Multicoin Capital: Why is Geodnet a critical link in the era of physical AI?

Original article: Shayon Sengupta , Venture Partner at Multicoin Capital

Compiled by: Yuliya, PANews

Multicoin, a well-known crypto investment institution, announced on February 25 that it had strategically acquired GEOD tokens worth $8 million from the Geodnet Foundation. It is reported that Geodnet is a precise positioning network that provides key positioning services for drones, self-driving cars, and robots that may emerge in large numbers in the future through the DePIN (decentralized physical infrastructure network) economic model.

The era of physical AI is coming

Although we have not yet reached the future scenario depicted in "Blade Runner 2049" where humanoid robots live together with humans, in 2025, professional robots have quietly integrated into all aspects of modern life. Currently, language models are commoditizing intelligence, unleashing new creativity and changing the form of knowledge work. However, the development of AI is not limited to the fields of text, images and videos. Its evolution is extending to the physical world, and robotics will become the next important frontier.

As AI models become more powerful, their ability to understand and interact with the physical environment will be significantly enhanced. This shift will give rise to new autonomous systems, from self-driving cars and humanoid robots to drones and industrial automation equipment, which will operate with unprecedented intelligence and autonomy. To function, these robots need to answer a basic question: Where am I?

Positioning: A $5 billion problem

When tens of millions of autonomous and semi-autonomous devices are deployed, they all face the same challenge: spatial perception . Drone delivery, self-driving cars navigating in dense urban environments, agricultural machines performing precision seeding, etc. all require sub-centimeter positioning accuracy to operate safely and efficiently.

To achieve such high accuracy, these systems rely on sensor fusion, combining multiple localization methods.

- LiDAR can provide high-resolution depth mapping, but does not perform well in fog or rain (and is heavy, power-hungry, and expensive).

- Radar provides robust distance measurements but lacks fine precision.

- Vision-based SLAM technology supports real-time mapping, but its performance will drop significantly in low-visibility environments.

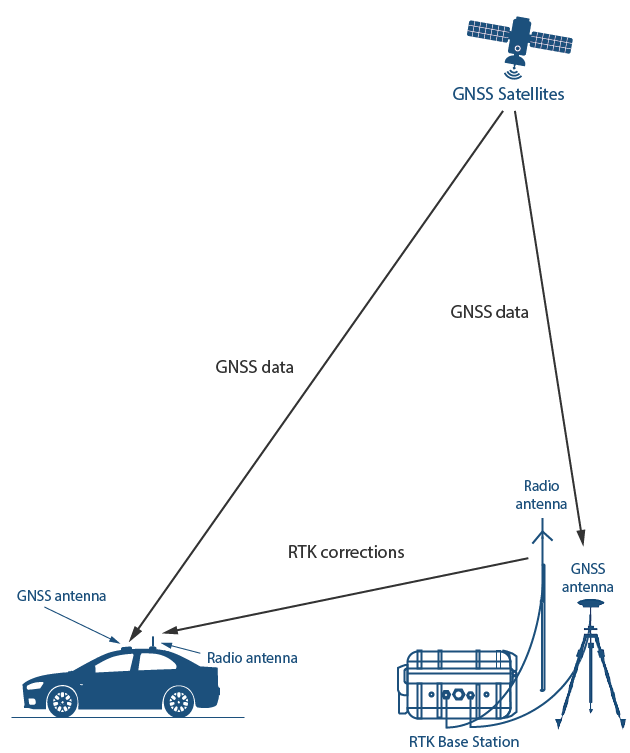

Among the various existing positioning solutions, the positioning system based on GNSS (Global Navigation Satellite System) combined with RTK (Real Time Kinematic) base station correction is recognized as one of the most reliable solutions.

Standard GNSS positioning has an inherent accuracy deviation of 5-10 meters due to atmospheric interference and multipath errors. RTK solves this problem by using fixed base stations to compare satellite signals with known positions and transmit real-time correction data, achieving centimeter-level accuracy - which is critical for physical AI applications. Currently, mainstream robotics and automation companies have integrated RTK in their systems:

- DJI for high-precision drones;

- John Deere for self-driving tractors;

- Tesla for self-driving cars;

- Boston Dynamics uses robots for industrial inspection.

