16 (8.7195 BTC), sold nine days ago.

Four CryptoPunks rounded out the top five:

- CryptoPunks #6615 sold for $153,356.75 (47.99 ETH) nine days ago

- CryptoPunks #309 sold for $134,530.52 (42 ETH) nine days ago

- CryptoPunks #4566 sold for $123,808.45 (39.9 ETH) four days ago

- CryptoPunks #4172 sold for $111,232.08 (33 ETH) three days ago

You May Also Like

Historic Debut: U.S. Sees Launch of Spot ETFs for DOGE and XRP

Now You Don’t’ New On Streaming This Week, Report Says