Can the MEME Act proposed by U.S. congressmen prevent politicians from "cutting leeks"?

Author: Zen, PANews

On February 27, California Democratic Congressman Sam Liccardo launched his first legislation after taking office. The bill is named the Modern Emoluments and Malfeasance Enforcement Act (MEME Act), which aims to prohibit senior federal officials from issuing, sponsoring or promoting securities, commodities or digital assets. Violators will be subject to criminal and civil penalties.

"Make corruption criminal again," the new member of the U.S. House of Representatives opened his speech using the "MAGA" phrase.

Directly targeting Trump and $TRUMP, forcing them to "eat and vomit"

Liccardo's Modern Emoluments and Malfeasance Enforcement Act has more than a dozen Democratic co-sponsors. According to the draft of the bill, it will prohibit the president, members of Congress and other senior officials, as well as their spouses and children, from issuing or sponsoring securities, commodities and cryptocurrencies such as meme coins. In addition to restricting potential politicians from issuing coins to "cut leeks" in the future, the bill also requires Trump to hand over all profits he made from selling meme coins.

"I think everyone was confused when President Trump started this scheme of pumping up stocks and selling them," Liccardo said, adding that such behavior is clearly unethical and one can't help but wonder why there is no clear enough ban. He also added that Trump's meme coin has raised concerns about transparency, insider trading and negative overseas influence.

