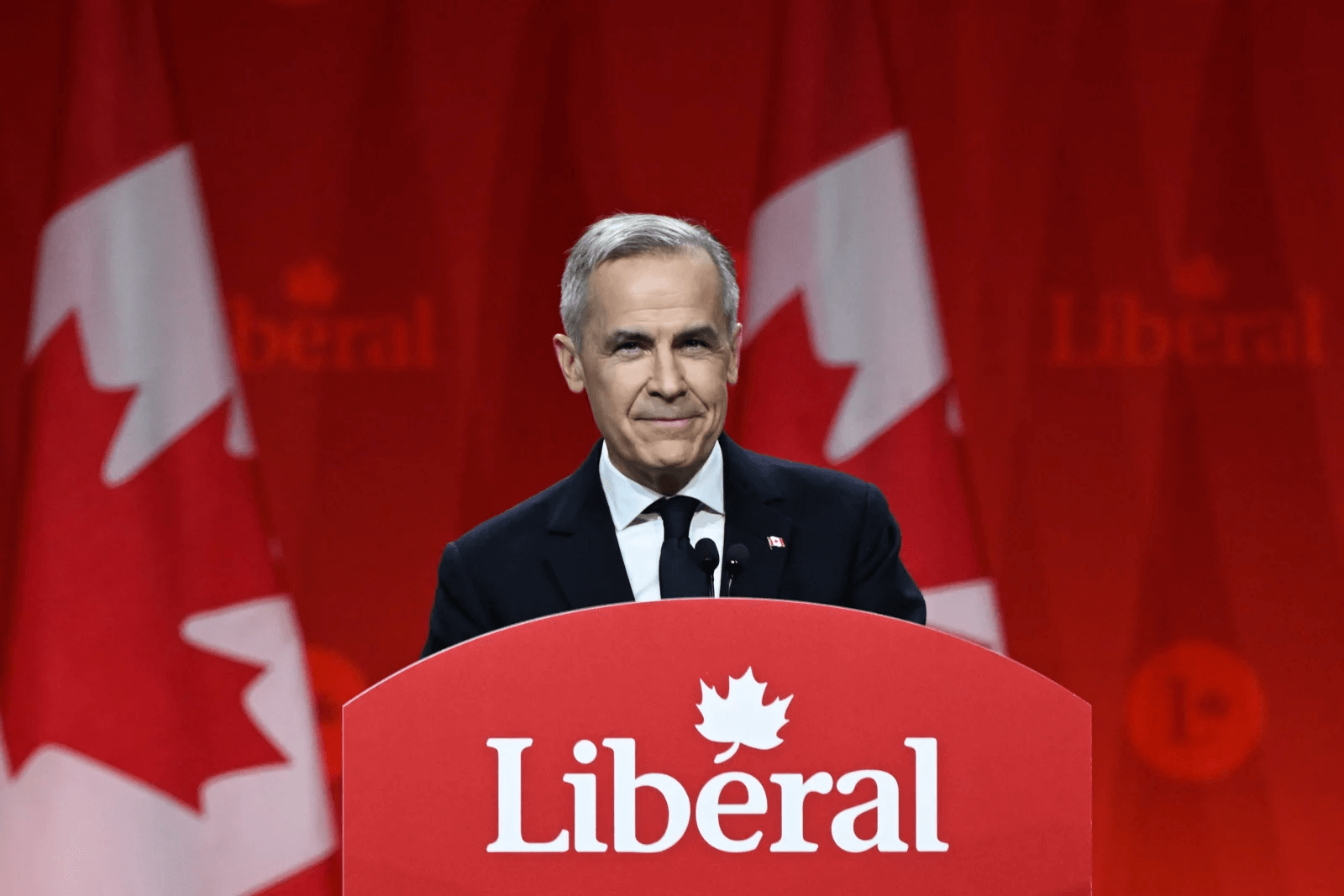

Economist Mark Carney officially takes office as Canada's Prime Minister. How will Bitcoin "critics" affect crypto policy?

Author: Zen, PANews

On the morning of March 14th local time, Mark Carney, who won the Liberal Party election with nearly 86% of the votes, will officially take office as Prime Minister of Canada.

As an economist who was originally a central bank governor, the 59-year-old Carney is also a political novice. He also became the first prime minister in Canadian history who has never served as a member of parliament.

Since the last Canadian Prime Minister Justin Trudeau announced his resignation, US President Donald Trump has begun to impose high tariffs on Canada and has repeatedly talked about making Canada the 51st state of the United States. Under normal circumstances, Carney, as a political outsider, would hardly qualify as a candidate, but his successful record as a central bank governor may make him the best choice to lead Canada in dealing with the tariff crisis initiated by Trump. Carney believes that he is the only one who is ready to deal with Trump.

"I know how to manage crises... In this situation, you need experience in crisis management, you need negotiation skills," Carney said during last month's leadership debate.

"Pragmatic Banker": Former Governors of the Bank of Canada and the Bank of England

Carney graduated from Harvard University in 1988 with a bachelor's degree in economics, and then continued his studies at Oxford University, where he obtained a master's and doctorate in economics. He began his career at Goldman Sachs, working in its London, Tokyo, New York and Toronto offices for 13 years. In the early 21st century, he returned to Canada and entered the public service. In 2003, he was appointed Deputy Governor of the Bank of Canada, responsible for overseeing the country's monetary policy, and the following year became Senior Deputy Minister of the Treasury.