Image source: GNSS Store

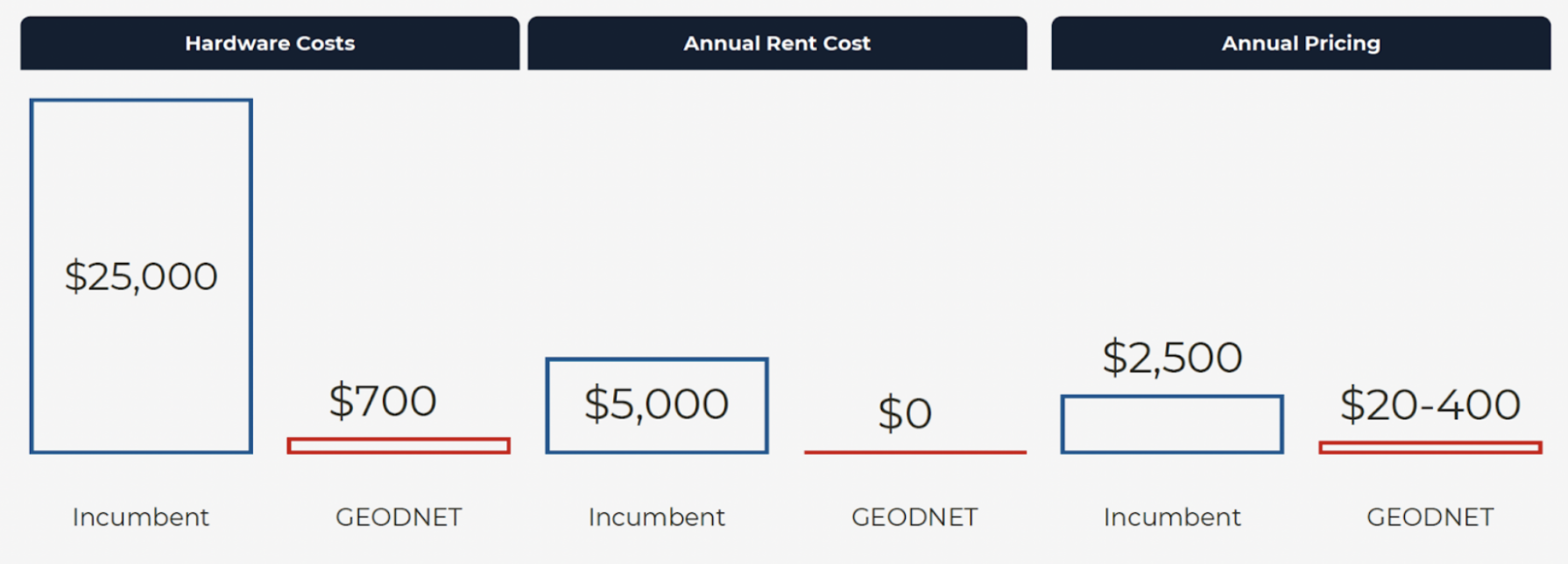

However, RTK currently faces cost challenges. Building and maintaining RTK base stations requires a lot of capital investment, including hardware, site acquisition and maintenance. Traditional suppliers such as Trimble, Hexagon and Topcon build their own base stations and charge thousands of dollars for each tracking device, which limits its accessibility and deployment speed. Coverage is often concentrated in profitable areas, resulting in many areas still unable to obtain high-precision positioning services.

Restructuring the cost structure through DePIN

Based on the token-incentive contributor ownership model, DePIN fundamentally restructures the cost structure of the global hardware-intensive network. As the world's largest precision positioning network, Geodnet uses this principle to incentivize independent operators to install RTK base stations and provide correction data in exchange for token rewards.

