Only one cryptocurrency set to lead stablecoin hype, Electric Capital says

Stablecoins are booming, and one cryptocurrency could quietly become the foundation of a new dollar-based economy, analysts at Electric Capital say.

Despite widespread talk about “de-dollarization,” the global thirst for U.S. dollars is far from disappearing. In fact, it’s reaching new heights. Behind the scenes, a powerful shift is underway: billions of people and countless businesses worldwide are finding fresh ways to access dollars, not through banks or traditional finance, but via stablecoins.

As Electric Capital, a crypto investment firm and research organization, noted in a recent report, the shift is creating the biggest expansion of the dollar’s network in decades, and one cryptocurrency is positioned to benefit the most.

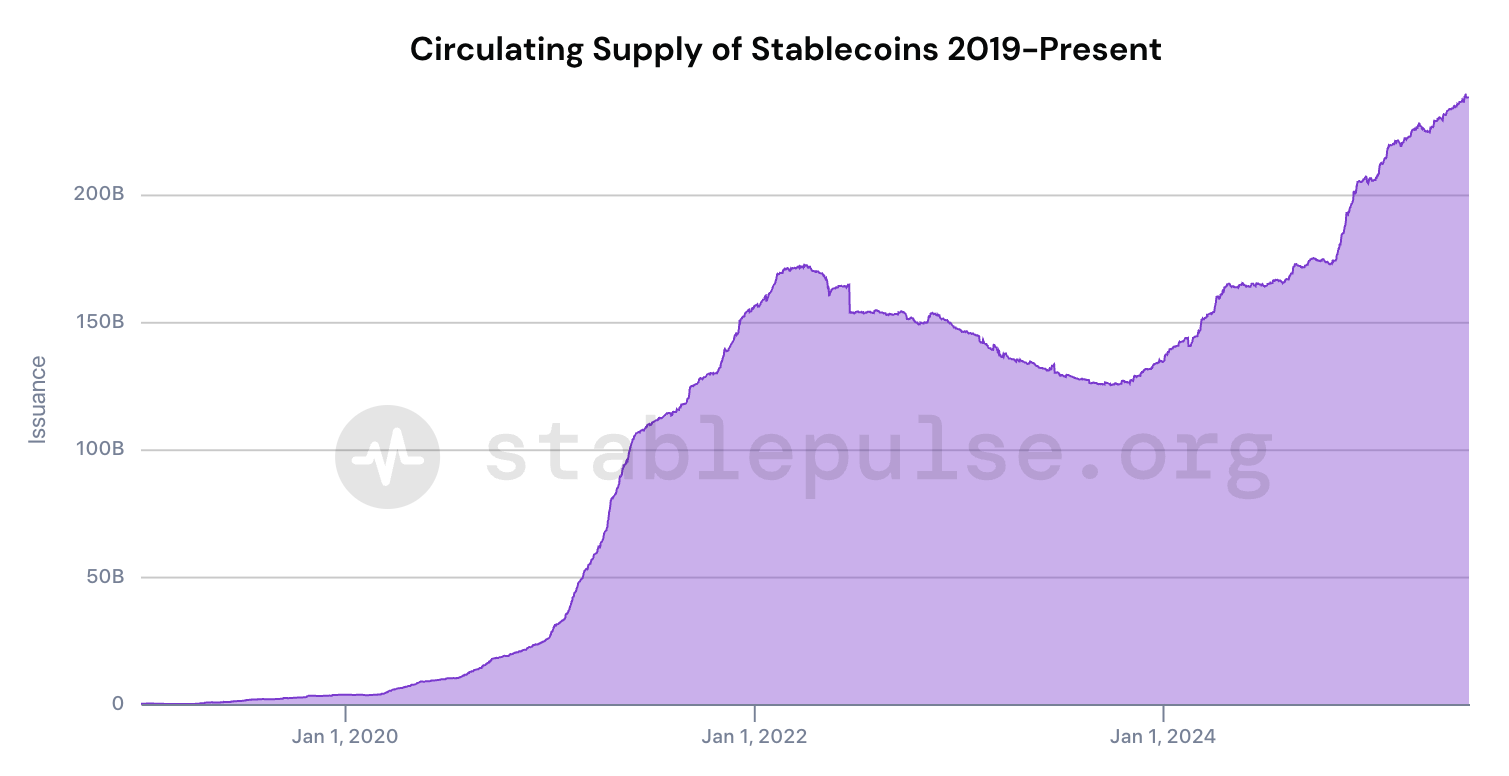

Since 2020, the stablecoin market has grown nearly 60-fold to over $200 billion, fueled largely by demand from emerging markets where traditional banking remains limited or unstable.

Electric Capital points out that billions of people around the world face currency risks. Political instability, poor monetary policies, and high inflation — sometimes above 6% annually — threaten the value of local currencies. In such places, holding dollars means more financial security.

Businesses also need dollars to operate. The U.S. dollar dominates global trade, involved in about 88% of all foreign exchange transactions. For many small and medium-sized enterprises and freelancers, especially in emerging economies, digital dollars help avoid currency mismatches and simplify cross-border payments.

Most importantly, stablecoins allow anyone with internet access to hold dollars: no bank account or government permission needed. This global accessibility is unprecedented.

The problem with TradFi

While this new wave of dollar holders is exciting, it comes with challenges. Millions of new users want more than just to hold stablecoins, they want to earn yield, invest, and access financial services. However, traditional finance cannot serve this growing market well, Electric Capital notes.

The U.S. banking system, for example, requires strict regulatory compliance that excludes many people globally. Cross-border financial services are often expensive and slow, and are generally designed for institutions or wealthy individuals, not everyday users in emerging markets.

This gap calls for new financial infrastructure that is global, safe for institutions, and resistant to government interference.

How one crypto stands out

