Cardano Whales Stack 210M ADA, Igniting $1 Recovery Hopes

Cardano continues to trade in a massive drawdown even after rebounding from the $0.30 lows. However, fresh on-chain data shows whales are back to aggressively buying ADA alongside other altcoins.

Large holders have stacked another significant volume in recent weeks, signaling renewed conviction despite broader market pressure.

This accumulation, combined with tightening supply and improving technical setups, is once again fueling speculation of a stronger recovery push toward higher levels.

With interest creeping in, can it sustain a bullish sentiment for Cardano’s price?

Cardano Whales’ Purchases Spark Recovery Hopes

According to data from Ali Martinez, a popular analyst on X, whales have bought 210 million Cardano tokens over the past three weeks. This level of accumulation signals strong interest from large holders.

In one of the latest buys, a whale deposited $7.9 million USDC into the Hyperliquid exchange, buying 6.46 million ADA for a position worth about $2.50 million.

Whale activity is an indicator of informed money, suggesting the Cardano token price could be gearing up for a rally.

ADA Volumes Increase In The Derivatives Market

Cardano is seeing increased volume in the derivatives market, with traders now watching what comes next for its price.

Data from Coinglass shows that Cardano has increased 10,654% in futures volume on the Bitmex exchange, reaching $40.04 million.

This indicates a surge in activity in the derivatives market, given that Bitmex is a major derivatives exchange.

Can ADA Rally To $1?

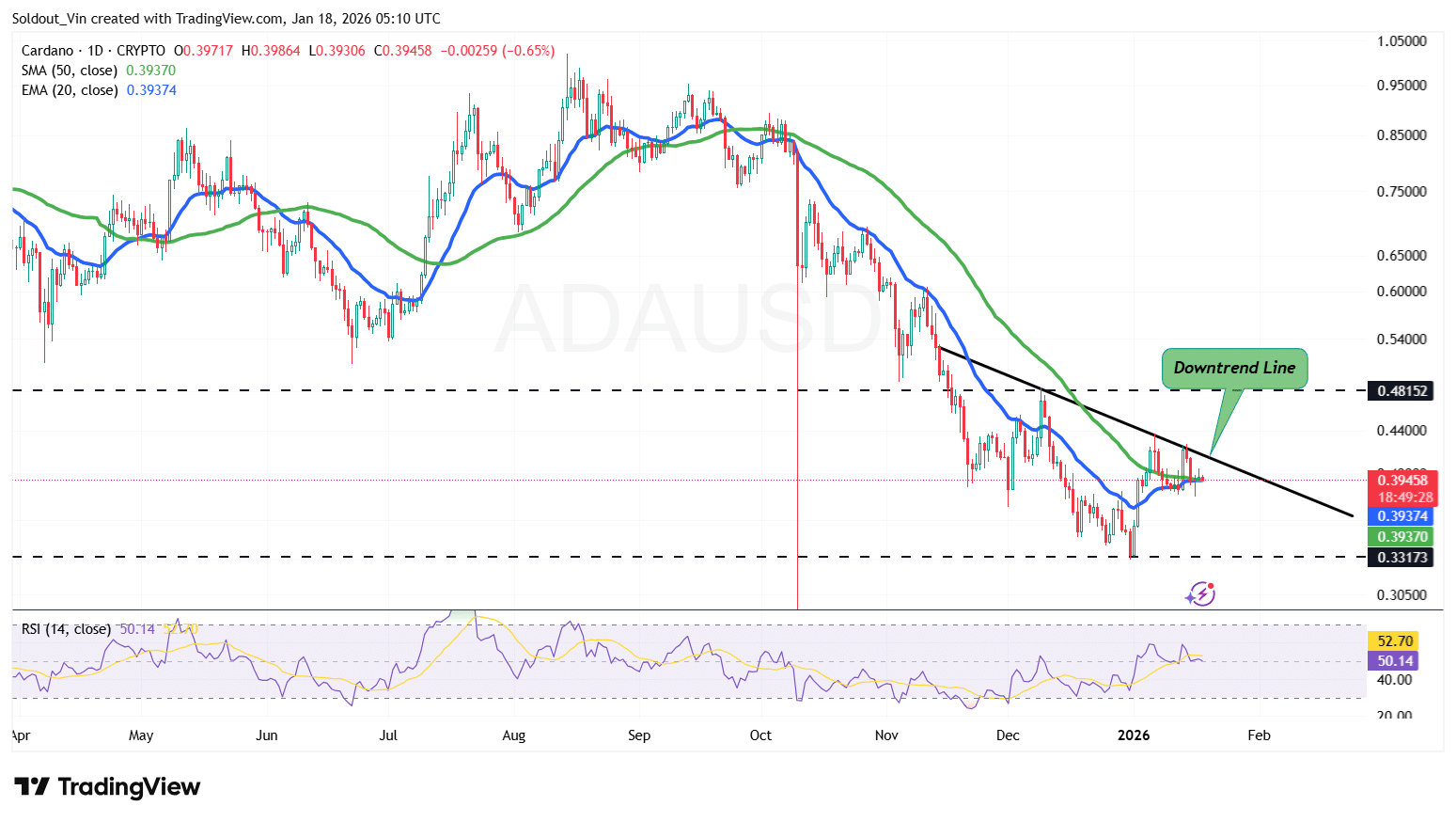

Cardano’s price is currently consolidating near the $0.39–$0.40 region, holding above the short-term support zone at $0.33–$0.35, which buyers have defended following the recent sell-off.

This stabilization followed a sharp decline from the October highs, with demand stepping in near $0.33, a historically significant support level. The bounce from this area suggests selling pressure is easing, although bullish conviction remains cautious.

ADA is trading around the 20-day EMA (~$0.39) but remains below the 50-day Simple Moving Average (SMA) near $0.48, which continues to act as a key overhead resistance. The downward slope of the 50-day SMA suggests the broader trend remains bearish unless ADA can reclaim and hold above this level.

Cardano’s Relative Strength Index (RSI) is hovering around 52, sitting near the neutral zone. This reflects modest momentum recovery without signs of overbought conditions, meaning price has room to move higher if buying strength increases.

ADA/USD Chart Analysis Source: TradingView

ADA/USD Chart Analysis Source: TradingView

From the 1-day ADA/USD chart perspective, Cardano could attempt a move toward the $0.45–$0.48 resistance zone, where the downtrend line and the 50-day SMA converge. A clean breakout above this area would be the first meaningful signal of a trend shift and could open the door for a move toward $0.60 in the medium term.

For ADA to realistically target $1, the price would need a sustained trend reversal, including a break above its resistance around $0.54.

Conversely, failure to break above the downtrend resistance could trigger another pullback, with $0.35 as initial support, followed by the $0.33 demand zone if selling pressure returns.

Related News:

You May Also Like

Trump roasts Mike Johnson for saying grace at prayer event: 'Excuse me, it's lunch!'

Where Can You Turn $1,000 Into $5,000 This Week? Experts Point Towards Remittix As The Best Option