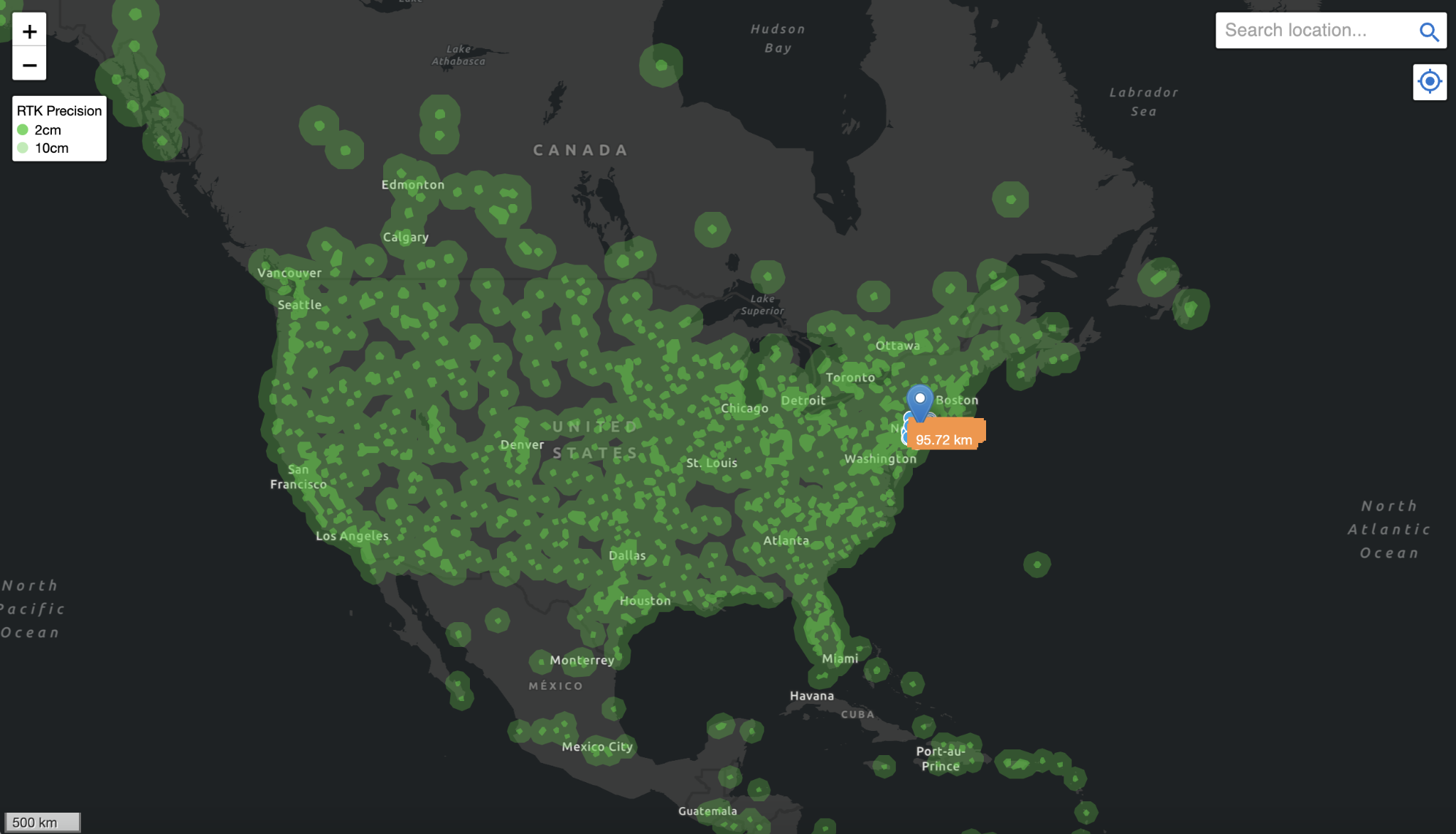

By shifting the cost burden from a single operator to a distributed network, Geodnet is able to deploy production-grade RTK base stations at a cost far lower than traditional suppliers, primarily by eliminating the two main costs of building a network: land and labor. This enables Geodnet to expand coverage faster, ensure redundancy, and provide more reliable GNSS correction services than existing service providers.