Carney took over as governor of the Bank of Canada in February 2008, just as the global financial crisis was brewing. One month after taking office, Carney immediately cut Canada's interest rates. This move and other subsequent measures helped boost market confidence and enabled Canada to recover from the crisis faster than most countries. Carney also won widespread praise for his handling of the financial crisis that year, creating new emergency lending facilities and providing rare clear guidance to maintain record low interest rates for a specified period of time.

In 2013, Carney was recruited by then-Chancellor of the Exchequer George Osborne to become the first non-British governor of the Bank of England. Because of his similar appearance to Hollywood actor George Clooney, Carney was nicknamed the "rock star central bank governor" at the time. After arriving in London, Carney was determined to bring changes to this "old-fashioned" central bank with a history of more than 300 years. He launched plastic banknotes and introduced a new communication method called "forward guidance" to give investors a clearer understanding of the direction of interest rates.

Carney has also weighed in on the heated debate over Brexit, repeatedly warning of the risks it poses to the British economy, for which he has been accused of politicising an independent central bank. But he says it is his job to talk about those risks. Sterling fell sharply within hours of the 2016 Brexit referendum result. Carney made a televised speech to assure markets that the central bank would launch liquidity support measures if needed. In 2020, Carney left the Bank of England and subsequently became the UN Special Envoy for Finance and Climate Change, continuing his work in an area he highlighted during his time as governor: the need for financial markets to keep up with the risks posed by the climate crisis.

On January 16, 2025, Carney officially announced his candidacy for the leader of the Liberal Party. Despite his unusual path into politics, Carney told his supporters: "We are in a far from ordinary time." It is worth mentioning that Carney was born in Canada, and his grandparents immigrated to Canada from Ireland. He said that his Irish ancestry is an important part of his character. He obtained Irish citizenship in the 1980s and became a British citizen in 2018 while at the helm of the Bank of England. However, as a candidate for prime minister, he said he intends to give up his British and Irish citizenship.

Calls for strict regulation of crypto assets and supports CBDC

As a heavyweight in the economic field, Carney has been called the "Bitcoin Critics" for his negative comments on Bitcoin and cryptocurrencies. So far, Carney's observations and positions on crypto assets have been mainly concentrated in a speech he gave in 2018 titled "The Future of Money."

"The fixed supply of cryptocurrencies such as Bitcoin is not an advantage, but a serious flaw. Fundamentally, if these currencies are widely adopted, it will lead to deflationary pressure on the economy." Carney believes that rebuilding a global "virtual gold standard" would be an act of ignorance of monetary history.

Carney also said that cryptocurrencies perform poorly as a store of value in the short term. "Over the past five years, the daily standard deviation (i.e. volatility) of Bitcoin has been ten times that of the British pound. Imagine if you borrowed a £1,000 student loan with Bitcoin last December to pay for your living expenses in pounds for the next year, you would now be out of pocket by about £500. If you did that in September last year, you might have made £2,000 instead. It's simply a lottery game." In addition, he also pointed out that the most fundamental reason why people remain skeptical about the long-term value of cryptocurrencies is that it is still unclear whether they can become an effective medium of exchange.

“Regardless of the merits of cryptocurrencies as money, regulators should be careful not to stifle technological innovation that could enhance financial stability in the future and support more innovative, efficient, and reliable payment services with the potential for wider adoption.”

Carney believes that the widespread adoption of a segregation strategy could miss the significant opportunities presented by the development of underlying payment technologies. A better path is to regulate certain parts of the crypto-asset ecosystem to combat illegal activities, promote market integrity, and protect the safety and soundness of the financial system. "It is time to bring the crypto-asset ecosystem under the same standard framework as the rest of the financial system."

Carney acknowledged the impact of the core technology of cryptocurrencies. He believes that incorporating crypto assets into the regulatory framework may promote innovation and provide better services to the public. In fact, he pointed out that crypto assets point the way for the future of money in the following three aspects:

- Uncover how money and payments need to adapt to meet society’s changing needs — especially the need for decentralized peer-to-peer interactions;

- Improve the efficiency, reliability and flexibility of payments through the potential of its underlying technology;

- This has led to speculation about whether central banks should offer central bank digital currencies (CBDCs) to the public.

Carney is a staunch supporter of central bank digital currencies (CBDCs), and has pointed out that in the future world he envisions, CBDCs will be at the core of the economy. He believes that CBDCs provide greater security and a better user experience than cryptocurrencies and stablecoins, which is similar to his predecessor Trudeau. Trudeau has been critical of cryptocurrencies and is inclined to promote a Canadian dollar CBDC.

Canada has always been open to cryptocurrencies, treating them as commodities and requiring platforms operating in Canada to register and comply with securities laws, but has not been supportive of them. Carney's "critical attitude" towards Bitcoin also indicates that he will not follow the United States in promoting strategic reserves of crypto assets.

From an ideological point of view, Carney's promotion of CBDC may just be a desire to improve the economic situation of his beloved country, but the leader of the opposition conservative party, Pierre Poilievre, is strongly opposed to this.

It should be noted that Carney may not be able to serve as prime minister for long. According to polls, the opposition Conservative Party currently maintains a slight lead in the general election to be held before October 20 this year. However, Carney and the Liberal Party are also rising rapidly due to the rising anti-Trump sentiment and people's disbelief that the populist Poliev will stand up against Trump.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models