Understanding Crypto Market Cycles: Why This Cycle Is Different

Original: SubQuery Network

Compiled by: Yuliya, PANews

The cryptocurrency market is known for its cyclical fluctuations, often characterized by extreme peaks and deep pullbacks. Since the birth of Bitcoin in 2009, the market has gone through multiple cycles, and the price trend of each cycle is affected by different factors. Although some elements remain unchanged, such as the four-year Bitcoin halving cycle, each cycle also introduces new dynamics that change the way the market operates.

As the new market cycle approaches in 2024-2025, the market generally believes that this time is different from the past. From institutional adoption to changes in retail investor participation, multiple factors make this cycle unique. The following will analyze why this cycle will unfold differently from the past and what this means for investors and builders.

Review of traditional cycles in the cryptocurrency market

Cryptocurrency market cycles generally follow this pattern:

- Correction/Bear Market: Markets return to reality, profit-taking accelerates, and liquidity in speculative assets dries up.

- Mania/Peak: The market is overheated, speculative sentiment dominates, and altcoins experience extreme gains.

- Expansion/Bull Market: Optimism returns, prices rise, and media coverage attracts new retail investors.

- Accumulation phase: After a bear market, smart money and long-term holders accumulate assets at low prices.

This pattern has been repeated over and over again in multiple cycles, from the boom and crash in 2013, to the ICO frenzy in 2017, to the bull run driven by DeFi, NFTs, and institutional interest in 2021. However, the market cycle in 2024 presents a different pattern, and some unique forces are reshaping the market environment.

Institutional adoption drives Bitcoin strength

The biggest difference in this cycle is the role of institutional capital. Unlike previous bull markets that were mainly driven by retail speculation, this cycle has witnessed large-scale institutional adoption:

- Derivatives market growth : The expansion of Bitcoin futures and options trading has made the market more structured and liquid, with lower volatility than in previous cycles.

- Corporate and Sovereign Interest : Large corporations and even some countries are adding Bitcoin to their balance sheets or using it as a hedging instrument.

- Bitcoin Spot ETF : The United States approved the Bitcoin spot ETF, opening a channel for institutional investors, allowing trillions of dollars of capital to enter the Bitcoin market in a regulated manner.

As a result, Bitcoin has become the most outstanding crypto asset, firmly sitting on the throne of "King of Cryptocurrency", reaching new highs and dominating market liquidity. It is difficult for altcoins to gain the same explosive growth space in this cycle as in the past.

Market dilution: Altcoins surge, gains shrink

In previous cycles, the supply of newly launched altcoins was relatively small, creating opportunities for explosive growth. However, this time around, the number of crypto projects has increased dramatically.

According to Dune Analytics, by the end of January 2025, there will be more than 36.4 million tokens in circulation, compared to only about 3,000 in 2017-2018. The reasons for this change include:

- Token unlocking: Many projects continue to release locked tokens, increasing market selling pressure and causing most token prices to fall sharply.

- The Meme Coin Market is Overcrowded: Unlike past cycles where a few Meme coins (such as Dogecoin and Shiba Inu) attracted most of the attention, a large number of new Meme coins are launched every day in 2024, making it difficult for a single token to continuously gain market momentum.

- Proliferation of Layer 1 and Layer 2: The rise of hundreds of Layer 1 and Layer 2 scaling solutions has fragmented market liquidity.

This market dilution means that while some altcoins can still perform well, the broad-based rally seen in past cycles, where nearly all tokens surged, is unlikely to repeat itself.

Retail liquidity is directed to new areas

Retail traders have been an important driving force behind the cryptocurrency bull market, but the key difference in this cycle is that retail liquidity is being attracted to new mechanisms outside of traditional spot trading.

The rise of Pump.fun

Pump.fun went live on January 19, 2024, completely changing the behavior of retail cryptocurrency investors around the world. The platform allows anyone to create Solana tokens for free in one minute, spawning some of the biggest memes of 2024 and attracting retail funds to high-risk, high-return speculative small-cap tokens and away from major altcoins.

This development has several notable consequences:

- Providing more exit liquidity for insiders: Insiders launch new tokens, which quickly attract retail funds, but the constant rotation causes many retail investors to suffer losses before transferring their profits to major altcoins.

- Fund rotation is accelerated: the flow cycle of retail funds between new tokens is shortened to hours or days, making it difficult for mature altcoins to form a sustained upward trend.

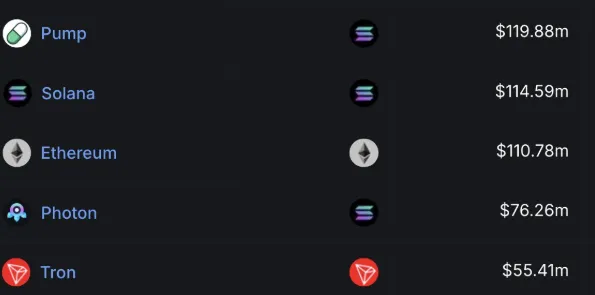

As of January 2025, Pump.fun has generated $116.72 million in revenue, surpassing Solana ($116.46 million) and Ethereum ($107.64 million) in revenue.

What does this mean for crypto investors?

Although this cycle is still developing, several key conclusions are clear:

- Retail speculative funds are being directed to emerging platforms such as Pump.fun and innovative on-chain trading mechanisms. Understanding these changes will help traders determine liquidity trends.

- The altcoin market will be more selective. Unlike in the past when almost all tokens rose, in this cycle, projects with practical application scenarios, strong token economic models and real demand will become the main winners.

- Bitcoin remains a dominant force due to institutional adoption, with many investors focusing on Bitcoin rather than speculative altcoins.

in conclusion

While the cryptocurrency market still follows familiar cyclical patterns, the market cycle in 2024 is different from previous ones. The rise of institutional adoption, market dilution, retail liquidity shifts, and changes in the macro environment have combined to shape the new market landscape.

For investors and builders, adapting to these changes is key to successfully navigating this cycle. The rules of the market have changed, but opportunities remain for those who can see where the money is flowing.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models