CS2 accessories are rising against the market trend: When the "Dragon Sniper" is put on the chain, can the NFT market usher in summer again?

Original: msfew

Compiled by: Yuliya, PANews

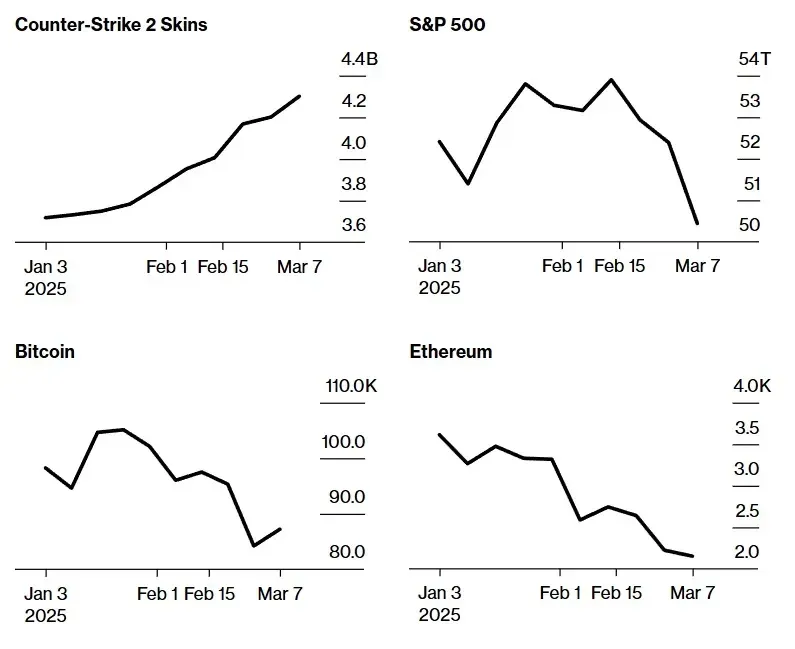

Recently, the price of CS2 accessories has risen sharply, while the US stock market and cryptocurrency market have fallen. In contrast, the game not only brings fun but also creates profit margins, while cryptocurrency trading is physically and mentally exhausting and prone to losses.

This article will explore the characteristics of the CS2 accessories market from the perspective of a senior CS2 player, and analyze its potential integration opportunities with blockchain technology. As a mature digital asset market that has existed for many years, the CS2 accessories trading system may provide a useful reference for the blockchain industry.

CS2 Accessories

CS2 accessories have many similarities to NFTs. Each weapon model has a different skin style, and is categorized by wear (similar to NFT rarity) and specific random patterns (for example, a full blue "case hardened" AK-47 can be worth hundreds of thousands of dollars).

Accessories are mainly divided into the following categories:

- Weapon Skins : The most common, prices vary by weapon model and style.

- Knife Skin : A rare drop, there is a large visual difference between the default knife and the skin knife, the price is higher, and it is considered a "blue chip" asset.

- Glove skin : rarer and more expensive than knife skin, a high-end collector's item with poor liquidity.

- Stickers : Highly speculative, some limited edition stickers (such as Titan Holo) can cost up to $60,000.

The main uses of these accessories include:

- Cosmetic Decoration : Players can obtain cosmetic items through randomly dropped boxes (keys can be unlocked at an additional cost), and most players will quickly equip commonly used weapons with skins to avoid using the default appearance.

- Investment value : Due to scarcity (such as knife skins), prices rise with demand. The market liquidity is low and is easily manipulated (such as the "pump and dump" of unpopular stickers). Compared with the cryptocurrency market, CS2 players generally lack investment experience and are more likely to become targets of harvesting.

- Medium of exchange : Prizes or collateral used in gambling platforms.

Trading Model

CS2 jewelry trading is similar to NFT, using an order book mechanism. Common trading strategies include hoarding, building momentum, raising prices, and shipping. The price chart is even similar to the candlestick chart on TradingView. The market relies on the continuous inflow of new players and new funds, and is essentially a Ponzi cycle with games as the theme.

The main market participants include:

- Players : Purchase accessories for in-game use.

- Investors : Speculate based on market fluctuations.

- Trading platform : Provides trading services (Steam official market restricts withdrawals, resulting in insufficient liquidity).

- Streamers/professional players : Promote specific accessories as a KOL, for example, professional player donk buys stickers of his opponent during a game to create market hotspots.

