Ethereum Price Breaks $3K as Vitalik Buterin Pushes “World Computer” Vision

The Ethereum price surged 1.7% in the past 24 hours to trade at $3,025 as of 04:02 a.m. EST, with trading volume dropping 23% to $12.4 billion.

This comes as Ethereum co-founder Vitalik Buterin, in a New Year’s message on Thursday, emphasized the long-standing vision of Ethereum as a “world computer,” which is a shared, neutral platform for applications that can operate without reliance on centralized intermediaries.

In the message, Buterin says that the Ethereum network’s real test lies in fulfilling its original mission, not in chasing the latest crypto narratives.

Working as a world computer, Buterin says that the vision centers on applications designed to function without fraud, censorship, or third-party control, even if their original developers disappear.

Therefore, for Ethereum to succeed, it must be usable on a global scale and also remain genuinely decentralized.

Furthermore, Buterin says that Ethereum made significant progress in 2025, becoming faster, more reliable, and better able to handle growth without sacrificing its decentralized design.

Therefore, Ethereum is moving closer to becoming a new kind of shared computing platform rather than just another blockchain.

However, ETH dropped 11% year-to-date. Can the Ethereum price perform well in 2026?

Ethereum Price Shows Signs Of Recovery

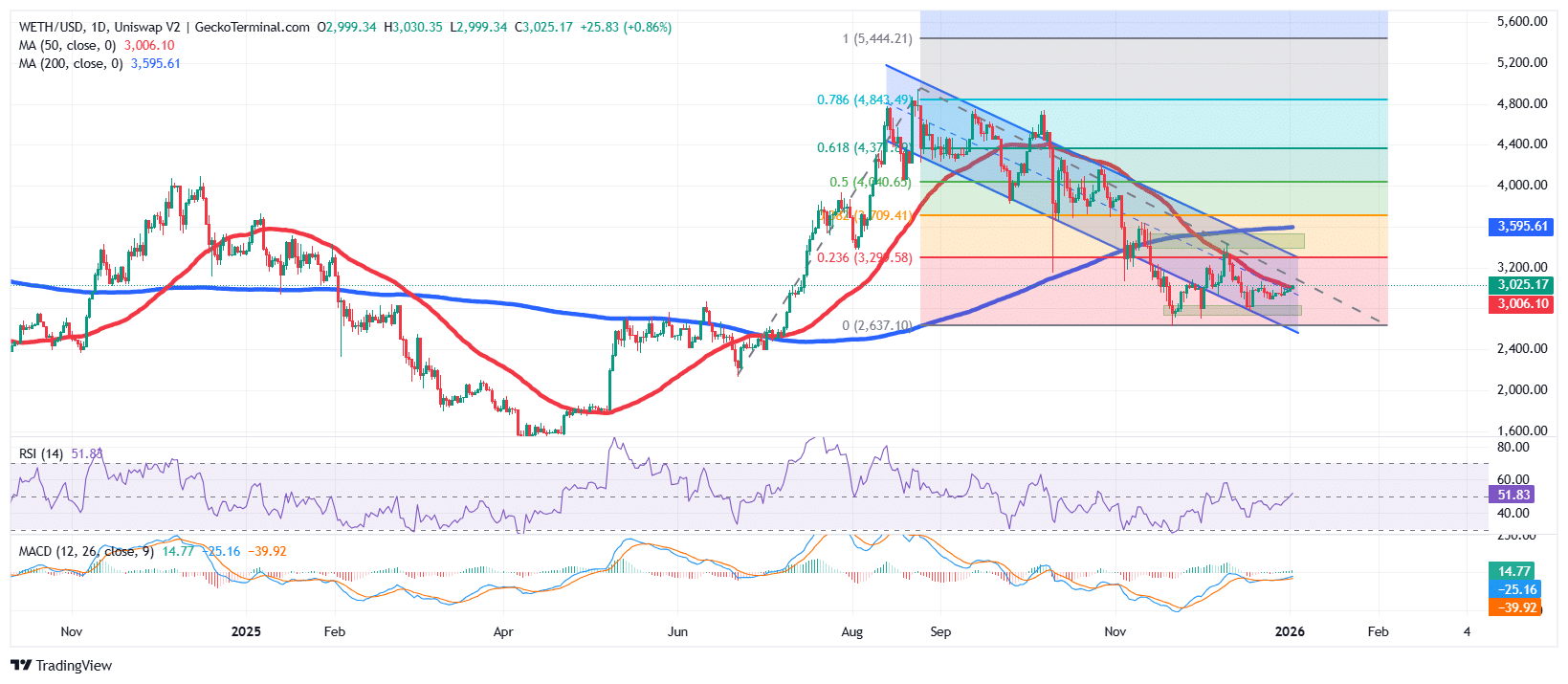

The ETH price has crossed above the $3,000 level, as it still trades within a falling channel and is barred by the $3,400 level on the mid-line level of the channel.

Ethereum went on a sustained bearish trend after hitting an all-time high of above $4,900 in the last quarter of 2025.

This trend was further fueled after the Ethereum price dropped below both the 50-day and 200-day Simple Moving Averages (SMAs), with a death cross around $3,556, throwing caution to the bulls.

However, ETH has now crossed above the 50-day SMA (3,006), which is an indicator that buyers may be stepping in to defend the previous support around $2,800.

Main indicators also support the bullish sentiment, with the Relative Strength Index (RSI) crossing the 50-midline level, currently at 51.72, suggesting building buying pressure.

Moreover, the Moving Average Convergence Divergence (MACD) also cements the bullish outlook, with the blue MACD line crossing above the orange signal line, indicating that positive momentum may be picking up.

ETH/USD Chart Analysis Source: GeckoTerminal

ETH/USD Chart Analysis Source: GeckoTerminal

ETH Price Prediction

Based on the ETH/USD daily chart, ETH price action suggests a cautious, range-to-bearish outlook with early signs of stabilization.

ETH is trading above the 50-day SMA, which keeps the broader trend technically slightly bullish, as price is attempting to base around the $3,000–$3,100 support zone.

In the short term, if ETH holds above this support and continues to respect the lower boundary of the descending channel, a relief bounce is possible.

A sustained move above the 50-day SMA near $3,050–$3,100 could open the door for a recovery toward $3,300, followed by $3,600, which aligns with a key Fibonacci retracement (0.236 and 0.382).

In a more bullish scenario, a daily close above the channel resistance and the $3,600–$3,700 region would significantly improve market structure. That would increase the probability of the price of Ethereum revisiting $4,000+.

On the bearish side, failure to hold the $3,000 psychological level would weaken the current base. A breakdown below this area could send Ethereum back toward $2,700, with deeper downside risk toward $2,400–$2,600, which previously acted as a major demand zone.

Related News:

You May Also Like

Sui Ecosystem Gains Spotlight as Taipei Builders Demo Day Highlights New DeFi Ideas

Stability World AI Makes AI Accessible and Ownable for People