Jupiter (JUP) Price Prediction 2026, 2027-2030

- UP price prediction for 2026 is $0.3012 to $0.4844.

- Jupiter (JUP) price might reach $3 soon.

- JUP price prediction for 2026 is $0.1083.

Jupiter (JUP) price prediction 2026, 2026-2030, we will analyze the price patterns of JUP by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

|

TABLE OF CONTENTS

|

|

INTRODUCTION

|

|

|

JUPITER (JUP) PRICE PREDICTION 2026

|

|

| JUPITER (JUP) PRICE PREDICTION 2027, 2028-2030 |

| CONCLUSION |

| FAQ |

Jupiter (JUP) Current Market Status

| Current Price | $0.2235 |

| 24 – Hour Price Change | 2.17% Up |

| 24 – Hour Trading Volume | $22.39M |

| Market Cap | $713.09M |

| Circulating Supply | 3.19B JUP |

| All – Time High | $2.04 (On Jan 31, 2024) |

| All – Time Low | $0.13 (On Oct 11, 2025) |

What is Jupiter (JUP)

| TICKER | JUP |

| BLOCKCHAIN | Solana |

| CATEGORY | DEX Exchange |

| LAUNCHED ON | January 31, 2024 |

| UTILITIES | Governance, Community Engagement, & Rewards. |

Jupiter serves as Solana’s primary liquidity aggregator, facilitating seamless token trading and optimal route discovery across various DEX markets and AMM pools. Its native cryptocurrency, JUP, launched on January 31, 2024, gained significant investor interest with a 1 billion airdrop.

Jupiter directly connects all DEX markets and AMM pools regardless of the provider, enabling efficient route discovery between any two tokens on Solana. Recognized as one of the industry’s most advanced swap aggregation engines, Jupiter plays a pivotal role in providing essential liquidity infrastructure for the Solana ecosystem. Additionally, Jupiter actively expands its DeFi product suite, offering a comprehensive range of services, including Limit Order, DCA/TWAP, Bridge Comparator, and Perpetuals Trading.

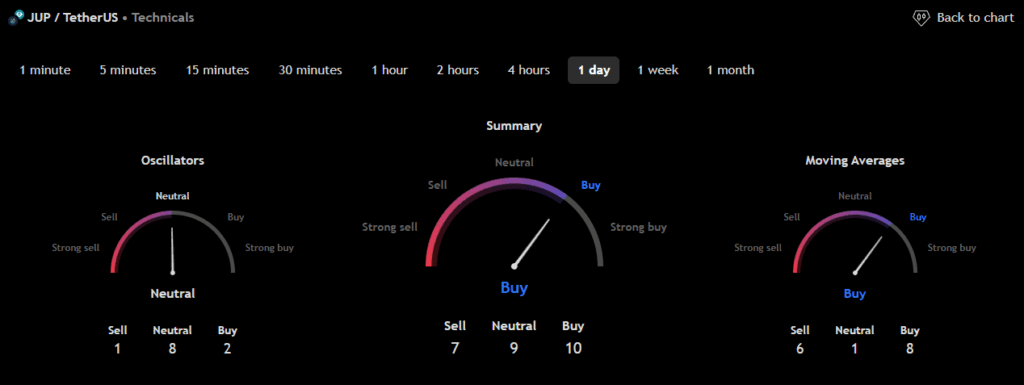

Jupiter (JUP) 24H Technicals

(Source: TradingView)

(Source: TradingView)

Jupiter (JUP) Price Prediction 2026

Jupiter (JUP) ranks 78th on CoinMarketCap in terms of its market capitalization. The overview of the JUP price prediction for 2026 is explained below with a daily time frame.

In the above chart, Jupiter (JUP) laid out an Horizontal channel pattern. The Horizontal channel pattern is also known as the sideways trend. In general, the horizontal channel is formed during the price consolidation. In this pattern, the upper trendline, the line that connects the highs, and the lower trendline, the line that connects the lows, run horizontally parallel, and the price action is contained within it.

A horizontal channel is often regarded as one of the suitable patterns for timing the market, as the buying and selling points are in consolidation.

At the time of analysis, the price of Jupiter (JUP) was recorded at $0.2235. If the pattern trend continues, then the price of JUP might reach the resistance levels of $0.2008 and $0.2207. If the trend reverses, then the price of JUP may fall to the support of $0.1917 and $0.1826.

Jupiter (JUP) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Jupiter (JUP) in 2026.

