3 Hottest Meme Coins That Could Make You a Millionaire

The post 3 Hottest Meme Coins That Could Make You a Millionaire appeared first on Coinpedia Fintech News

2025 is poised to become the year of an explosion in the meme coin market, and some of these tokens have massive upside potential. Notable among them are LILPEPE, Floki, and Dogwifhat, which are all geared towards enormous profits. These meme coins are not only fueled by viral trends but supported with robust communities, actual utility, and market traction. Here is why these three meme coins can make you a millionaire in 2025.

Little Pepe(LILPEPE): The Meme Coin that has 1000x Potential

It is a fact that LILPEPE is among the most popular meme coins in 2025. It is priced as low as $0.0021 but is still in its presale, allowing investors to get in at a very low price. So far, LILPEPE has already raised over $ 22.4 million, and over 14.2 billion tokens have been sold. This is a Certik-audited project, which guarantees its security and trust.

Unlike traditional meme coins, LILPEPE has utility, featuring the PEPE Launchpad, which supports the incubation of future meme coins. Being a meme and having a blockchain purpose is a rare combination; that is why LILPEPE has a good chance of growing 1000x during the next bull run. As the presale progresses, experts believe that LILPEPE may skyrocket to a potential of reaching the $3 mark, which would provide life-altering returns. Zero buy/sell tax and sniper-bot-proof technology are making LILPEPE a magnet to heavy traders and whales. LILPEPE is among the most promising opportunities on the meme coin market in case you want to make millions in 2025.

The Meme Coin That Has Huge Community Strength: Floki(FLOKI)

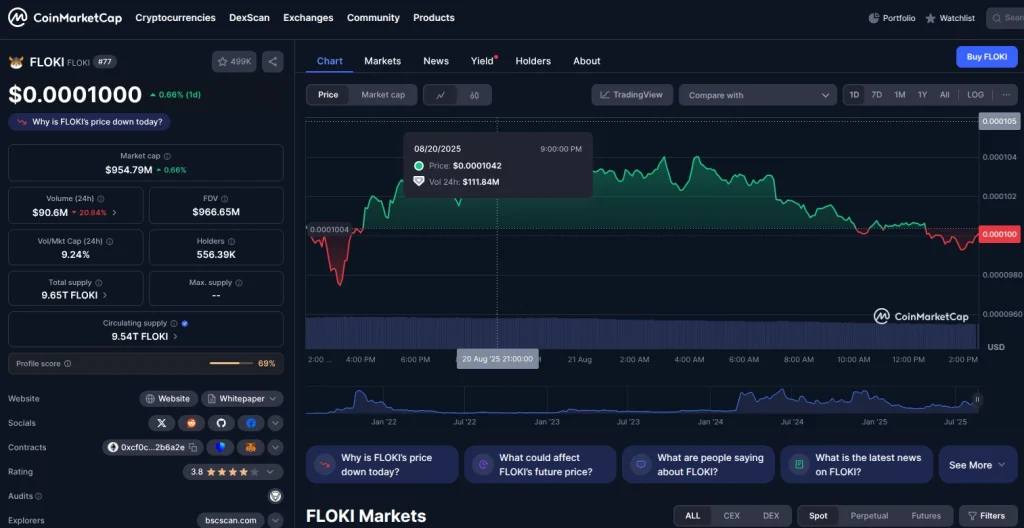

Currently, FLOKI is one of the brightest memecoins on the market, with a price of $0.0001000 and a market cap of $ 955.82 million. Floki has added 0.3 percent over the last 24 hours, and despite this, it remains a good meme token with sound fundamentals. The strong community of 556,000 coin holders is another defining feature of the coin, as is the increasing interest in it on the market.

Floki truly has a distinctive ecosystem that sets it apart from the other meme coins. With a circulating supply of 9.54 trillion FLOKI tokens, it has generated a 24-hour trading volume of $90.89 million, thus establishing good liquidity. The project does many things to solidify its existence as much more than just a joke token, such as FlokiFi (a DeFi platform for staking and yield farming) and Floki Inu University (which centers on blockchain education).

