Top 3 Banking Presales for the Next Cycle – Digitap ($TAP) Tops Best Crypto Presales ($TAP, BlockchainFX, Remittix)

The post Top 3 Banking Presales for the Next Cycle – Digitap ($TAP) Tops Best Crypto Presales ($TAP, BlockchainFX, Remittix) appeared first on Coinpedia Fintech News

As users take positions for the next cycle, banking-focused crypto presales are emerging among the most compelling investment opportunities. These projects are designed to operate in the real-world economy.

Digitap ($TAP) leads this banking presales group since it is building an omni-bank ecosystem. The ecosystem integrates crypto, fiat, payments, and spending into one usable platform. Alongside BlockchainFX ($BFX) and Remittix ($RTX), Digitap represents a thriving group of presales that want to become the financial rails of the next cycle.

Digitap also dominates because it is running a 12-day Christmas giveaway to reward early investors. These features and giveaways explain why the $TAP presale is flying off the shelf.

Why Banking Crypto Presales Are Attracting Smart Capital

The recent bull cycle favored speed, hype, and speculative innovation. However, as the industry matures, the next cycle may reward stability, utility, and integration. In 2025, regulators have become more active, users more cautious, and liquidity more disciplined.

In this scenario, banking-style crypto platforms thrive since they resolve persistent global problems. These platforms improve payments and offer users more access and financial control.

Currently, cross-border transfers remain slow and expensive. Several regions around the world still struggle with restricted banking access. Simultaneously, users want crypto exposure without transacting outside the financial system.

Projects that make crypto spendable are rapidly becoming an important part of the global financial industry. This explains why crypto presales that focus on banking infrastructure are attracting long-term capital at an early stage.

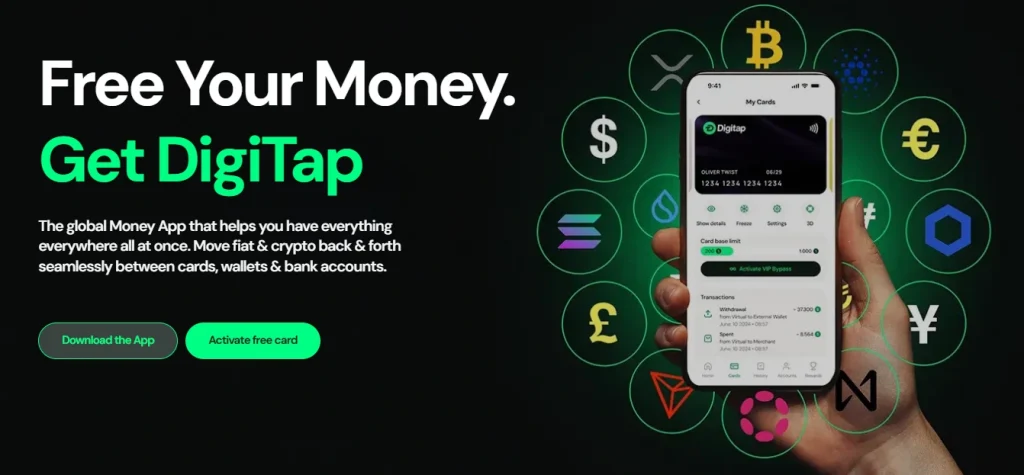

Digitap Turns Crypto Into a Seamless, Spendable Ecosystem

Digitap is dominating the list because it does not approach banking as a feature. Instead, the project treats it as a whole system. The platform is built as an omni-bank ecosystem where users can move value across borders, convert between assets, store crypto, and spend through Visa-linked cards from one interface.

The project is gaining momentum at an early stage because financial behaviour is continuous. Users do not like having separate apps for holding, sending, converting, and spending. They want one platform that does all these things.

Digitap’s strength is fueled by its ability to merge all these steps into one seamless transaction flow, making crypto spendable in the real world. $TAP is incorporated into this ecosystem, not existing beside it.

In that context, built-in buy-back and burn mechanics link growth directly to supply reduction, while platform usage feeds into token demand. This method of operation builds an economic loop underpinned by activity, not hype or speculation. Hence, $TAP is a good crypto to buy this December.

Why $TAP Is Gaining Traction as a Utility-Driven Crypto

Digitap’s appeal thrives beyond product scope. It has built a product that aligns with the way real users interact with money. Instead of relying on traders, it targets freelancers, businesses, and normal users who require reliable financial tools, irrespective of the market’s direction.

Furthermore, Digitap’s approach to compliance and privacy is balanced. Users enjoy increased flexibility, which accelerates $TAP’s adoption across regions with different regulatory policies. Therefore, Digitap is inherently global.