According to Electric Capital, Ethereum (ETH) is uniquely positioned to serve this new digital dollar economy because it meets three key requirements:

- Global accessibility: Ethereum works 24/7 and is available to anyone with internet access, whether in New York, Nigeria, or rural Nepal.

- Institutional safety: Ethereum offers needed security, regulatory clarity, and flexibility for institutions to build large-scale financial products.

- Resistance to government interference: Ethereum operates in a decentralized manner, making it harder for governments to restrict or censor.

Electric Capital’s analysts note Ethereum’s history of community funding and Proof-of-Work launch gave it broad asset ownership and a culture focused on decentralization, creating a moat that is difficult for other blockchains to replicate.

The Ethereum network supports more than $140 billion in stablecoins, over $60 billion in decentralized finance protocols, and billions more in tokenized real-world assets.

In traditional finance, a reserve asset is the trusted base layer that supports lending, borrowing, and transactions. Examples include U.S. Treasuries, gold, and the dollar itself.

The report explains that as stablecoins on Ethereum grow, participants need a secure, productive asset to back financial activities. ETH fits this role perfectly, the analysts suggest, as the cryptocurrency is:

- Scarce, with predictable supply and low inflation.

- Productive, because it generates yield through staking.

- Collateralized, backing over $19 billion in lending protocols.

- Resistant to seizure or censorship by governments.

- Programmable and liquid, deeply integrated into the on-chain financial system.

As stablecoin adoption increases, so does the demand for ETH to power the ecosystem, they say.

Layer 2s as supporters, not competitors

More than that, Ethereum’s Layer 2 scaling solutions make transactions faster and cheaper, opening more use cases for ETH as collateral and reserve asset, expanding its reach in the digital dollar economy, the analysts claim.

Beyond powering DeFi and stablecoins, ETH also has properties that make it a strong store of value, comparable to Bitcoin but with additional yield potential.

And, unlike gold, which generates no income, ETH holders can earn staking rewards, a feature that appeals to investors who prefer yield-generating assets. The report suggests that rather than competing with Bitcoin, ETH and BTC might both take market share from traditional stores of value like gold, treasuries, and real estate in the years ahead.

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared