Mastermind Behind $4.5 Billion Bitfinex Hack Walks Free with Trump Pass

Ilya Lichtenstein, one of the masterminds behind the popular $4.5 billion Bitfinex exchange hack that involved nearly 120,000 Bitcoin stolen, has been released from prison early under a law enacted during President Donald Trump’s first term.

The 35-year-old hacker thanked Trump’s First Step Act in a Friday post on X, expressing his commitment to making a positive impact in cybersecurity while looking forward to proving his doubters wrong.

The First Step Act, signed by Trump in 2018, allows prisoners to earn early release through rehabilitation programs and productive activities.

From Tech Entrepreneur to Federal Criminal

Lichtenstein and his wife, Heather Morgan, were arrested in New York in February 2022 after authorities traced their wealth to the crypto heist.

Morgan had cultivated a public persona as a successful tech businesswoman, describing herself in Forbes articles as an “economist, serial entrepreneur, software investor and rapper” while secretly helping her computer programmer husband launder the stolen fortune from Bitfinex.

Both pleaded guilty to money laundering, with Morgan facing an additional conspiracy to defraud charge.

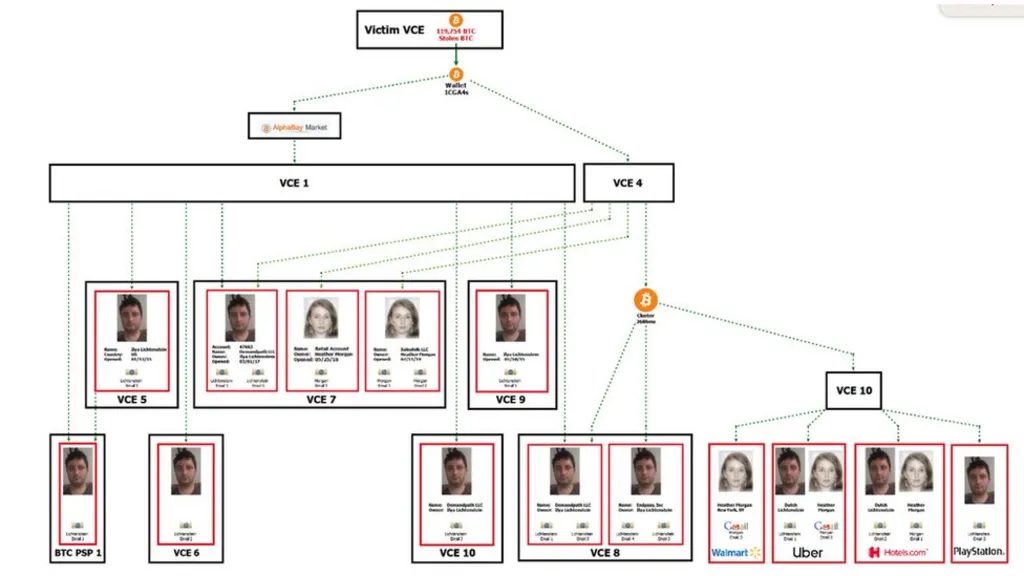

Court records reveal the couple used fake identities and transferred crypto in small increments to evade detection, employing sophisticated methods to obscure the digital trail of their ill-gotten assets.

Source: BBC

Source: BBC

Cooperation Secures Lighter Sentences

Morgan’s attorneys successfully argued for time served in a Washington, DC federal court, citing harsh pretrial detention conditions, including surgery recovery and contracting COVID-19.

She stayed free on personal recognizance, which allowed her release without bail, up until her sentencing hearing last year.

Morgan received an 18-month sentence and was released in October 2024 after serving approximately eight months.

Their cooperation with U.S. authorities on other crypto prosecutions reduced their potential prison time from what could have been decades behind bars for orchestrating one of the largest crypto heists in history.

In a video posted to X following the conclusion of their case, Morgan said: “It’s over, and I’m very excited that I will soon be telling my story, sharing my thoughts, and telling you more about the creative and other endeavors I’ve been working on.”

Trump’s Crypto Clemency Wave Draws Political Fire

Lichtenstein’s release comes during a broader pattern of leniency toward crypto offenders under Trump’s administration.

In March 2025, Trump pardoned BitMEX co-founders Arthur Hayes, Benjamin Delo, Samuel Reed, and employee Greg Dwyer, all of whom pleaded guilty in 2022 to Bank Secrecy Act violations for failing to implement anti-money-laundering controls at their crypto derivatives exchange.

Binance founder Changpeng Zhao received a presidential pardon in October after pleading guilty to similar violations for failing to implement an effective anti-money laundering program at his exchange, the world’s biggest crypto platform.

Trump has also expressed willingness to consider pardoning Keonne Rodriguez, CEO of privacy-focused Bitcoin wallet Samourai, who was sentenced to five years for money laundering in December.

During an Oval Office event on December 16, Trump told reporters:

“I’ve heard about it, I’ll look at it. It sounds like, based on your question, Rodriguez. We’ll look at that, Pam,” addressing U.S. Attorney General Pam Bondi, who was present during the session.

California Governor Gavin Newsom has intensified criticism of Trump’s pardon strategy, launching a state-backed website in December tracking what his office calls Trump’s “top criminal cronies.”

The site references Ross Ulbricht, Silk Road’s founder, sentenced to life for narcotics and money-laundering conspiracy involving over $214 million in illegal Bitcoin-facilitated drug sales, alongside newly released crime data showing continued declines across California’s major cities.

This series of pardons and appeals has triggered significant political backlash, framing crypto clemency as part of a wider debate over corruption, public safety, and the expanding role of digital assets in American politics.

You May Also Like

The Channel Factories We’ve Been Waiting For

WHAT NOT TO MISS AT CES 2026