From the above chart, we can analyze and identify the following as resistance and support levels of Jupiter (JUP) for 2026.

| Resistance Level 1 | $0.3012 |

| Resistance Level 2 | $0.4844 |

| Support Level 1 | $0.1857 |

| Support Level 2 | $0.1083 |

JUP Resistance & Support Levels

Jupiter (JUP) Price Prediction 2026 — RVOL, MA, and RSI

The technical analysis indicators, such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Jupiter (JUP), are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Jupiter (JUP) market in 2026.

| INDICATOR | PURPOSE | READING | INFERENCE |

| 50-Day Moving Average (50MA) | Nature of the current trend by comparing the average price over 50 days | 50 MA = $0.2803 Price = $0.1913 (50MA > Price) | Bearish/Downtrend |

| Relative Strength Index (RSI) | Magnitude of price change;Analyzing oversold & overbought conditions | 29.8903 <30 = Oversold 50-70 = Neutral >70 = Overbought | Oversold |

| Relative Volume (RVOL) | Asset’s trading volume in relation to its recent average volumes | Below cutoff line | Weak volume |

Jupiter (JUP) Price Prediction 2026 — ADX, RVI

In the below chart, we analyze the strength and volatility of Jupiter (JUP) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Jupiter (JUP).

| INDICATOR | PURPOSE | READING | INFERENCE |

| Average Directional Index (ADX) | Strength of the trend momentum | 39.0772 | Strong Trend |

| Relative Volatility Index (RVI) | Volatility over a specific period | 33.22 <50 = Low >50 = High | Low volatility |

Comparison of JUP with BTC, ETH

Let us now compare the price movements of Jupiter (JUP) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, the price action of JUP is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of JUP also increases or decreases respectively.

Jupiter (JUP) Price Prediction 2027, 2028 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Jupiter (JUP) in 2027, 2028, 2029, and 2030.

| Year | Bullish Price | Bearish Price |

| Jupiter (JUP) Price Prediction 2027 | $3.5 | $0.09 |

| Jupiter (JUP) Price Prediction 2028 | $4 | $0.08 |

| Jupiter (JUP) Price Prediction 2029 | $4.5 | $0.07 |

| Jupiter (JUP) Price Prediction 2030 | $5 | $0.06 |

Conclusion

If Jupiter (JUP) establishes itself as a good investment in 2026, this year will be favorable to the cryptocurrency. In conclusion, the bullish Jupiter (JUP) price prediction for 2026 is $0.4844. Comparatively, if an unfavorable sentiment is triggered, the bearish Jupiter (JUP) price prediction for 2026 is $0.1083.

If the market momentum and investors’ sentiment elevate positively, Jupiter (JUP) might hit $3. Furthermore, with future upgrades and advancements in the JUP ecosystem, JUP might surpass its current all-time high (ATH) of $2.04 and mark its new ATH.

FAQ

1. What is Jupiter (JUP)?

Jupiter is a liquidity aggregator for the Solana blockchain, facilitating seamless token trading and route discovery across decentralized exchange (DEX) markets and automated market maker (AMM) pools.

2. Where can you buy Jupiter (JUP)?

Traders can trade Jupiter (JUP) in the following cryptocurrency exchanges such as Binance, OKX, Bybit, Bitget, and LBank

3. Will Jupiter (JUP) record a new ATH soon?

With the ongoing developments and upgrades within the Jupiter platform, Jupiter (JUP) has a high possibility of reaching its ATH soon.

4. What is the current all-time high (ATH) of Jupiter (JUP)?

Jupiter (JUP) hit its current all-time high (ATH) of $2.04 on January 31, 2024.

5. What is the lowest price of Jupiter (JUP)?

According to CoinMarketCap, JUP hit its all-time low (ATL) of $0.13 on October 11, 2025.

6. Will Jupiter (JUP) hit $3?

If Jupiter (JUP) becomes one of the active cryptocurrencies that majorly maintain a bullish trend, it might rally to hit $3 soon.

7. What will be the Jupiter (JUP) price by 2027?

Jupiter (JUP) price might reach $3.5 by 2027.

8. What will be the Jupiter (JUP) price by 2028?

Jupiter (JUP) price might reach $4 by 2028.

9. What will be the Jupiter (JUP) price by 2029?

Jupiter (JUP) price might reach $4.5 by 2029.

10. What will be the Jupiter (JUP) price by 2030?

Jupiter (JUP) price might reach $5 by 2030.

Top Crypto Predictions

XDC Network (XDC) Price Prediction

Pi (PI) Price Prediction

Uniswap (UNI) Price Prediction

Disclaimer: The opinion expressed in this article is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.

You May Also Like

RWAs Are Defining the Next Phase of Crypto Adoption—Chainlink Co-founder

Silver Price Forecast: XAG/USD Dips to $82.50 Amid Critical Profit-Taking, US Retail Sales Data Looms Large