SOL and XRP Spot ETFs Record Inflows as BTC and ETH See Outflows on Dec. 24

Spot exchange-traded funds (ETFs) tied to Solana (SOL) and XRP recorded net inflows on December 24, while Bitcoin (BTC) and Ethereum (ETH) spot ETFs experienced notable net outflows, highlighting diverging investor sentiment across major digital assets.

Daily Spot ETF Flow Overview (Dec. 24)

According to market data, capital flows across U.S.-listed spot crypto ETFs broke down as follows:

- Bitcoin (BTC): –$175.29 million

- Ethereum (ETH): –$52.7 million

- Solana (SOL): +$1.48 million

- XRP: +$11.93 million

The data suggests investors rotated capital away from the two largest cryptocurrencies by market capitalization, while selectively increasing exposure to alternative layer-1 and payment-focused assets.

Bitcoin and Ethereum ETFs Face Selling Pressure

The combined outflows of more than $228 million from BTC and ETH spot ETFs point to short-term risk-off behavior, likely driven by year-end portfolio rebalancing, profit-taking, or macro uncertainty.

Bitcoin spot ETFs accounted for the majority of the outflows, reflecting cautious sentiment following recent price consolidation. Ethereum ETFs also saw sustained redemptions, extending a trend of uneven flows since their approval earlier this year.

For broader context on U.S. spot Bitcoin ETF performance, see:

https://www.farside.co.uk/bitcoin-etf-flow-data/

SOL and XRP Attract Fresh Capital

In contrast, Solana spot ETFs posted $1.48 million in net inflows, signaling modest but positive demand. Solana has continued to benefit from strong on-chain activity, ecosystem growth, and its positioning as a high-throughput alternative to Ethereum.

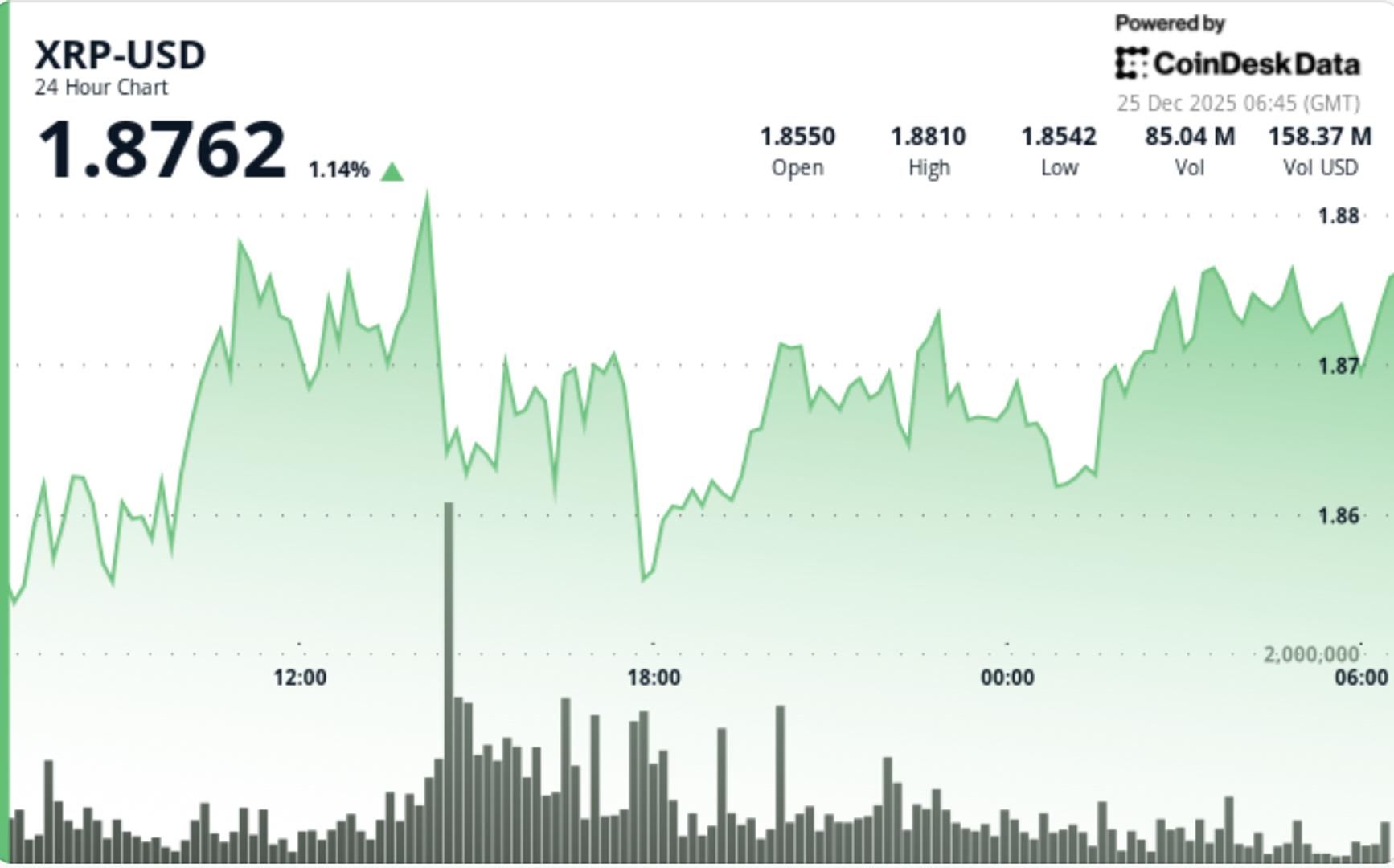

More notably, XRP spot ETFs recorded $11.93 million in net inflows, outperforming all other crypto ETFs on the day. The inflows suggest rising investor confidence in XRP amid improving regulatory clarity and renewed institutional interest in cross-border payment infrastructure.

Additional market data can be tracked via:

https://coinglass.com/

Market Implications

The divergence in ETF flows underscores a rotation narrative within the crypto market:

- Investors appear to be trimming exposure to large-cap assets like BTC and ETH

- Capital is selectively moving toward altcoins with specific growth or regulatory catalysts

- ETF flows remain a key short-term sentiment indicator for institutional demand

While single-day flows do not define long-term trends, sustained inflows into SOL and XRP ETFs could support price stability and broader market interest if the pattern continues.

Outlook

As 2025 approaches, analysts expect ETF flows to remain volatile amid shifting macro expectations, interest rate uncertainty, and regulatory developments. Market participants will closely monitor whether capital returns to BTC and ETH ETFs or continues rotating into select altcoin products.

You May Also Like

Dogecoin (DOGE) and Shiba Inu (SHIB) Likely to Underperform as Capital Flows to New Token Set to Explode 19365%

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch

XRP ETF net assets cross $1.25 billion milestone, but price-action muted

Copy linkX (Twitter)LinkedInFacebookEmail