The possibility of CS2 accessories + blockchain

1) CS2 Jewelry AMM (Automated Market Maker)

Interestingly, the original inspiration for AMM came from Minecraft HyperConomy in 2012. Currently, CS2 jewelry trading adopts an order book model, which is similar to the NFT market, and has obvious liquidity problems. Many jewelry orders are left unsold for several days, and eventually can only be sold below the market price, forming a price spiral.

To improve the trading experience, the AMM (Automated Market Maker) mechanism can be introduced:

- Pure off-chain model : It is necessary to develop similar aggregator protocols to integrate buy and sell orders from multiple platforms to improve transaction efficiency, or to establish independent fund pools by market makers (similar to Sudoswap). However, this method relies on centralized market makers, and the user experience is still limited.

- On-chain mapping mode : We can learn from the tokenized RWA approach, map the accessories to the chain, provide price data through the oracle, and then build a liquidity pool. However, this method only optimizes the trading experience and cannot really promote the actual circulation of accessories.

2) Short selling and leverage trading

If CS2 accessories can be shorted and support leveraged trading, the market may see more aggressive price fluctuations, and some low-value accessories can return to reasonable pricing.

The CS2 accessories market already has similar mechanisms, such as the accessories rental model, where some players rent accessories for 100 days for short selling. In addition, Steam's 7-day trading cooldown period is essentially equivalent to the 7-day expiration time of European options. Therefore, a derivative trading system can be designed based on the traditional short selling mechanism.

The key challenge lies in the liquidation mechanism. Currently, if the market rises, some users who borrowed accessories may directly "run away", causing the platform to bear losses. We can learn from the perpetual contract of cryptocurrency and design perpetual contracts for accessories based on market prices. For example, based on the price of "AWP Dragon Lore", leveraged long and short transactions are opened, and the platform calculates the funding rate at certain intervals to ensure market stability.

3) CS2 Jewelry Index Fund

CS2 The jewelry market naturally has the conditions for building an index fund. For example, the index can be divided according to the jewelry category.

The design of traditional index funds is self-explanatory. On the blockchain, DAO governance funds can be introduced to allow users to pledge high-value accessories in exchange for fund shares and realize fragmented transactions of accessories. This mechanism can improve market liquidity and provide new investment opportunities.

4) Infrastructure construction

VC-friendly but lower-paying opportunities:

- Data analysis : Similar to gmgn.ai, it integrates market transaction data, provides real-time quotes, historical trends, market depth and other information, and supports the "one-click buy/sell" function to simplify the transaction process (avoid frequent logins to Steam to confirm transactions).

- Market intelligence : Track jewelry holdings, analyze KOL and professional player trading behaviors, and assist in investment decisions.

- Custody and security : Establish a professional CS2 jewelry custody platform, and use multi-signature and cold storage (cold Steam account) to ensure the security of user assets.

Other directions include API services, insurance platforms, security tools, transaction front-running (MEV) mechanisms, social/community platforms, etc. However, the root cause of the current low transaction efficiency lies in the limitations of Steam. Even if on-chain can optimize the experience to a certain extent, it cannot fundamentally change the liquidity problem of the Steam ecosystem.

Other key points (from DeepSeek)

- Centralization risk : Although CS2 accessories are similar to NFTs, their ownership belongs to Steam, and there is a risk of platform ban or rule changes (Steam officials resist NFTs to maintain their own closed-loop economic system).

- Regulatory arbitrage : Some Chinese players circumvent foreign exchange controls through jewelry trading. This is theoretically feasible, but the actual losses are too high. Unless there is a clear need for fund laundering, this path is unattractive.

- Liquidity stratification : High-end accessories (such as dragon snipers and gemstone knives) are mainly traded in the OTC market, and the pricing mechanism is similar to the cryptocurrency OTC market. The player groups of these top accessories are highly concentrated, similar to the holder ecology of blue-chip NFTs such as CryptoPunks.

- Economics of wear and tear : There is a "pseudo-metaphysical" premium phenomenon in the wear and tear range of 0.15-0.18, and the additional premium is caused by scarcity.

Position management is crucial

The combination of CS2 accessories + blockchain may be the only area where players can proudly say: "I not only defeated my opponent in the game, but also successfully shorted the market and made a profit!" This delicate balance between gaming and investment is the unique charm of the CS2 accessories market.

However, whether it is gaming or investing, managing your “position” is crucial. After all, even if you have the coolest skin, you may still have to be frugal when buying armor during the Eco Round due to a tight budget. The real victory is not only the profit on paper, but also the sense of accomplishment and happiness gained in the game.

I hope every player can be invincible in the arena and win the market. Now, it is time to put down the analysis and return to the battlefield.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models