Dogwifhat(WIF): The Emerging Meme Coin With A Viral Momentum

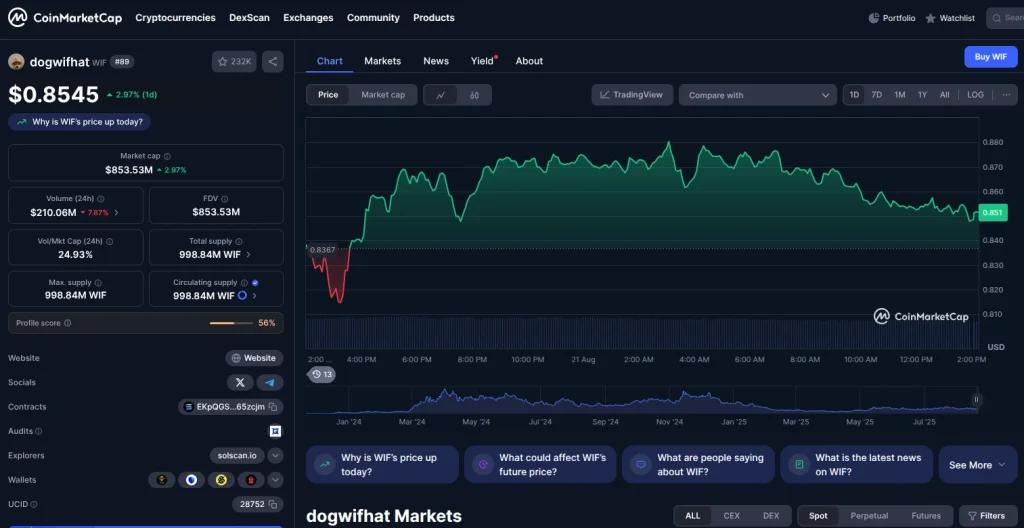

Dogwifhat (WIF) has become a fast-growing meme coin, currently trading at $0.8531 and boasting a market cap of $ 852.95 million. Although the coin rose by 2.84% over the past 24 hours, market activity remains high, with a 24-hour volume of 195.12 million, indicating high liquidity and increased interest. Dogwifhat, with 998.84 million tokens in circulation, has been gaining considerable trading volume and market traction, making it a meme coin with potential to grow exponentially in 2025.

What makes Dogwifhat unique is its blend of viral qualities and an active community of 232K holders. It has a robust market dynamic and memetic power, which makes it a risky but potentially rewarding investment, as meme coins continue to gain traction. With the hype of meme coins hitting the market, Dogwifhat could be seen as surprising the market with huge returns for early investors as the following bull run approaches.

Conclusion: LILPEPE Is The Meme Coin To Watch In 2025.

Although both Floki and Dogwifhat (WIF) are promising cryptocurrencies, LILPEPE is the best meme coin to monitor in 2025. LILPEPE’s Ethereum Layer 2 ecosystem, Certik audit, and practical application make it more than just a meme coin: it is a game-changing token with long-term potential. The presale success of LILPEPE, raising $ 22.3 million with 14.2 billion tokens sold, demonstrates that interest in this coin is rising. Its ability to reach a price of $3, based on the current price of $0.0021, provides unparalleled 1,000x growth potential to those who invest in the presale. LILPEPE is the meme coin that can turn a small investment into a life-changing amount. Don’t wait to be left behind, buy LILPEPE during the presale at littlepepe.com before it is listed on major exchanges and becomes the meme coin of 2023.

For more information about Little Pepe (LILPEPE) visit the links below:

- Website: https://littlepepe.com

- Whitepaper: https://littlepepe.com/whitepaper.pdf

- Telegram: https://t.me/littlepepetoken

- Twitter/X: https://x.com/littlepepetoken

You May Also Like

DOGE to $1 Still Possible, But This Meme Coin Could Turn $20 Into $2,000

Bitcoin Selling Pressure: Crucial Analysis Reveals Short-Term Holder Impact