Ethereum Price Prediction December 2025: Best Crypto to Buy Now?

Ethereum price continues to face downside pressure as a short-lived bounce quickly faded, pushing ETH back below the $3,000 level where consolidation now dominates. Buyer demand remains weak, but a breakout above the $3,025 resistance could spark a renewed Ethereum price recovery.

This article examines the current market backdrop, highlights the most important technical levels, and outlines the most likely price scenarios ahead.

The goal is to provide a clear and practical framework that helps identify high-value decision zones and prepares traders for increased volatility in the days ahead.

While major assets like Ethereum search for a floor, many investors are shifting attention to high-utility projects that blend strong narratives with technical innovation.

Bitcoin Hyper (HYPER) stands out as a new ERC-20 token and is gaining recognition as the best crypto to buy now among traders aiming to tap into the Bitcoin scaling narrative.

Source – Cilinix Crypto YouTube Channel

Ethereum Under Pressure as ETF Outflows Surge

The broader financial markets currently present a mixed picture. Equity indices remain resilient and have even posted pre-market gains following the latest unemployment data, while the crypto market continues to lag across the board.

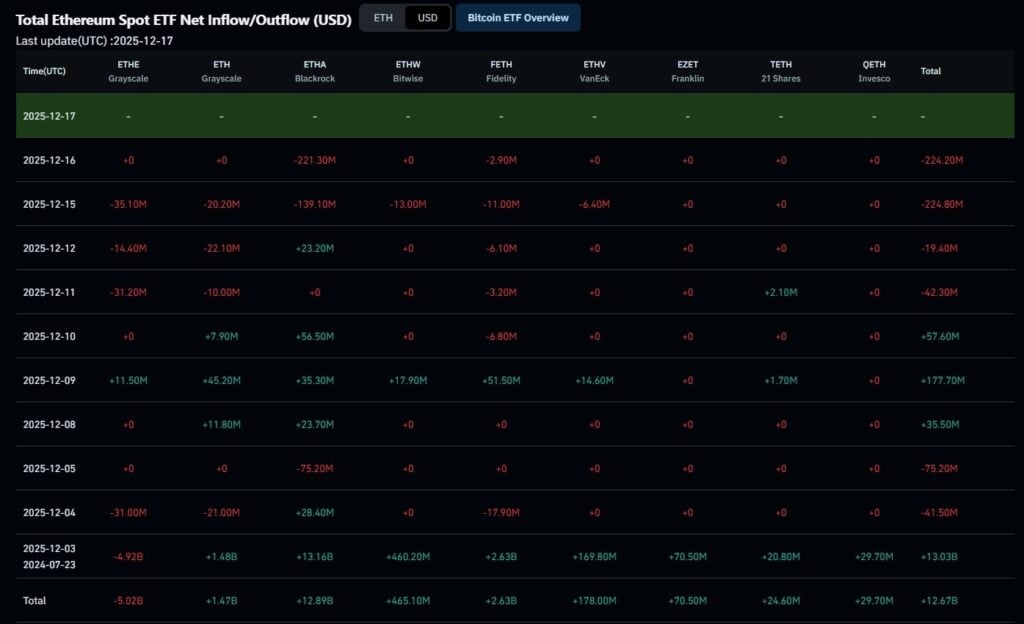

Ethereum (ETH) is absorbing most of this pressure, driven largely by a sharp reversal in institutional sentiment. Mid-December spot ETF data shows a clear shift away from the strong accumulation phase seen earlier in the month, which peaked at $177.7 million in inflows on December 9.

In contrast, net outflows exceeded $224 million per day between December 15 and 16, led by BlackRock’s ETHA alongside redemptions from Grayscale and Fidelity.

This four-day streak of withdrawals has pushed the month into net outflow territory and reflects fading demand as ETH fails to reclaim key resistance levels.

Despite this near-term caution, the long-term institutional thesis remains intact, with cumulative spot ETF inflows still near $12.67 billion. However, the short-term price outlook remains pressured by technical weakness.

ETH/BTC recently confirmed a failed breakout, suggesting Ethereum will continue to show relative weakness against Bitcoin until a clear catalyst emerges. With Bitcoin also lacking a strong bullish backdrop, Ethereum remains stuck in a high-correlation, downward-trending environment.

Ethereum Price Prediction

Ethereum trades within a defined range where several critical technical levels shape short-term market behavior.

The Yearly VWAP and Point of Control (POC) at $3,140 create a strong resistance zone because this area merges the range’s primary volume node with a persistent fair value gap; a clean break and sustained hold above $3,140 would signal a shift in market character and ignite bullish momentum.

The Value Area Low (VAL) at $2,900 offers a temporary floor, but it lacks the strength of the primary demand zone between $2,830 and $2,800.

This lower cluster includes a naked POC at $2,800, historical single prints, and a weak low structure, making it the most attractive accumulation zone once the market confirms a reversal.

Current fundamentals and this week’s news flow support a likely path where Ethereum tests $3,120-$3,140, rejects from that region, and rotates back through $2,900.

This movement opens the door for a sweep into the $2,840-$2,780 optimal buy zone, which addresses lingering inefficiencies on lower time frames before any sustained reversal develops.

Effective execution demands patience and confirmation through order flow rather than blind limit orders. High-conviction opportunities appear when late longs trap themselves into resistance at $3,140 or when shorts exhaust themselves at the $2,840-$2,780 support zone.

If neither setup forms, staying on the sidelines remains the most disciplined strategy until the market presents a clear decision point.

Traders looking to diversify beyond Ethereum are starting to explore early-stage opportunities. Bitcoin Hyper has launched as a new ERC-20 token focused on fast execution and scalable infrastructure across the Bitcoin and Ethereum ecosystems.

As capital shifts toward emerging narratives, Bitcoin Hyper is gaining attention in discussions around the best crypto to buy now.

New ERC-20 Token With High Upside Potential

Bitcoin Hyper (HYPER) treats BTC as real digital money rather than a passive asset. The team aims to solve Bitcoin’s slow transaction speed by creating an off-chain execution layer that runs beside the main Bitcoin network.

This setup keeps the base Bitcoin protocol untouched while shifting actual transaction processing to a faster layer.

The execution layer uses the Solana Virtual Machine, which allows the system to process transactions quickly before settling them on the Bitcoin blockchain. This structure supports DeFi apps, games, and other projects that require high-speed activity.

The platform uses Bitcoin as its main currency. Apps built on Bitcoin Hyper use BTC directly instead of wrapped versions or substitutes.

The $HYPER token plays three roles in the system. It acts as the gas token for network fees, the staking asset that helps secure the network, and the governance token for voting on future decisions. These functions position $HYPER as a core asset in the growing Bitcoin Hyper ecosystem.

Strong early interest reflects that appeal. The presale has already raised more than $29.5 million, with tens of thousands of early supporters backing the project. Well-known crypto creators like ClayBro and Borch Crypto have also highlighted Bitcoin Hyper as one of the best crypto to buy now.

Anyone who wants to join the early phase can visit the Bitcoin Hyper website and buy $HYPER using ETH, USDT, BNB, or a credit card.

The team recommends using a trusted non-custodial wallet like Best Wallet, which many in the community view as one of the top Bitcoin and crypto wallets.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Solana Price Prediction: Litecoin Latest Updates As Pepeto Gains Buzz With Analysts Calling 100x Potential