For a crypto presale, this level of operational clarity is rare, explaining why investors consider Digitap as an early-stage financial platform.

BlockchainFX’s Strength Is Also Its Limitation

BlockchainFX is using a different strategy to gain traction in the banking presale sector. It is designed as a hybrid trading and financial platform to merge crypto, forex, commodities, and traditional assets into one platform.

The vision is ambitious and makes sense to experienced users who prefer widespread market exposure. BlockchainFX has invested heavily in liquidity access, infrastructure, and multi-asset trading capabilities. Normally, these components could appeal to professional and semi-professional users in the next bull market.

Nevertheless, this strategy could slow the rate of mass adoption. Platforms designed around trading seem to cater to a smaller user base and depend heavily on market activity. While BlockchainFX may thrive during high-volume periods, its everyday relevance for non-traders is not guaranteed.

While $BFX is a strong crypto presale, its underlying ecosystem only serves a specialized segment of the market. $TAP outpaces it to become the best crypto to buy this December because its omni-bank ecosystem is designed to make crypto spendable for everyone.

Remittix Solves Transfers, But Faces Structural Limits

Remittix has adopted a more focused approach, targeting crypto-based remittances. Since the global remittance market is massive, this strategy provides the project a logical entry point. Notably, it offers faster settlement and lower fees, which are clear advantages over traditional operators.

With that in mind, Remittix’s scope of operation is relatively narrow. It may solve how money moves, but it does not explain what happens before or after. Users must find separate reliable solutions to store funds, spend locally, and manage balances over time.

In a sector majorly dominated by platforms that provide end-to-end financial experiences, Remittix could become a component only and not an entire financial ecosystem. Moreover, its success could be determined by the partnerships or integrations it makes and may not thrive as a standalone ecosystem.

While Remittix operates within a restricted environment, Digitap works as a global general-purpose financial system. This strategy offers $TAP a massive user base, multiple adoption pathways, and many use cases. Therefore, Digitap is the best banking crypto presale for the next cycle.

Digitap vs BlockchainFX vs Remittix: The Ecosystem Test

Ecosystem depth seems to be the main differentiator between Digitap, BlockchainFX, and Remittix. BlockchainFX thrives in multi-asset access while Remittix targets one high-demand use case. On the other hand, Digitap integrates everyday financial behaviour into a single platform.

History shows that platforms that support users’ transactions entirely seem to outperform over time. They generate stronger network effects, recurring usage, and resilient tokenomics. Digitap’s structure aligns with this pattern.

This means Digitap is better positioned to operate as a default financial layer, not a supplementary tool like BlockchainFX or Remittix.

From Functionality to Scale: What Wins the Next Crypto Cycle

Crypto presales linked to a functional infrastructure explode after adoption accelerates. In that context, payments and banking platforms build user trust before scaling quickly when conditions improve.

As the next cycle approaches, attention is moving from speculative projects toward platforms that are already functional. Digitap is prepared technically and structurally, which gives it an upper hand in that transition.

Investors want presales that can survive and thrive in volatile markets.

Digitap Combines Utility and Incentives to Boost Presale Adoption

Digitap has collected over $2.6 million in early funding. Notably, it has appealed to most buyers due to its omni-bank model that offers early-stage utility and a 12-day Christmas giveaway program. This giveaway campaign kicked off on December 13 and will run up to December 24.

Every 12 hours, investors are served with a new reward, which explains $TAP’s accelerated momentum. Some of the gifts on offer include free Premium and PRO accounts, and massive $TAP bonuses.

To make the campaign highly impressive during this festive season, the event is designed with green-and-gold visuals, glowing Advent boxes, and a snow globe countdown. Users can log in on the official website, open the Offers tab, and collect rewards before they vanish.

Currently, $TAP’s crypto presale is selling at $0.0371, a low entry price. This valuation explains why investors are buying the token rapidly in round 3. This token price is a 73.5% discount from its launch value of $0.14. Over 150 million $TAP tokens have been acquired, and more than 120,000 wallets are linked to the project.

Digitap’s Omni-Bank Model Sets the Banking Presale Standard

Among the leading banking presales for the next cycle, each of the three projects brings something tangible to the table. BlockchainFX is designed to offer widespread market access. On the other hand, Remittix addresses cross-border challenges. However, Digitap delivers a complete omni-bank experience.

The banking completeness enables Digitap to dominate in this group. It does not rely on one market condition or behavior alone. It is developing a financial system built to thrive irrespective of volatility.

For investors looking for crypto presales that could deliver long-term relevance, Digitap stands out as the strongest opportunity in this group.

Digitap is Live NOW. Learn more about their project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Building a DEXScreener Clone: A Step-by-Step Guide

Which DOGE? Musk's Cryptic Post Explodes Confusion