Trump named Cardano as one of the US's strategic crypto reserves. How does Cardano create a bull market illusion through narrative?

Author: Nancy, PANews

Through the ups and downs of the crypto market, the old public chain Cardano always has its own BUFF blessing, and it has been on the rise all the way. In this cycle, the old Cardano has been renewed, anchored in the Bitcoin L2 narrative, and recently has been frequently screened with multiple identities such as US crypto reserve assets, ETF application targets, and institutional configuration hot choices, making its presence felt.

Ecological indicators were crushed, and policy buffs were filled up, which was accused of being a relationship-based household.

On March 2, Trump issued a statement announcing that his digital asset executive order instructed the presidential task force to advance the strategic reserve of cryptocurrencies including BTC, ETH, XRP, SOL and ADA. However, this news was not entirely unexpected. At the end of January this year, Ripple CEO Garlinghouse confirmed that he had discussed with Trump the possibility of using XRP as a strategic reserve asset for the United States, and emphasized that the reserve should be diversified. Now it seems that this game has already been laid out.

Stimulated by this news, the crypto market "revived" overnight. Among them, Cardano's ADA performed particularly well. According to Coingecko data, its highest increase in 24 hours exceeded 78.1%, directly dominating the hot search list. However, while the market sentiment is high, there are also doubts: Cardano's technical strength and ecological development are slightly inferior to other selected assets. Why was it selected as a US reserve asset?