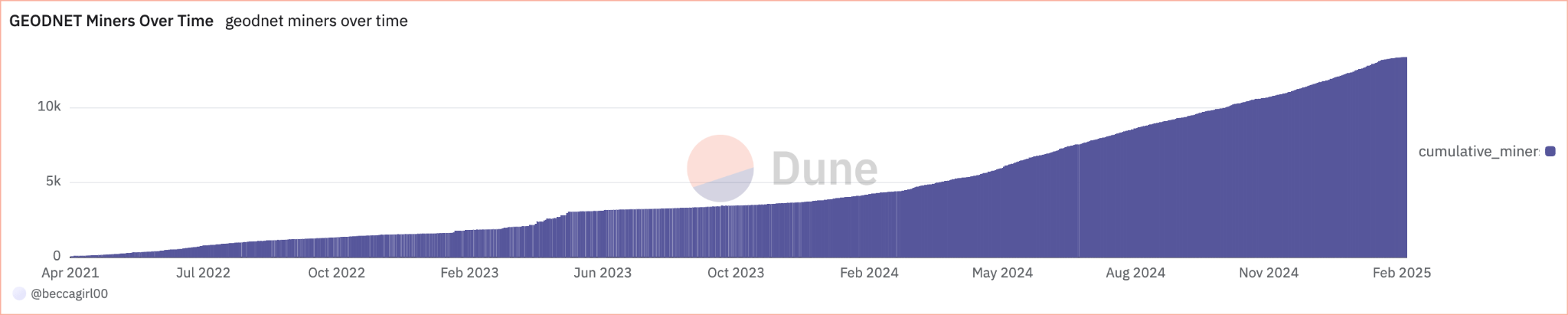

This model creates an organically expanded global distributed network, significantly reducing end-user costs while ensuring service quality. Geodnet has been expanding rapidly since last year, growing from 1,400 base stations in November 2022 to 7,800 in June 2024. As of January 2025, it has more than 13,000 base stations, covering 4,377 cities in more than 142 countries.

The Geodnet network has now achieved "threshold scale" and its service capabilities cover more than 60% of the GNSS correction market. It is worth noting that the network has obtained this supply with extremely high capital efficiency - only 11% of tokens have been issued to contributors in the past three years.

Geodnet is a classic example of the DePIN model in practice. Geodnet base stations not only reduce the cost of purchasing and deploying by an order of magnitude (consumer-grade mining machines are $700 vs. enterprise-grade RTK base stations are $12,000), but also significantly reduce annual pricing thanks to denser consumer-grade network deployment. Geodnet is undoubtedly the most scalable and cost-competitive positioning solution in the world today.