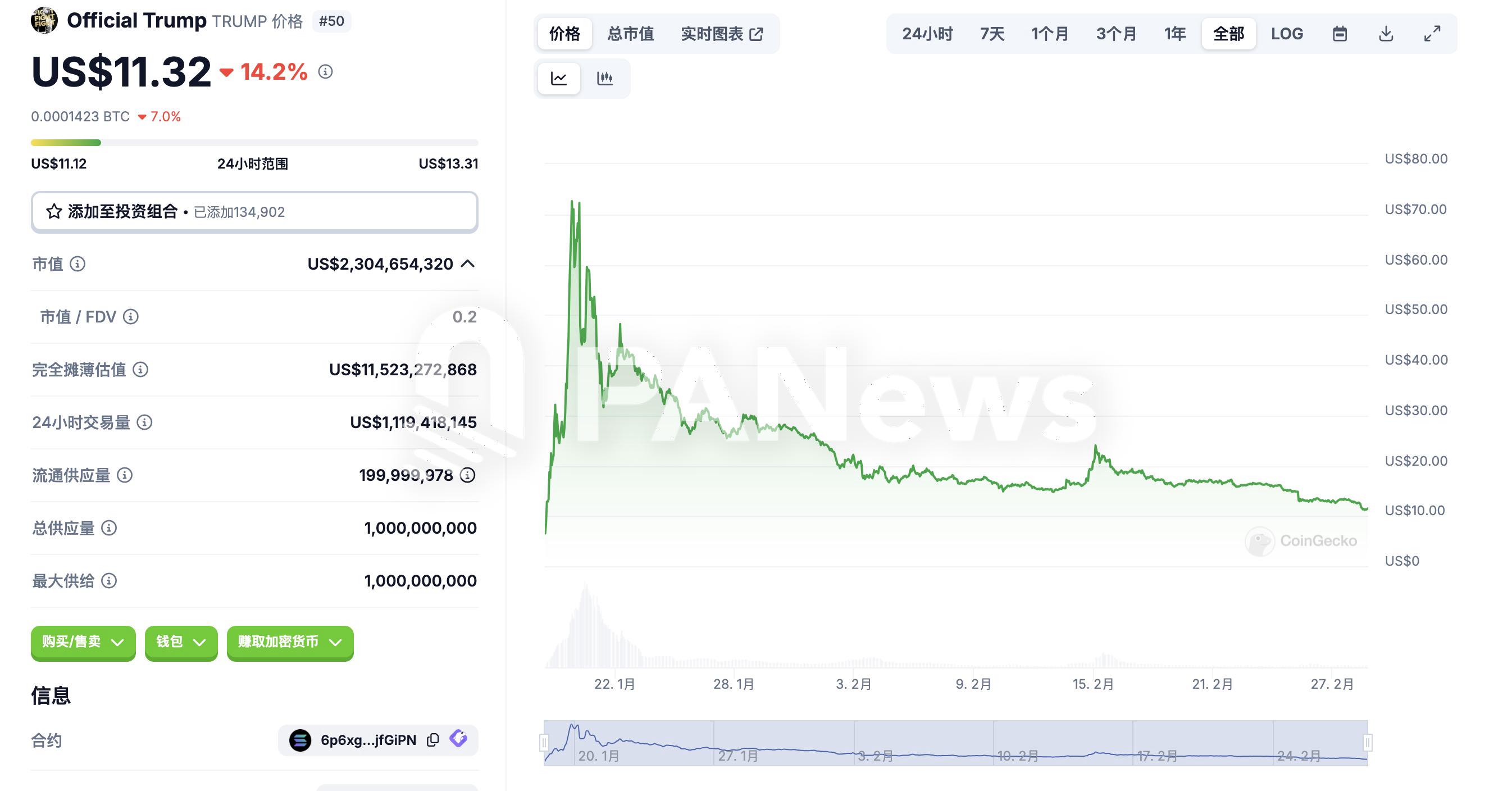

On January 18, Beijing time, on the eve of Trump's inauguration, he announced the launch of Trump's eponymous meme coin $TRUMP. According to the $TRUMP official website, two subsidiaries of the Trump Group control 80% of the total tokens, with an initial circulation of only 200 million, and the remaining 800 million will be gradually unlocked in the next three years. After Trump himself verified that "personally bringing goods" was true, $TRUMP soared rapidly, and the full circulation market value once exceeded US$70 billion, with a peak of US$80. According to Coingecko data, as of February 28, the price of $TRUMP had fallen to US$11.32, a drop of more than 85%.

According to Chainalysis, an on-chain data analysis company, about 200,000 retail investors suffered heavy losses in the crash, and retail investors and MAGA supporters who were attracted by Trump's influence became the buyers. According to Reuters , Meteora, the trading platform where $TRUMP was launched, allows creators to "mint meme coins and earn fees for life", and the creator of $TRUMP earned about $100 million by providing liquidity on the Meteora exchange.

Liccardo also compared Trump’s meme coin to similar actions by other national leaders, such as the Central African Republic’s meme coin CAR, and Argentinian President Javier Milley’s promotion of LIBRA — which has made him the focus of a corruption investigation.

A new bill that is unlikely to pass

"I can assure you that this was not my plan when I ran for public office." Liccardo said the reason for introducing the bill was that Trump needed to get some kind of response to the meme coin launched before he took office last month, which even Trump-supporting cryptocurrency enthusiasts found offensive.

However, Liccardo is well aware that the Modern Payroll and Malfeasance Enforcement Act, which is aimed directly at Trump, has little chance of passing in the current Republican-controlled Congress, and he said the bill could serve as a "placeholder" that could be reintroduced and passed if Democrats take power in the future, and as a symbolic protest against the obvious corruption.

"In the future at least we need to make sure this doesn't happen again," Liccardo said.

But just as laws like the Hatch Act prohibit government officials from using their positions to influence political campaigns, their effectiveness depends entirely on the White House's decision, and the same may be true of Liccardo's new bill.

A federal investigation found that at least 13 former Trump administration officials broke the law during Trump's last term by mixing campaign activities with government business. However, the 2020 election has shown that, at least for the most senior government officials, if the White House chooses to ignore the requirements of the Hatch Act, the American public will have no protection from senior government officials using their official powers to illegally obtain partisan political benefits.

In addition, Ivanka, Trump's daughter and then-senior adviser, promoted Goya coffee beans on Twitter in 2020, claiming that the company was treated unfairly and that she had "every right" to publicly express her support. Government watchdogs criticized her for not having the right to violate ethical standards that prohibit government officials from using their public office to support specific products or groups. The White House did not punish her for her ethical violations.

In contrast, President Trump tweeted the next day about his love for the Goya brand and posted a photo on his Instagram account showing him in the Oval Office with his desk filled with Goya products, even though the code of ethics for executive branch employees clearly states that one cannot use one's public office to promote private companies.

At the moment, what really prevents politicians from continuing to rush into the craze of issuing large amounts of coins is this already shaky market.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models