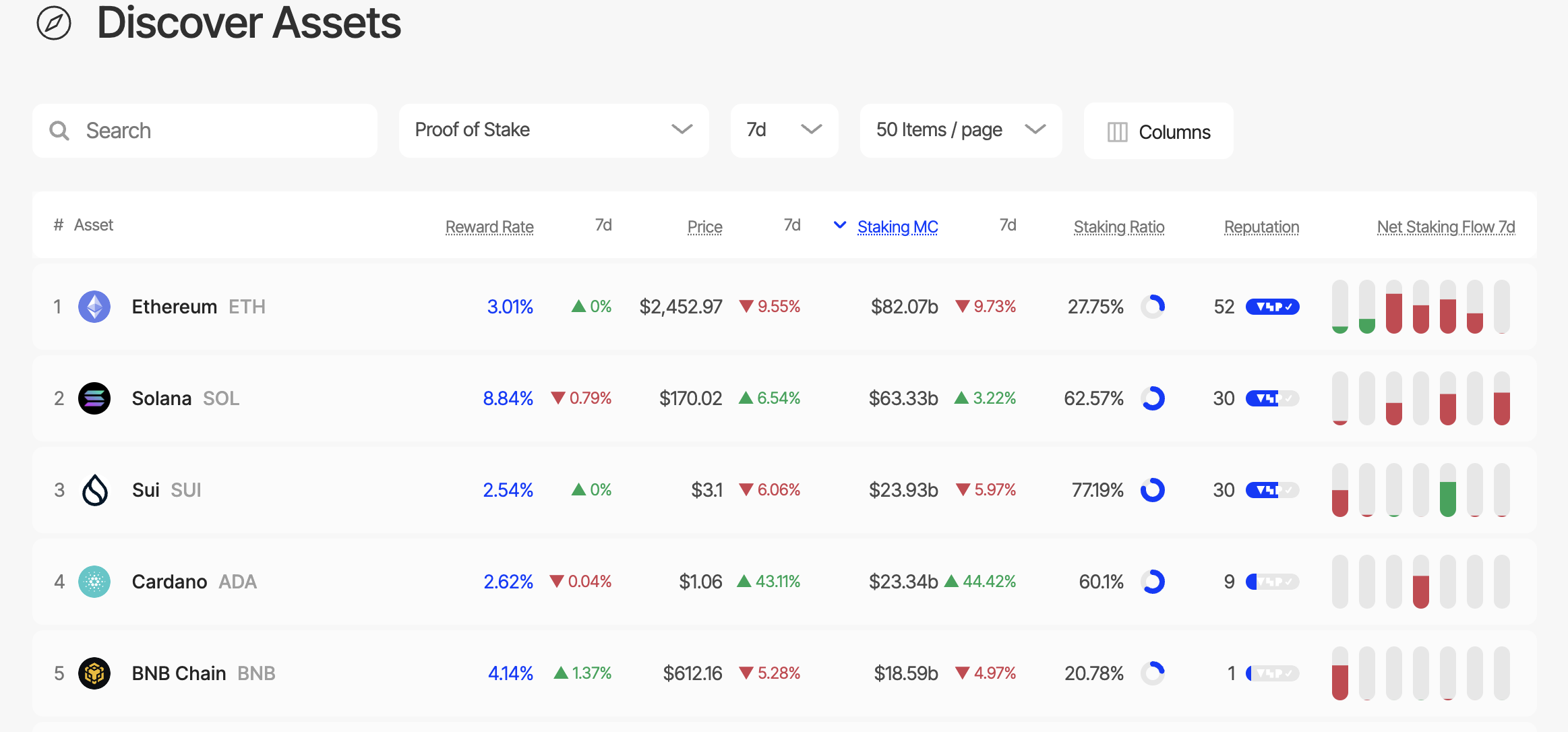

Cardano holders have a high willingness to hold for the long term, and more than 60% choose to lock their positions to support the network, which also increases the health of the network. According to the staking data website Staking Rewards, Cardano is the fourth largest POS blockchain network, with a staking amount of US$23.34 billion and a staking rate of 60.1%.

However, according to DeFillama data, as of March 3, Cardano's TVL was nearly $508 million, the market value of on-chain stablecoins was $22.55 million, and the application revenue in the past 24 hours was only $3,024. During the same period, Solana's TVL was as high as $8.38 billion, with a daily income of about $836,000. From the perspective of ecological indicators, Cardano lags behind the other selected assets. Despite the amazing scale of pledge, ADA's pledge has not been converted into actual dApp applications, which means that there are still large gaps to be filled in its ecology.

“So does this mean we have to change our name to ‘American Digital Asset’?” Cardano founder Charles Hoskinson joked in his latest tweet.

In fact, the outside world has always dubbed Cardano as the "Japanese public chain", but Cardano is an American-made project founded by American Charles Hoskinson, one of the original eight co-founders of Ethereum, who has invested a lot of money and energy in blockchain, longevity science, extraterrestrial exploration and other fields. In 2014, after Hoskinson left due to product differences with Vitalik Buterin over the development direction of Ethereum, he founded Input Output Global, headquartered in the United States, and launched Cardano. The reason why Cardano is so popular in the Japanese market and even called "Japanese Ethereum" is largely related to its early financing model. It is reported that nearly 95% of the buyers in Cardano's public offering are from Japanese investors, also known as "retirement investment", mainly because this public offering was led by the Japanese company Emurgo. At that time, Japan's regulatory environment was relatively loose compared to Europe and the United States, which also made Cardano misunderstood as a Japanese project. But with the increasing openness of US encryption policies, Cardano is gradually fading its Japanese impression.