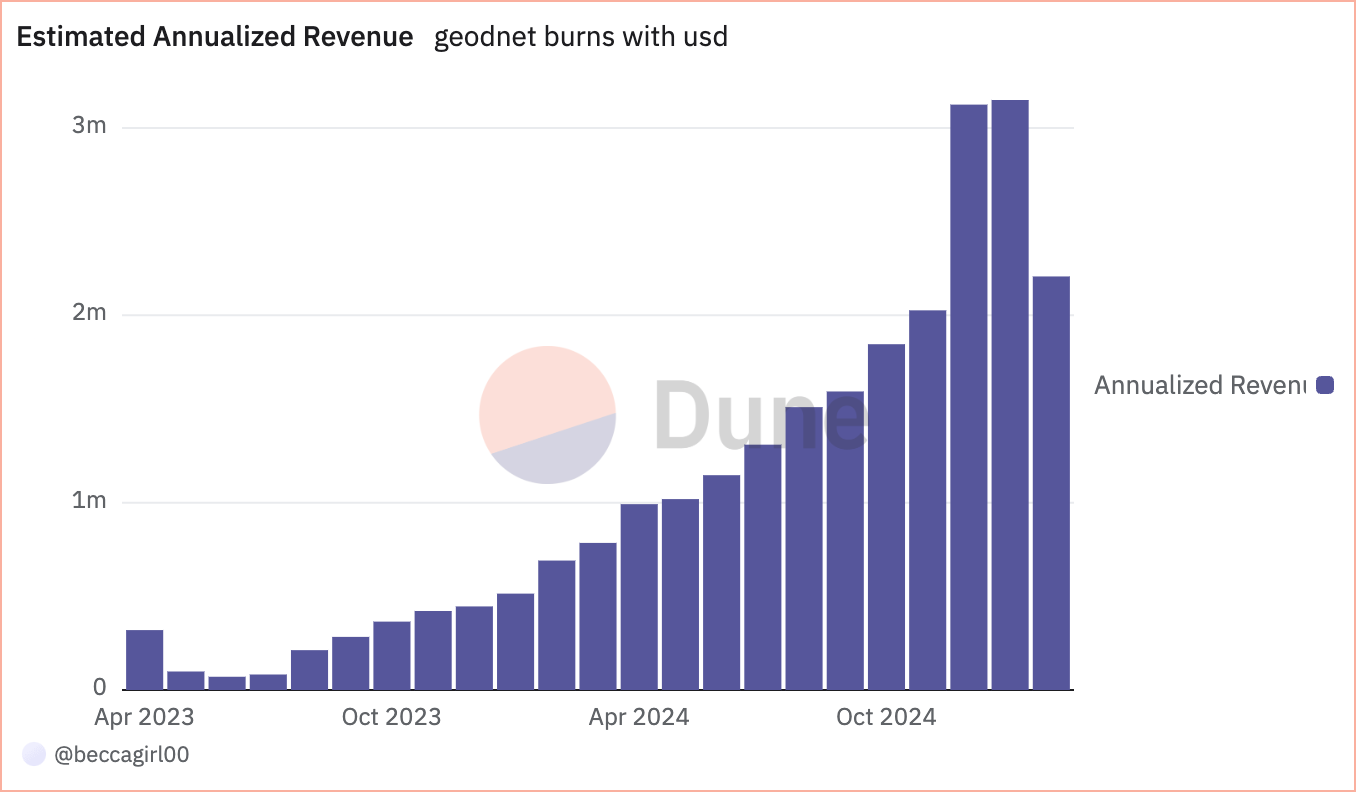

Currently, Geodnet generates approximately $3 million in annualized on-chain revenue by providing services to leading drone companies such as Propeller, DroneDeploy, and Quectel, as well as government agencies such as the USDA (U.S. Department of Agriculture), demonstrating the fastest demand-side growth in the DePIN field.

In early conversations with Geodnet founder Mike Horton, when asked how he acquired the world’s most influential autonomous driving, drone and agricultural robotics customers, his answer was always consistent: the core structural cost advantages brought by the DePIN model.

The turning point has arrived

Robotics will experience explosive growth in the next decade. From industrial manufacturing to daily life, tens of millions of robots are expected to be deployed in various fields. Drones will inspect power lines and pipeline facilities in the air, self-driving cars will reshape the landscape of freight and travel services, smart warehouse robots will replace manual operations on a large scale, and household humanoid robots will gradually enter thousands of households to assist in handling daily affairs.

Precise positioning capabilities are the cornerstone of this robotics revolution. Without reliable positioning data, any autonomous robot will find it difficult to perform its intended functions. Take self-driving cars, for example. In urban canyons where GPS signals are weak, they must rely on RTK-enhanced GNSS systems to navigate safely; delivery drones also require centimeter-level accuracy to accurately land at designated charging stations. Therefore, RTK positioning is no longer just a supplement to sensors such as lidar and radar, but has become a key infrastructure for robot operations.

Currently, many robotics companies pay high fees for traditional GNSS correction services every year, but still face many problems such as limited coverage and unstable accuracy. In contrast, Geodnet not only significantly reduces service costs through the innovative DePIN model, but also provides better positioning services. This breakthrough solution is attracting more and more enterprise-level customers to provide reliable positioning guarantees for current and future autonomous robots.

The AI-driven robot revolution has become an irreversible trend. The key lies in the timing of its full outbreak. The robot industry is accelerating, and Geodnet's precise positioning network will ensure that these robots can operate safely and efficiently. In the coming era of robots, Geodnet's positioning services will play an irreplaceable role, providing accurate and reliable location information support for robots around the world.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models