$875 Million Wiped Out as Trump’s Europe Tariffs Trigger Crypto Crash

President Donald Trump’s weekend announcement of escalating tariffs on eight European nations over Greenland triggered $875 million in crypto liquidations within 24 hours, with Bitcoin sliding 3% to $92,000 as traders slashed risk exposure.

The tariff shock sent shockwaves through global markets during thin holiday trading, forcing 90% of liquidated positions to unwind into longs while European leaders convened emergency meetings and threatened unprecedented retaliation.

Trump declared via Truth Social that Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland will face 10% tariffs starting February 1, escalating to 25% by June 1 “until such time as a Deal is reached for the Complete and Total purchase of Greenland.”

The move drew immediate condemnation from European capitals, with French President Emmanuel Macron calling for activation of the EU’s “trade bazooka,” an anti-coercion instrument designed to block US market access and impose sweeping restrictions on American goods and services.

Derivative Markets Absorb Brunt of Tariff Fallout

Leveraged crypto positions unwound rapidly as the announcement hit markets during US holiday closures, amplifying volatility through thinned liquidity.

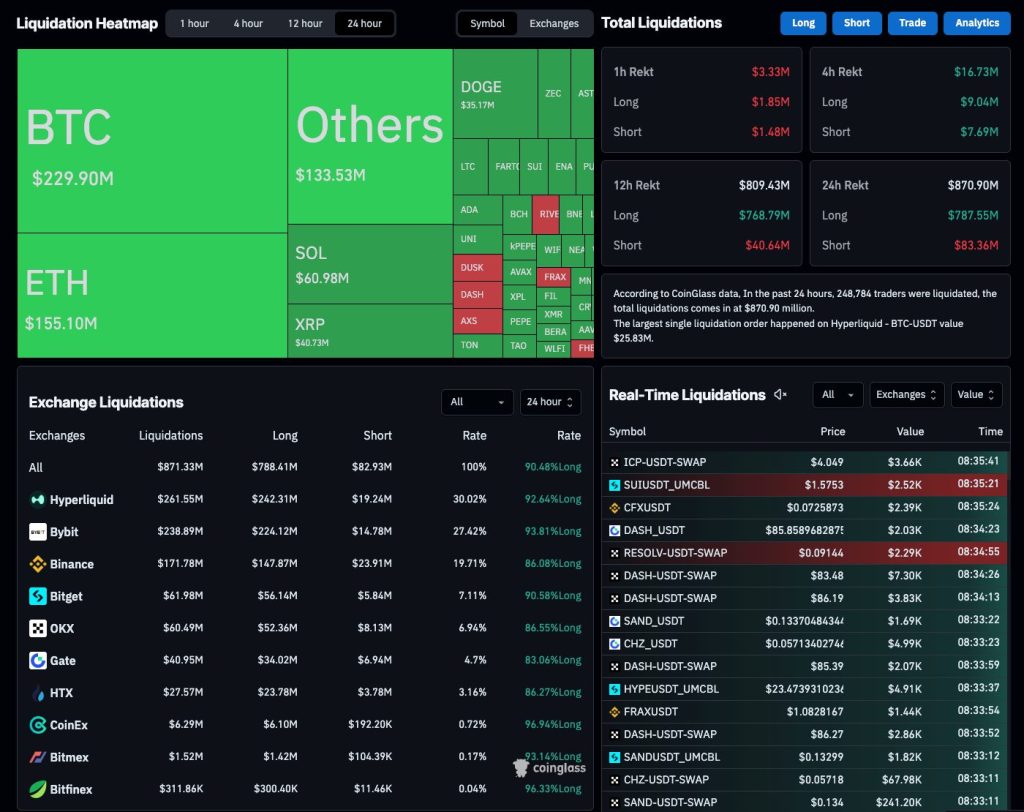

CoinGlass data showed that $788 million of the total liquidations came from long positions, while shorts accounted for just $83 million. This heavy but moderate liquidation shows that traders were caught betting on the upside when geopolitical risk materialized.

Source: CoinGlass

Source: CoinGlass

Hyperliquid led exchange liquidations totaled $262 million, followed by Bybit at $239 million and Binance at $172 million, with long positions accounting for over 90% of forced closures across all platforms.

Bitcoin futures open interest, which had recovered 13% from early January lows, is now facing renewed pressure, despite analysts noting that deleveraging could create stronger support for future rallies.

“At present, open interest is showing signs of a gradual recovery, suggesting a slow return of risk appetite,” CryptoQuant analyst Darkfost stated today, though the tariff shock threatens to reverse that momentum.

Beyond crypto, US stock futures fell 0.7% for the S&P 500 and 1% for the Nasdaq, while European equity futures dropped 1.1% amid a risk-off mood spreading across asset classes.

However, Gold surged 1.5% to record highs in the flight to safety, while the dollar weakened 0.3% against the yen.

“The fact that this threat was on social media instead of distilled into an executive order and it has a delayed implementation means a lot of investors might just decide to wait things out before overreacting,” said Brian Jacobsen, chief economic strategist at Annex Wealth Management, suggesting volatility may ease once markets digest the announcement.

Retaliatory Measures Threaten Transatlantic Economic Rupture

European leaders unified in condemnation despite political divisions, with UK Prime Minister Keir Starmer calling tariffs on allies “completely wrong” while Sweden’s Prime Minister Ulf Kristersson stated bluntly, “We will not let ourselves be blackmailed.”

Spain’s Prime Minister Pedro Sanchez also warned that a US invasion of Greenland “would make Putin the happiest man on earth” by legitimizing Russia’s Ukraine invasion and spelling “the death knell for Nato.”

EU foreign policy chief Kaja Kallas echoed this, noting “China and Russia must be having a field day” as they “benefit from divisions among Allies.“

The European Parliament moved swiftly to halt ratification of the EU-US trade deal negotiated last July, with German MEP Manfred Weber declaring, “The 0% tariffs on US products must be put on hold.“

That agreement, which eliminated tariffs on many US goods while accepting 15% duties on EU products and 50% on steel, had been criticized as skewed in America’s favor but was defended as providing stability.

Meanwhile, the EU is prepared to reactivate €93 billion in retaliatory tariffs previously delayed under last summer’s trade truce, while France pushed to trigger the anti-coercion instrument that could suspend US investment protections and restrict service trade access.

Deutsche Bank warned that the deeper market risk lies beyond tariffs themselves.

“It is a weaponization of capital rather than trade flows that would by far be the most disruptive to markets,” wrote George Saravelos, the bank’s global head of FX research, noting European investors hold roughly $8 trillion in US bonds and equities that could shift if tensions escalate.

Goldman Sachs estimated that the 10% tariff would drag European earnings-per-share growth by 2 to 3 percentage points, while ING’s Carsten Brzeski projected the levies would shave a quarter of a percentage point off European GDP this year.

You May Also Like

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy

Ondo Finance launches USDY yieldcoin on Stellar network