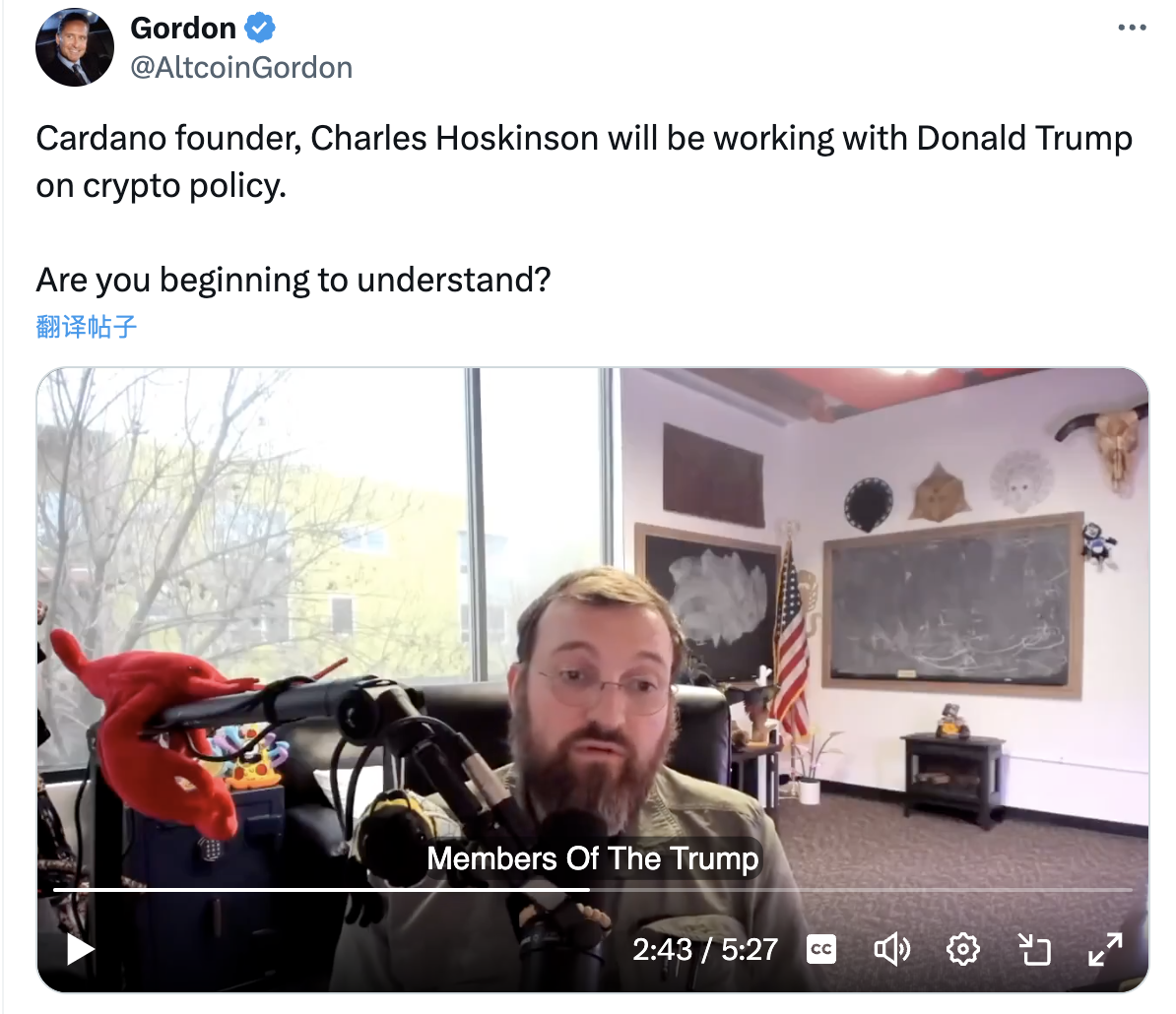

As for the selection of Cardano into the strategic asset reserve, many people speculate that it is not based on technology, but on the close connection with the US government, especially the founder Charles Hoskinson has hinted many times. For example, in November 2024, when Charles Hoskinson was rumored to be considered by Trump to appoint him as a crypto policy adviser, he revealed in a conversation that he had a close relationship with a member of Trump's team. He said that he would work with lawmakers and the government to promote the passage of a bipartisan bill. Cardano R&D company Input Output Global will establish a cryptocurrency regulatory policy office in early 2025, and plans to contact "leaders in certain key positions" in the US government to promote the formulation of a legislative agenda for securities and commodities related to cryptocurrencies. However, as of now, the specific progress of this plan has not been made public, and there is no evidence that he has been officially employed by the US government.

