Bitcoin Price Prediction: BTC Faces $76K Risk as Bears Prevail

TLDR

- Bitcoin price faced a strong rejection at $93K–$94K, confirming the zone as major bearish resistance.

- A breakdown below trend support shifts market structure firmly in favor of sellers.

- Analysts warn that failure to hold support could send BTC toward the $76K level.

- Despite short-term weakness, U.S. banks continue building Bitcoin infrastructure quietly.

Bitcoin price has come under renewed pressure after a sharp rejection from the $93,000–$94,000 region, with BTC now trading near the $85,000 area. Recent market behaviour reflects a clear shift toward a bearish short-term trend following a breakdown in structure.

The $93K–$94K zone remains the most significant resistance level in play, while traders closely watch whether the current support can hold or if further downside expansion is likely.

Bitcoin Price Rejected at $93K

According to Crypto Patel, Bitcoin price action has firmly validated the $93,000–$94,000 region as a dominant bearish order block. The chart shows a sharp rejection from this zone, where selling pressure quickly overwhelmed a brief recovery attempt. This behavior confirms that supply remains concentrated at higher levels, preventing BTC from sustaining upside momentum.

Following the rejection, Bitcoin price broke below a previously rising trendline and fell back toward the $85,000 zone. The loss of this structural support signals a shift from bullish continuation to bearish control. As long as BTC trades below the $93K resistance band, rallies are viewed as corrective, with sellers maintaining the upper hand.

Downside Targets Point to $76K

Crypto Patel’s analysis highlights $76,000 as the next key downside level if current weakness persists. This zone aligns with prior demand and represents a critical test for buyers attempting to slow further declines. Failure to stabilize there could expose Bitcoin price to an extended move toward the $70,000 region.

Additional technical factors reinforce this bearish outlook. Multiple fair value gaps remain above the current price, suggesting limited bullish follow-through in the short term. Until Bitcoin price reclaims the broken structure with strong confirmation, downside risks remain elevated, and broader market sentiment is likely to stay cautious.

U.S. Banks Quietly Expand Bitcoin Infrastructure

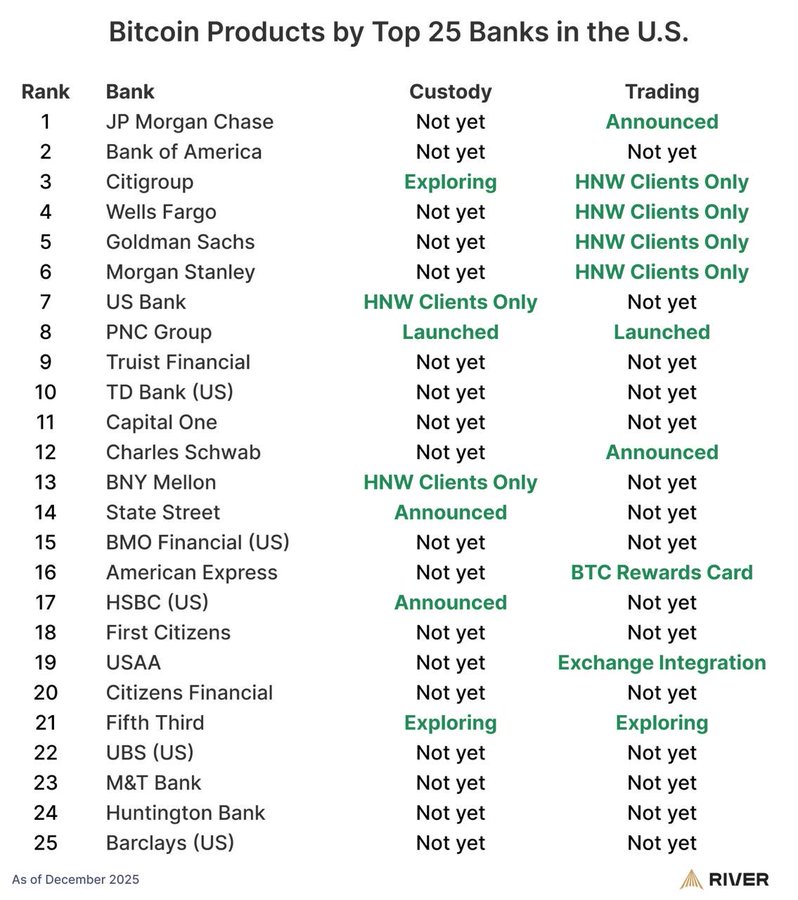

Meanwhile, according to LondonCryptoClub’s interpretation of River data, institutional adoption continues to progress beneath the surface. Fourteen of the top 25 U.S. banks are now building, exploring, or announcing Bitcoin-related products. This trend indicates that Bitcoin is steadily becoming an integral part of mainstream financial infrastructure, despite near-term price weakness.

Most banks are taking a phased approach, initially offering custody or trading access to high-net-worth clients. Institutions such as Citi, Goldman Sachs, and Morgan Stanley are limiting exposure to select segments, reflecting regulatory caution rather than lack of demand. From a longer-term perspective, this measured expansion provides structural support for Bitcoin’s future role in traditional finance.

Market Bets Reflect Caution on Bitcoin Price

Additionally, Polymarket data shows traders assigning a 15% probability that Bitcoin price could reach $80,000 before year-end. This forecast underscores prevailing uncertainty as volatility, liquidity conditions, and macroeconomic factors weigh on risk assets. The pricing suggests that a move lower is considered a realistic scenario rather than an extreme outcome.

-

- Source: Polymarket

While longer-term fundamentals remain constructive, short-term sentiment remains mixed. Traders appear focused on downside protection as technical resistance caps upside attempts. Until Bitcoin price regains key resistance levels, market positioning suggests caution will continue to dominate near-term expectations.

Bitcoin price now sits at a crossroads, with technical pressure pointing lower while institutional groundwork continues to build quietly in the background.

The post Bitcoin Price Prediction: BTC Faces $76K Risk as Bears Prevail appeared first on CoinCentral.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

‘Love Island Games’ Season 2 Release Schedule—When Do New Episodes Come Out?