Charles Hoskinson also clarified on March 2 that “no one has been appointed to a cryptocurrency-related role by the executive branch tonight. The meeting does not mean an endorsement or granting of magical new powers. The legislative process is like this. It takes time and effort. I will not comment on this topic again until there is definite and substantive news about the legislative process. These news must be related to the formulation of new laws to enable the industry to survive and prosper in the United States.”

From academics to Bitcoin wingmen, Cardano's narrative posts are hot topics

Narratives may change, but Cardano remains unchanged.

Recently, Cardano's multiple market dynamics have made it one of the hottest targets in the market. For example, ADA is one of the top three assets in the latest holdings of Grayscale Smart Contract Fund, accounting for 18.23%; Grayscale's application for Cardano spot ETF has been accepted by the US SEC; Cardano plans to integrate Ripple's RLUSD stablecoin to enhance its DeFi ecosystem and provide RLUSD with more extensive usage opportunities, etc.

Not long ago, Charles Hoskinson also disclosed that Input Output Global (IOG) will focus on developing the Bitcoin DeFi ecosystem in 2025. The team plans to cooperate with Fair Gate Labs, a multi-party computing protocol developer, with the goal of launching a demo version before the Bitcoin Conference in May 2025. The technology developed by Fair Gate Labs will become the basis of BitcoinOS, and there is no need to issue additional tokens. Cross-chain transactions only require Bitcoin. The project will also cooperate with community projects and wallet service providers to achieve the goal of "awakening the sleeping giant."

This time, the dividends of the strategic reserve policy will undoubtedly bring additional policy support to Cardano and provide it with new capital flows and attention in the market.

Looking back at the development history of Cardano, in the past few rounds of market baptism, Cardano has always been good at constructing eye-catching narratives to shape a unique market image and increase market attention by leveraging external events.

From its origins as a "research-driven third-generation blockchain" to its environmental brand as a "green Ethereum killer", to the ecological moment of the launch of smart contracts, it has now transformed into a new role as "Bitcoin Layer 2". These narratives are sometimes not entirely based on the technology itself, but are more driven by external events and public opinion. In particular, bull market cycles tend to magnify its potential and quickly become the focus of market attention with its strong ability to pull the market.

However, from the initial academic school to the current Bitcoin "wingman", although Cardano has been quite successful in narrative evolution, the actual application problem behind it is still its biggest weakness. With the help of the "U.S. policy tailwind", whether Cardano can break the inherent impression under the previous bull market illusion remains to be seen.

It is said to be a piece of paper, and the execution path remains a mystery

However, in addition to the question of interest transfer, the implementation method, timetable, specific scale and source of funds of altcoins such as ADA being named by Trump as strategic reserve assets are still unclear. The market believes that it is more at the intention stage and the execution is a mystery. (Related reading: Trump announced the cryptocurrency reserve plan: 5 assets were selected, but the "advertising space" was questioned and the implementation method is uncertain )

Udi Wertheimer, founder of Taproot Wizards, believes that “the best view of the strategic reserve that I have seen so far is that this is just a typical Trump negotiation tactic. To actually build a reserve, Trump must convince Congress, and he can't decide alone. Whenever Trump needs to convince other stakeholders, he always makes a ridiculous claim first, which he can retract later. So, in Trump's chess language, this just means that he is telling Congress that if you don't agree to the Bitcoin reserve, I will propose more outrageous conditions.”

Arthur Hayes, co-founder of BitMEX, pointed out, “There’s nothing new here, just empty talk. Tell me when they get congressional approval to borrow money or raise the price of gold. Without these, they have no money to buy Bitcoin and altcoins.”

"Investing only in Bitcoin may be the best option - the simplest, and the logic behind it as the successor to gold is also clear; if people want more diversified options, they can build a market capitalization-weighted crypto asset index to keep it unbiased," said Brian Armstrong, co-founder and CEO of Coinbase.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models